($PMD) Psychemedics Corp: Hair today, sold tomorrow

... well, eventually... probably. Quick idea to ride along a going-private, bet-the-jockey investment.

Ticker: PMD

Marketcap: $14MM

Price: $2.35

PT: $8

Payback period: 3yr - 4yrs

Upside CAGR: 52% - 28%

Downside: $1.60

Downside CAGR: -12 - -9%

IDK when exactly the take-private reverse/forward split is scheduled to happen, but it already got the required votes at the Nov 25, 2024 shareholder meeting (https://www.sec.gov/Archives/edgar/data/806517/000117184324006571/0001171843-24-006571-index.html), so I’d expect it to happen rather soon —it could happen tomorrow as far as I know— and so I’m just trying to quickly write this over the weekend based on my existing saved notes (and will update this post with smaller details I might have skipped if more time passes between now the actual event). This is well enough, as the idea is rather simple.

********** UPDATE 20241213: Psychemedics is now trading under the ticket PMDI on the OTC Pink sheets (https://www.otcmarkets.com/stock/PMDI/overview). From the take-private proxy: “We expect the delisting of our common stock will be effective 10 days after we file the Form 25 with the SEC and the deregistration of our common stock under Section 12(b) of the Exchange Act will take effect 90 days after the filing of the Form 25.” However, the company filed the Form 25 today and it is already trading on the OTC markets under the ticker PMDI and the PMD ticker on the NASDAQ has stopped trading (as opposed to a 10-day delay); there is ostensibly 90 days remaining before they deregister the with the SEC and are freed from certain reporting requirements (which may result in the stock moving from the Pinks to the Expert Market). Meanwhile, the price has dropped significantly (to $1.70/sh at the time of this writing) —which is just as well as I was planning on marking the position to zero until an eventual sale of the business or other final outcome, assuming that it would only trade on the OTC Expert Market after deregistration— so maybe I should have waited to buy (and maybe I will add a bit if the price gets really low, keeping in mind that the last two quarters reported TBV/sh of $0.99-0.92). However, I had some uncertainty has to how fast exactly things would move after the split in terms of delisting (as demonstrated by the immediate delisting after the Form 25 filing) and how liquidity would look on the other side, so I wanted to make sure I got the shares I wanted before things started moving. In any case the intermediate volatility isn’t an issue for the ultimate business-sale thesis (not to say that other things can’t go wrong before that end of the tunnel).

I was also asked about Kamin’s latest selling activity in a recent Form 4 filing (https://www.sec.gov/Archives/edgar/data/806517/000142050624002619/0001420506-24-002619-index.html). If my interpretation of the footnotes is correct, it looks like Kamin (indirectly through 3k) sold some amount of shares back to PMD (now PMDI on the OTC Pinks) for the reason that they ended up buying more than originally estimated would be required “following the final determination of the purchase price required to purchase fractional shares in the Issuer’s recently completed reverse stock split.” (ie. they bought more than needed to buy out the fractional shares expected in the recent split). Note that even after this sale, Kamin has still nearly tripled-down on his position (which was bought at much higher costs basis), going from 647,737 shares (https://www.sec.gov/Archives/edgar/data/806517/000117152024000290/0001171520-24-000290-index.html) to 1,736,741 (https://www.sec.gov/Archives/edgar/data/806517/000117152024000386/0001171520-24-000386-index.html).

**********

**********

UPDATE 20241202: So it looks like the split ratio is going to be 1-for-5000 on December 3 after market close and the ticker will continue to trade publicly thereafter for the time being.

[T]he Company’s Board of Directors has approved a 1-for-5,000 reverse stock split of its common stock (the “Reverse Stock Split”) followed immediately by a 5,000-for-1 forward stock split of its common stock (the “Forward Stock Split,” and together with the Reverse Stock Split, the “Stock Split”), to be effective at 5:01 p.m. and 5:02 p.m., Eastern Time, respectively, on Tuesday, December 3, 2024. Beginning with the opening of trading on Wednesday, December 4, 2024, the Company’s common stock will continue to trade on the Nasdaq Capital Market on a post-Forward Stock Split basis under the existing symbol “PMD” ~~~ https://www.globenewswire.com/news-release/2024/12/02/2989790/0/en/Psychemedics-Corporation-Announces-Reverse-and-Forward-Stock-Split.html

I’d expect the stock may drop lower after this as those who were buying/holding shares for the cash-in-lieu from the take-private spread go away —though the market might also take Kamin’s tripling-down as a bullish signal of confidence. This may be a better time for anyone interested in holding through the take-private and betting on a later sale of the company to buy at a lower price. May buy a bit more if it goes low enough, though note also that liquidity could to be a lot tighter after the split and many of the remaining shareholders are more likely to be those that intend to hold the shares into the going-dark phase.

Per the deal proxy, there should be 88 days between now and the delisting (iff the company files all the necessary paperwork with the SEC right after the split).

The suspension of our obligation to file periodic reports and other documents under the Exchange Act will become effective after the filing with the SEC of both a notice of removal from listing of our common stock from listing on the Nasdaq Capital Market and termination of registration under Section 12(b) of the Exchange Act on Form 25, and a certification and notice of termination of registration on Form 15. The deregistration of our common stock under Section 12(b) of the Exchange Act will take effect 90 days after the filing of the Form 25 and the deregistration of our common stock under other provisions of the Exchange Act will become effective 90 days after the filing of the Form 15. ~~~ https://www.sec.gov/Archives/edgar/data/806517/000117184324005690/0001171843-24-005690-index.html

**********

TLDR

Opportunity to bet-the-jockey and follow well-known activist nanocap investor, Peter Kamin, into an going-private deal as he triples down on his existing stake in hair-based drug testing company, Psychemedics, and takes it private to —I believe— re-work the cost structure and eventually facilitate a sale of the company himself after several failed attempts by previous management whom he’s now eliminated from the company. His track record with getting on the board of companies that are later acquired at a higher price is good and at the very least you’re unlikely to lose money at the current price. The incoming Trump admin in planning on taking tougher stance on the fentanyl epidemic in the US (https://trumpwhitehouse.archives.gov/ondcp/the-administrations-approach/the-administrations-strategy/) in 2025 and serves a nice potential bonus as well that could increase the value of PMD’s drug testing product/services in the coming years.

Business

Psychemedics Corporation is the world’s largest provider of hair testing for drugs of abuse. The company utilizes a patented hair analysis method to detect the presence of drugs of abuse in human hair samples. This method involves three steps:

Hair Digestion: A patented technology is used to digest the hair sample and release the drugs trapped within it without destroying the drugs themselves. This step ensures that virtually 100% of the drug is extracted for accurate measurement.

Enzyme Immunoassay (EIA): A proprietary and patented enzyme immunoassay (EIA) is performed on the liquid supernatant above the residue material obtained from the digested hair. This test helps detect the presence of specific drugs.

Mass Spectrometry Confirmation: The results from the EIA are confirmed using mass spectrometry, a highly sensitive and accurate analytical technique. This step ensures the reliability and validity of the test results. Not that it really matters for our purposes, but I thought these videos on how mass spectrometry is used to identify elements were interesting…

PMD serves a diverse customer base, including:

Fortune 500 companies

Small to mid-size corporations

Schools

Government entities

Management and setup

Prior to Kamin’s active involvement in the company, PMD had been run by CEO and Chairman Raymond C. Kubacki since 1991. Under his management, the company’s stock price saw some periods of volatile spikes, but generally languished and had declined severely by 2021. Meanwhile revenues had remained stagnant (really declining, in inflation-adjusted terms) notwithstanding a breif revenue boost from the Brazilian drug testing market (2015/2016 - 2019) due to the passage of a favorable 2015 law in the country. However, this ultimately turned out to be an unprofitable boondoggle (see “Distribution” and MD&A section re. revenues in the 2019 10K, https://www.sec.gov/Archives/edgar/data/806517/000117184320001248/0001171843-20-001248-index.htm).

… These were some of the primary complaints raised against the company’s unjustifiably-tenured management team, as he might put it, by well-known smallcap investor, Peter Kamin, in his public letter to the board on September 23, 2021 (https://www.sec.gov/Archives/edgar/data/937541/000092189521002309/0000921895-21-002309-index.html). The letter itself serves as a nice basic checklist for things you don’t want to see from a management team…

As you are aware, I am one of the largest stockholders of Psychemedics Corporation (“Psychemedics” or the “Company”), owning approximately 8.4% of the outstanding shares of common stock of the Company. I have decided to send this letter as a follow-up to my September 14, 2021 private letter (the “September 14 Letter”) to the Company’s Board of Directors (the “Board”). […] [B]y any measure, the Company has vastly underperformed any minimal expectation of performance and/or profitability under Mr. Kubacki’s leadership. On an inflation adjusted basis, the Company’s revenues are lower and its stock price is less today than when Mr. Kubacki became CEO 30 years ago in 1991. […] [E]ach of the current Directors have served for over 18 years, and in the case of lead Director, Fred Weinert (“Mr. Weinert”), for over 30 years. […] [T]he Board and management collectively own less then 7% of the Company – and these amounts are almost irrelevant relative to the rest of their compensation package. […] Even more alarming to me than the Board’s failure to govern the Company was its recent decision to downplay an apparent approach from a third party concerning a potential strategic process. […] Mr. Kubacki and this Board, with a thirty-year track record of underperformance, owes us an obligation to publicly commit to conducting a transparent, robust and unobstructed sale process. I believe there may be many strategic buyers for Psychemedics and I urge the Board to consider any strategic alternatives that will generate superior returns for stockholders. I also strongly urge the Board to retain a nationally recognized investment bank and to form a special strategic committee chaired by Director, Robyn Davis to initiate an objective and comprehensive strategic review of the Company. ~~~ Peter Kamin to PMD’s BoD (emphasis included from original letter)

Kamin is a rather famous activist in nano/smallcap investing circles and not for no reason. Looking at all of the public companies that Kamin has been involved in over the years (https://investors.tileshop.com/board-member/peter-kamin; https://www.marketscreener.com/insider/PETER-KAMIN-A00KKI/), we can see that his participation is usually a net positive and usually materially so vs general market returns:

By June of the next year, about eight months after filing his public letter, Kamin and Darius G. Nevin (whose expertise appears to be in advising private equity firms) were jointly appointed to the board or directors as part of a cooperation agreement with PMD and Kamin’s hedge fund, 3K L.P. (https://www.sec.gov/Archives/edgar/data/806517/000117184322004265/0001171843-22-004265-index.htm). (Nevin’s direct association to Kamin and the takeover are further solidified by the fact that Nevin was identified as a director “affiliated with the Investors” (ie. Kamin and his associated entities) in the context of the going dark transaction), https://www.sec.gov/Archives/edgar/data/806517/000117184324005690/0001171843-24-005690-index.html).

CEO Kubacki would also be replaced by Brian Hullinger two month after that on August 17, 2023 and Kubacki’s Chairman titled appointed to Nevin (https://www.sec.gov/Archives/edgar/data/806517/000117184323004498/0001171843-23-004498-index.html; https://www.sec.gov/Archives/edgar/data/806517/000117184323005387/0001171843-23-005387-index.html). In a near exact inverse ratio to Kubacki’s past compensation, Hullinger’s compensation for 2023 was comprised of around 80% stock option awards (that would vest in 3rds over a 10yr period) and 20% cash compensation (https://www.sec.gov/ix?doc=/Archives/edgar/data/806517/000117184324001671/pmd20231231_10k.htm).

Examining the BoD and exec team of the company in the year prior to Kamin’s appointment to the board vs the composition right before the take-private announcement, we see that only two of the original nine members remained (Robyn C. Davis and Andrew M. Reynolds).

(https://www.sec.gov/Archives/edgar/data/806517/000117184322002192/0001171843-22-002192-index.htm; https://www.sec.gov/Archives/edgar/data/806517/000117184324001671/0001171843-24-001671-index.htm)

.

2020 and 2022 strategic review + going dark discussions…

The public filings seem to indicate that Kamin was a driving force in re-starting the BoD’s strategic review to find a buyer for the company in 2021; they tried and failed. Now it looks like he’s kicked out most of the old management team and is going to get the company ready for a sale himself, starting with cutting the time and reporting costs of remaining a public company. On Aug 12, 2024, the company announced the negotiated offer from Kamin’s 3K L.P. to take the company private in a reverse/forward stock split that will cash out minority shareholders of (at least) lesser than 4000 shares at $2.35/sh before the delisting and deregistration of the company’s common stock with the SEC.

Post-take-private, Kamin will own around 35% of the company’s common stock. that is, he is more than tripling down on the size and value of his existing position (given that all his other buys were at a higher cost basis than current price) from 624,737 shares as of the latest 13D filing with an additional 1,595,744 shares post-transaction (https://www.sec.gov/edgar/search/?r=el#/q=kamin&category=form-cat3&ciks=0000806517&entityName=PSYCHEMEDICS%2520CORP%2520(PMD)%2520(CIK%25200000806517)). Additionally, his hedge fund 3K L.P. will have the right to designate 2 directors and limit the total BoD seats to 5; he will essentially have total control of the board given that he is also on the BoD and the 4th seat is occupied by Chairman Nevin who was appointed as part of the original cooperation agreement between PMD and Kamin’s 3K L.P.

Below is a graphical timeline of the relevant events —I think things are a bit more understandable in this visual form, though at the expense of being able to add the relevant filing links. (In any case, most of the relevant timeline and deal details can be read about in the proxy related to the going-dark transaction here https://www.sec.gov/Archives/edgar/data/806517/000117184324005690/0001171843-24-005690-index.html).

(Base image from https://www.insidearbitrage.com/symbol-metrics/PMD/insider-transactions)

(Note that most of the details of the 2020 strategic review, including the $12.00 offer, were mostly left hidden/opaque to investors at the time —as decried by Kamin in his 2021 letter— and were only revealed in 2024 via the definitive proxy related to Kamin’s take-private offer. It may be relevant to keep in mind that he increased his stake to 10.99% in April before actually joining the BoD in June, so it’s somewhat unlikely that this $12.00 price point informed his buying at the time.)

.

Before joining the company’s BoD, Kamin owned ~8.4% of shares. Examining his public filings, it appears that around half of this block was acquired at a cost basis of around $4.50 (https://www.sec.gov/Archives/edgar/data/937541/000117152020000488/0001171520-20-000488-index.html) and the other half at around, say, $7.00 (https://www.sec.gov/Archives/edgar/data/937541/000092189521002154/0000921895-21-002154-index.html). Some months after writing his letter to management, we see that he later upped his stake to 11% at a cost basis of around $6.50 - $7.00 (https://www.sec.gov/Archives/edgar/data/937541/000092189522001328/0000921895-22-001328-index.html). If the proposed reverse split at $2.50/sh occurs at the midpoint of 1-for-5000, his stake would increase to around 35% ownership of the company (34.94%, https://www.sec.gov/Archives/edgar/data/806517/000117184324005690/0001171843-24-005690-index.html). I think it’s fair to assume that Kamin expects to be able to get north of $7.00 in a sale of the company based on his past purchase prices.

(More of his Form 4 and 13D filings can be found here: https://www.sec.gov/edgar/search/?r=el#/q=kamin&category=form-cat2&ciks=0000806517&entityName=PSYCHEMEDICS%2520CORP%2520(PMD)%2520(CIK%25200000806517); https://www.sec.gov/edgar/search/?r=el#/q=kamin&category=form-cat3&ciks=0000806517&entityName=PSYCHEMEDICS%2520CORP%2520(PMD)%2520(CIK%25200000806517))

Valuation

We can glean some idea of what the company might be worth by looking at the buying history of the person who is now planning to take the company private. Kamin’s main bulk of share purchases occurred at around $4.50, $7.00, and $6.50, so we can assume he thinks it’s worth at least $7.00. (https://www.sec.gov/edgar/search/?r=el#/q=pmd&ciks=0000937541&entityName=Kamin%2520Peter%2520(CIK%25200000937541)). $7.00/sh was also the price of the 2022 verbal offer and well below the 2021 $12.00 non-binding offer that was abruptly dropped.

As part of PMD’s “going dark” discussions, the company commissioned Mirus Securities Inc. as an independent advisor to evaluate the company and provide a fairness opinion on Kamin’s take-private offer, which was apparently internally code-named “Project Northern Lights”. As part of their fairness analysis, in addition to comparable going-dark reverse stock split pricing precedents, Mirus conducted valuation analysis of PMD based on comps analysis, comparable/precedent transaction analysis, DCF analysis, and estimates for how the company would sell in an LBO scenario (https://www.sec.gov/Archives/edgar/data/806517/000117184324005038/exh_cii.htm; https://www.sec.gov/Archives/edgar/data/806517/000117184324005522/0001171843-24-005522-index.html, see Exhibit (c)(ii)). (The Mirus presentation slides below are from the August 2024 valuation section).

(Something to keep in mind is that the DCF and LBO valuations by Mirus were informed by management’s given forecasts for the business —which were likely not accounting for any planned cost-cutting or other changes that Kamin may be planning for the company once he takes it private).

(In this last table, I remove the extreme high and low outlier values included in the Mirus precedent transaction valuation analysis)

Note that even on the low end, you wouldn’t lose too much money buying in at the $2.35 reverse split price and in most cases you are at least doubling your money.

My downside estimate of $1.60 is purely based on taking the minimum between the Mirus valuations (in this case, the DCF valuation low) and the 52-week lows that the stock traded at (which was actually a 20yr low for the stock) in the time prior to the disclosure of the Kamin take-private deal.

Catalysts

Kamin take-private, turn-around / cost-cutting, and subsequent sale of the company.

Risks

Perhaps this doesn’t need mentioning, but I will mention it anyway: there is no guarantee that Kamin will ever be able to successfully sell the company, what that timeline might be, or if that is even his actual intention. ********** UPDATE 20241203: For an example, see the comment thread here. ********** Based on the past events and what I’ve written in this post, I think that is exactly what is planned and think he will be successful, but others may disagree (if you have a good reason to doubt, do let me know before the transaction actually happens!).

Note that in the intervening time between the going-dark event and the —expected— sale of the company, the deal proxy does not guarantee that shares will even trade on the OTC Pink or Expert market. That is, you should assume you will be locked in for the foreseeable future.

Any trading in our common stock after the Stock Split and deregistration under the Exchange Act will only occur in privately negotiated sales and potentially on the OTC Pink Market, if one or more brokers chooses to make a market for our common stock there, subject to applicable regulatory requirements; however, there can be no assurances regarding any such trading. ~~~ https://www.sec.gov/Archives/edgar/data/806517/000117184324005690/0001171843-24-005690-index.html

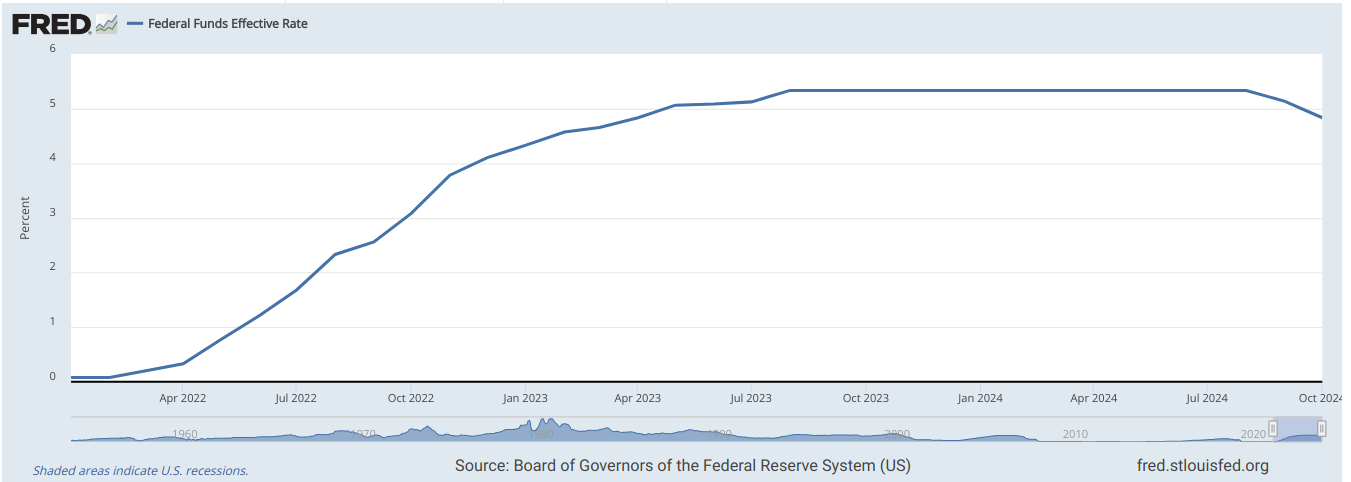

Furthermore, some of those precedent comparable transactions documented by Mirus occurred at times where interest rates differed from where they are at today and likely make a difference in how much a strategic buyer is going to be willing to pay (both from a DCF equation POV and a debt burden / financing POV).

(https://fred.stlouisfed.org/graph/?g=1BRzG)

Some odds and ends

An interesting twitter thread on potential regulator tailwinds lining up for PMD’s business: https://twitter.com/ragnarisapirate/status/1672244729394917376?s=51&t=oE6GN6vLZWb087-UBs2QXA

Note that the reverse/forward split is currently planned to be within a range from between 1-for-4000 to 1-for-6000, so, to be conservative, one would need to purchase a block of 6000 shares if they wanted to ride along into the take-private.

********** UPDATE 20241211: This is a bit late at this point, but just wanted to clear something up. The way the reverse forward split worked was like this: Market closes, shares are set to reverse split at ratio of 1-for-5000, anyone who would end up owning less than 1 share as a consequence the reverse split instead gets all of their shares bought out at $2.35/sh right before the split, the reverse split then happens, then the forward split was done in order not to cause an artificial spike in stock price nor affect liquidity for remaining shareholders. So if you had 5001 shares going into the split, you did not lose that 1 share nor and up with 5001 shares after the forward split, you ended with that same amount you went in with because you owned at least 5000. Why not directly buy shares at that $2.35 price (up to the total amount specified in the going-dark proxy filing) via a rights offering? It’s because the goal was not to reduce float or simply obtain more stock, but to reduce the total number of stockholders of record (which the proxy filing estimated would be reduced from 201 to 39). Doing the reverse/forward split provided an indirect way to forcibly buy out smaller shareholders (those with less than 5000 shares). **********

If you do buy a sufficient block of shares and intend to allow them to go dark along with Kamin, you should also be sure to contact your broker in cases where your shares are held in “street name” by you broker, rather than yourself, to ensure that they will not unintentionally cash you out in the reverse split. (The company intends to treat “street name” shares no different than any others, but you may want to double check ( https://www.sec.gov/Archives/edgar/data/806517/000117184324005690/def14a_101824.htm, see “Treatment of Beneficial Holders (Stockholders Holding Shares in “Street Name”)”)).

One should also take care that they own their blocks of shares in a single account, rather than only in aggregate across multiple accounts that would result in them being cashed out on an individual basis.

.

One possibility to keep in mind is the following: stock moves to expert market with limited financials available > stock price drops > Kamin gets the company into better shape > performs a reverse split of say 250,000-1 for a medium price, leaving only a few shareholders, then sells the company to a third party for a higher price or uses the company as a dividend cash cow. Everything works as hoped for with one exception, regular shareholder are cut out of enjoying any of the benefits (this seems to be happening at CLWY).