($FRMO) FRMO Corp: A uniquely managed OTC jockey-stock hedged for inflation and with incoming catalysts

A overview of the origins, mgmt incentives, assets, and upcoming catalysts for this interesting underfollowed basket of call options and contrarian plays

********** UPDATE 20240210:

Here is a screenshot of my spreadsheet that makes some adjustments to certain holdings of FRMO. It's a little old, so some things are slightly out of date, but I tried to clean it up a bit just now with updated values from the more recent FRMO, WELX, and CMSC reports.

The HK Revenue Stream value is based on the most recent annual Fee Income that FRMO get (I'm pretty sure) exclusively from the HK Stream multiplied by a median of 22x and 7x. The 22x is based on average EV/EBITDA multiples of streaming cos. like FNV, WPM, TPL, BSM (which is not unreasonable, IMO, given the kinds of things HK investments focus on). The 7x is based on the implied multiple from backing out of a (IMO, very) conservative and simple DCF on the Fee Income.

The HK LLC Equity value is based on FRMO’s 4.95% ownership of HK LLC and the median total company value as projected in the recent $SLGD reverse merger news (see the very bottom of this: https://www.sec.gov/Archives/edgar/data/88000/000095017023072802/slgd-ex2_1.htm). I might be doing this part wrong; need to look into this more.

The MIH/MIAX stuff is just based on FRMO’s own accounting of MIH's per share value which is just valued on a Precedent Transaction basis (can't remember where this is mentioned), so it's likely undervaluing the shares (MIH is supposed to IPO at some point, but not sure when). I had some old scratch work that tried to value the biz based on volumes that they report (https://www.miaxglobal.com/) + the fact that FRMO owns 1% of the equity (I think), but it's kinda old so I don't really trust it at this point.

**********

********** UPDATE 20230815: It’s been a while since I initially wrote this post and I’ve realized that I don’t do a great job of distinguishing between calendar and fiscal years when referencing FRMO’s financial statements, which is an important distinction to make since FRMO’s fiscal year does not match the calendar year. You can read a bit about the why here (https://www.frmocorp.com/_content/letters/2012_int.pdf), but I’m not totally sure of the reason myself. In any case, I’ll just note that FRMO’s fiscal year ends on May 31 (or starts on June 1) and goes like this:

June = Q1, September = Q2, December = Q3, March = Q4

**********

Table of Contents

Quick Pitch

"One reason some people no longer resist the idea of inflation is because they’re hearing about it in the news. Others have begun to notice it in their daily lives. You, this audience, are well aware that we’ve been writing for some years about observable conditions that were creating serious inflation risk. The most recent extended discussions were in the March 2020 and June 2020 Quarterly Reviews. But the media made no such mention of inflation at the time; in fact, their concern was deflation." —- https://horizonkinetics.com/app/uploads/Q3-CVALUE-Review_FINAL-1.pdf

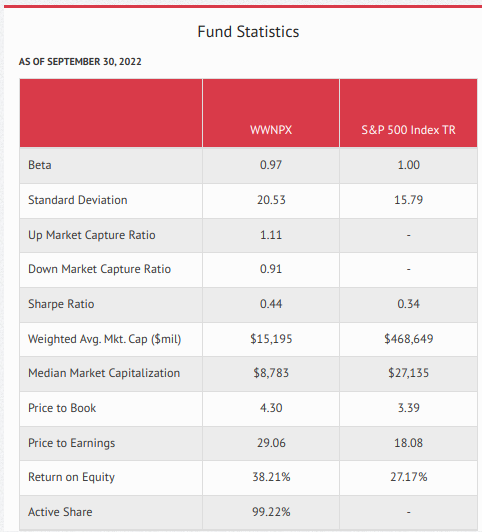

FRMO Corp is an underfollowed investment holding company, with no debt, owned and operated by two very smart value investors (Horizon Kinetics (HK) founders —you may know it from TPL fame— Murray Stahl (CEO) and Steve Bregman (president) (S&B))1 whose ownership structure and stake (owning ~40% of shares) in the company aligns them well with shareholders. They were one of the early “institutional” adopters of bitcoin (back in 2015) and have been warning about —and positioning for —(energy) inflation since before it was cool. You can look at the active share of any of their managed mutual funds2 to see that they are certainly not following the crowd. They recently expanded their BoD with new non-independent members and have announced the intent to spin off their crypto mining operations (whose true value is currently obscured by the at-cost accounting of those assets on the balance sheet); there also exists the potential of (an eventual) up-listing to a major exchange.

Overall, while fairly valued relative to historical P/TBV (noting that much of their assets are not marked-to-market), if you are going to bet on inflation remaining more than transitory and for crypto to continue it's extreme —and often conviction-testing— long-term rise, fairly-valued may end up being an acceptable entry price for having that allocation stewarded by these managers in this unique, shareholder-aligned, jockey stock.

FRMO's returns compared to some other holding companies and the S&P 500:

5yr CAGR

FRMO (Stahl / Bregman): 20%

IEP (Ichan): -1.6%

TPOU.L (Loeb): 16.2%

GLRE (Einhorn): -20.3%

PSH.L (Ackman): 16.8%

BRK.A (Buffett / Munger): 12.6%

SPY (Reddit, grandma, The Fed, and me): 16.2%

10yr CAGR

FRMO: 17%

IEP: 4.3%

TPOU.L: 11.5%

GLRE: 10.4%

PSH.L: 2.9% (7yr CAGR)

BRK.A: 14.4%

SPY: 15%

17yr CAGR

FRMO: 11.2%

IEP: 4.4%

TPOU.L: 8.3% (14yr CAGR)

GLRE: -7.8% (14yr CAGR)

NA

BRK.A: 9.9%

SPY: 8.5%

********** UPDATE 20221117: We can also use HK’s headline mutual fund, the Paradigm Fund, as another proxy for Stahl’s investing outperformance vs the stock market over the longrun:

**********

Note that FRMO trades on OTC Markets, but is Pink Current and so is not affected by SEC Rule 15c2-11 and the subsequent changes many brokers are currently making around clients' ability to trade OTC stocks.

Also note that — as a lower-liquidity, OTC stock — FRMO's market pricing is more volatile than the other holding companies mentioned here, so buying only when cheap (eg. low price to TBV) or dollar cost averaging into the position may be important here.

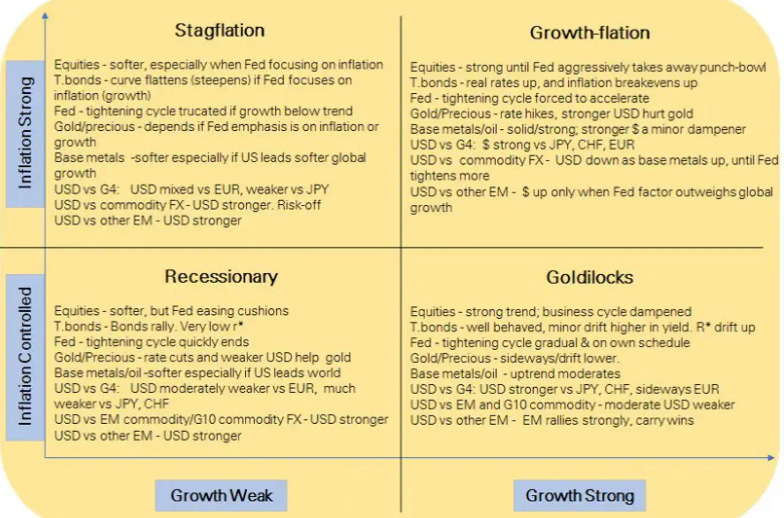

Ready for what the indexes aren’t

Here are the past 5 and 10 year 12-month rolling correlations between some of the major category ETFs vs the S&P 500 vs a Horizon Kinetics mutual fund KMKNX (the one which I believe is most like the Polestar and Multi-Strategy LPs that make up ~50% of FRMO’s TBV — based on past comments by Stahl — as well as having a more similar makeup to FRMO itself when considering their ownership of TPL via Horizon Kinetics Hard Assets (FRMO’s OTC price was not available in the data on this site)):

Notice that all of the major category ETFs (ex. EEM) are nearly 90-100% correlated to the index (including both value and growth ETFs, interestingly), while the HK fund was about as correlated as the emerging markets fund though at a far greater return — matching or beating the S&P. So we see FRMO management providing the most non-correlated performance that can match or beat the market (and unlike the Kinetics fund unitholders here, FRMO shareholders get this management without any management expense fees).

Furthermore, FRMO is positioned for the segments of the economic quads that the broad market and — by extension, as we’ve just seen — all of the other category indexes (which are invested mostly in the deflation+growth paradigm) are not ready for.

Management

Origins of FRMO

FRMO was re-founded by Murray Stahl and Steve Bregman from the shell of FRM Nexus after it spun off substantially all of its asset into subsidiary MFC Development Corp. in November 2001; FRM was recapitalized privately by Stahl and Bregman and transformed into the public FRMO Corp (which stands for “Financial Risk Management Organization”… Corp)3. FRMO was created in order to hold certain assets that did not make sense to or could not properly be held in HK Asset Management LLC (HKAM). Also, having a publicly tradable capital vehicle allowed it to be used in ways HK or HKAM could not be (eg. making charitable donations).

********** UPDATE 20240617: Based on commentary in the FY2024Q3 conference call (https://www.frmocorp.com/_content/letters/2024_Q3_FRMO_Transcript.pdf; see “Questioner 3”), here is a brief history on the organizational structure of FRMO in relation to it’s sister companies within the Horizon Kinetics (HK) complex: When Stahl et al founded HK, it was originally two companies; Horizon Asset Mgmt (focused on securities research and private individual accounts) and Kinetics Asset Mgmt (which hosted the mutual funds). These companies were largely made up of “transitory” capital that was characterized by in/out flows at the “worst times” (ie. clients pulled money out in down markets, when assets were cheapest, and poured money in during rising markets). Thus FRMO was formed around early 2000 in order to be a home for “permanent capital.” HAM and KAM were merged in 2011 to become the asset management company HK LLC and a separate chunk of capital that became Horizon Common which Stahl et al invested for themselves. **********

Here, Stahl goes into FRMO's origins and why it was created (see QUESTIONER 3 and QUESTIONER 4): https://www.frmocorp.com/_content/letters/2012_FRMO_Transcript.pdf

The transcripts also have some interesting commentary on how the 2008 GFC — the FRMO site has no other shareholder meeting transcripts before 2012 — affected S&B and their investing POVs (eg. the dangers of indexation etc) as well as how they think about certain investments (near the end of the Q&A) that you can read if you’d like. FWIW note that — just by looking at the stock price history — Stahl does not appear to have been among the likes of Bill Ackman and Michael Burry who saw the GFC coming (IDK for sure b/c there are no letters etc around this time pre-GFC).

MURRAY STAHL: First, thank you for attending. Since the last shareholder meeting, we seem to have attracted more interest, so I’m gratified about that. During the brief period before the meeting began, I had a chance to talk to some of the attendees. It seemed to me that not everyone was acquainted with what FRMO does, which is, I think, rather unusual for a shareholder meeting. I will spend a couple of minutes discussing the history of the company, why we formed it, what we’re in business to do, what our goals and aspirations are, and how we propose to accomplish them.

If you were to see our first balance sheet, we had virtually no capital. We were founded as what we called at the time an “intellectual capital company.” The idea was that, given our positions in then-Horizon Asset Management, we would occasionally find an interesting investment idea that was at its inception stage and had virtually no revenue. Horizon would sell FRMO Corporation a revenue interest in that product and, if it was successful, the corporation would collect a certain amount of revenue from it with very little associated expenses. If it was not successful, there was very little capital placed at risk.

Basically, (if I'm understanding this right) FRMO would add a track record to Horizon LLC and Kinetics LLC investment products (when had not yet been merged to become HK LLC) when they came up with new ideas or seeding capital for new products to work with in exchange for piecemeal revenue interests. This later became an interest in the single HK entity when they two combined:

As the capital began to grow, because we did, in point of fact, have some successful investment products, we would invest that capital. This practice proceeded in a very intriguing way until 2008. No need to go into what happened in that year; we all know what happened. All investors—including us—were bedeviled by the events in 2008. I’ll come back to that momentarily. Right now, I’m just going over the history. I’ll give you more detail in just a minute.

Despite the fact that the investment business, especially the active equity business, which is the business we’re de facto in, was not doing very well, the balance sheet actually prospered. I think that the current shareholders’ equity is the highest we’ve ever had in the company. In terms of balance sheet structure, we’re in as good a condition as we’ve ever been which, in itself, is very unusual for a company involved in a business that has not prospered in the way we would have liked.

I mentioned the investment products in which we buy revenue interests. Those investment products came from Horizon Asset Management. At the time of our inception, Horizon Asset Management had a sister company called Kinetics Asset Management. Horizon Asset Management was organized around two activities: one is investment research, which we would sell to other investment advisors; and the other is money management, primarily, but not exclusively, for wealthy individuals. Kinetics was organized to manage money for various mutual funds and for a variety of institutions.

In May of 2011, Horizon and Kinetics merged to form Horizon Kinetics LLC, of which we, FRMO, own a little bit less than one half of one percent (0.47%). We recently sold our smallest revenue interest to Horizon Kinetics in exchange for more Horizon Kinetics stock. I don’t remember the share count; it’s not going to move anything very much. We’re shifting our strategy a little bit, in that now we’d much prefer to have an actual equity interest in Horizon Kinetics itself.

FRMO's HK participation later changed between 2012 and 2013 from a piece-wise participation in individual HK products to a single gross 4.2% revenue stream from HK. From the 2020 annual report: https://www.frmocorp.com/_content/10k/FRMO_Annual_Report_2020.pdf

The Company [FRMO Corp] holds a 4.95% interest in Horizon Kinetics LLC and earns substantially all of its advisory fees from Horizon. As of May 31, 2020 and 2019, the Company held a 19.23% and 15.49% equity interest in Horizon Kinetics Hard Assets LLC (“HKHA”), a company formed by Horizon and certain officers, principal stockholders and directors of the Company. Due to the common control and ownership between HKHA and the Company’s principal stockholders and directors, HKHA has been consolidated within the Company’s financial statements. [...] [And] In 2013, the Company amended the terms of its product-specific revenue interests in the following products managed by Horizon Kinetics and its subsidiaries: (i) a mutual fund, (II) two private investment funds, (III) a consultative relationship with an institutional investor and, (iv) an institutional separate account. Since then, FRMO now receives a single revenue interest (the "Revenue Interest") equal to 4.199% of the gross revenues of Horizon Kinetics.

Aligned Incentives

Frankly, I don’t know of another company in my portfolio of investments, nor have I ever come across a company, that had two fellows like these who work for nothing, in FRMO at least. Although, I can’t really say exactly nothing, because they’re the two largest shareholders in the company, so they’re working for their investment. But they’re not working for their current compensation. And I think the price-to-gray matter ratio is very low. So, I’m just mentioning that as something you might consider. I can’t think of another company to which I would apply a price-to-gray matter ratio into the calculation of what it’s worth. —- Questioner 7, FRMO shareholder meeting 2018 https://www.frmocorp.com/_content/letters/2018_FRMO_Transcript.pdf

An interesting thing to note is that S&B take no salary for running FRMO and are only compensated by the gains in FRMO as shareholders.

The FRMO website (FRMO Corp.) does not really have any proxy statements where we could see executives' compensation breakdowns that would definitively show this nor does the company file such a thing w/ in OTC Markets disclosures (https://www.otcmarkets.com/stock/FRMO/disclosure), so where can we actually see this?

From the 2014 annual letter regarding some drama between a proxy advisory firm and S&B's compensation at FRMO: https://www.frmocorp.com/_content/letters/2014.pdf

As we prepared to write the fiscal 2014 shareholder letter, we were confronted by a most interesting occurrence that properly may be utilized as an introduction to a shareholder letter. It seems that Institutional Shareholder Services (ISS), a well-known proxy advisory firm, recommended that an affirmative vote for current management of FRMO be withheld at this year’s election of directors.

Some of the reasons for withholding an affirmative vote are, on their face, actually rather sound and convincing: FRMO has no compensation committee at the board of directors level, so that the management decides upon its own compensation; furthermore, the board does not contain genuinely independent directors who could serve on a compensation committee and amend this practice; in addition, there is no board nominating committee to select independent directors who might, theoretically, alter this situation.

Apparently, ISS was contracted by HK to facilitate proxy voting for shareholders (https://www.privatebank.citibank.com/pdf/adv/Horizon_ADV.pdf, Appendix G) and recommended shareholders vote not to continue with current management for the fact that there is no independent compensation committee oversight (I can't find this proxy vote form, so IDK exactly what they were saying to withhold the affirmative vote for, but I assume it was something like that). S&B had this to say:

Indeed, we agree that management compensation should be subject to independent director oversight. There really is no excuse for our conduct. We might only say in our own defense that we did not subject our compensation to independent director oversight, because we actually receive no compensation.

The facts are as follows. Technically, we do receive compensation of some $12,000 per year each. The amount was chosen to be roughly equivalent to the minimum wage rate. However, we do not actually take the money. The salaries are contributed back to the corporation. Although the reader may find this procedure to be somewhat bizarre, many years ago it was found by our auditors to be necessary in an accounting sense as well as a tax sense because our labor, inadequate as it may be, still has some value that must be recorded as an expense. Once the sum in question is expensed, it becomes momentarily our property, at which point we are at liberty to, essentially, decline to cash the check.

[...]

In its current incarnation, the form versus substance issue arises again. We have publicly undertaken not to pay ourselves anything apart from what we might earn as shareholders from our stock holdings. We have also disaggregated a revenue share from our investment in Horizon Kinetics that is paid directly to FRMO [referring to the 4.2% revenue stream that FRMO receives straight from the top-line at HK], essentially creating a type of special earnings that cannot be used to compensate management [being S&B among others at HK]. Consequently, it is for these reasons that we have not undertaken to engage paid independent directors to make certain that we are not paid.

I didn't 100% understand that last part about how the HK revenue stream claim can't be used to compensate FRMO's mgmt and I would still like to see independent directors confirming that S&B are indeed not getting paid (just for the sake of solidifying the shareholder alignment narrative); I don't understand how that last paragraph is an argument against having that. I'll say this though: S&B have a combined ~32% stake in the company, a big part of the the investment appeal of the company is the shareholder alignment, if it ever came out that they were lying and taking a significant compensation that would be a big trust issue w/ existing investors so it just doesn't seem like something worth lying about in the first place.

More on this from the 2014 shareholder meeting: https://www.frmocorp.com/_content/letters/2014_FRMO_Transcript.pdf

Murray Stahl:Thank you, Therese, and thanks, everybody, for coming today.

I was very fortunate when beginning to write the annual Letter to Shareholders to be apprised of an event that you may have read about in that letter. The idea was that we as a corporation were lacking in certain corporate governance formalities and requirements, one of which happened to be the lack of a compensation committee, and I took the occasion to comment on that. I hope you’ll understanding that I did it tongue in cheek. Corporate governance is a very serious matter, but in our case the recommendation of a certain proxy firm was to withhold the vote from us for, among other reasons, the lack of corporate governance relating to management compensation.

Now, there’s no excuse in a normal corporation for not having proper oversight of management. The only excuse we can offer on our own behalf is that we don't actually receive compensation and, therefore, we didn’t think it was necessary to appoint a board, independent as they might be, and properly compensate them and incentivize them to rule on whether or not we’re actually going to be compensated.

Interestingly enough, you might observe that since we control the company we could dismiss the board anytime we wanted to. So we’d be supervised by people who effectively serve at our pleasure. I didn’t put this next point in the annual letter, but I might have. In terms of motivating us, our compensation is designed to come from our return as shareholders, and we don't wish to get any other compensation. Of course, a compensation committee could theoretically overrule us and force us to take compensation. They might be within their rights and might arguably do that with the idea that if we don't get compensation, how can they possibly motivate us to work harder, since only the threat of removing the compensation that we get would impel us to make the effort that's really required. To put themselves in that position, they would have to first give us compensation and, as big shareholders, the compensation would actually come from us. We would be compensating ourselves.

I get the logic of the last paragraph and I don't really think anything untoward is happening (but, again, they don't have an independent compensation committee or file proxy statements so who really knows and having some kind of independent committee to confirm this would add a bit more comfort). Anyway, finishing out the Q&A transcript...

Steven Bregman: Then if they did that we would have to fire them.

Murray Stahl: Yes. Of course, I respect the corporate governance process, and I trust we have been faithful to it because we are the fiduciaries, we are the custodians, effectively, of the shareholder trust among other things. We take that responsibly very seriously. But the question is larger. The question is about form versus substance. Is one a proper corporate steward because of the presence of certain formalities, or is one a proper corporate steward by taking that responsibly very seriously?

To that I say it’s not a ‘form v substance’ issue, it’s about the reduction of doubt or any appearance of corruption. Of course this all could have changed since this was written and maybe they do take a salary. I assume not, but again they don't file w/ the SEC and so have no consistent Proxy Statements to confirm/disprove4 — you can however use the google search query “site:frmocorp.com + compensation | proxy statement” to find bits of info. Though if this really did change, I suppose this would be visible by some big change in the FRMO compensation expenses which has not happened. In any case, I ultimately trust FRMO management on this.

********** UPDATE 20221202: Note that FRMO does presently have two paid employees: in-house counsel, Jay Kesslen and corporate secretary Therese Byars. (This I learned in the Q3FY2022 earning call — where I accidentally confused a past statement re. HK employees w/ FRMO and management graciously assumed that the mistake must have been a past miscommunication on their part, I was “Questioner 1”). **********

S&B's Stake In FRMO

From my reading, Stahl has about 20% of his net worth in FRMO, and both S&B own 16% stakes in FRMO (32% combined):

Basically, we're on the beach about 16.6%, that's not the exact number, it may be off by a few basis points, but my personal holding it was something like 16.6%, something like that. And that's the [weighting] it is right now, (Bregman) https://seekingalpha.com/article/4420765-frmo-corporation-frmo-ceo-murray-stahl-on-q3-2021-results-earnings-call-transcript

(Bloomberg has FRMO shares outstanding at ~43M. 7/43 ~= 16%, so their statements do jive with the data available).

We can get a better sense of how Stahl views his stake in FRMO from some of the older FRMO investor meeting transcripts...

https://www.frmocorp.com/_content/letters/2012_FRMO_Transcript.pdf

QUESTIONER 3: How important is FRMO to you, relative to Horizon Kinetics?

MURRAY STAHL: Well, let me give you a little history to answer that question, so you can get an idea of who we are as people. When we founded Horizon Asset Management in 1994 and then Kinetics in 1996, the precursors of Horizon Kinetics, we weren’t thinking about FRMO. We weren’t involved in FRMO until 2001. In 1994, we had just left a large financial institution. All we wanted to do at the time was to make a reasonable living, manage a little money, have a few clients, and have a nice life. That’s all we wanted to do. We had no other objective than that.

Now, my partner, to my right [Steven Bregman], tells the story slightly differently and more colorfully. You see, we didn’t like the institutional framework of investing, so we were really running away from that. The way he describes it, if you ever saw the movie Raiders of the Lost Ark, you know the scene where Harrison Ford is running through the cave with the big rock rolling after him? He says that was us. [LAUGHTER]

In any event, we founded Horizon Asset Management. Then, roughly two years after, we founded Kinetics, which was for mutual funds. And we had success financially that, frankly, we never thought we would ever have. So, we became wealthy to the degree that we really didn’t have to work anymore. We didn’t have to. We could have gotten rid of every client, and stopped doing it.

I view the thrust of your question as to get an appreciation for what sort of person I am. Don’t forget, I write research almost every week. No doubt you see it. It’s usually 15 or 20 pages long. Imagine if your job was writing a term paper every week for the rest of your life. You have to like it to do it. If you don’t like it, you can’t do it. Now, it’s for you to judge, by reading it, whether I execute that task well or poorly. But, to merely do it at all, you have to like it.

For me, the ultimate destiny of FRMO is that I don’t intend to sell my stock. I intend to build up the market value and place either all my shares or—close to my demise; [...] — I want to set up a family foundation, and I want my kids to basically run the family foundation and give money to charity, because I want them to think that their home and their world is not a place that you just eat and sleep in, that you do things with it.

[...] Now, for tax purposes, Horizon Kinetics is a Subchapter S corporation. If you’re a Subchapter S corporation based in the city of New York, they hit you with every tax you can possibly imagine.

If you’re a C Corp, you’re advantaged in taxes, at least from that point of view. And you can judge the rest of it. It’s better to have more of your cash flow in a C Corp [FRMO] than it is an S Corp [Horizon Kinetics (Horizon Common LLC)], if you want to maximize your wealth for the charitable purpose that I enumerated.

So Stahl ostensibly does not plan to sell and rather is intending to build FRMO for the long term as an inheritance for his own children. That kind of personal investment make FRMO seem like a good vehicle to ride S&B's investing coat-tails on into the long run, IMO (assuming you believe they are truthful about their intentions — which I'm inclined to — and that you approve of their investing style/philosophy, which I do). This was in 2012 and I've seen no indication that Stahl (or Bregman) has sold any of their stock since then.

More on Stahl's intention w/ FRMO:

QUESTIONER 5: What would you like to accomplish by having FRMO as a public company that you might not accomplish if you took out the public stock?

MURRAY STAHL: What would I like to accomplish? Well, I believe a couple of things. First of all, I believe that, at the end of the day, we’ll get a higher value for the company in the public domain than in the private domain. [Secondly] There may come a time—although we’re nowhere close to that time—when, if we do a good job, it may be possible to use shares to effect a transaction that we could not have done otherwise. [...] There comes a time, every so often, although it’s very rare, when it’s possible to engage in a transaction with common stock as the currency. It’ll happen very infrequently, and there’s nothing on the horizon, so to speak, like that now.

QUESTIONER 5: Any other reason?

MURRAY STAHL: Well, if I’m ultimately going to put the assets, the shares, in a charitable foundation, you have to give a certain amount of money. If it’s a private company, how can you do that? So, at some point, my heirs are going to have to sell some shares. It’s much easier to sell publicly traded shares than privately traded shares.

There was also a question about Stahl's ownership interest in FRMO re. his total net worth:

QUESTIONER 3: Can you describe in numbers what percentage of your wealth is in FRMO versus Horizon Kinetics versus other outside investments?

MURRAY STAHL: Well, I can do this. All my money is managed by Horizon Kinetics, other than my checking accounts, and you can consider my house as part of my net worth. At the moment, I believe that my ownership interest in FRMO, its market value, is somewhat less than the market value of my interest in Horizon Kinetics. And then I have my marketable securities. So, I would say, all together—I probably shouldn’t disclose my net worth, but I would say maybe—this is off the top of my head—let’s say at least 20-plus percent of my net worth is in FRMO. Of course, that fluctuates on a daily basis, so you’ll need to view that accordingly.

This is from 2012 (though also note that Stahl has not sold any shares of FRMO since 2010 that I could see).

********** UPDATE 20220909:

From the 2022 annual shareholder meeting proxy (https://materials.proxyvote.com/Approved/30262F/20220725/NPS_514395.PDF)…

… we can see that ~75% of the company shares are owned by the officers and directors of the company, themselves — making it more likely that the shares will trade based on the underlying value of the business in the medium/long-term vs trading on systematic risks as aggregated and commodified securities in general with the rest of the highly index-controlled market. Though really, I don’t really see much of the directors selling, so it’s really more just outsiders trading the remaining 25% of shares, so it could also mean movements even more based on thinly-traded retail vagaries. We also see in the “Compensation of Officers” section that '“The Officers of the Company, who are major shareholders, have agreed not to draw any salaries for the fiscal year ended May 31, 2022, or for the current fiscal year. A notional salary allocation is required under GAAP and accordingly non-cash compensation is recorded as an expense and as an increase to additional paid-in capital.”

**********

All this to add some vivid color to the main points that FRMO management...

Has a large equity stakes in the company relative to both the shares outstanding and their own personal net worth

Takes no salary

Enjoys the work for it’s own sake

Is personally invested in the long term success of the company — for both their own wealth as well for for their progeny / legacy / charitable giving capabilities of their children

Bottom line: If you’re looking for management with, as Charlie Munger calls it, the “fiduciary gene”, I believe these guys have got it.

Asset Breakdown

The company takes a diversified approach, balancing exposure to traditional assets and emerging opportunities like cryptocurrencies. The inclusion of various small private equity and micro/smallcap investments shows Stahl’s philosophy of exploring potentially high-reward longterm investments while keeping risk de minimis.

I won' try to go too much into the individual investment thesis for each of these holdings (unless they aren't marked-to-market or don't have a market value), but I will try to untangle certain confusing things withe how FRMO records their assets and highlight the basics as I see them and ID some main things to monitor for some.

.

The corporate structure and holdings of FRMO relative to HK is a bit confusing, but below is my understanding of the ownership structure (w/ rounded asset weights based on the Q1FY2022 earnings report relative to TBV5 (currently $179M)).

“I thought I’d commence today by reviewing the income statement and balance sheet, showing you how to read them, because there are some new accounting guidelines. If you don’t know how to read them, I imagine it would look fairly bizarre.“, https://www.frmocorp.com/_content/letters/2019_Q1_FRMO_Transcript.pdf

The way that FRMO’s holdings are recorded in their filings is also a bit confusing, so in order of concentration to FRMO's attributable TBV the holdings are...

Horizon Kinetics LPs (50%) + HKHA which together encompasses most of FRMO’s holdings of…

Cash and equivalents (20%)

Reciprocal ownership stake in Horizon Kinetics as well as an HK royalty interest (14%)

********** UPDATE 20230502: Securities exchanges (3%, book value accounting based on prior transaction costs of shares) **********

Everything else (other equity securities, crypto mining assets)

Keeping things simple, I look at it like this: As long as 1 and 3 (the most concentrated individual investments held by FRMO) are OK, then 4-5 will be fine as well because of the thematic similarity between all of these particular investments.

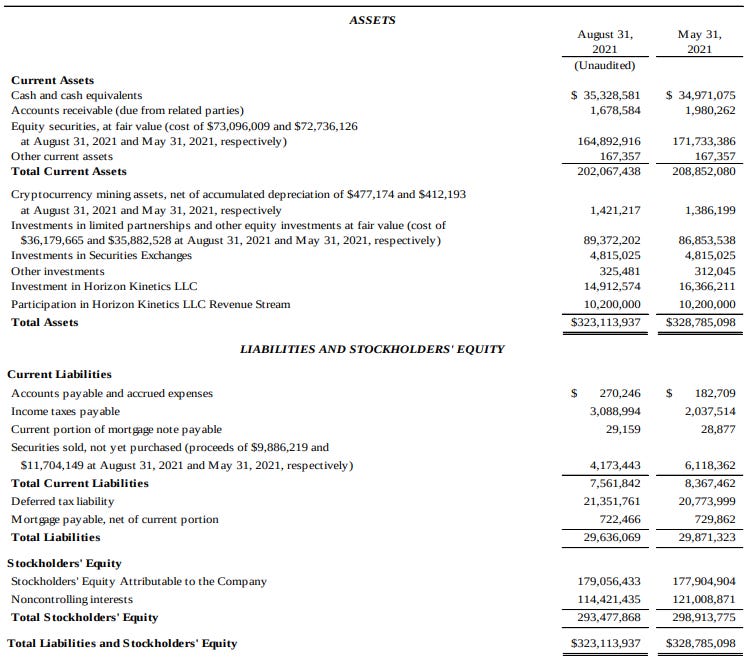

Like many other holding companies that are mostly just collections of other businesses that are already actively valued by the market, FRMO generally trades in correlation to it's TBV which is why most of my focus is on the balance sheet.

Note that I only use data starting from 2011 here, b/c FRMO was dark until around that time; I assume that TIKR is pulling it's data from the quarterly releases from OTC Markets.

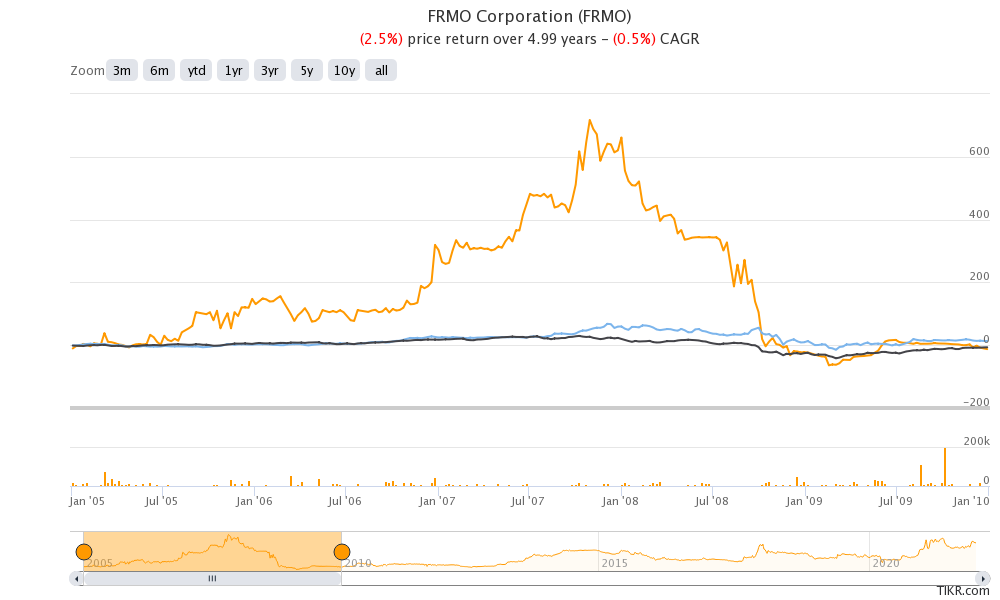

However, we can look at FRMO’s non-GAAP self-reported TBV from their 2011 annual letter for the missing period from 2001 to 2011 — particularly what the deal is with the massive rise and fall in share price leading up to the 2008 GFC6:

Using that table, we can see the P/TBV for that period:

Notice 1) the strong TBV growth even through the 2008 finacial crisis and 2) the wild P/TBV valuations that FRMO was trading at from 2006 to 2008. I currently have no explanation for the valuation during this period and I could not find any resources of S&B looking back and reflecting much on this period or much mention of this in their earlier annual letters post-2011 (in contrast to the transparency and candor of their shareholder letters and meeting today)7.

Also, just an FYI, the shareholders equity in the FRMO statements differs from what is shows as Net Assets on OTC Markets. This is because that Net Assets also deducts the (80%) Noncontrolling Interest of HKHA that is consolidated in FRMO's financials, because of the common control by S&B of both HKHA and FRMO as described in their annual reports, but can be confusing at first glance (ie. you need to look at the "Stockholders' Equity Attributable to the Company" breakout to see the real TBV or NAV)). 8

“The accounting practice is as follows: You take all of the assets, whatever they are—and many are equity securities—and you put them in the equity securities category on the balance sheet. Then, on the liabilities side, you back out non-controlling interests. You’ll see, all the way down, right above shareholders’ equity, the non-controlling interests. If someone doesn’t pay attention to that, it would be very easy to get the idea that we really are sitting here with $52.6 million in equity securities, but we are not; the actual value is a lower number. Why do we even consolidate this? Why not just be a limited partner, as we’re a partner in the other funds? Because this is an entity that FRMO [management] is actually running, so that is the appropriate accounting treatment.” —- https://www.frmocorp.com/_content/letters/2019_Q1_FRMO_Transcript.pdf

HK LP Investments

********** UPDATE 20221030: Stahl and Bregman have explicitly clarified the actual strategies of the various LPs in the 2022 annual shareholders meeting, see (Questioner 10). I will include a few snippet from that discussion here, below, in place of what I initially wrote. https://www.frmocorp.com/_content/letters/2022_FRMO_Transcript.pdf

“What you discover about life's shell game is that it's hardest to follow the pea when you're the pea.” —- Robert Breault

https://www.frmocorp.com/_content/10q/FRMO_Corp_Q1_2022.pdf

South LaSalle Partners holds shares of MIAX, that's the Miami International Holdings, otherwise known as MIAX, and it's a private company. It's a one-stock private company, and presumably it's going to come public, and we'll see how well we do.

(I will go over MIAX a bit more in a later part of this post)

The Multi-Strategy Fund has become quite concentrated, and not because we ever took the position of saying, let's make a very large position in something. It’s not that we wagered that we know enough to take that much capital risk in two positions, but this has come about through the combination of appreciation over a fairly extended holding period, and periodic withdrawals from the Fund. Actually, in the last year or two, there were few withdrawals, almost none, so I guess whoever's in there now either likes what they've got or is resigned to what they've got. In any case, there are two familiar investments, which comprise a great portion of the assets now: Texas Pacific Land Corp., which is probably just about two thirds of the market value, and bitcoin, through a couple of different kinds of fund instruments. It accounts for another 15% or so, so I'd say 80%-plus of the fund is in those two securities. FRMO Corp. probably owns close to a third of the Fund, so somewhere north of 25% and a bit less than a third is probably FRMO's capital. We're eating the same cooking, and I thought it might be interesting to look at how much we put at risk. It's difficult to know because, again, there have been withdrawals over time, but if we look at the tax cost, the actual cost of these holdings, TPL on a cost basis is probably 6% of market value of the fund, and the bitcoin position is probably, in terms of cost basis, about 2½ % or so.

CDK Partners was started to do two things. It was started to invest in exchanges. South LaSalle was started to invest in exchanges as well, and now it owns one exchange. CDK Partners was investing in a variety of exchanges, and it still does that, but it also had some cash, and we bought some shares of TPL, and we put some crypto in there. Why did we do that? Because we're the only partners, we don’t have any shareholders, so it's our money and we thought it was a good idea, and we did it. So, you could say it has three things in it. We also sold short some path-dependent ETFs.

(IDK if I’m going to get around to describing S&B’s POV on “path dependent ETF” in much detail anywhere else on this post, so I’ll just say that they are essentially shorting ETF that are structured using futures contracts and that have a predictably negative roll yield (eg. long-volatility ETFs) —IDK exactly who their counter parties are in this trade).

The Polestar Fund basically also has a holding in TPL, and the three companies that I mentioned that are in HK Hard Assets II, they're being bought every single day in the Polestar Fund, so little by little it's growing. And there's one other security that has nothing to do with Hard Assets. It's just a very undervalued security that you could call a special situation that we're also buying there. And in the Polestar Fund, we do short pathdependent ETFs, and we short some of the path-dependent gold-related ETFs as well.

(I don’t think he names the HKHA II holdings in the transcript, but I think he has mentioned some names in recent past before this meeting that include Mesabi Trust and PrairieSky Royalty. Not sure what the 3rd investment would be.)

The Multi-Disciplinary Fund was started to do two things. The approach was to buy bonds and generate supplemental income by writing options. And we came to two conclusions. Number one, interest rates eventually got so low, it didn't make any sense to do a lot of work with bonds, so we got rid of most of the bonds. I think there's one bond that's left in there, and it's probably going to be shorted in a week or two. So, the Multi-Disciplinary Fund, since it's mostly our money anyway, sort of looks a lot like Polestar.

(As I’m doing this update in Q2 2023 where FFR rates have drastically risen to near pre-GFC levels, I wonder if S&B will re-implement this fund’s original bond put-writing income strategy).

Kinetics Institutional Partners, it does have outside money in it. It has not purchased those commodity royalties that are in the Hard Assets II portfolio. However, it's much more aggressive, as far as that goes, with special situations. And then there's Shepherd. Shepherd is similar to Kinetics Institutional Partners. It just has a much bigger exposure to cryptocurrency than Kinetics Institutional Partners.

(Not really sure what to make of these last two, but the stake is so tiny that I’ve basically just been glossing over it in my mind).

**********

So initially, I could not find of whole lot of public information on these various LPs, but was able to see some commentary by Stahl here (see “QUESTIONNER 1”): https://www.frmocorp.com/_content/letters/2013_FRMO_Transcript.pdf

"The Multi-Strategy Fund is a classical hedge fund that was formed in 2007 in partnership with Credit Suisse. Its strategy goes across the asset classes. [...] The Polestar Fund is not radically different from the Horizon Multi-Strategy Fund, with one salient difference. The Polestar Fund created a subclass called Class S, which is designed to give clients of the Polestar Fund direct exposure to some of the index arbitrages that we would engage in on our own balance sheet. [...] The Multi-Disciplinary Fund was designed to do the same sorts of things, but in the form of options. Specifically, we believe there are certain inefficiencies—they’re not huge inefficiencies, but certain inefficiencies—in the business of writing puts versus engaging in buy-writes. [...] There’s also a mutual fund that’s not listed among the various funds detailed in the Annual Report. It’s called The Kinetics Multi-Disciplinary Fund (KMDNX), and it’s a conventional mutual fund. The reason for having two funds is that this fund is not leveraged"

While this would seem to imply that the Multi-Strat. fund is similar to the Polestar fund which is similar to the Multi-Disciplinary fund (whose main difference from the MS and Polestar funds are that it uses put writing strategy rather than a buy-write strategy) which is similar to the fixed-income focused HK Multi-Disciplinary mutual fund (sans leverage), looking in more recent documents this appears to no longer be — or never has been — the case.

“Regarding the partnerships, using the Polestar Fund as an example—I may be slightly off, but I think it’s 39.4% TPL, and the Horizon Multi-Strategy is roughly 43% TPL. So, when you see these movements up or down,they’re largely—not entirely—but largely either TPL or bitcoin.“,https://www.frmocorp.com/_content/letters/2020_Q3_FRMO_Transcript.pdf

In looking trying to resolve this confusion a bit more, it was cathartic to see it addressed in a way during the shareholder meeting as well (and it appears they plan to do something about it):

“[…] from the point of view of generally accepted accounting principles,there is no bitcoin, there is no TPL; there’s HK Hard Assets, which is a fund. There is the Polestar Fund. There is the Multi-Strategy Fund. […] But everybody who looks at the FRMO stock is thinking about cryptocurrency, they’re thinking about TPL; they’re not thinking in terms of the Multi-Strategy Fund or the Polestar Fund, or HK Hard Assets because,as funds without an explanation, they’re just inscrutable. That’s one of the problems that we want to solve. If we put the two companies together, that might solve the problem, so we’re thinking about it.“,https://www.frmocorp.com/_content/letters/2020_Q3_FRMO_Transcript.pdf

In any case, based on how Stahl has talked about the LPs — in terms of visibility into the holdings and themes — I take HK’s Paradigm mutual fund or Market Opportunities fund (this second one maybe more so) to likely be good proxies for what is going on with the Polestar and Multi-Strat. funds (w/ the main difference between these LPs and the MFs being the use of margin). As explicated by Stahl in the 3Q2020 transcript, the main movers of these funds are going to be TPL and Bitcoin (ie. GBTC).

(When looking at more recent filings’ “Note 4“s — the image posted at the start of this section) — I assume that “Equity Securities“ are mostly TPL via HKHA (which jives with the numbers for “Investment A“ ) and that GBTC comes mostly from the LPs (which jives with the numbers for “Investment B“) in the filing. Read on to see what I mean by “Investment X“)

$TPL

“But you can't forget that what you are sitting on, you are sitting on like the greatest hydrocarbon property in North America and you can even make a strong argument maybe even the world. The technology keeps getting better. This pipeline is being constructed, as gas being flared that in 11 months is not going to be flared and this is going to -- there is leases, there is water being sold, there’s all kind of things happening except those variables don’t change in any appreciable way in a matter of week[s].” —- https://www.frmocorp.com/_content/letters/2019_Q2_FRMO_Transcript.pdf (Question 6)

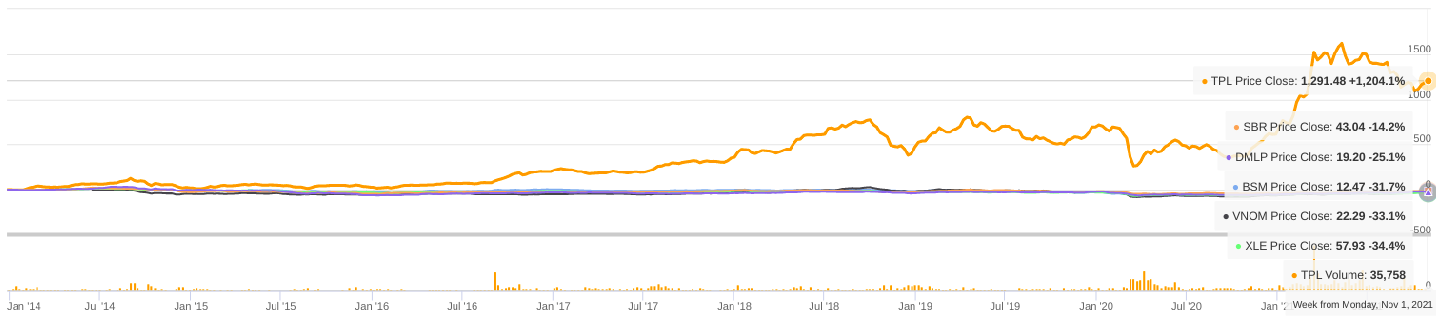

TPL has been a concentrated holding of FRMO’s for a long time and Murray Stahl’s involvement dates back to the mid 80s (and HK first started accumulating shares in the mid 90s). He also now sits on the board of trustees after fighting his way on in 2019 and pushing for TPL’s conversion from a trust to a C-corp (you can see about when this started happening by the large uptick in the graph below near the beginning of 2021).

TPL is a large O&G royalty streamer in Texas that fits into Horizon’s “hard asset” - asset-light inflation beneficiaries theme of companies that benefit from increased dollar costs while not themselves getting hit on the other side by capex inflation. Below are the returns of TPL vs other royalty streamers and oil funds over last 7yrs (I use 7yr because that’s when a lot of these other royalty companies begin, but rolling the window further back does show anything different) — all of which would have a negative return today if held through the same period:

FRMO owns TPL through it's 20% stake in the FRMO inflation “fund” HK Hard Assets (HKHA)9 of which TPL is the primary holding (more than 90%) — as well as through its LP investments — and its total direct and indirect amount owned by FRMO is cryptically aggregated as "Investment A" (GBTC being the similarly reported as "Investment B"). I don't 100% get why they report these investments in this cryptic way, even after reading the transcripts, but there you go. Again, note this “Investment X“ notation encompasses TPL and GBTC exposure FRMO has through all the LPs and HKHA (discussed here, see “Questioner 6”) (so be careful not to double count when summing up individual parts on your own).

That disclaimer aside, TPL is well covered at this point and I'm not going to be able to say much new about it right now (and in any case it's already marked to market on the B/S), but I will say this: If energy inflation turns out to be non-transitory, I think oil and gas royalty companies are going to be one of the best ways to benefit without getting hit on the other end with capex inflation. The major thing to watch here I'd say is oil prices (primarily regarding forces on the supply side).

You can read more about TPL’s history here (I found the explanation of why, when looking at a map of TPL’s acreage, its plots of land are in a checkerboard patter rather than being contiguous, to be very interesting): https://www.oilandgaslawyerblog.com/texas-pacific-railway-texas-pacific-land-trust-history-railroads-texas/

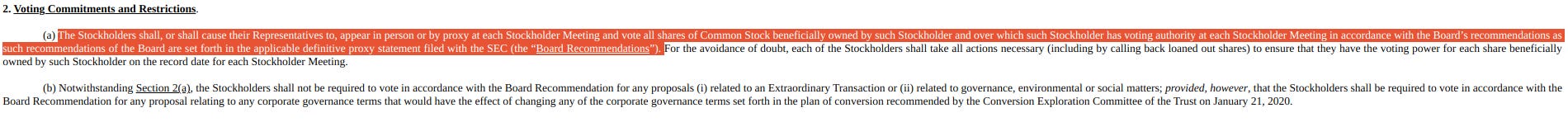

Furthermore, I generally see TPL as a special situation bet on HK eventually taking over —or something analogous to this. In the fullness of time, if HK is able to take greater control (eg. by getting free of the Stockholders’ Agreement10), I wonder how TPL's trading multiple could change given that it already trades richly despite, from what I can tell, having a BoD with a history of being openly adversarial towards shareholders, while enriching themselves.

**********

UPDATE 20230120: In yet another example of value destruction and ignoring shareholders, we can see the letter here from ATG Capital: https://www.globenewswire.com/news-release/2022/11/14/2555309/0/en/Texas-Pacific-Land-Corporation-shareholder-Gabi-Gliksberg-shares-public-letter-to-stockholders-about-upcoming-Annual-Meeting-outlines-why-he-plans-to-vote-against-Board-recommendat.html

Guess how TPL’s BoD reacted to the failure of the initial vote allowing them to dilute shareholders for empire building aspirations? They sued a bunch of the major recalcitrant shareholders.

Hoping the issue would become moot if enough stockholders voted for Proposal Four, TPL took a “wait and see” approach to see how the vote turned out. When Proposal Four failed at TPL’s November 16, 2022 annual meeting, TPL adjourned the meeting to February 14, 2023, and filed this action six days later. TPL simultaneously moved for expedited proceedings, requesting a trial on February 3, 2023, less than ten weeks from now. —- https://assets.law360news.com/1554000/1554265/defendants'%20opposition%20to%20plaintiff's%20motion%20for%20expedited%20proceedings%20with%20certificate%20of%20service.p.pdf

Stahl had this to say in response to my …generalized… question during the Q2FY2023 shareholders meeting:

[…] I don't agree that it makes sense to acquire royalty interests for equity like we've done in a transaction that you described. So I'll explain why. The royalty, no matter how good the royalty is, the royalty is finite. Sooner or later, so every oil royalty has a decline curve. Sooner or later it will produce no oil, even if it's great and lasts long period of time. The equity is forever. So equity is a perpetuity. […] You buy a business, whatever it is, in this case it's royalties, but it could be technology, it could be machinery, it could be even pharmaceuticals, it could be anything.

[…] So when you offer stock for someone else's business, the business you buy is going to have finite life. The stock you were offering has changed to that has an infinite life. And that's the problem with using equity in acquisitions.

[…] But the problem is every business is like a human being. It has a finite life and the equity has an infinite life. So ultimately it's not a sensible strategy and I don't think very highly of it. And when the reason is why we don't use equity very much to buy things at FRMO. So that's how I feel about that.

**********

Steve Bregman had a lot of interesting things to say about the current energy inflation situation and TPL (and other asset-light operations with “hard assets” exposure) in HK's 3rd Quarter Commentary (see “Why can the coming inflation be severe?“ and “Why will the energy price reaction be severe?“).

In terms of things to look for, I mainly look at it like this:

Supply constraints

Aggressive ESG policies by Dem. Congress / White House

OPEC+ refusing to release reserve supply

Continued under-investment by O&G industry post-2014 oil bust (exacerbated by increased debt and equity financing difficulties due to ESG trends amoung banks and investors)

3/7 Energy companies that require external financing in order to expand production -of the KEY commodity in any economy– can’t get it. The divestment movement (see gofossilfree.org), has $13trillion of commitments by institutions to sell energy investments/withdraw funding

3/7 Energy companies that require external financing in order to expand production -of the KEY commodity in any economy– can’t get it. The divestment movement (see gofossilfree.org), has $13trillion of commitments by institutions to sell energy investments/withdraw funding

Lockdowns (which killed a good number of O&G businesses)

Demand pulls

Gov stimulus (eg. the US recently passed the $1.2T infrastructure bill and France recently introduced a fuel subsidy to offset rising costs)

An economic recovery or growth

General fossil fuel demand in-elasticity

You can read more about TPL on the interesting blog here: https://tpltblog.com/

Cash and equivalents

"He thinks of cash differently than conventional investors. He thinks of cash as a call option with no expiration date, an option on every asset class, with no strike price.", (Warren Buffett’s biographer Alice Schroeder (author of “The Snowball”))

… or in Stahl’s own words…

I like the flexibility to be able to act when I need to, or when I wish to. But I don’t want to have the obligation to do so, merely because I happen to have cash. Let’s say that all the cash arrived on the balance sheet today. Of course, it didn’t, but let’s just imagine it did. Therefore, should I limit in time, temporally, my selection set to the next couple of days? If on a certain Tuesday, the money were to arrive, should I then limit myself to saying I intend to have all that money or the bulk of that money, invested by Friday, simply because it existed? […] The funny thing about the investment process is that, in the modern day and age, it’s possible to move, if you wish to, billions of dollars in the click of a computer mouse. It’s a technological achievement; I’ll certainly agree with that. But whether or not it’s conducive to good investment results is an entirely different question. I certainly don’t think it is. We like to be reflective. We like to be deliberate. We like to study our potential investment candidates to the degree that we can, and sometimes it’s very time consuming.

Not much to say here about this other than that it is a rather large cash horde and given the current state of the market (which Stahl mentions in the 2019 annual letter), I'm comfortable with the amount of dry powder S&B are holding on to right now.

Just as a little experiment, we can play around with what the value of a dollar from that cash horde would be if S&B were to invest it in the future:

Here I assume that the money just sits there for 5 years while discounting at 11% (the 17yr CAGR for FRMO) and then is spent to compound that same 17yr CAGR over the next 5 years. We see that the present value of such a dollar would be worth 3x (so from thie POV, the 20% cash holding would contribute a (0.2 x 3) - 0.2 = 40% gain to FRMO's TBV). I wouldn't go so far as to actively mentally adjust that into FRMO's TBV, but it's an interesting POV to play around with (in any case, I think 1 FRMO dollar is worth more than 1 me-managed dollar (SPAC premium-to-trust ratios come to mind here )).

Here’s what management had to say about their large cash position in 2014:

Cash and Equivalents. This segment comprises roughly 24.6% of total corporate assets. Ordinarily, since cash produces essentially no return, this would severely limit our possibilities for earning a robust return on shareholders’ equity. In fact, we were able to avoid this problem for two reasons.

First, as noted previously in this text, we were easily able to use the cash as collateral for our short sale activity. A successful short sale of one dollar of a path dependent ETF is over 200 times as productive as cash, even if interest rates were somewhat higher. Moreover, we only needed to use a very small proportion of our cash balances as collateral. In fact, the short sales themselves produce cash.

Second, the revenue share from Horizon Kinetics is structured to be a high return vehicle that generates cash with no reinvestment requirement. Most corporate earnings streams require the reinvestment of a significant quantity of the earnings generated. It is therefore obvious that our situation is unique.

It should also be obvious that our cash balances vastly exceed our normal operating requirements. We are therefore in a position to invest a substantial amount of capital should the opportunity arise. In fact, given that shareholders’ equity now exceeds $94 million, we could, in principle, borrow against that sum, as we are a debt free company. This is not to assert that we are about to engage in such an undertaking. The purpose is merely to observe that we could theoretically write a very substantial check if such an action were desirable.

Thus, cash is a quasi dormant asset that can be mobilized to increase return on equity. It is only quasi dormant as it does serve a collateral purpose, in part. This cash sum, when considered as only part of our liquidity in addition to our closed end bond fund assets and potential borrowing capacity, should give the reader a proper sense of our total available liquidity. Such a figure, even calculated most conservatively, comfortably exceeds 50% of corporate assets.

In any case, I think of this portion of FRMO’s assets as the deflation-hedged part of their portfolio.

********** UPDATE 20230518: With interest rates now higher than they’ve been in a decade, far from previous zero-bounded yields, this cash can earn a meaningful amount of interest income. I’ve seen a lot of talk of recession resistance in stocks like API Group and HireQuest —I have allocations of both— citing their ability to draw down on working capital in the COVID-lockdowns crash of 2020 as a useful feature in hard times. The one gripe I would point to with this is that this working capital drawdown came from collecting accounts receivable due to the businesses and would have eventually run out as cash inflows to the companies’ top line dried out in this environment —you can kind of think of these AR items like buffers or capacitors11 to the business machine that can smooth the flow of power/capital to the business if there are quick, temporary shutting off of electricity. Large cash reserves like this, on the other hand, have the ability to generate income even in a recessionary environment —though I’d also expect rates to be cut significantly in such an environment. The value of cash in a recession is mentioned repeatedly in the firsthand historical account of the Great Depression by Benjamin Roth in “The Great Depression: A Diary”.

**********

Crypto assets

"The reason Bitcoin is successful is that its distribution allows for it to be used as a store of value. It was designed to appreciate in value and to become harder to produce. Therefore, its intrinsic value is supposed to rise. One Bitcoin now is worth roughly $430." — Murray Stahl, https://horizonkinetics.com/app/uploads/December-2015_Cryptocurrencies-An-Emerging-Asset-Class.pdf

I think an overlooked aspect of gaining exposure to cryptocurrency via FRMO is that crypto transactions can come with very complex tax consequences (that are no doubt going to be subject to relatively eventful regulatory changes going forward) and having all of that handled by FRMO as Stahl & Bregman think through and experiment in this space is a significant benefit of ownership.

How many publicly traded, owner-operated, smallcap businessses are there with existing traditional high-ROE operations (or large interests therein) that are also backing incremental de minimis investments into very young emerging industries (so young as to not have any primary incumbent players or business roadmap for the industry) that have the potential for orders-of-magnitude greater returns?

********** UPDATE 20230502:

The purpose of this labyrinthine approach is not to be opaque, although this is the unfortunate effect; rather, the purpose is to explore new asset classes and new business opportunities in a gradual manner that limits risk and disruption. Risk is not merely the possible loss of capital. —- https://frmocorp.com/_content/letters/2019.pdf

In the 2021 annual meeting, Stahl mentions that

1) they had always planned to move beyond being an asset holding company —in order to have something that could generate cashflow even after they had eventually departed— and wanted to build some kind of operating business,

2) the type of business they eventually decided to pursue was (ironically, if your goal was to generate “cash”-flow) Bitcoin and cryptocurrency, and

3) due to the predictable nature of the Bitcoin protocol block reward halving and the associated sporadic and unpredictable deflationary innovation (and corresponding obsolescence of existing generations of technology and equipment) that it incentivizes, they did not want to make singular, large capex spends in order to build up a crypto business. (This step-wise approach to capex spending in their crypto investments also helped FRMO avoid making fresh losses during the crypto crash the unraveling of the FTX scandal through 2022).12

But to put too much money in any new-generation equipment risks their obsolescence if a halving is approaching and, therefore, places in peril the whole cryptocurrency mining effort, so we can’t do that. So, we have to move in a step-by-step function in terms of capital investment. You’re taking a machine and operating it until it can’t operate anymore, until it’s worn out, and, effectively—we want to think of it this way—you’re converting it into cryptocurrency. You’re taking a temporal asset, one that has a limited life and for which it’s hard to judge the lifespan at point of purchase, to convert it into crypto.

Thus, when looking at FRMO’s various crypto investments, you should keep in mind that these are not intended to remain separate from each other, but are planned to eventually be operated together in an integrated manner. In short, those components are…

Data center monitoring equipment and crypto mining (via Winland Electronics Inc. and Winland Mining LLC (which HK hosts on their behalf) under Winland Holdings (WLEX))

THÉRÈSE BYARS: "That’ll be my pleasure. The first one says, “Are there any updates to potentially becoming an operational business rather than just an owner of assets? Are there any updates that can be discussed with shareholders?” MURRAY STAHL: I alluded to it but I didn’t elaborate. The easiest path is to acquire 51% of one of our publicly traded subsidiaries. The company we have the biggest stake in right now is Winland, at about 29% [31% as of more recent earnings calls]. In the most recent quarter, we bought some more. So, if we end up going in that direction with one of our businesses, we’d acquire 51%, if we could, and conduct our operations via that entity. —- https://www.frmocorp.com/_content/letters/2022_Q2_FRMO_Transcript.pdf

“FRMO owns 30.8% of Winland. […] What we’ve been doing in FRMO is to nibble away, when we thought it was appropriate, at Winland shares. So, we’ve been buying Winland shares, and we thought that was the best use of the capital, given what was going on in the mining rig market” —- https://www.frmocorp.com/_content/letters/2023_Q2_FRMO_Transcript.pdf

Mining rig sales, repairs, and rig hosting, as well as mining for their own account (HashMaster (A.K.A. HK Tech LLC) (HMT))

“One is called HashMaster. We own, I think it’s 7.1%. Horizon Kinetics itself owns over 50%, so we obviously have a big stake in it. HashMaster does a number of things.” —- https://www.frmocorp.com/_content/letters/2022_Q3_FRMO_Transcript.pdf

“It's our default mining site, so if we don't want to or we cannot or we find it disadvantageous to be in other sites, we can always retreat to HM Tech. We've done that more than once when we couldn't get terms that we needed, and of course HM Tech repairs our equipment. Also, there's some HM Tech mining for its own account.” —- https://www.frmocorp.com/_content/letters/2023_Q2_FRMO_Transcript.pdf

S&B’s / HK’s own mining efforts (currently named Consensus Mining & Seigniorage Corporation (“CMSC”) and should be due to go public on the OTCQX exchange tier this year)13

On December 1, 2021, two of the Company’s Other Investments, HK Cryptocurrency Mining, LLC (“HKCCM”) and HK Cryptocurrency Mining II, LLC (“HKCCM2”) merged into a newly created Delaware corporation named Consensus Mining & Seigniorage Corporation (“CMSC”)., https://www.frmocorp.com/_content/10q/FRMO_Corp_Q3_2022.pdf

“In the HK Cryptocurrency Mining LLC, the idea is to mine the cryptocurrency, then sell it that day. We accumulate the cash for a quarter, and then we pay it out as a dividend. Internally, we refer to that dividend as seigniorage, meaning we’re actually creating money—if you accept the idea that cryptocurrency is going to be money—and earning a margin on that.” —- https://www.frmocorp.com/_content/letters/2018_Q3_FRMO_Transcript.pdf

I could find not information on what exactly HK Cryptocurrency Mining II does, but I assume it’s the side of CMSC that mines and retains Bitcoin on its own behalf give that HKCM I sells its BTC, yet transcripts show that CMSC does hold BTC as well.

These crypto assets make up around 10% of FRMO’s TBV at the time of my writing this update. More commentary on FRMO’s various larger crypto investments can be found here (espeicailly in response to Questioner 7): https://www.frmocorp.com/_content/letters/2023_Q2_FRMO_Transcript.pdf

This figure also factors in FRMO’s GBTC and direct Bitcoin, Litecoin, and various other smaller cryptocurrency holdings either directly or via Grayscale trusts (eg. Ethereum Classic, ZCash, Bitcoin SV, and Bitcoin Cash). The logic in holding these smaller cryptos was enumerated in the 3QFY2021 earnings call (see “Questioner 5”). The basic logic is that the network effects of a crytpo are/should be generally correlated to the value of it’s monetary policy; all of these smaller cryptos have similar monetary policies to Bitcoin; due to their obscurity or unpopularity after their forking from Bitcoin (or other parent crypto), they are akin to spinoff businesses that have been sold off for non-economic reasons (recall Joel Greenblatt’s “You Can Be A Stock Market Genius”). Furthermore, they have lower total supply as many of their addresses have since been “lost.” Stahl believes that when (not if) a BTC spot ETF is approved by the US, it will open the flood gates for other cryptocurrency spot ETFs; market liquidity will flood into crypto space; Mr.Market will be able to bring greater crowd-wisdom to bear in the space; these obscure cryptos should end up with similar total marketcaps to BTC due to their comparable monetary policies; just holding a few could then fetch a 400x return per unit of these cryptos —that have much lower un-lost supply and currently trade at tiny fractions of BTC’s price— when this correction happens.

One last thing I’d like to add re. CMSC: As further evidence of S&B’s confidence in the mining operations and crypto space in general, it should be noted that while the initial investment in equipment for CMSC came from FRMO and HK, they never had CMSC repay that investment once the business actually started generating cash, but rather had FRMO and HK accept stock in the new company.

My only-intelligible-to-me notes on FRMO’s cryptocurrency businesses are included below —ignore the diagram of securities exchange holdings in the lower left side which will be relevant in a later section of this post (and feel free to ask me for clarification on this cryptic drawing the comments if it’s too confusing):

**********

I'm still not totally convinced that the historic rise of cryptocurrency is not just the 21st century's biggest global Ponzi scheme (including Bitcoin). HK recently published an article regarding the possibility of cryptocurrency being outlawed to which their response was to point out the fact that many illicit markets continue to exist for outlawed goods, to which I'd say: Fair enough, but FRMO would no more be able to hold any cryptocurrency assets in such a situation as they would be able to hold any cocaine distribution businesses today. I've read the commentary by Howard Marks, Murray Stahl, and Matt Huang and still cannot fully buy in to either camp, but the asymmetric long term reward/risk of holding bitcoin in a success scenario + the fact that I just find it interesting does seem to merit some kind of allocation (I personally am allocated such that a total zeroing out of FRMO’s GBTC position represents a 2pps VAR for my portfolio).

I think the major things to watch for here are

Regulatory assassination by world governments (esp. the US)

Public acceptance of bitcoin (as "the likelihood and timing of the success scenario for bitcoin, it is ultimately merely a function of public acceptance as an alternative medium of exchange.", Bregman)

That it is never proven that one-way cryptographic functions can't actually exist (ie. someone finds a way to reverse them or the mere possibility of such), although this is not really a specific risk to cryptocurrency as it is to the whole digital world we rely on, so if this goes down your going to have much bigger problems on your hands

$GBTC

"As to what to do about the discount, I’d first ask a preparatory question. Is bitcoin a long-term strategic asset in your portfolio, or a trading security? We treat it as the former, no different than four years ago. As a strategic holding, in a success scenario, bitcoin’s future returns vs. the dollar would be even greater going forward (by our estimation, of course) than it has been since 2017. In that context, the 17% discount is an irrelevance.", https://horizonkinetics.com/app/uploads/Q3-CVALUE-Review_FINAL-1.pdf

“Most of our cryptocurrency is in the form of the Grayscale Bitcoin Trust, ticker symbol GBTC.“, https://frmocorp.com/_content/letters/2020_Q2_FRMO_Transcript.pdf

Another popular stock — and the primary way that FRMO own Bitcoin — that I'm not going to go too far into here, but I will just say that GBTC has been a long time holding of FRMO and provides institutions with a liquid pure-play exposure to BTC as an asset class in a way that does not currently exist in any other form other than actually buying and holding BTC in a digital wallet or cold storage device in earnest and that GBTC could see another leg of its historic run if they ever actually get SEC approval to convert to an spot-tracking Bitcoin ETF as they are intending to do.

Personally, I see it like this: There is a non-zero probability B that the Fed/SEC simply bans BTC before too many rich donors’ and politicos’ personal fortunes are significantly tied to it for it to be too painful to carry out. There is some non-zero probability S that Murray Stahl’s total-success case comes to pass and a single BTC is worth V = $3M.

So the (eventual) expected value of BTC is V * P(S) * (1 - P(B))

Note that as BTC continues to gain momentum unabated (sans some intermittent volatility that will no doubt be touted as the death of crypto each time) the probability P(B) grows ever smaller from a Lindy Effect POV.

Apparently, Stahl thinks P(S) is much closer to 1 than 0 and P(B) is much closer to 0 than 1, but you can do your own calculations for an expected value of BTC using this same formula.

As Bill Miller recently noted: “It [Bitcoin] has worked for twelve years with little regulatory interference under multiple administrations. In fact, the regulatory outlook for Bitcoin in the US has never been brighter, which may explain why so many institutions are now getting involved.”

This is how Stahl (and many other’s Bitcoin bulls nowadays) look at Bitcoin: As a fiat debasement bet without having to be long any side of a particular trading pair. As the best bet on a store of value when/as the world economy falls into the inflation-contraction quadrant.

With cryptocurrency it’s the same sort of thing. But not exactly, not really. We’re used to saying that bitcoin goes up or bitcoin goes down, and I do it, too. But it’s wrong and I need to remind myself to stop doing it, because bitcoin doesn’t go up and bitcoin doesn’t go down. Everybody should turn the bitcoin charts upside down. If you turn them upside down, what it would show is the value of the dollar in relation to bitcoin. When bitcoin “goes up,” what’s actually happening is the dollar is going down in relation to bitcoin, and the euro is going down in relation to bitcoin, as well as the Swiss franc, as well as sterling, as well as the yen, and so on. Basically, bitcoin is a long-oriented way of shorting fiat currencies. Why do you want to short them? Because, altogether, they are clearly losing purchasing power., https://www.frmocorp.com/_content/letters/2020_Q3_FRMO_Transcript.pdf

What's more to say really? Be it as a global Ponzi scheme, digital gold, or the next evolutionary step in modern finance, I don’t think anyone believes Bitcoin is going to move anywhere near sideways from here on. Murray Stahl thinks BTC has a good shot of reaching $1M per coin. In either case, I think that Stahl is going to do a better job at monitoring that outlook — and positioning for it — with a more informed and level head than I would. More on Stahl’s BTC outlook can be found here.

(Again note that GBTC is held by FRMO through its investments in the various LPs et al and it’s value is aggregated as “Investment B“ in their reporting)

Consensus Mining

"[...] we have these investments in the various cryptocurrency mining companies. And I'm pleased to report that we are bringing those investment, we're consolidating those LLCs and we're bringing it public. So, there's going to be a public listing and direct listing for what we call or what we will call consensus mining, which is going to be a publicly traded mining company and it's going own a fair amount of cryptocurrency.", FROM's (FRMO) CEO Murray Stahl on Q4 2021 Results - Earnings Call Transcript

https://www.frmocorp.com/_content/10q/FRMO_Corp_Q1_2022.pdf

FRMO recently announced in October that they are going to spin off their crypto mining operation into a public company called Consensus Mining. This intent could have been sniffed out by listening to Stahl's comments on FRMO's crypto mining operations in the recent 2021 annual letter in August:

"The challenge for FRMO is to convert its disparate cryptocurrency exposures into an actual operating company that will be valued on its produced profits and not merely on the basis of the aggregate value of its individual parts. This would be a big change for FRMO, since it would itself become an operating company with actual employees and all of the complexities that actual operations entail.", https://www.frmocorp.com/_content/letters/2021.pdf

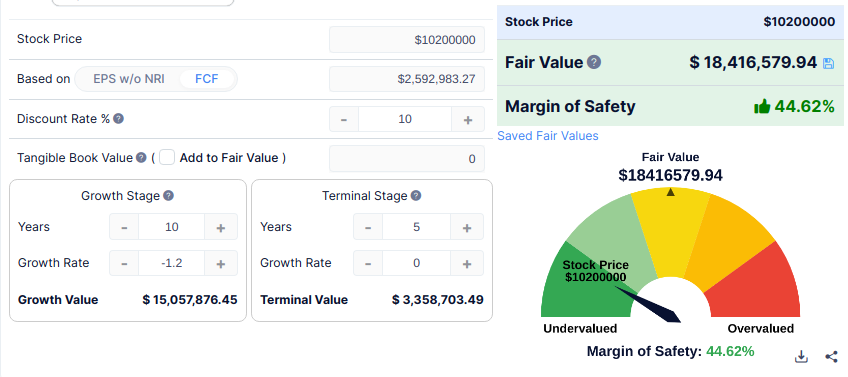

The operation is carried on the balance sheet at $1.4M **14 and makes up just a small amount relative to total assets as it is reported at cost (which also does not include the market value of the various cryptocurrencies mined and held by FRMO). It's a development that's worth mentioning that could be worth $0 or could actually turn out to be something.

The crypto mining assets’ BV does not really move the needle much relative to FRMO’s total TBV, but we could really bump this up to something meaningful by applying a market multiple to the BV of this line item. As Bregman states in a recent HK commentary regarding cryptocurrency mining companies:

"A price-to-book value multiple would be a more meaningful comparator. Indeed, book value seems to be how investors are pricing these companies. Price relative to property and equipment (P&E), perhaps adjusted to exclude cash and cryptocurrency holdings, might be an even better way, because for some of the miners, book value includes very large intangible assets. On a price/book value basis, the six companies I took a quick look at, including Hive Blockchain Technologies (HIVE), which has a $1.2 billion market cap, trade between 2.0x and 8.4x their June 30th book value. Leaving out the lowest-valued one, Cleanspark, the range is 3.7x to 8.4x. Of course, this is an industry in rapid development and flux, which can distort some of these valuations.", https://horizonkinetics.com/app/uploads/Q3-CVALUE-Review_FINAL-1.pdf

Just applying the adjusted range extremes, we could have a market value of the crypto mining operation of between $5.2M to $11.8M (a 2-6% increase in FRMO’s total TBV).

From the 4Q2021 earnings transcript, we can also get a view of how much cryptocurrency FRMO directly holds that could be going along with the crypto mining spinoff:

"And here's what we own directly without being the funds. We own 110.4 Bitcoin real Bitcoin; it comes from our mining ownership. Basically, we're always mining, so we're always increasing that. [...] We have mind and we continue to hold 1,060 Litecoin. We have mind and continue to hold 35 Ethereum, and we have mind that continue to hold 661.7 Ethereum Classic. And we have mind and continue to hold 58.9 Zcash. [...] And then Winland Holdings; so, we own, we min[e]d this quantity 39.1 Bitcoin itself. And then there's a separate we acquired through and that through buying up a partnership, we acquired 7.4 Bitcoin, that's why there's sanction there. So, you have to add together 39.1 and 7.4 to get our whole Bitcoin exposure. We owned 14.9 shares of liter coins I should say of Litecoin.", FROM's (FRMO) CEO Murray Stahl on Q4 2021 Results - Earnings Call Transcript

The transcription here is not the best, but the numbers roughly jive with the 2021 annual letter which I believe was released just a few months prior to this shareholder meeting — in Aug 2021 — which shows a cryptocurrency inventory of...

So according to this call, we have…

BTC: 110.4

ETH: 35

Litecoin: 1,060

...and the rest I'm not going to go through the trouble, since Bitcoin and Ethereum are the main attractions here.

Though note that the value of the cryptocurrency held by FRMO is already factored into their B/S under the Equity Securities line:

Questioner 9