($IAA) Insurance Auto Auctions: You asked why I love $CPRT so much; 'cause she's a older you

A durable, beaten down bet on continued automobile supply shortage on a duopoly's ugly duckling

********** UPDATE 20250112: RBA (previously IAA) position up 70% since initial buy, but may sell soon. The way I see it, RBA’s main strength is their global physical site network. Yet it could be argued that IAA was more valuable as a more focused business (auto salvage in the US, Canada, and UK) where they shared a North American duopoly with Copart. As part of RBA, investors are now exposed to global competition and all the other manner of alternative re-selling channels for not just vehicle salvage, but for commercial transport equipment, other industrial equipment, and gov/military surplus, as well as competition in the same space as RBA’s various value-added services like financing, inspections, and appraisals. That is, acquiring IAA helped RBA gain a revenue source, but RBA is a less focused business than IAA (which IAA shareholders have been sucked into). **********

********** UPDATE 20240615: RB Global (RBA) +10.06%. The stock rose the most on Monday +8.85%. The company, which provides a marketplace for buying and selling vehicles, is set to join the S&P MidCap 400. YTD, +19.60%. (https://seekingalpha.com/news/4116474-enovix-surges-to-top-industrial-gainer-of-week-preliminary-earnings-drag-down-msc-industrial) **********

********** UPDATE 20231011:

Was randomly looking an insider activity for stocks in my portfolio and noticed that the RBA CEO and various directors made a cluster of open market buys 1) in the months after the IAA acquisition when the stock dips slightly below the price the stock hit at the time of the acquisition and 2) just a few months ago before filing their 10Q in August.

The things I take away from this is that 1) the management is pretty good at deciding when to buy —which could come in handy in the future— and 2) I should probably continue to hold the stock.

**********

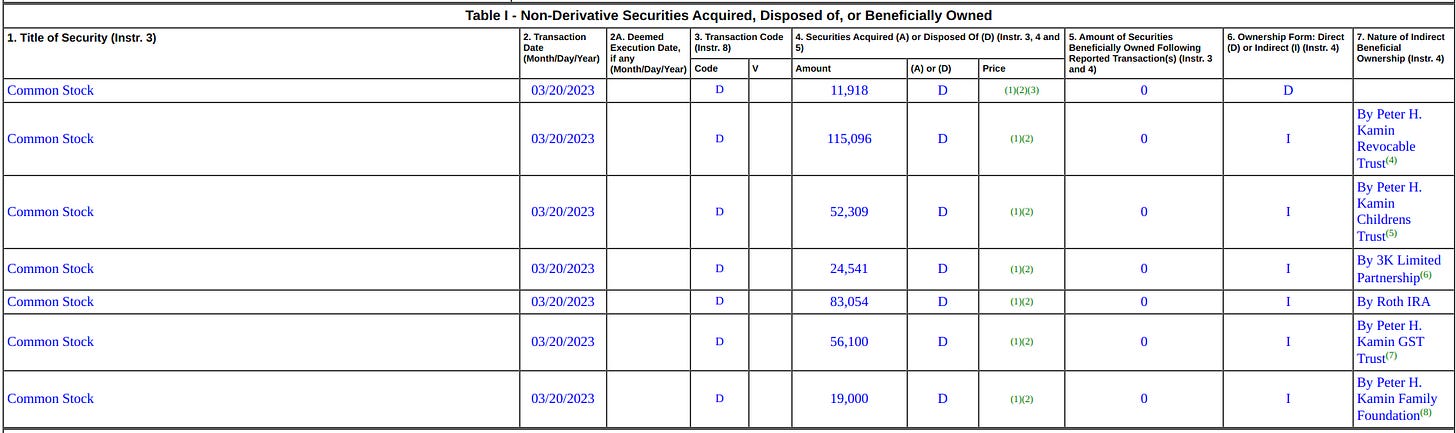

********** UPDATE 20230321: From what I can tell Peter Kamin —whose board presence was one of the things that originally got me interested in the business— has not sold his shares; the most recent filing by Kamin re. IAA was related to the conversion of IAA shares to RBA shares per the acquisition terms:

1. Pursuant to an Agreement and Plan of Merger and Reorganization, dated as of November 7, 2022, as amended by the Amendment to the Agreement and Plan of Merger and Reorganization, dated as of January 22, 2023 (the "Merger Agreement" and the transactions contemplated thereby, the "Merger"), by and among the Issuer, a Delaware corporation, Ritchie Bros. Auctioneers Incorporated, a company organized under the federal laws of Canada ("RBA"), Ritchie Bros. Holdings Inc., a Washington corporation and a direct and indirect wholly owned subsidiary of RBA ("US Holdings"), Impala Merger Sub I, LLC, a Delaware limited liability company and a direct wholly owned subsidiary of US Holdings, and Impala Merger Sub II, LLC, a Delaware limited liability company and a direct wholly owned subsidiary of US Holdings,

2. (Continued from Footnote 1) each outstanding share of the Issuer's common stock held by the Reporting Person immediately prior to the effective time of the Merger automatically and without any required action by the Reporting Person, was converted into the right to receive: (i) 0.5252 of a common share of RBA plus cash in lieu of any fractional RBA common share, and (ii) $12.80 in cash, without interest and less any required withholding taxes (the "Merger Consideration").

3. Includes shares subject to a restricted stock award that were converted at the Effective Time into the right to receive the Merger Consideration.

**********

********** UPDATE 20230314: “"IAA, Inc. (NYSE: IAA) (“the Company”) today announced that its stockholders have adopted the previously announced merger agreement providing for the stock and cash acquisition of the Company by Ritchie Bros. Auctioneers Incorporated (NYSE: RBA) (TSX: RBA) (“Ritchie Bros.”) at the Special Meeting of IAA Stockholders held earlier today. […] Under the terms of the merger agreement, IAA stockholders will receive $12.80 per share in cash and 0.5252 common shares of Ritchie Bros. for each share of IAA common stock they own. Upon completion of the transaction, the parties expect that on a fully diluted basis IAA stockholders will own approximately 37.2% of the combined company and Ritchie Bros. shareholders will own approximately 62.8%.”, https://www.businesswire.com/news/home/20230314005855/en/IAA-Announces-Stockholder-Approval-of-Merger-Agreement-with-Ritchie-Bros. **********

********** UPDATE 20230117: Regarding that last comment below, this article gives an interesting overview of the outlook for used car prices into 2023 —TLDR, it’s steadily downwards— as well as a view on the tight financing conditions that auto lenders are (going to be) in. **********

********** UPDATE 20221204:

On November 7, 2022, IAA announced that they would be acquired by Ritchie Bros. Auctioneers Incorporated (NYSE: RBA).

Under the terms of the merger agreement, IAA stockholders will receive $10.00 in cash and 0.5804 shares of Ritchie Bros. common stock for each share of IAA common stock they own. The purchase price of $46.88 per share represents a premium of approximately 19% to the closing share price of IAA common stock on November 4, 2022, and 23% to the 10-day volume-weighted average price, using Ritchie Bros.’ 10-day volume-weighted average price on the NYSE of $63.55. The total purchase price also reflects a transaction multiple of 13.6x IAA’s last twelve-month Adjusted EBITDA2 as of October 2, 2022. Upon completion of the transaction, Ritchie Bros. stockholders will own approximately 59% of the combined company and IAA stockholders will own approximately 41%. —- https://www.iaai.com/Press-Releases/ritchie-bros-to-acquire-iaa-create-a-leading-global-marketplace-for-commercial-assets-vehicles

I don’t plan to sell at the moment. Some observations: 13.6x TTM EBITDA is near the upper range of where IAA traded over the last 12 months — after the initial fall with the overall market in the beginning of the year (+ the big drop after IAA’s earnings report in Q1FY2022).

When I initially wrote about this quick idea in March 28 2022, it traded for $38/sh, so the acquisition price represents a 23% return — which was actually pretty close to the very simple fair value I originally gave of $53/sh in this post.

Ancora Holdings — who wrote an earlier criticism of IAA management that was included in this original post (who now owns 4% of IAA vs the 2% when I originally wrote this post) — opposes the deal and voiced their concerns in the letter here.

Whether the deal goes through or not, I’m content to hold on to my shares for the time being.

As for the decline in used car prices we’ve seen through the year, like I stated in the original article: It’s kinda a non-issue (as used car prices are not really a huge input contributor to their business, but a nice topping on vehicle ARPU at auctions) —despite being the initial reason for me looking at the stock in the first place.

Like I mention elswhere in the original post, the longer-term idea is that IAA couldn’t get much worse (I mean, they still managed to remain #2 in the oligopoly despite all the problems described in the Ancora letter) and a Copart-like biz is the possible upside if the company had the right mgmt… maybe RBA's management can be that team. **********

.

Overview

“These businesses predominantly share the characteristic of being ‘asset-light’ or ‘hard asset’ – they don’t require an asset-heavy balance sheet in order to operate and, so, are less exposed to the ravages of cost inflation upon their operations. Would I rather be a manufacturer, or just a fee collector? As in, would I want to be a car manufacturer during an extended inflation, burdened with rising replacement costs for my enormous plant and equipment base, and with compensation increases for my large employee base? Or would I rather be a car dealer: basically, an upgraded parking lot with short-term inventory and a certain pass-through margin on sales? That margin generates proportionally more dollars of profit as car prices rise, but without much increase in operating costs.“ —— https://horizonkinetics.com/app/uploads/Q3-CVALUE-Review_FINAL-1.pdf

Given the recent run on many inflation-adjacent names in the market, IAA 0.00%↑ provides a beaten-down way to invest in the inflation / supply shortage theme, operating in a duopoly, with a (ballpark) 30% upside, currently trading at it’s 52-week low (below the price and EV/EBIT multiple it was trading for pre-COVID — something not many stocks I’d be interested in have going for them ATM).

With the current inflation / shortage themes going around ATM (as well as the “low interest rates = low output/hr theory” I went over in the last post), I was recently thinking about these articles…

…and this:

Which got me looking for a supply/demand indicator to get a bit of historical context; one of which I take as a proxy, here:

And then there’s this1:

Note, from the Wolfstreet article mentioning this Manheim index:

“Dealers that go to the auctions to buy inventory to sell on their lots are paying those prices. They’re bidding against each other to get some of this inventory – confident that they can pass those higher prices plus big-fat profits on to consumers.

These dealers are now also bidding against rental car companies that are normally the biggest sellers at these auctions, but that are now running low on vehicles in their rental fleets amid a burst of domestic travel demand, and now they have turned into buyers at auctions.”

And in looking for beneficiaries thereof, I found this recent insider buying from board member Peter Kamin for car salvage facilitator/auctioneer IAA in the range of $31-$36/share (as well buying action from CEO John Kett2):

And these:

https://www.kbb.com/car-news/even-wrecked-used-cars-are-getting-expensive/

BTW, the increased price of new and used vehicles puts downward pressure on buyer behavior which should increase the average age of vehicles on the road, which would increase the supply of total loss cases that supply IAA.

Note that IAA is currently priced at a 52 week low to it’s cheapest post-KAR spinoff EV/EBIT — having its market price fall ~30% in a years time.

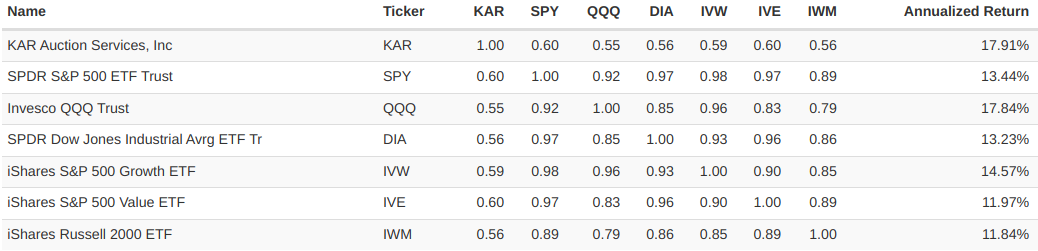

IAA also has a rather low correlation to the rest of the market3:

Thus, my thought process for into looking into this specific name a bit more is that I think 1) Peter Kamin —most recently, of (relevantly) recent Tile Shop and Calloways’s Nursery success4 (not much is written about him, but you can read a nice little blurb with links here)— is a very smart investor and that 2) he’s not planning on catching a falling knife here, plus 3) I like the relative historical cheapness and low correlation to the rest of the market.

There you go, a look into my simple-brain investment ideation process.

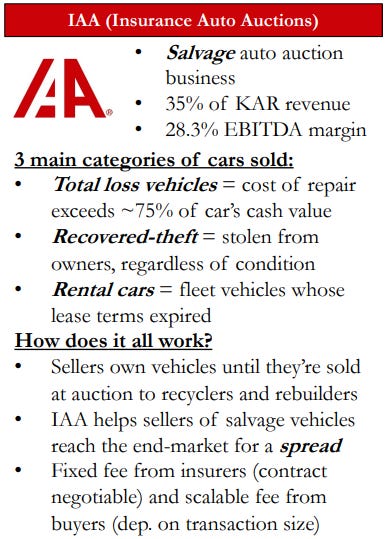

Business

“A storm sweeps through town, uprooting the tree in your front yard, which lands on top of your car. Then boom, your vehicle is totaled. If you have auto insurance, you’d probably expect your insurer to cover the damage. Luckily, they will if the repairs cost less than what the car is worth. But if they will cost more to repair than what it’s worth, the insurer will declare the vehicle a total loss. The company will then reimburse you for the actual cash value of the car — not the total cost of the repairs.” — https://www.kbb.com/car-advice/insurance/totaled-car/

IAA operates in a near total duopoly with slightly larger competitor — and “100-Baggers” author Chris Meyer holding — Copart5 (with IAA taking 40% of market share and Copart around another 40%) where it collects and stores total-loss vehicles from (mostly) insurance companies and then auctions them off to used car dealer, exporters, salvage yards, et al, collecting fees on both sides in proportion to the auction prices. Basically, the eBay of used, damaged, and salvage vehicles. The "total loss ratio" is the percentage of how much of the vehicle's actual cash value that a damaged vehicle's repairs would need to cost for the vehicle to be declared a "total loss" -- usually around 70% to 75%6.

You can read about the business7 + some of the existing vehicle complexification8, et al tailwinds and risks that IAA already had going for it in 2019 in the VIC article here — the comments to the post are very interesting as well.

The one issue I have with the analysis here is that it relies on comps analysis and the comparative spread in value ratios vs counterpart Copart to paint the picture of the investment upside. A bit further down, I do something a little bit different — though arguably no less simplistic.

(I like the VIC article for its brevity, but I actually initially invested in the 2019 RemainCo, KAR, in the year of the spinoff — at the bottom of the temporary dip — after randomly coming across the Sohn, London idea competition slides detailing the desirability of IAA’s business here).

There’s not much on the business model that I can add beyond this, but for a bit for flavor on how IAA makes money from the buyer side of the market (the side that generates the majority of IAA’s revenues), see here (note the first video is quite older — from 2017):

********** UPDATE 20230116: This graphic by Chris Mayer presents a good summation of IAA’s business drivers including whether various key factors are positive or negative contributors to the various drivers as well as recent trends (in 2016, so not so relevant for our purposes here) applicable to the drivers…

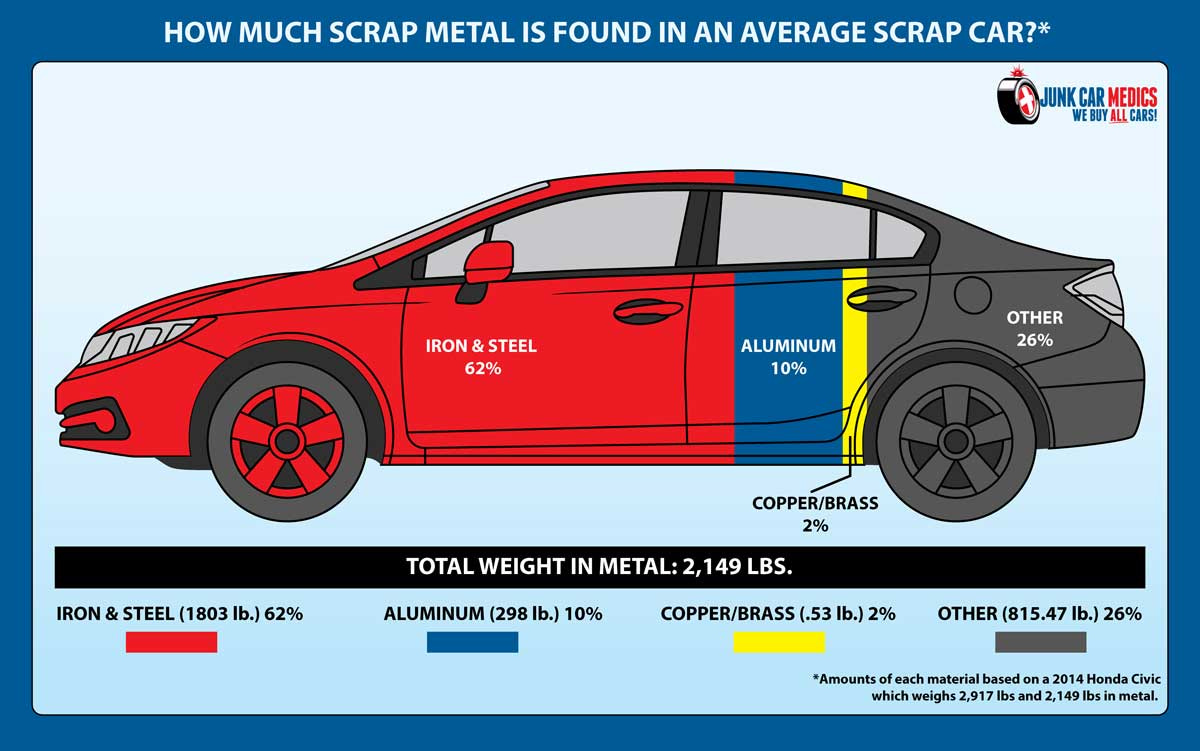

If inventory shortages persist, the average age of vehicles on the roads will increase, leading to a higher rate (though, who knows about absolute volume given the rising prices and questions of affordability) of breakdowns and total loss write-offs. If shortages persist and drive up both new and used vehicle prices, then older and older inventory will become more attractive, leading to even more breakdowns and total-losses. At the same time, if general inflation remains high, then scrap values should also remain elevated. **********

Why has IAA been beaten down?

Ancora Holdings — owning 2% of IAA stock — issued a PR on March 15 detailing some complaints (you can read the full release here):

“In our view, this underperformance can be attributed to a multi-year period of market share loss, poor capital allocation decisions related to acquisitions and issues pertaining to guidance and investor expectations. In our view, Chief Executive Officer John Kett bears significant responsibility for these unacceptable missteps and results. […] The Company’s shares sold off significantly following the fourth quarter earnings release on February 11, 2022. We believe the sell-off was related to continued market share loss, missing analysts’ estimates for EBITDA and initiating lower forward EBITDA guidance than the market was forecasting.“

While these are not trivial issues, inverting on the POV these things have (as implied by Ancora) already been priced in with the current decline and thus, IMO, any improvement in these areas would contribute to the upside. My interest in IAA mainly comes from Peter Kamin’s recent buying and IAA’s interesting asset-light business model, so that’s the POV I’m riding into this with.

Even the Ancora letter acknowledges this last point:

“As noted, the industry is a duopoly market dominated by IAA and Copart. Collectively, these two companies hold an estimated 80% of the North American market share. We suspect, based on estimates and our own analysis, that IAA could have roughly 40% of the market. These businesses are very desirable assets given the high barriers to entry, counter cyclical and recession resistant characteristics, strong market share, secular growth and high cash flow generation.“

One of the things considered to be a large factor in the difference between Copart and IAA is the superior management at Copart, which to me speaks to the durability of IAA’s moat given that they’ve been able to retain their duopoly market share in spite of this as well as implying some optionality in a change-of-management situation at IAA that is not present in Copart.

PIE

“Those who feel it unsound to use long-range forecasts under any circumstance may still use the new formulas in another way, a way that was almost impossible with the old methods. They may transpose the new formulas and use the actual market price as a datum, instead of seeking the theoretical investment value as an answer. Then with the transposed formulas that may deduce the particular rate of growth, the particular duration of growth, or the like, that is implied by the actual market price, and see is this way whether the prevailing price is reasonable or not. Thus the formulas become a touchstone for absurdity.“ —— John Burr William describing the early theory of DCF in “The Theory Of Investment Value“

First let’s look at a simple model of what you’d have to believe in order to think that IAA’s trading price represents its fair value.

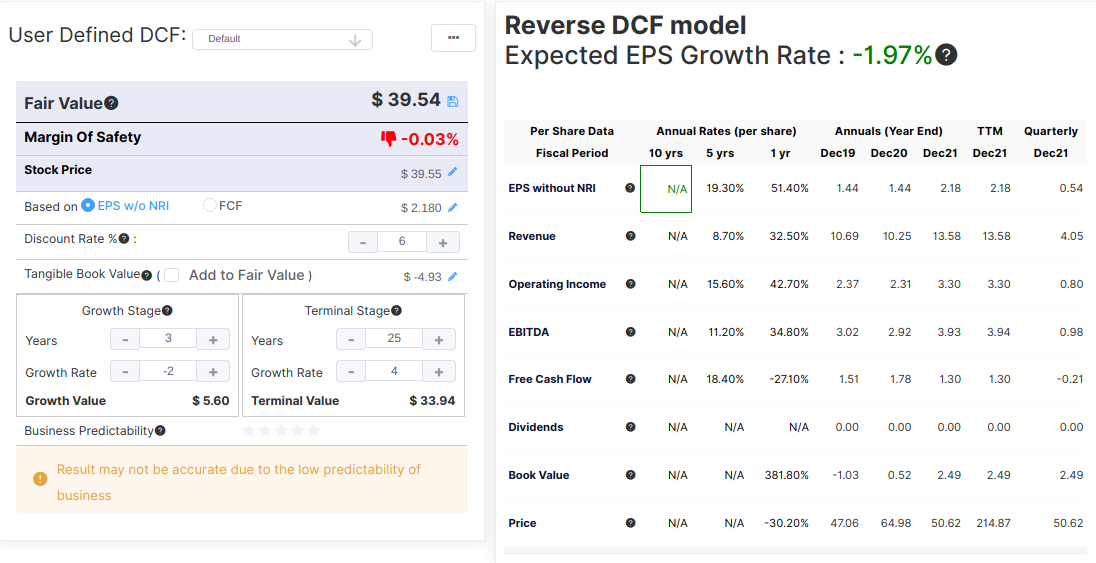

Below, I’m assuming a 6% discount rate is fine, since 1) this would be a normalized interest rate level and 2) is already greater than the ~4% aggregate earnings yield of the S&P 500. For the terminal stage growth rate, I use 4%/yr rather then the standard CPI 2%/yr — here deferring to the long-term, post-2008 trend as posted by the Big Mac Index — which I think is a more accurate long-term inflation value (BTW, changing this to 2%/yr does not make a huge difference). Taking the 2021-2024 CAGR of the normalized EPS estimates9 of -2%/yr (basically a total collapse in earnings growth from the last 5 years), plugging that into a simple model, and stretching the expected terminal lifetime of the business until we get the current market price, we get a vision of what the market believes about IAA’s prospects:

Just playing with presumed growth rates and growth/terminal stage period lengths into a shorter timeframe (eg. assuming the business only lasts for 15 more years), you would need to believe that IAA’s future EPS growth (excl. NRI) will to fall by ~10pps (a 50% decline from the current trend of 20%) to around 11% growth/yr in order for the current market price to represent fair value in this simple model — IMO a POV that is still banking on inflation and supply chain issues being transitory, a POV I don’t really agree with.

Now, using the assumption that IAA simply continues along it’s existing 5yr trend of ~20% EPS growth10 (excl. NRI), we can see that IAA still has a ~25pps spread to the associated DCF fair value:

So IMO, as long as the longterm tailwinds in the VIC article + the current cherry-on-top inventory shortage themes, as highlighted earlier, continue to play out11, then the future will be as good if not better for IAA wherein this earnings growth trend projected above is not overly optimistic and is likely underestimating the potential for IAA. Given the recent run on many inflation-adjacent names in the market, IAA provides a beaten-down way to invest in the inflation / supply shortage theme, operating in a duopoly, with a (ballpark) 30% upside, currently trading at it’s 52-week low (below the price and EV/EBIT multiple it was trading for pre-COVID — something not many stocks I’d be interested in have going for them ATM).

(Your estimates on the probabilities of outcomes (eg. durability of the present inflation and supply chain situation) will determine position sizing12)

Risks

(Here, mostly mentioning some risks that were not as prescient at the time that the other articles I’ve linked to regarding IAA were written)

High gas prices, WFH, and less miles driven: From IAA’s recent 10K…

“increases in fuel prices that could lead to a reduction in the miles driven per vehicle, which may reduce the accident rate;“

With the rising price of oil, this issue may become more relevant. Though what really matters is miles driven — which affect the statistical frequency of car accidents which contribute to the supply of total loss vehicles that IAA auctions off. To this end, the durability of work from home policies may be a bigger issue, given that this eliminates a lot of — otherwise, mandatory — driving.

Greater total-loss threshold for vehicles going to auction: Again from the 10K…

“Also, when used vehicle prices are high, used-vehicle dealers may retail more of their trade-in vehicles on their own rather than selling them at auction. If the supply or value of damaged, total loss and low-value vehicles coming to auction declines significantly, our revenues and profitability may be adversely affected.“

While the rising price of used cars is currently benefiting IAA, it may also affect insurers13 and used car dealers decision-making in auctioning vehicles.

“ARPU growth was driven in part by the strong used car pricing environment, which results in higher proceeds in our auctions. Used car prices have continued to grow throughout the year, with the Manheim Index increasing 15.3% sequentially in the fourth quarter. At this point, we believe that used car pricing will remain elevated at least through the first half of 2022.

ARPU also benefited from our initiatives to drive higher auction proceeds, including enhancements to our merchandizing platform, interact, and the growth in our global buyer base, which increases auction liquidity and drives higher returns.

Volume growth in the quarter benefited from the extra week, increased volume from the CAT and the continued recovery of miles driven offset by a decline in the total loss ratio as published by CCC to 18.7% from 21.7% in the fourth quarter of 2020.

We believe the strength in used car pricing, which benefits us and ARPU, may have some impact on the total loss ratio as it increases the threshold for deeming a vehicle to be at total loss. Over the long term, we expect the total loss ratio to resume its upward trend due to factors we have previously discussed, such as increased vehicle complexity, higher repair costs, longer repair times, and attractive salvage returns.“

Though, in so much as these used car prices are driven by supply chain and commodity price issues, the problem of rising market values of used cars affecting decision making for sending vehicles to auction may be countered by similar rises in repair costs and continued vehicle complexification.

Of course you could also look at this and say it looks like a peak about to fall off a cliff

CEO John Kett bought shares at around $32/sh in that same month, https://www.sec.gov/Archives/edgar/data/1295822/000089924322009861/xslF345X03/doc4.xml

I’m using the spinoff’s remainCo here since it has a longer operating history — IAA only having been spun off in 2019 — but the businesses are roughly the same, so I don’t think using KAR here is too much of a stretch. From 2014-2019 (I use 2014 as the starting point just because that’s when current CEO John Kett first took the position) IAA represented ~35-40% of ParentCo KAR’s revenues (the majority of revenue coming from KAR’s ADESA business) — excl. 2019 where IAA accounted for 87%.

I would have said “fame“, but — working mostly with micro/smallcap, OTC stocks — Peter Kamin is not really that well known from what I can tell. Eg. I could not find a single mention of him on Reddit or the CNBC website using Google query searches (eg. “site:msmbc.com "peter kamin"“). See his LP holdings and insider TXs here and here for a sense of what I mean.

A good description of Copart of the salvage auction business can be found here:

For the bit lazier, you can listen about it here.

(Update) There is also a bit of a discussion of Copart vs IAA here:

One of the things they note — and I also get into this a bit further into this article — is that a large factor in the difference between Copart and IAA is the superior management at Copart (I’d also note the difference in debt levels at Copart vs IAA, as well), which to me speaks to the durability of IAA’s moat given that they’ve been able to retain their duopoly market share in spite of this as well as implying some optionality in a change-of-management situation that is not present in Copart.

Note also that unlike Copart — where my understanding is that they own a good deal of their real estate — IAA does not own most of their facilities’ real estate. This actually bothers me the most for some reason, as owning the RE would have been an interesting inflation hedge.

As of January 2, 2022, our owned and leased properties used for auction and storage purposes provided us with an aggregate footprint of approximately 9,000 acres in the United States and approximately 550 acres in Canada and the United Kingdom. Approximately 90% of our total acres in the United States, Canada and the United Kingdom are leased.

For further reading, Copart’s founder wrote a book.

The 10K is another good source for the basics of a business, so I leave that here for reference (https://www.sec.gov/ix?doc=/Archives/edgar/data/0001745041/000174504122000005/iaa-20220102.htm#id6e7cfe30a9f4f919395021813a138f9_16)

Which ties into the longerterm lithium pricing theme explained here: https://capitalistexploits.at/investing-for-the-greenwash-bubble/

IDK how exactly TIKR presetns financial estimates (eg. median, mode, other), but I think — in the case of IAA — the estimates here are an OK representation of consensus outlook given that we can see that there are a good amount of analysts covering the stock as well as that the dispersion between the high and low PTs are not too wide

Just staying very simple and doing a linear regression against the non-NRI EPS from 2015 - 2021, we get the linear fit of…

30.1821 x + 52.4571 …with a pretty OK R-squared of 0.88 that implies an annual growth rate of 30%/yr.

Going for a logarithmic fit, we get…

90.3304 log(2.01248 x)…with an R-squared of 0.97. Taking the growth rate 5 periods out from that fit, we get ~20%/yr.

Not to extrapolate this to predict any future figures — as we are literally fitting a curve here — but just to show that the trend rate being used in the model is generally fine.

Though they’re kinda hedge on this trend reversing in the sense that IAA primarily makes their money by moving volumes — the Copart interview in the footnotes also notes this as well as the IAA CEO in some of the recent conference calls where questioners have made note of current used car prices.

I own shares of IAA

Generally, insurance companies determine if a wrecked vehicle is a “total loss” (and thus better to be auctioned rather than repaired) by comparing the cost of repairs relative to a calculation that takes into account the market and salvage value of the car. If the cost of repairs is above this value (using the Total Loss Formula) or is above some percentage of the market value of the vehicle, then the car is designated a total loss. When used car market prices are higher, then there is going to be a higher absolute value threshold that damages are going to need to meet in order for a car to be considered a total loss, thus affecting inventory supply to auctioneers like IAA.