($CRMZ) CreditRiskMonitor.com: Commentary

Niche, asset-light, economic anxiety beneficiary microcap set to inflect on continued deglobalization and tightening credit supply

********** UPDATE 20241013:

**********

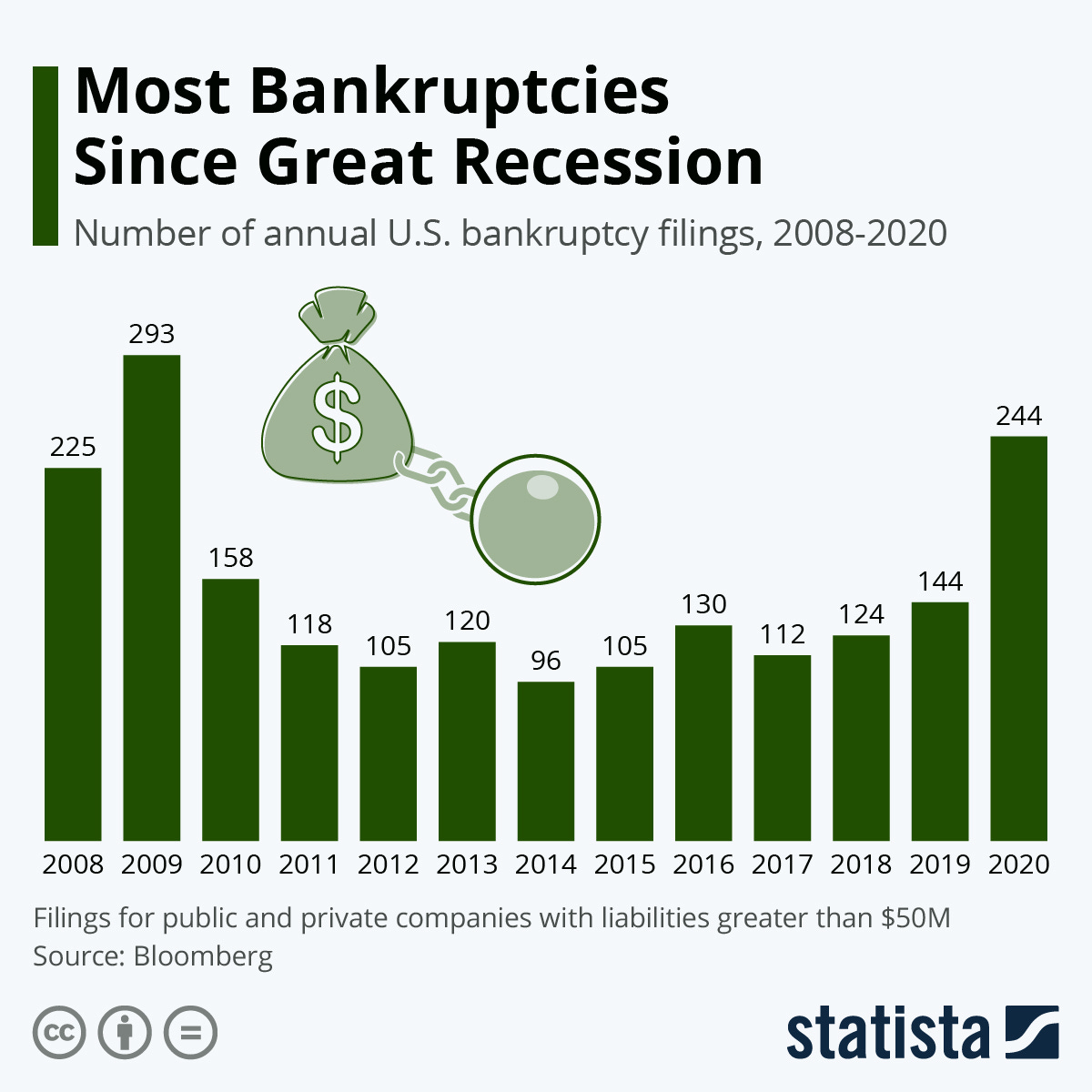

“Given the inflationary environment in 2022, the corresponding tightening of interest rates by central banks, and the number of businesses with limited ability to cover their interest expenses with earnings, the Company expects that the number of corporate bankruptcies will at worst return to long-term average levels which will support the need for the Company’s solutions.” —- CRMZ 2022 10K

Not many companies can say that bankruptcies and greater economic uncertainty are a good thing for their business, but this is generally the case for CreditRiskMonitor.com which sells subscription-based B2B trade-credit risk analysis services.

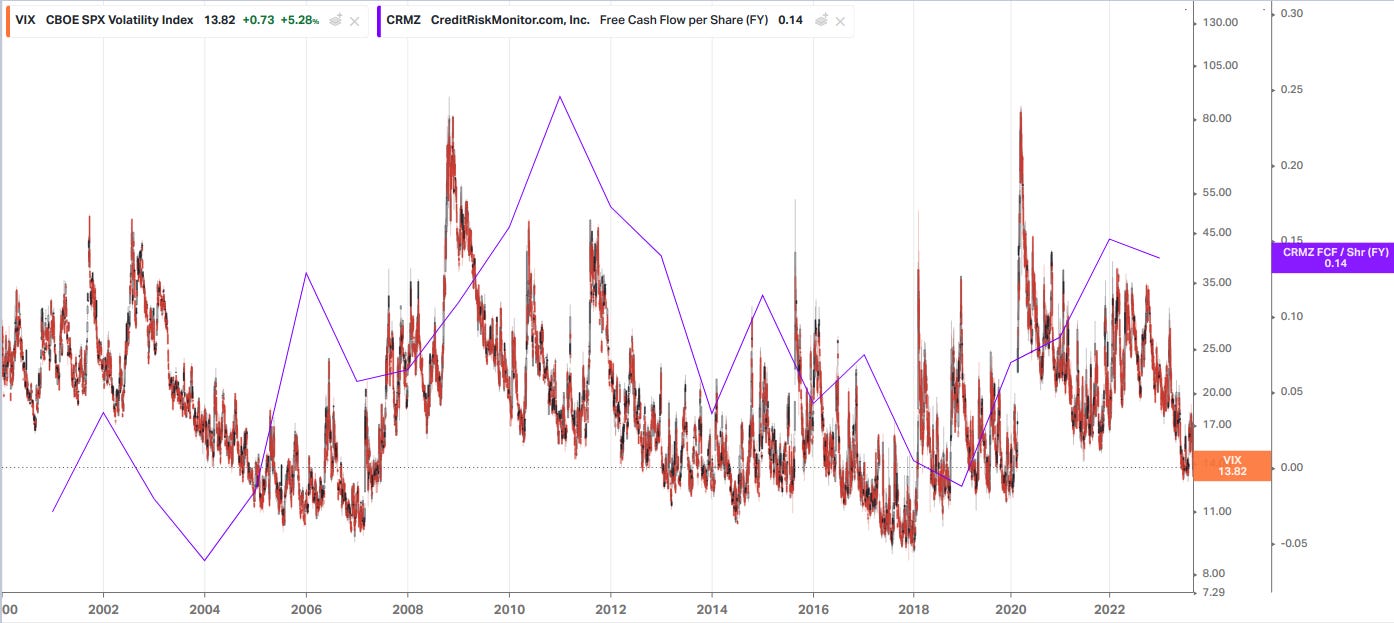

TLDR: CRMZ —like many OTC stocks— is a small, illiquid, and underfollowed company. Unlike many microcaps, it has no debt, hasn’t a single year of negative cashflow from operations (since 2005), is managed by owner operators with a lot of skin in the game, and has a 10yr history of returning capital to shareholders. It’s business model is acyclical and has historically (for better or worse) functioned as a proxy for economic uncertainty and market volatility —and you can own it without the inevitable negative rollover yield that would come with holding a VIX ETN for any sustained period (+ it’s an actual operating business). BTW, that lumpiness in the economics could be coming to an end with a new product launch and younger CEO.

(koyfin.com; note that I have the VIX graphed on a log scaled axis only because the values would otherwise be too nominally different in scale to show the pattern of CRMZ’s correlated FCF here)

Looking at the volatility chart above, CRMZ’s 16x P/E is pretty reasonable if you think that the red-and-black line is going to trend upwards going forward in the medium- to long-term. The current historic rise in interest rates could push many zombie companies —that may have previously found it difficult to go bankrupt in the previous ZIRP environment of the past decade, despite not generating enough cashflows to cover their debt payments— into insolvency and provide a slow-rolling tailwind of demand impulses for risk analysis services by the surviving businesses as their accounts receivable dollars for these zombie customers become uncollectable1.

CRMZ might not even need a recession to thrive if the likes of Zoltan Pozsar, Harald Malmgren, and Howard Marks turn out to be correct and supply chains continue to lengthen and reconfigure, introducing greater weak-link risks for businesses, while higher-for-longer rates reduce the global supply of credit.

*Disclaimer: I sometimes write about ideas I think are good and sometimes about ideas I just think are interesting, this post falls more into the latter category. I could find relatively little written or discussed online about this name, so when translating my raw notes into this post, I erred on the side of keeping, rather than cutting, information.

*I’ve DCA’ed some money into this stock, but not very much at present. 2

Brief history

“I was rich enough that I could retire; I'm the kid in a hedge fund; it’s you know 1998. My partners are all 90 and 80 years old and I'm an old guy, so they're all trying to get rid of money; they’re giving money to their great grandchildren for crying out loud and I said ‘look, take the money back, I'm not doing anything’ and I decided what am I going to do. I'm going to take a company and, finally, I'm going to build one company from scratch that I design that meets all the criterias that I am looking for in every company over the last 50 years in the hedge fund. I was going to start and build that and I had to take it from whatever I thought was the environment that we were starting with, and I think there is a debt crisis.” —- Jerome Flum, Planet Microcap interview

CRMZ’s Chairman (and former CEO before his son took over the role in early 2023) Jerome Flum worked as the GP at a hedge fund, Flum Partners3, starting in 1972, investing in the smallcap space. Flum closed the fund (or at least returned the money to his LPs) in 1998; it was apparently quite successful throughout this period4. CreditRiskMonitor.com was (re)founded by Flum that same year after Flum Partners bought majority control of the company, formerly a diet snacks business called New Generation Foods Inc, and transformed it into the trade-credit data service that exists today.

In their earliest 10K filing, the history of the company is described thusly:

“CRMZ was organized in Nevada in February 1977 and was engaged in the development and sale of nutritional food products from 1982 until October 22, 1993, when it sold substantially all of its assets (the “Asset Sale”), as previously reported. In September 1998, the Company acquired an option (the “Option”) to purchase the assets of the CreditRisk Monitor credit information service (“CM Service”) from Market Guide Inc. (“MGI”). The Company exercised the Option on December 29, 1998 and completed the purchase of the CM Service assets effective January 19, 1999. The assets included customer contracts, receivables, equipment, software and intangibles. Following the closing of the CM Service purchase, the Company commenced doing business under the name “CreditRiskMonitor.com”” —- 10K filing March 23, 2009.

However, looking at the 10KSB filings from their time as an even smaller company5 —most of which time they were not even an operating business— we can see a bit more detail on their bumpy origins…

“New Generation Foods, Inc. (the "Company" or "NGF") was organized in February 1977 under the laws of the State of Nevada and adopted its present name in August 1977. The Company was engaged in the development and sale of nutritional food products until October 22, 1993, when substantially all of its assets were sold (the "Asset Sale"), as described below. As a result of the Asset Sale, the Company is no longer an operating company. During 1994, 1995, 1996 and 1997, the Company had no revenues and its income was derived from interest and dividends and gains on the sale of its assets. The Company's assets consist principally of cash, cash equivalents and marketable investment securities.” —- 10KSB filed April 15, 1998

Flum was involved with the company since before it was CreditRiskMonitor, appearing as Chairman in CRMZ’s oldest SEC filing of May 15 1996, while the company was still New Generation Foods Inc6. The company’s oldest 10KSB (filed March 31, 1997) lists Flum as Chairman and CEO, holding approximately 37.5% of the outstanding shares of common stock for New Generation Foods and yet more via Flum and Flum Partners’ ownership of Series A (“each share thereof is convertible into .0297625 shares of Common Stock”) and B (“each share thereof is convertible into .0294125 share of Common Stock”) preferred shares (which we later converted to common stock when the company acquired CRM from Market Guide Inc)7 8.

The filing details a good bit of the companies early history:

“During the period 1982 - 1992, the Company developed a family of all natural, nutritional and dietetic food products made from high protein whole wheat utilizing its proprietary process. The Company's principal food product was Spicer's R Hunger Crunchers TM snacks, an expanded protein high fiber food (hereinafter sometimes called "Spicer's R"), produced with a crunchy consistency, presently in the form of small wagon wheel shapes and available in eight flavors. Spicer's R is made from high protein whole wheat (protein content of at least 14%) utilizing an extrusion process invented by Dr. Arnold Spicer, assigned by him to the Company and patented by the Company.”

I couldn’t find a picture of what these snacks looked like, but found this excerpt from a 2009 book by Ann Louise Gittleman, Ph.D. called “Beyond Pritikin: A Total Nutrition Program For Rapid Weight Loss, Longevity, & Good Health”9

“Jerome S. Flum has been a director of the Company since 1983. He was appointed President and Chief Executive Officer of the Company and Chairman of the Board of Directors in June 1985. Effective December 1989, he resumed his position as President. Mr. Flum, an attorney, has been, for more than five years, the sole General Partner of Flum Partners, a New York limited partnership which was organized in 1972”.

From this we can deduce that 1) Flum is somewhat responsible for the failure of the original company (though the line of business does not appear to have been his choice and rather something he stepped into from a director role) and 2) he was still running his hedge fund at this time.10

“The Company entered into an employment agreement with Mr. Flum, effective as of July 1, 1992. The employment agreement provides for Mr. Flum to serve as the Chairman and Chief Executive Officer of the Company until June 30, 1999, unless sooner terminated by the Company for cause, or upon death or permanent disability.”

Asset sale in Oct 22, 1993 of “substantially all of the Company's assets to American Pacific Financial Corporation”, “no determination with regard to use of the remaining proceeds of the Asset Sale”. At this time the company had just “one full-time employee who is its Chief Executive Officer [Flum] and one part-time consultant who acts as its controller” as “[f]ollowing the closing of the Asset Sale, substantially all of the Company's former employees became employed by American Pacific.”

Per 10KSB filed April 15, 1998 of the following year11…

“In November 1997, Flum Partners delivered a letter to the Company demanding payment of the applicable liquidation preferences on the Series A Preferred Stock and Series B Preferred Stock ($1,175,000 in the case of the Series A Preferred Stock and $310,000 in the case of the Series B Preferred Stock) and accrued and unpaid dividends on such shares. On the date of the delivery of the demand, accrued dividends on the Series A Preferred Stock amounted to $787,500 and accrued dividends on the Series B Preferred Stock amounted to $111,600. […] The Independent Committee then engaged in discussions with Mr. Flum, representing Flum Partners. Pursuant to such discussions, Flum Partners agreed to accept, in payment of the unpaid $1.16 million of cash, shares of a new series of convertible senior preferred stock ("Senior Preferred Stock"), with an aggregate liquidation preference equal to $1.1 million, which was $60,000 less than the unpaid liquidation preferences and accrued dividends on the Series A Preferred Stock and Series B Preferred Stock. The new series of Senior Preferred Stock does not accrue dividends, but converts into 90% of the Company's Common Stock on a fully-diluted basis.”

“After further negotiations with the Independent Committee, Mr. Flum agreed to a termination of his existing Employment Agreement effective December 1, 1997, saving the Company approximately $190,000 in salary expense through the end of the term of such Agreement, in consideration of which the Company transferred to Mr. Flum an automobile and computer equipment with an aggregate value not exceeding $10,000. Mr. Flum also agreed to continue as Chairman of the Board and Chief Executive Officer of the Company, without pay, on an "at will" basis. Mr. Flum also agreed for a twelve month period, to attempt to identify and consummate a transaction which would increase the value of the Company.”

… In September 1998, Flum did indeed identify a transaction and New Generation Foods would purchase Credit Risk Monitor from Market Guide Inc and change their company name to CreditRiskMonitor.com12:

“““

FORMER COMPANY:

FORMER CONFORMED NAME: NEW GENERATION FOODS INC

DATE OF NAME CHANGE: 19920703

[…]

(2) Purchase of CreditRisk Monitor and Capital Transactions

In September 1998, the Company entered into an option agreement (the "Purchase Option") to purchase the assets of the CreditRisk Monitor ("CRM") credit information service from Market Guide Inc. […] On December 29, 1998, the Company notified MGI of its intention to exercise this Purchase Option, which was consummated on January 19, 1999.

Concurrently, the Company completed a private placement of 1,300,000 shares of its common stock to approximately 25 "accredited investors" at a purchase price of $2.50 per share, for gross proceeds of $3.25 million. The proceeds from this offering were used to finance the cash portion of the CRM acquisition and the remainder will be used for future working capital needs.

As a participant in the private placement, Flum Partners purchased 160,000 shares of common stock. In addition, as a condition to the private placement, Flum Partners agreed to convert all of its 1,100,000 shares of senior preferred stock into 3,598,299 shares of common stock on or prior to the closing of the private placement. This conversion was effected as of January 19, 1999.

[…]

The transactions described above, along with the issuance of 2,000 shares of Common Stock to Flum Partners in November 1998 in consideration of its provision to the Company of a line of credit and the conversion by Flum Partners of its Senior Preferred shares into Common Stock on or about January 20, 1999, resulted in Flum Partners owning more than 72% of the Company's outstanding Common Stock (which is its only equity security now outstanding) after the 1999 Private Placement.”)

”””

(Note that while CRMZ’s current price sits at $2.55/sh, you’re not buying at the same price as the private placement participants of the company’s re-founding transaction; the total diluted shares outstanding at the time of the filing was 5,341,129 vs today’s 10,760,890 per the 2022 10K. If you wanted to pay a similar price to Flum’s initial cost basis here, you’d want to buy at $1.24/sh.13)

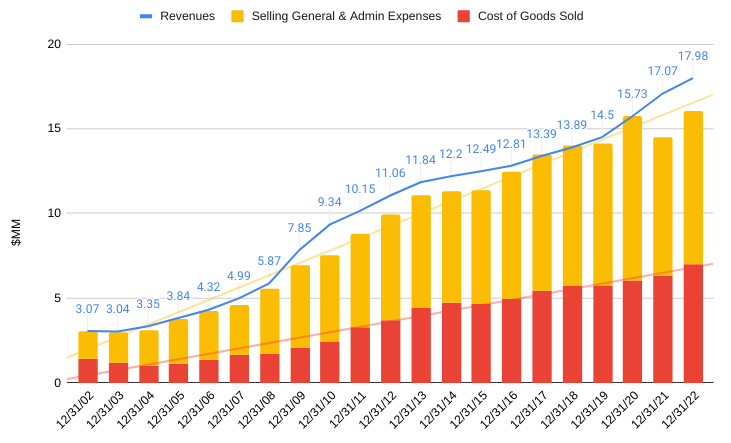

During the period from 1998 to 2004, it seems like the data and production costs remained around a steady ~$300K per period, while SG&A growth continued to slightly outpace the company’s steady revenue growth until 2005/2006 when profitability started picking up14 —though SG&A growth slowed to only a marginally slower pace than revenues. I chalk this up to an initial investment/growth period of CRMZ refining their sales process, but will have a bit more to say later about CRMZ’s apparent continued lack of operating leverage.

Since that time, CRMZ’s revenues have continued steady growth and the company has never posted a single year of negative cashflows from operations and only a single year of negative FCF.

Over CRMZ’s 22-plus years of operation, the company has since evolved the Credit Risk Monitor business from covering just a few hundred U.S. public companies to about 30 million public and private businesses worldwide and launched the Supply Chain Monitor service in early 2022 as well.15

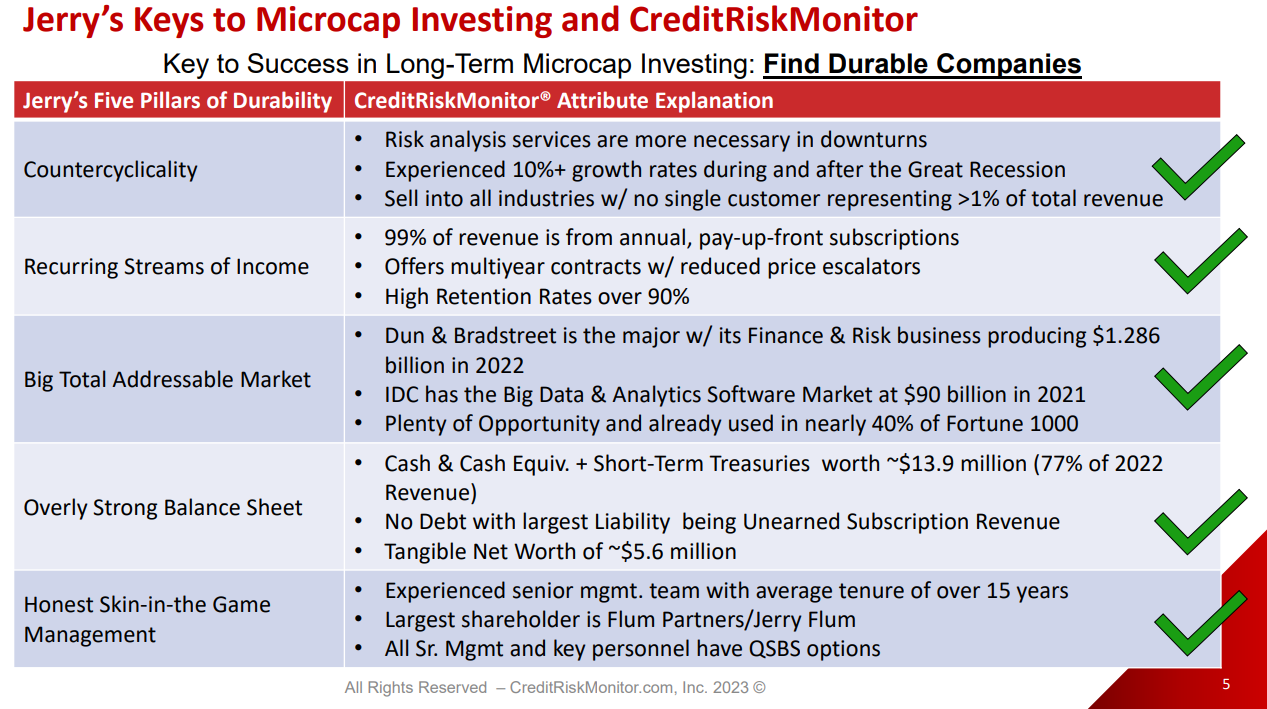

The business was selected and structured by working backwards from Flum’s “Five Pillars of Durability” which were originally used as a kind of bingo-card checklist he would refer to when looking for attractive investments in the micro/smallcap space during his decades as GP of Flum Partners. Those pillars are described below:

‘[A]t the end of the day, if you're going to invest in medium- and small-sized companies, “durable” is the key because if you have patience and it’s a decent business model, if that's your business plan and you have time and you have patience and you have a decent company and it’s durable, then you know you're going to make a lot of money. […] Durability is the key. Now, it would help, and these are the other things I think are critical to invest long term in a small cap: there are five or six things, and if you can get them, you’ll very rarely get them all in every smallcap or microcap you buy into, but if you can get them all or get as many as you can, you’re gonna have a winner —provided you have durability to last for 20 or 30 years. These are not in order of importance but they're critical […] and it's very rare to get them all. Our company, because I designed it, was designed for that.’ —- Jerome Flum, Planet Microcap interview

You can see how these pillars have manifested in the business in terms of its counter-cyclicality (the years during and following 2008 and 2020 were some of their best growth periods), consistent revenue growth, cash buildup (even while making fairly consistent dividend distributions in the recent decade), and debt-free balance sheet for most of CRMZ’s history16. Meanwhile, Jerome Flum remains Chairman owning 57.61% of CRMZ shares either directly or via Flum Partners (of which Jerome is the GP along with his son Michael Flum17 who joined CRMZ in 2018 and was the company’s COO until he was elected CEO in early 2023 as Flum Sr. stepped back from the role) —Michael Flum himself directly owns less than 1% of shares.

“My experience as a lawyer shows that a large proportion of business failures are caused by lack of capital rather than by lack of technical business knowledge.” —- The Great Depression : A Diary, Benjamin Roth, 1894-1978

Flum’s investment pillars have certainly delivered on their promise of durability at CRMZ and this is most obvious when we look at their cashflows during past financial panics in the wider economy; this seems to be about the only time they are able to deliver any earnings growth. Put another way, they’ve done a good job on that pillar of “counter-cyclicality” —though their 10K touts the business as “non-cyclical”; a bit of false advertising if you ask me.

In any case, the Flums certainly don’t appear to be getting rich at the expense of fellow shareholders (as may be a concern with certain other family-owned businesses on the OTC exchanges) —the value of Flum Sr.’s CRMZ holdings are currently worth 104x his annual compensation as Chairman— but, as we’ll see, the way they’ve chosen to build their business around these pillars has produced questionable results when it comes to any sustained compounding of value (though that may be about to change for several reasons that I will cover later in this post).

The end result is a founder-led company with high insider ownership, no debt, and recurring revenues whose income actually grows when the rest of the market is generally looking gloomier, but also shrinks when Mr.Market (and the businesses and individuals of which he is composed) cast pessimism and risk-aversion aside.

The business

Per the 2022 10K, “nearly 40% of the Fortune 1000 and well over a thousand other large corporations worldwide, use the Company’s timely news alerts, research, and reports on public and private companies to make important financial risk decisions.”

CRMZ’s trade-credit risk data business sees cashflow growth when the state of the economy is looking scary and AR dollars-at-risk become a more focused concern for businesses, while (I think the idea is that) the supply chain risk business sees demand when the economy is chugging along and businesses want to focus on getting their input materials reliably and on time18. These two segments combine to form an asset-light business that can generate profits through both the ups and downs of the economic cycle.

Quick snapshot of some figures and commentary:

.

Trade credit

Imagine you have a neighbor, Bob, who sells you tomatoes for your restaurant. Because Bob is a good neighbor, he lets you take the tomatoes today and you assure him that you will pay for them next week once your restaurant collects the cash and credit card payments from its customers, with Bob possibly offing a discount if you pay him within just, say, half that time —an “interest rate” on the “loan” that you’d be getting the discount off of having already been implicitly baked into the sticker price of the tomatoes that you initially agreed to pay for. This arrangement is a credit between you and Bob. You get to use the tomatoes right away to make your dishes, and Bob trusts you to pay him later and records your owed amount as accounts receivable (AR) on his balance sheet.

In a business to business (B2B) setting, businesses often buy and sell goods or services from each other at various deferment terms and conditions, this is called “trade credit”; one business allows another business to take their products or services and pay for them at a later date.19

Trade credit is is the 3rd most popular form of credit used by small businesses whose access to capital markets may be limited and evidence suggests that firms —especially smaller firms— use more trade credit when credit from financial institutions is unavailable. Around 2009, the World Trade Organization estimated that 80-90% of all world trade relied on the extension of trade credit.20

Trade credit is an important source of funding for non-financial corporations (NFCs). As a volume of balance sheet trade payables, trade credit represents one third of NFC’s outstanding bank loans (as bank-guaranteed trade finance), a similar size to outstanding corporate bonds, and approximately 20% of world GDP over the past 25 years (LHS figure in the graphic below).21

(Notice also the lengthening of supply chains over time (global value chains (GVC)), which means that the production and supply of goods have come to involve more stages and multiple countries, resulting in more complex supply chains with more intermediaries and participants, which should structurally increase the general demand for the kind of product CRMZ offers as reliance on longer and more complex supply chains may make even the largest companies “as weak as the weakest link”).22 23

Just like how Bob trusts you to pay for the tomatoes, businesses also want to be able to trust each other to honor these trade credit agreements. Trade credit risk is about the concern that the business buying the products or services might not pay as promised or otherwise default on the “loan”; like Bob worrying that you might forget to pay him back for those tomatoes or that your restaurant might go bankrupt and simply lose the ability to pay him back.24

The challenge of assessing customer creditworthiness for trade credit suppliers is where CreditRiskMonitor.com comes in.25

Our Risk Management Solutions help customers increase cash flow and profitability while mitigating credit, operational and regulatory risks by helping them answer questions such as:

• Should I extend credit to this new customer?

• Should I do business with this entity?

• What credit limit should I set?

• Will this customer pay me on time?

• How can I avoid supply chain disruption?

—- CRMZ competitor Dun & Bradstreet’s 2018 10K26

.

CRMZ has two lines of business: Their CreditRiskMonitor (CRM) data product that they’ve been refining since 1998 and the SupplyChainMonitor (SCM) product that was launched in early 2022.

.

Credit Risk Monitor (CRM)

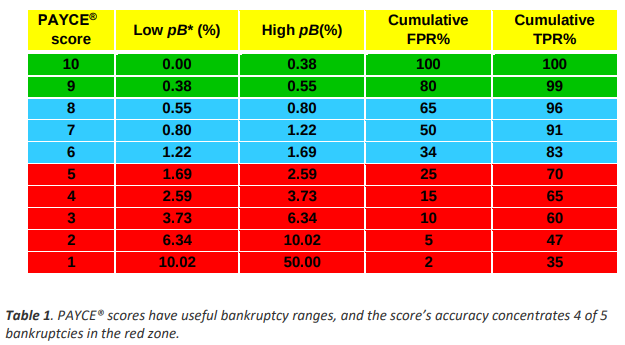

CRM encompasses a suite of data analytics tools focused on assessing the creditworthiness of prospective trade credit borrowers, offering some form of coverage for 30 million public and private companies27 28. (That number is largely made up of smaller private companies of which CRMZ collects trade data; you can see the 70K public companies CRMZ tracks in the sample directory, here). This coverage includes CRMZ’s proprietary FRISK and PAYCE scores which the company claims to be 96% and 80% accurate in predicting bankruptcies, respectively. (Note that these scores are not simply binary as may be the impression from their marketing, what this really means is that, for example, the FRISK score is able to capture/predict 96% of bankruptcies occurring during the subsequent 12 months of a company that is placed in its “high-risk” categories (1 to 5 of a 1-10 scale)).29

(IDK why the lowest scores even have an upper bounding pB, here. Unless I misread the whitepaper, this means that a score of 1 indicates that a company has a 10-50% chance of bankruptcy in the next 12 months. What score is assigned if the model predicts a 51% chance of bankruptcy?)

FRISK scores use daily crowdsourced sentiment analysis on the metadata collected by tracking the behavior of existing users’ interactions with CRM’s various tools, data, and coverage universe (eg. what kinds of data they are clicking on and for what industries or individual companies and how this behavior is changing over time) in addition to public company data and data from credit rating agencies that are combined to produce a score intended to signal the probability of company bankruptcy within the subsequent 12-month period.30

“We’re capturing the sentiment of the very people in charge of the extension of trade credit. When the sentiment indicates increased concern for a particular counterparty, a likely result could be the reduction in the extension of trade credit to that counterparty. The loss of that trade credit will create a hole in that firm’s working capital, escalating its risk of bankruptcy. […] Additionally, all of these credit managers are outside of SEC Fair Disclosure31 meaning that they are allowed to have non-public conversations with their competitors and customers without triggering the need to make a public filing.” —- Michael Flum, https://www.ceocfointerviews.com/creditriskmonitor22.html

As CRMZ describes it: “Website click pattern data from CreditRiskMonitor subscribers, represent[s] key credit decision-makers at more than 35% of current Fortune 1000 companies plus thousands of other large companies worldwide […] It is commonly known [that] credit managers confidentially share information with other credit managers, thus collectively, their behavior helps to provide advanced insight to financial problems in public companies.”32

On the subject of negative feedback loops in their crowdsourced data, remember that FRISK data is also supplemented with credit rating agency scores as well as public company data (whose reporting is based on longer time frames than the daily usage statistics of the CRM subscriber metadata that might, on it’s own, produce more volatile spikes in sentiment)33.

PAYCE scores apply to private companies for which financials are not publicly available. This is done using client companies’ trade payment information along with U.S. public-record filing information (i.e., suits, federal tax liens on companies’ unpaid taxes, judgments, and bankruptcy info).34 These scores are similar to the PAYDEX scores provided by Dun & Bradstreet (D&B)35 whose Finance & Risk business segment is the primary incumbent in CRMZ’s industry.

.

Trade payment data —generally considered extremely valuable credit information— is collected from CRMZ’s Trade Contributor Program. This is a give-to-get program where companies (who are not necessarily CRM subscribers) can become a node in CRMZ’s trade data network and agree to share their trade data (essentially their AR data and associated customer business accounts tied to those AR dollars)36 with CRMZ. This gives them access to the FRISK and PAYCE scores as well as CRMZ’s Days Beyond Terms (DBT) Index score37 and other CRM tooling on a limited coverage basis for the accounts in the contributor’s own trade payment portfolios (in the case of TCP members that are not also CRM customers) —all of which are now enhanced by the contribution of this incremental contributor data.

This data contains information related to the payment behavior of a business or entity when dealing with its suppliers and customer accounts. CRM mostly uses this for tracking the timeliness and consistency of payments made by accounts to their suppliers (CRM subscribers and data contributors) for goods or services received.

Contributors are able to see their own AR portfolios stratified by dollars at risk across various FRISK, PAYCE and DBT Index levels and drill into what individual accounts are contributing to the risk scores on those dollars in AR, they can see how promptly they are being paid by accounts vs the various anonymized counter-parties that account also does business with (that are part of CRMZ’s trade data contributor network), and receive notifications of counterparty bankruptcy filings among other things. Providing trade data also allows CRM subscribers to see how much of their own AR dollars are actually covered by CRM’s various scoring models in addition to the benefits above.

For more info on how trade receivables data is used by companies like CRMZ to determine risk at private companies, see the CRMZ podcast episode with the Flums here: https://www.creditriskmonitor.com/resources/podcasts/trades-thing

You can see a sample of CRMZ’s credit risk report on themselves, here: https://info.creditriskmonitor.com/Report/Snapshot.aspx?BusinessId=2274 (I do find it odd that they don’t appear to have FRISK or PAYCE scores on themselves in this report).

.

CRMZ’s claims that the FRISK score is 96% accurate in predicting bankruptcy and they provide an ROC curve vs the Altman-Z score to demonstrate its superiority as a metric, but I question if skewness of their training and testing data might be giving their model a boost here (given that I assume their data likely would not have had an equal balance of bankruptcies vs non-bankruptcies). For example, in describing how CRMZ developed their PAYCE scoring model, they mention that the data used “a total of 60,000 unique businesses and a total of 1,150 bankruptcies”38, so around just 2% of the training data contained true positives; this wouldn’t seem like a hard subset for a machine learning model to overfit for.

Their whitepaper on the FRISK model notes that “[t]he CreditRiskMonitor database was used to develop the FRISK® score using company data and bankruptcies between 2003 and 2013. This period covers 9,600 unique businesses and includes 580 U.S. public company bankruptcies.”39 This is not a very large data corpus40; perhaps Z-scores don’t work better, but work more often? I haven’t fully thought through that whitepaper yet, so maybe I’m getting this wrong and there could be details that the whitepaper does not cover.

.

Supply Chain Monitor (SCM)

The SCM product emerged from CRM customer account executives getting feedback from clients and learning that many were using their existing CRM product to evaluate their suppliers in addition to the typical/intended use case of evaluating buyers / trade credit “borrowers” —apparently 15-20% of CRM’s business was made up of clients who were using CRM for this purpose. Around 2019, CRMZ then decided to design a new product specifically for clients to evaluate their supplier-side risk and lunched SCM in early 2022. In SCM, users can upload lists of their suppliers and view FRISK and PAYCE scores across their supply chain, examine and monitor financial stability metrics of vendors across peers, alternatives, and across industry SIC codes41, as well as generate custom reports.

CRMZ’s podcast episode with Jerome and Michael Flum on the SCM product can be found here: https://www.creditriskmonitor.com/resources/podcasts/enter-supplychainmonitor

A description of some of the technology details behind the SCM service can be found here: https://www.otcmarkets.com/otcapi/company/research/360363/content

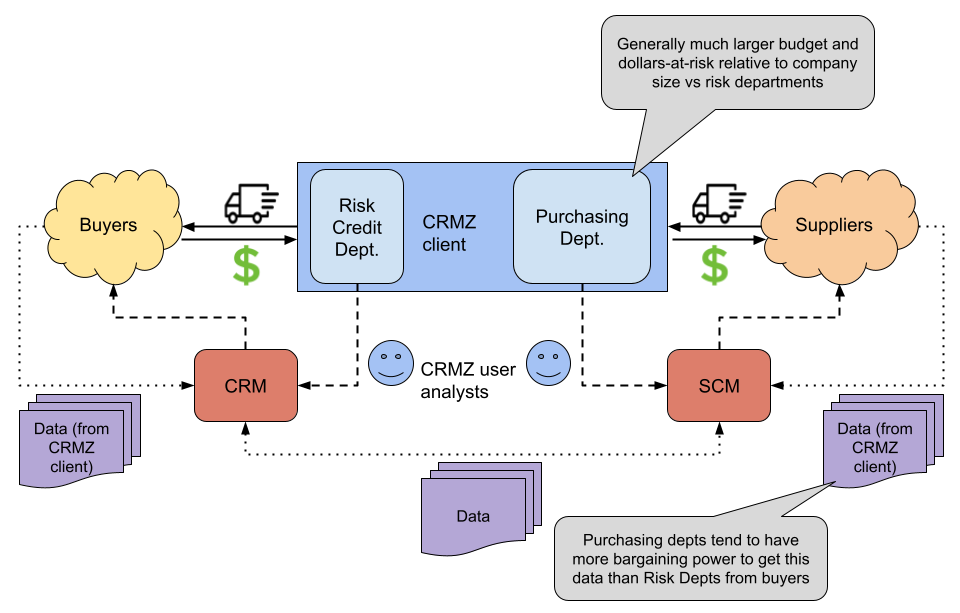

The opportunity here is that purchasing departments are generally much larger than the credit/risk departments that CRMZ typically sells to and these departments tend to have greater bargaining power to obtain relevant trade data from counterparties that can be supplied to improve SCM analysis.

.

.

As of 2023, the CRM World Wide flagship product is billed on a per user basis at around $11,450 for the first user and $1,680 per additional user with additional add-on features available. The SCM product is billed at $25,000 annually per 20 users and additional 20 user slots being sold at declining rates; the more batch-focused manner of the SCM fee schedule being a testament to the larger relative sizes of client purchasing departments vs credit risk departments —as well as likely acting as a form of per-user rebate as CRMZ continues to build out the value of SCM and learning how to best to sell the product to customers.

.

“Each CreditRiskMonitor subscriber enjoys the services of a dedicated account manager to help solve problems and assist you in finding the biggest risks within your A/R portfolio.” —- https://www.creditriskmonitor.com/why-creditriskmonitor/dedicated-support

Jerome Flum has stated that ‘every client gets a personal account manager to work with’.42 This high-touch customer service model —which allowed CRMZ to identify the opportunity to extend their existing product and competencies to SCM— seems to have been a drag on margins for a long time. Perhaps one could consider this a structural cost of differentiation in addition to their focus on keeping prices for customers extremely low. In this case it paid off, but overall I find this aspect unappealing. Surely in their 20yrs of operation they could have come up with some strategies to get these costs under control.

Examining the financials

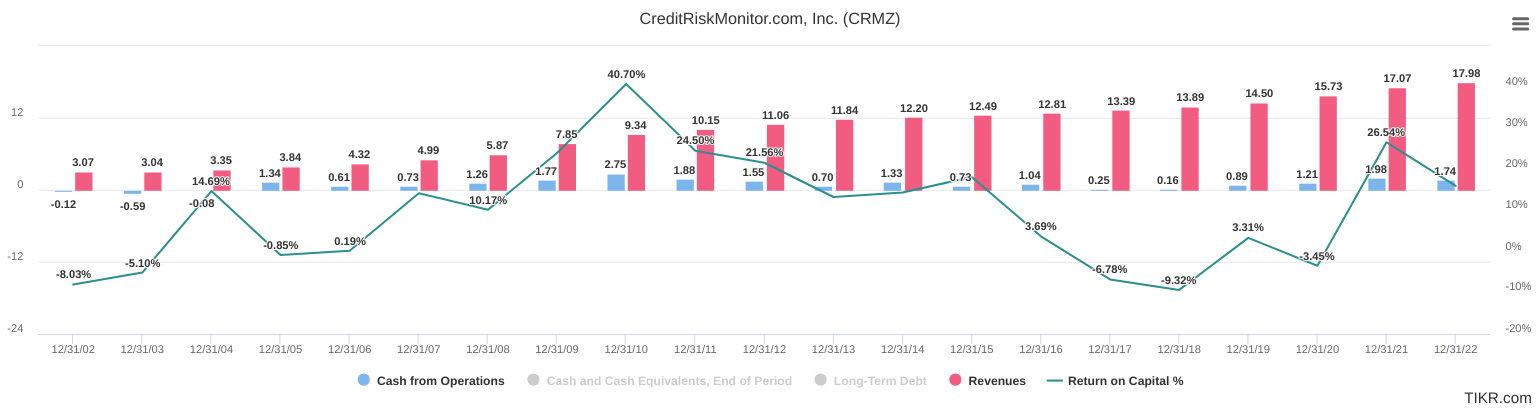

Below we see CRMZ’s CFFO, earnings, and ROIC43 over time…

… Notice that profits spike upwards during, and in the wake of the 2008 GFC and 2020 COVID-19 pandemic and that the company has managed to never have a year of negative CFFO since 2005 even in the off periods.

Looking at some of the other past CFFO spikes…

2005: Revenues etc didn’t change too much but they had a big bump due to “Gain on settlement of litigation” over something that began in early/mid 2004.44

2014/16: The 10K attributes this to new subs growth w/out attributing a “why” and the company does not do conference calls. There are many economic-uncertainty events that one could speculate as having contributed to CRMZ’s uptick in business and the demand for CRM services, among them are: the oil bust during this time45, Greece (a major player in global shipping) becoming the first developed country to default on IMF loans in 201546, and the UK Brexit referendum in June 2016.

.

Let’s look at how CRMZ has spent their cashflows over time:

Some notes on this cashflow spend:

Net cash was positive in 2003 despite negative CFFO due to issuance of common stock for a sum of $830K. (Note: I skimmed the 10QSBs from 2003 and 1Q2004 and couldn’t find this sum, so there might be something wrong with TIKR’s / S&P CapitalIQ’s data here —which is what TIKR sources their data from).

I don’t include the cash inflows from sales of marketable securities, since I’m just trying to look at how CRMZ spends and retains their CFFO here. The 2008 investment was in “U.S. Government intermediate bond funds” and was sold for a slight profit in 2009; the 2010 investment was in “U.S. Treasury Note, due 11/15/2015” sold at a slight loss in 2015 due to rising interest rates at the time; the 2020 investment in municipal bonds were sold for their approximate cost basis in 2021; in 2022 CRMZ invested $4MM into ultrashort USTs and is still holding on to them.

“In April 2008, the Company prepaid, without penalty, the remaining $254,000 balance on the promissory note related to the January 1999 purchase of the CreditRisk Monitor credit information service from Market Guide Inc. This note provided for periodic monthly payments with the last payment due on December 31, 2009.” After this point, the company did not take on any other debt —until a PPP loan in 2020, later forgiven.

Computer equipment and software seems to consistently be the majority of CRMZ’s capex spending. I’d argue that some portion of their SG&A should be capitalized as well since some of that spend goes into retaining existing clients over the longterm and could be considered as maintenance capex47. We can play around with this idea to get a view as to how that changes ROIC and their P/E multiples, below:

We can see from 2009 to 2019 that dividends also made up a large portion of CFFO spending; there are points where no CFFO is retained and instead capital is simply returned to shareholders. We can at least surmise from this that the Flums are not simply interested in empire building. I assume the pause in 2020 was done for the dual purpose of 1) strengthening the company’s balance sheet in the face of economic uncertainty —which I assume was similarly the reason for the US bonds investment in 2008— and 2) retaining excess cash for investment into CRMZ’s Supply Chain Monitor business that began development in 2019 and was launched in 2022.

The constant middling bond investments and dividend distributions coinciding with the long period of falling CFFO seems to imply that management couldn’t really find any great uses for their capital until starting work on SCM in 2019. I think is this something to watch.

The spike in net cash in 2020 beyond their CFFO was mostly due to the injection of a Payment Protection Plan loan of $1.56MM that was later forgiven in 2021; “In accordance with the requirements for forgiveness of the PPP loan under the CARES Act, the Company has used the entire proceeds from the PPP loan for eligible payroll, benefits, rent, utility costs, and maintained its employment levels.”

.

Business moat commentary

The business has a strong foothold in providing financial risk analysis services, with a significant subscriber base that includes 40% of Fortune 1000 companies. Though, IMO, the threat of new entrants is relatively high.

On the public data side (eg. where the FRISK scores are derived) IDK that this isn’t something that any other well capitalized competitor or entrant couldn’t also do for themselves (eg. Google or anyone else with some data engineering, analysis, and machine learning skills)48. The private data side (eg. the PAYCE scores) has some barriers to entry in the fact that private businesses’ internal trade receivables accounts data is not something that is very willingly shared, but these programs do have a precedent at many corporate ratings businesses that collect trade data (eg. CRMZ and D&B) and, to my understanding, it’s not as if these networks are defended by any kind of regulatory moats. However, the recent failure of the launch of Meta’s Threads feature49 does give some evidence of a well-capitalized and -reputed competitor failing to capture market share due to a lack of in-place network effects.

The company's Trade Contributor Program, which aggregates confidential trade receivables data from subscribers and other give-to-get contributors, creates a network effect that enhances its data quality and relevance. So long as CRMZ continues to provide value to subscribers and contributors (I believe Flum has mentioned that their subscriber re-sign rate is around 90%) via their proprietary ratings and data tooling, I’d expect this network to strengthen over time.

The company relies on data suppliers like corporate issuer ratings from key Nationally Recognized Statistical Rating Organizations (NRSROs), it’s their main COGS expense. If it has established long-term contractual agreements and diversified its data sources, its bargaining power could be strong, but really IDK. I would say the power CRMZ has over any of their data suppliers is likely low, though note that their proprietary scores like FRISK and PAYCE are —aside from external ratings agency scores that are blended into FRISK— based on public information or data from trade data contributors, so their proprietary data is not too dependent on much upstream proprietary data, itself.

CRMZ’s main customers are corporate credit and procurement departments. The business may have a degree of pricing power if it can continue to deliver accurate and timely information, but CRMZ competes with Dun & Bradstreet’s Finance & Risk business, Experian’s, and Equifax’s credit risk analysis products50 largely on costs, so IDK what kind of pricing power CRMZ has over buyers; goal of being the “lowest cost provider” is right in their 10K.

“A common pattern is to identify the most valuable use case for your data asset yourself; wrap it into a software app; and then sell the app. Google is the canonical example here: one of their data assets is ‘knowledge of customer intent’, which they wrap into their Ads business. Advertisers covet the ability to get their product in front of the ‘right’ customers; they’d do this themselves if they knew who the right customers were; Google has that info, and so does it for them, at a price. Experian does the same for consumer credit data;” ~~~ Pivotal 51

In both the 10K and in interviews with Flum Sr., it is noted that CRMZ aims to be the lowest-priced services compared to major competitors while maintaining high accuracy levels (as demonstrated by their FRISK and PAYCE scores in stratifying bankruptcy probability). This counter-positioning strategy I think is one of the main strengths of CRMZ.

CRMZ’s CRM data product differs from the primary incumbent in their industry, Dun & Bradstreet (D&B or ticker DNB), by offering a low-cost subscription model (though with a less well-covered universe of private companies) to D&B’s higher cost —and Flum Sr. would argue ‘monopolistic rent seeking’— data offerings. This counter positioning can be traced back to CRMZ early strategy of competing with Dun & Bradstreet.

“Nobody gets fired for using DNB” —- Michael Flum

In CRMZ’s early years of operation, when their data product was less robust, D&B sold their customers prepaid units and/or reports (“units”) on an annual basis, which they could then use to buy DNB products throughout the year52; these were pricey reports, so customers had to be judicious about which companies they would use these credits on. Utilizing CRM as an initial low-cost filter for further credit risk analysis considerably decreased the evaluation expenses that client risk teams dedicated to potential vendors —allowing them to ensure that only financially strong vendors qualified for more expensive and comprehensive due diligence such as utilizing one of their DNB credits. In 2005, CRMZ became aware that DNB had also begun selling some parts of its service on a subscription basis, expanding this practice under the trade name “DNBi” in 2006.

In any case, Flum’s current position is that CRMZ’s data is now at a point where they are more confident in competing with any other credit risk data product in their space in a more head-to-head manner and the company is still able to compete on price because D&B is just so large and dominate in the industry that they simply don’t need to make an effort to meet CRMZ’s prices (doing so would just be too much of an opportunity cost vs D&B ability to continue exercising their monopolistic entrenchment in the space). Utilizing CRM/SCM as an initial filter for credit risk and supplier research still decreases the evaluation expenses for client risk and procurement teams before financially strong vendors qualify for more expensive and comprehensive due diligence and site assessments —though no doubt to a lesser extent than if D&B had stuck to their credits-based model. All that aside, CRMZ’s main data focus actually differs a bit from D&B’s.

This difference is somewhat illustrated by the fact that DNB and CRMZ share 80% of their customers. In an interview with Jerome and his son Michael Flum, Flum Sr. notes that D&B’s main source of proprietary data comes from their breadth of trade receivables data coverage of private companies. In contrast, CRMZ’s coverage is more focused on depth of coverage on public companies (covering 60-70K public companies and 6-9MM private companies via client trade receivables data).53 Flum contends that the majority of dollars-at-risk at most businesses comes from their exposure to public companies and prominent private companies —thus likely falling into CRMZ’s private coverage universe— both of which tend to be larger and thus represent a larger volume of business dollars for companies despite usually making up only a small portion of a business’s total number of counter-parties.

As noted earlier, trade credit is the 3rd most popular form of credit used by small businesses whose access to capital markets may be limited and that firms use more trade credit when credit from financial institutions is unavailable —the current environment of rising interest rates comes to mind. CRMZ’s product is positioned to be cheaper than D&B or their more direct comps in the credit risk analytics space and thus more readily available to SMEs vs larger companies that may be less price sensitive and thus more likely to simply go with the default incumbent, D&B.54

.

(Disappointingly, CRMZ’s 10K and other filings mostly report the bare minimum in terms of financial details or KPIs (unlike other SaaS platforms like, say, Thryv Holdings or, fellow OTCQX member, OTC Markets Group) and does not have quarterly or annual calls, so it’s hard to track typical SaaS KPIs of the business over time (eg. subscriber growth, number of clients, ARPU, MAU, churn, breakouts between the CRM and SCM segments, etc). TBH, based on just this fact of limited disclosure, alone, I’d say a lot really just depends on you liking the business model and trusting management incentives.)

CRMZ does not publish KPIs on their 10Ks, but Flum Sr. claims that CRM’s re-sign rates with customers is around 90%. The consistent growth in revenues over time would seem to indicate this is the case.

(While revenues are steadily rising over time (at a 9.3% CAGR) with consistently high GPM, so are their SG&A costs —greatly outpacing the COGS primarily from data and production expenses. I wonder what this might imply about the quality of the product? How much of sales is driven by organic growth vs driven by consistent active marketing?)

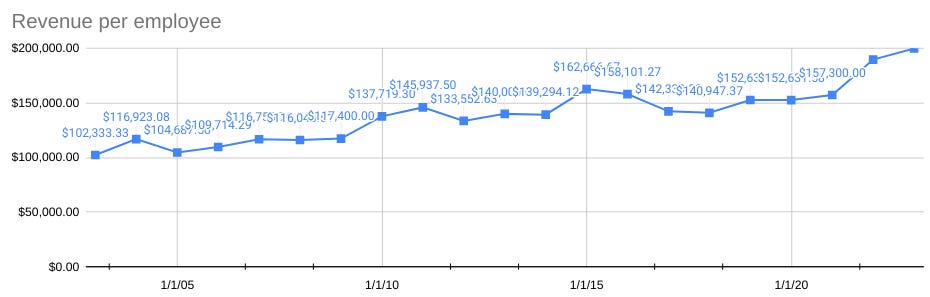

While revenue per employee has been ever so slightly rising over time (at a CAGR of around 3.4% from 2002 to 2022), the apparent lack of any significant scale economies or operating leverage is concerning.

SG&A grows right along side revenues, so despite the longterm topline growth, operating profits have been very lumpy over the years to due to the tight margins and subsequent sensitivity to any downward shifts in sales as user acquisition and churn rates fluctuate. Michael Flum has indicted that SG&A spikes are also associated with much higher sales commissions for acquiring new customers —vs re-signers.

(koyfin.com)

The below-par nature of these margins can be seen in CRMZ’s own CreditRiskMonitor report on themselves (see https://info.creditriskmonitor.com/Report/Snapshot.aspx?BusinessId=2274), where I’ve chosen to compare them against the peer groups that I think CRMZ is most closely associated with and which I see most often referenced as CRMZ’s actual competitors per their own 10K (those being DNB, Equifax, and Experian)55 —rather then the generic “Computer Services” category their CRM report displays them under by default:

.

“Dun & Bradstreet’s main competitors in the enterprise and mid-market include Bureau van Dijk (owned by Moody’s Corporation), Experian and Creditsafe in Europe and Experian and Equifax in North America. In the SMB market, our competition generally includes Equifax, Experian and other consumer credit providers that offer commercial data. Additionally, there is a fragmented tail of low cost, vertical and regionally focused point solutions in this market that may be attractive to certain clients but lack the scale and coverage breadth to compete holistically.” —- Dun & Bradstreet’s 2022 10K

(Just going by the listed competitors DNB and CRMZ have in common and CRMZ’s product offerings, I’d put CRMZ somewhere in between the “SMB market”- and ‘low cost point solution lacking the scale and coverage to compete holistically’-buckets).

CRMZ’s main comps and primary incumbents in their industry —those listed as competitors in their own 10K, anyway— are Dun & Bradstreet (DNB), Equifax (EFX), and Experian (EXPN). These companies don’t have the same kind of pure play B2B risk-analytics exposure that CRMZ has (which seems to contribute to the company’s lumpy performance vs their more diversified peers). Looking at the respective 10Ks for 2022: DNB has the Finance & Risk segment that generates 60% of revenues, EFX appears to only deal with commercial credit reporting in its USIS segment that makes up 33% of revenues, and EXPGY groups B2B credit risk analytics under its Decisioning group which makes up just 21% of the company’s revenues.56

(Note that the 2009 tax rate was negative due to the reversal of valuation allowances that were set aside in prior years due to the history of losses in CRMZ’s yearly years up until 200557. In 2017, the Tax Cuts and Jobs Act (enacted on December 22, 2017) reduced the federal statutory corporate income tax rate from 35% to 21% for the company's 2018 tax year. With the lower tax rate, the company expected that the future tax liabilities, previously recorded at the higher rate, would be less burdensome. Thus CMRZ reduced the value of its deferred tax liabilities and actually recognized a tax benefit rather than deficit58; the tax rate is recorded as positive in this year due to the fact that the company’s EBT was negative for the year.59)

.

As a positive, CRMZ management don’t seem to have ever been too concerned with playing the ESG signaling game that many larger companies might care about. IMO, it’s a waste of time and totally orthogonal to growing ROIC, FCF, etc. I see this as a green flag.

“You know, tongue-in-cheek, I think ESG is something to be concerned about but at the same time I almost feel like this is a side effect of the the bull market to some degree. Like when you personally, if you take it to an individual level, I can care a lot more about ancillary rights of marginalized groups when I don't have to worry about putting food on my table or putting you know a roof over my head those are more basic needs that I would be concentrating on if I didn't have them. So, I feel like some of these evolutions towards those sorts of ‘risk’ concerns are just basically because we’re getting to a point where we’re not worrying about profitability so we're concentrating on something else I think in general as markets pull back that’s going to be the return.” —- Michael Flum, Planet Microcap interview

Michael Flum’s comment here echoes the same kind of warning of “end of history” Marxist ideas that have also been discussed by Peter Thiel:

“There’s a Marxist theory that the time for Communism is when interest rates go to zero, because a 0% interest rate is a sign that the capitalists no longer have any idea what to do with their money — there are no good investments left and that’s why rates are zero. Therefore, all you can do at that point is redistribute the capital.” —- Peter Thiel

.

Lastly, for whatever it’s worth, the company has a pretty average review score on Glassdoor with 40 reviews total60, which I think is a pretty good sample size considering that as of February 1, 2023, the company reported having only approximately 90 employees. IMO, a ‘pretty average’ employee review score is good to see when is comes to tiny, illiquid, microcaps in the otherwise fraud-fraught OTC universe; employee satisfaction is at least an indicator of non-toxic management and work environment.

The complaint of low base pay was a bit concerning considering that SG&A is already a big part of operating margins (how would the company keep salaries competitive with inflation?), but looking at the submitted salaries on Glassdoor they are actually not too far from what the CEO and Chairman themselves are actually getting paid… So, I mean, at least everyone is in the a similar boat in this respect.

Management

Per the 2022 proxy, Flum Sr. owns 6,239,776 shares of CRMZ. With his annual total compensation for the past 10 years varying around $150K-$200K since 2013 (the date of the oldest proxy available) —the absolute oldest record of Flum’s compensation I could find was in the company’s March 31, 1997 10KSB filing where Flum’s normalized compensation from 1994-1996 was around $120K61— that puts the current value of his total equity ownership at ~80x his annual compensation (using the $2.55/sh stock price that CRMZ currently sits at as I’m writing this).

Something that does make me look askance at management is that, I’m sorry to say, in the interviews I’ve seen with Flum Sr., he often derides investors’ inclination for smoothness and growth and throws out ‘man in the arena’ excuses that I find are actually very common fallbacks for managers that have underperformed their peers. (See timestamp 1:22:38)

He talks about the lack of fundamental distinction between SaaS and ‘software subscription’ businesses and criticizes the common growth-at-all-costs strategy of many modern SaaS businesses as if this is all some kind of folksy insight (as if the former is anything other than semantics and as if the latter is something that has no rationale and has not long been discussed by investors)62 63. At the same time, CRMZ’s continually rising revenues don’t seem to be able to make proportional contributions to their own cashflows.

Flum’s comments here appear to be more used like a rhetorical tool to shift the conversation away from expectations of economies of scale and operating leverage that would be commonly expected of a cloud-based software subscription business (or whatever you want to label it) like CRMZ’s —which has had 20+ years to work that out— or DNB’s (which had consistent op. margins above 20% for the past 20yrs until their take-private in 2019).

This is a very subjective data point, but you can listen for yourself here and —taking into consideration the context of the question this is a response to— make your own judgement; maybe I’m just being overly harsh to compensate for the fact that I otherwise like this stock a lot, but smells off to me. (See timestamp 1:34:14)

Taking on a more generous interpretation of Flum Sr.’s comments here —combined with some final brief comments he and Flum Jr. make near the end of this interview regarding scaling and marketing pushes— I suppose it could also be seen as not wanting to make any incremental step that is not cashflow positive in the near-term; a difference between jogging with your eyes on a compass vs trying to sprint to what might look like the top of the mountain and ending up winded; not every horizon on a trail is the peak —by definition, most are not. Though I’d, again, note CRMZ’s lumpy cashflows.

In any case, the younger Michael Flum is now CEO of the company and he has mentioned wanting to implement more technology solutions/interventions to avoid further staffing costs (1:32:36 in the video above, “technology interventions as opposed to staffing interventions”), noting that marketing and commissioning are their largest SG&A expenses with sales force only being an issue in periods of spiking demand. (Again, I wonder what this might imply about the quality of the product and the company’s ability to generate organic growth given that so much of revenue apparently has to be driven right back into active marketing).

Due to how small the company’s existing margins are, any small (sustainable) improvement would be significant, percentage-wise; increasing margins by 1pps would be a 12% increase to CRMZ’s current 8% operating margins. Developing these technology levers, in addition to the rollout of the SCM product, may prove to be a positive long-term inflection point in CRMZ’s margins.

.

By the way, like a quickly mentioned earlier, the Flums hosted a podcast for a while in 2022 and it offers some insight into how they think about the general business and business environment.

.

I also happened to notice that fellow FRMO long —actually much long’er and for longer than myself— Lawrence Goldstein of Santa Monica Partners LP (SMPLP), who is on the FRMO Corp. board of directors, is also a material beneficial owner of CRMZ, so I’d consider myself in good company (or perhaps more accurately and possibly less encouraging, like-minded company).64 65

(https://www.sec.gov/Archives/edgar/data/315958/000114036123028586/0001140361-23-028586-index.html)

Comparing Goldstein’s CRMZ sharecount and the stock’s price, we see that the market value of his position is around (693744 x 2.5 =) $1,734,360 which makes CRMZ somewhere between just 1% to 1.5% of SMPLP’s total public portfolio when going by their SC 13F-HR forms (which is missing a few stocks that SMPLP reports beneficial ownership of in 13G and 13D forms).66

An interesting thing to note here is that CRMZ does not appear in the 13F holdings report forms (SEC Schedule 13F-HR)67 for Goldstein’s SMPLP. If you were to look at SMPLP’s most recent 13F-HR, you’d never know that they owned CreditRiskMonitor.com; most insider and institutional holdings tracker websites miss this fact as well (note CRMZ’s absence here https://fintel.io/i/santa-monica-partners68 and here https://whalewisdom.com/filer/santa-monica-partners-lp).

(https://www.sec.gov/Archives/edgar/data/904793/000090479323000008/0000904793-23-000008-index.htm)

The only way to tell that SMPLP is involved with CRMZ is by looking at the 13G filings. My understanding is that a Schedule 13G is filed when an investment firm acquires beneficial ownership of 5% or more of a company's voting class with no intention of altering or impacting control over the issuer or company (in the case of CRMZ where the founder owns the majority of the shares, what could you do anyways?); unlike the other companies in SMPLP’s 13F-HR, under these conditions, they can just report it in 13G forms and amendments —which I assume is the same reason that they do no report their FRMO position in the 13F-HR.

*If anyone reading this knows more about how this works and why CRMZ does not show up in the 13F-HR forms, do let me know.

Valuation

The stock trades at a 9.15x TEV/FCFF (10.9% FCFF yield). Taking the 20yr average FCFF compared to current TEV, we have an average TEV/FCFF multiple of 18.61x (5.4% FCFF yield). Given that 10yr USTs are now around a 5% yield, I’d say that even for this kind of growing, niche, family-owned/operated, SaaS business the price might be a bit much —in a normalized FCFF future scenario, the stock is going to have to come down significantly to bake in the higher risk free rate.

If you think that deglobalization and heightened credit risk trends are going to continue or accelerate going forward, then the current 9x TEV/FCFF could turn out to be a good price as I’d expect that FCFF to only grow as more more businesses take a greater interest in their trade credit and supplier risks.

From the 20yr chart below, I just use the through-cycle FCF growth (which I take as the CAGR from 2006 to 2019, the lowest FCF-positive periods before the lead-ups to the most prominent left-tail financial crises in which CRMZ has thrived) of 2%/yr CAGR69 as CRMZ’s longrun, terminal growth rate.

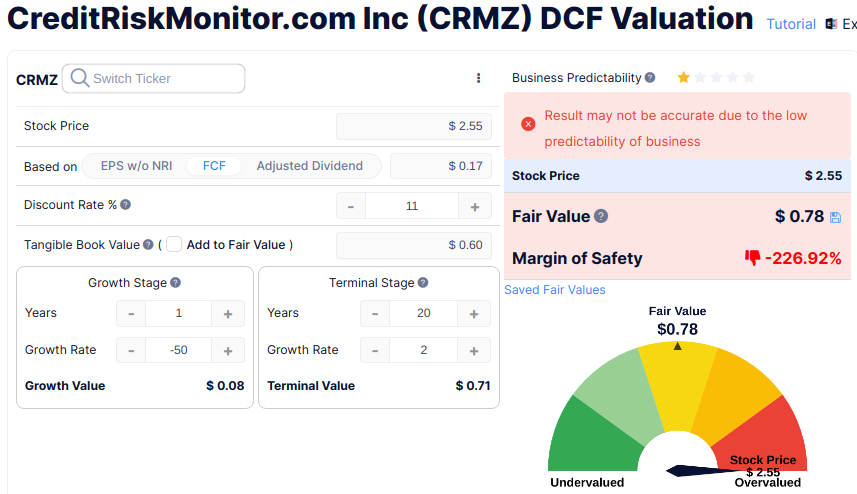

Using this, we can take a look at what kind of assumptions would have to be realized for CRMZ’s current price to make sense in a simple DCF model. Working backwards, this gets us an implied FCF growth rate of 7.5%.

(https://www.gurufocus.com/stock/CRMZ/dcf)

(If the SCM product succeeds at adding some acyclicality into CRMZ’s FCF that 2% terminal rate may be justifiably bumped to the more-commonly-used longterm GDP growth rate of 4%, putting CRMZ’s fair value around $2.77).

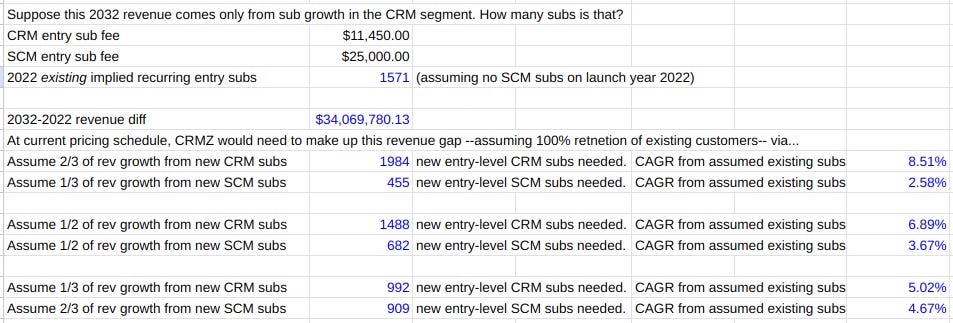

We know the prices of the CRM and SCM subscriptions. What kind of simple assumptions for growth at the level of the unit economics would be required to achieve this FCF?

Below, I just take the price implied FCF growth rate from the simple DCF model above and work backwards to see what kind of revenues CRMZ would need make over the next 10 years in order to achieve that FCF…

(Using a 10% FCF growth rate in the DCF model would imply a 7% revenue CAGR target and put CRMZ’s fair value at $3.05. Is a 200bps improvement from past base rate revenue growth reasonable to expect in a deglobalized, higher-rates environment? I don’t think it’s too crazy. Also, both revenue growth and margins would actually be much much higher is using 20yr CAGR and median, respectively.)

… Given that the price implied revenue growth rate essentially just projects the past 10yrs into the coming 10yrs, I think the current price is reasonable if not undervalued, depending on how heavily you weight the probabilities of the possible future macro environments. This implied forward 10yr $52MM revenue figure would still be minuscule compared to D&B’s 2022 North America revenues for their Finance & Risk segment of $866.9MM.

Assuming static FCF margins —ie. no increased operational leverage from Michael Flum’s planned “technology interventions”— how many new CRM and SCM subscribers does CRMZ need to gain each year to maintain a 7.5% growth in FCF for the next 10yrs?

Recall: As of 2023, the CRM World Wide flagship product is billed on a per user basis at around $11,450 for the first user and $1,680 per additional user with additional add-on features available. The SCM product is billed at $25,000 annually per 20 users and additional 20 user slots being sold at declining rates.

CRMZ does not publish their client numbers or other KPIs, but just assuming that the amount of SCM users since the 2022 launch has been negligible and taking the entry price for both products, we can get a very rough idea of existing subscribers using the 2022 revenue figure and use the implied revenue expectations from the DCF model to play around with the numbers to guess at how many additional new subscribers CRMZ would need to acquire and retain in order to meet the price-implied forward target figures:

In the median case, does it seem reasonable that CRMZ can add around 150 new CRM accounts and 70 SCM accounts a year for the next ten years? I’d think so as long as global credit continues to tighten and supply chains continue to face reconfiguration strain, as they’ve been doing.

I’m hesitant of painting a brighter picture for CRMZ’s FCF via straight-line projection here due to the boom-bust nature of how FCF has worked historically. Yet, keep in mind that SCM, in success mode, could add a lot of acyclicality to the company’s otherwise counter-cyclical, CRM-based business.

Let’s suppose total FCF falls back down from $1.5MM to the 2019 year-end level of $750K, before stabilizing:

This gets us a 69% decline in share price. Though it should be noted that the last time FCF was around this level in 2019, CRMZ only traded at a low of $1.30 and average of $1.60 (vs the $0.68 target in this simple model).

From a technical analysis POV, I’d point out this TTM squeeze chart of the last 3yrs:

I don’t look at charts very much, but I do think that looking at a stock’s historical momentum and volatility can be interesting (if you’ve ever read Ted Warren’s “How to Make the Stock Market Make Money for You”).

Of course, I’m not looking at CRMZ as a short/medium-term trade and the stock is too illiquid to treat as such, so the economics of the business matter a lot more here. Still, it’s interesting to think about what this could be saying re. market participants’ sentiment and thoughts on the stock’s outlook.

Catalysts

“Never invest on the basis of a story on Page One - that is the efficient market. Invest on the basis of a story on Page Sixteen, that is headed on its way to Page One.” —- Don Coxe

End of ZIRP

“If you go into the wilderness in Maine and there’s reindeer and they’re populating like crazy, they will take over the world unless there's a natural predator in the forest, a wolf; you kill the wolves and the reindeer go wild. In debt, the natural predator is interest rates.” —- Jerome Flum

Interviewer: Do most businesses do routine credit checks on their customers; is it standard practice?

Mr. [Michael] Flum: Yes and no. For most sophisticated businesses, credit checks have certainly been more standard operating procedures, but there is a big distinction between conducting an initial review and ongoing monitoring of customers. Most public businesses have a process for approving credit requests and quarterly reviews of outstanding AR to assess the allowances reserved for bad debts as required for regulatory compliance. Most of those businesses have a team dedicated to processing credit applications and a collection function, whether in-house or outsourced.

That said, since the Great Recession, the world has been in an exceedingly easy credit regime supported by the central bank policies of very-low-to-zero interest rates and quantitative easing. These policies have made it exceedingly difficult for low-quality, non-profitable, businesses to go bankrupt since they’ve had consistent access to cheap, plentiful credit and can roll that financing over at each maturity. A fact reflected by the spectacular growth in the number of “zombie” companies, those that cannot effectively cover their interest expenses with their earnings, over this period.

We’re already starting to see risk mounting in the B2B market, foretelling a spike in bankruptcies. —- https://www.ceocfointerviews.com/creditriskmonitor22.html

May in the market believe —maybe better described as hope— that the Fed will be forced to pivot on rates and that the economy will return to the zero-bound rate environment that has characterized the last decade. Though, what if J. Powell actually means what he says? Here is a some snippets on Jerome Powell and the subject of lowering rates from 2022 to today:

“The Federal Reserve will deliver more interest rate hikes next year even as the economy slips towards a possible recession, Fed Chair Jerome Powell said on Wednesday, arguing that a higher cost would be paid if the U.S. central bank does not get a firmer grip on inflation.” —- https://www.reuters.com/markets/us/fed-set-slow-pace-rate-hikes-inflation-grinch-loses-steam-2022-12-14/

Powell, speaking at a press conference following a Federal Open Market Committee meeting where the officials lifted their overnight target rate by half a percentage point, was asked whether the Fed might consider moving its 2% inflation target up to a higher level.

"We're not considering that. We're not going to consider that. Under any circumstances," Powell said. "We're going to keep our inflation target at 2%. We're going to use our tools to get inflation back to 2%," he said, although he allowed "there may be a longer-run project" that could take a fresh look at the central bank's inflation goal. —- https://www.reuters.com/markets/us/powell-says-fed-will-not-change-2-inflation-goal-2022-12-14/

CHAIR POWELL. “And we say we’re committed to achieving and sustaining a stance of monetary policy that’s sufficiently restrictive to bring down inflation to 2 percent over time—we said that. But the fact that we decided to maintain the policy rate at this meeting doesn’t mean that we’ve decided that we have or have not at this time reached that—that stance of monetary policy that we’re seeking.” —- https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20230920.pdf

The consensus among those predicting a credit implosion in the near/medium-term future seems to be that Powell is determined to hike as much as politics and Mr.Market will allow / give him an excuse for until he can conjure a recession to bring down inflation; focusing on his legacy and determined to be remembered as a Paul Volcker, rather then an Arthur Burns, and fine-tuning the economy with interest rates while QT continues unabated in the background.70

At the time of my writing this, Howard Marks of Oaktree Capital recently published a memo “Further Thoughts on Sea Change” where he predicts that the next decade is going to be characterized by an environment where…

economic growth may be slower;

profit margins may erode;

default rates may head higher;

asset appreciation may not be as reliable;

the cost of borrowing won’t trend downward consistently (though interest rates raised to fight inflation likely will be permitted to recede somewhat once inflation eases);

investor psychology may not be as uniformly positive; and

businesses may not find it as easy to obtain financing.

We see less optimism among participants and less certainty around the availability of credit; sounds like a very favorable environment for a business like CRMZ’s.

Marks also notes that we may be moving to an era of fiscal, rather than monetary “excess”. A recent study on businesses’ use of trade credit in response to the government interventions related to the 2020 pandemic found that “overall, the monetary interventions are associated with lower levels of trade credit, while fiscal interventions increase the use of trade credit.”71

Deglobalization

CRMZ may also be an asset-light beneficiary of the continuing supply-chain straining, grayzone warfare, deglobalization trend.

Direct from the 2022 10K: “The Company expects the driving forces for adoption of its new SupplyChainMonitor product are the material shifts away from globalization, offshoring, and logistical complexity mandated to support “just-in-time” inventory models due to geopolitical and macroeconomic pressures. As businesses look to “nearshore,” “friendshore,” and relocate supply hubs away from regions with national security or concentration concerns, they will need extensive data on alternative suppliers and the financial stability of those alternatives.”

This is not a novel thesis and seems to be common among many inflationistas.

More on this idea, I think, is best articulated by Zoltan Poszar. I’ve condensed some of his writings on the topic here:

Recession

“We would tell you that a recession is almost as likely as very slow growth, so that’s a fact. I think that is partly because of us having raised rates quite a bit, but this is what it takes to get inflation down.” —-Federal Reserve chair Jerome Powell (in what he had believed to be a private call with Ukrainian President Volodymyr Zelenskyy which was later revealed to be a deepfake of the Ukrainian President fabricated by Russian hackers)

In January 2023, Russian pranksters Vladimir Krasnov and Alexei Stolyarov, known as Vovan and Lexus, tricked Federal Reserve Chair Jerome H. Powell into an extended phone call by posing as Ukrainian President Volodymyr Zelensky. The pranksters shared a video call with Powell on Russian television, which was later posted on social media. The video appears to show Powell discussing the economic impact of interest rate hikes and admitting that a US recession is likely. A Fed spokesperson said that “[t]he video appears to have been edited and I cannot confirm it is accurate. The matter has been referred to appropriate law enforcement, and out of respect for their efforts, we won't be commenting further”. While that certainly is a statement, what it isn’t is any categorical denial of Powell’s claims of a likely recession in the video.72

Of course, many did not need to get this info pranked from Powell on a Zoom call to be concerned about the present state of the economy nor about the effect that interest rates are having on such.

If CRMZ’s own FRISK score for the aggregate US economy is to be believed, the economy is approaching a level of stress equivalent to that of the COVID19 panic.

(https://info.creditriskmonitor.com/FriskStressIndex.aspx)

… Perhaps this helps to explain why they did not resume their decade long annual dividend after the pause in 2020 and have instead been storing more cash in short-term USTs.

Buybacks

“In January of 2022 the Company’s Board of Directors authorized a share repurchase program for the repurchase of up to $1,000,000 of the Company’s outstanding common stock. The Company has not repurchased any shares under this program.” —- CRMZ’s 2022 10K

… Note that, as I write this, CRMZ’s market cap is around $27MM, so this buyback program at current prices would be able to purchase 3.7% of total shares outstanding, though I’m not sure how they plan on doing this given how illiquid the stock is —my little limit orders have had to wait days or weeks to get filled over time as I’ve been averaging into the stock. I’d expect this to act more like a floor or safety net to CRMZ’s stock price rather than a tailwind; tracking any reduction in share count in the company’s 10Qs could be a useful way to determine if one should nibble at the stock alongside the company themselves.

Risks

The most obvious risk IMO is highlighted by the fact that, as I write this, the Fed Funds Rate is around 5.33%. Referring back to the simple DCF model for CRMZ and the comment I made about a fair value of $3.07 (at a 10yr FCF growth rate of 10%), it can be seen that the IRR of your investment over any period beyond 4yrs in such a scenario is less than the much safer return you could get from simply investing that same capital in money market funds.

(https://www.schwab.com/money-market-funds)

The reasonable question arises of: Why not just hold MMFs instead? While rising interest rates are causing people all across the risk curve to rethink their allocations, rising interest rates may be particularly relevant to CRMZ as an investment. MMFs are more liquid, produce a similar IRR (in this particular conservative case), and (like CRMZ) act like a volatility hedge —that cash can be deployed opportunistically when large bouts of uncertainty hit the markets.

You’d need a ~20% FCF growth rate for 10yrs (for a fair value price of $5.31) to get a 10% IRR. That is, the next 10yrs of FCF growth are going to have to look like the aggregate past 3yrs; CRMZ should hope that Howard Marks is right and we are indeed entering a sea-change period where certainty, financing, and friendly credit terms (with associated lax scrutiny of counterparties) will be in short supply.73

.

CRMZ seems to have a lack of cost control within the organization. As a result, the company has struggled to translate its consistent top-line growth into sustainable bottom-line profits. The inability to rein in SG&A expenses has been a persistent suppressor of the company’s profitability and hindered its ability to scale and to generate stable and predictable earnings and free cash flow.

The company was (re)founded in 1999 (with TIKR data available to me starting in 2002) and in all those years their earnings and CFFO seem to have no consistent growth, but rather follow a cyclical pattern of rising in the years during and after financial crises before slowly falling in years later —granted we’ve only really had two major financial crises since 2002, but that’s the pattern I see and it makes sense relative to the type of product CRMZ has historically offered.

Perhaps the SCM product can grow and become a counterbalancing source of profits for times of lower economic stress, but having only just launched SCM in 2Q2022 it’s still too soon to tell if this is working and the company does not break out subscriptions by product in their reports.

I suppose we’ll see what Michael Flum’s technology interventions look like in terms of taking load off of the company’s marketing and commissioning expenses. We can likely expect a more pronounced focus on this strategy going forward now that he’s CEO.

One wonders why the business seems to require so much marketing spend and how well the business might do (or not do) if it it ever had generate growth organically, on the merits of the product alone.

.

Economic strain can go too far; you can’t sell Carfax reports if everyone’s cars have already driven them off a cliff and it’s debatable how good for business an actual apocalypse would be for proprietors of prepper manuals. As with many other businesses, the strength of CRMZ’s business —even in the “best” of times (ie. times of heightened economic uncertainty, in CRMZ’s case)— is going to depend on the solvency of their customers and the value they attribute to the product (the latter of which should be quite high in an environment of uncertainty, while the former may come into question).

Of course, the company has had some of their best years of operating cash flows in the periods following the 2008 GFC, the 2014 oil bust, and the global economic shutdown of the 2020 COVID-19 pandemic, so clearly business in the US still finds a way to muddle along in the aggregate and pay CRMZ even in the worst of times, the immediate after shocks of which have historically been tailwinds for the company.

By a less drastic token, one might wonder how CRMZ plans to balance it’s goal of being the “lowest cost provider” in an era of persistent and/or rising inflation. If inflation rises by 10% in a year, is CRMZ going to raise their prices? Would clients accept that?

.

Information risk: Unlike many other SaaS businesses, they do not publish key performance indicators in their annual reports (sometimes called “key business metrics” or “key performance measures” in DNB’s own reporting). Eg. I’ve seen SaaS businesses break out their monthly ARPU and total client numbers and DNB themselves break out revenue between their Finance & Risk vs Sales & Marketing segments —CRMZ had the opportunity to do this in 2022 for SCM, but didn’t (it’s not like they didn’t have time to prepare as SCM was launched early in 2022 and had been in development since 2019).

.

The stock is very illiquid. Unless they reinstate the dividend or otherwise return capital to shareholders via buybacks, if the SupplyChainMonitor business fails to gain traction and the CreditRiskMonitor side fails to attract and retain new clients, you’ve locked your money into a security that could really just end up languishing.

Given the Flums’ large stake in the business and the principles that Flum Sr. has espoused and historically run his business in accordance with, I’m not too afraid of management standing idly by and doing nothing in the case of the above scenarios. At the very least, we might then expect a return of the annual dividend.

.