($APG) APi Group: From Jarden to J2; Sir Martin Franklin's mission critical, fire safety 'fund'

...and I do think of it as a fund --and management seems to look at it this way as well

Intro

********** UPDATE 20240813: Re-shoring appears to going fine and should be bullish for APi Group’s business in the long-run.

**********

********** UPDATE 20240603: “The spike in factory-construction activity began in the second half of 2021. The CHIPS Act, signed into law in August 2022, seems to have turbocharged it, though the money hasn’t even started flowing yet. Beyond semiconductors, a large number and a great variety of manufacturing plants have been announced over the past two years, and we’ll get to some that were announced just in recent weeks. They’re part of what the National Manufacturing Association has termed, “general reshoring.”” ~~~ https://wolfstreet.com/2024/06/03/eyepopping-factory-construction-boom-in-the-us-semiconductors-auto-industry-and-everyone-else/

**********

There was a WSJ article some months ago titled “Capital Is Making a Comeback: Tangible investment will have to increase to meet climate goals, supply-chain pressures, shifting demographics and defense needs.”

The basic idea of this article is that the U.S. economy is entering a phase where tangible capital investment, such as property, factories, and equipment, needs to increase. Over the past few decades, intangible investment, such as intellectual property and software, has grown significantly, while tangible investment has stagnated. However, emerging economic challenges, such as decarbonization efforts, reshoring of supply chains, labor market constraints, and defense needs, require a greater focus on tangible capital investment.

Some investment implications that could be taken from this is that companies are likely to be investing in tangible capital, such as property, factories, and equipment to meet new economic demands in the long-term as businesses attempt to decouple production lines from China (as best they can) to reduce their geopolitical risk1, while also keeping in mind that rising interest rates have raised the cost of equity and hurdle rates for such capital investment.

Note that a business may take 3-6 months to even make a move decision for a single factory and 6-12 months to actually execute the move or switch. Multiply this by the tens of thousands of supply chains that interact with China —and each other— and you can see how such a reconfiguration by these collective businesses —if they are even actually seriously considering such moves— could take many years to fully play out (as noted by Kris Ektrit).

The idea (primarily driven by computer, electronic, and electrical manufacturing plants) was also discussed in a more recent WolfStreet post here.

I wrote a bit more about this general de/re-globalization POV and it’s implications as articulated by Zoltan Pozsar in an older post here:

When prices get "real" and The Great Re-Everything'ing

So, I just finished reading Zoltan Pozsar’s Bretton Woods 3.0 (BW3) follow-on articles “Money, Commodities, and Bretton Woods 3” (MC&BW3) as well as “War and Industrial Policy” (W&IP) and — while I have a few questions about the ultimate conclusions — wanted to make some quick notes

A similar idea to that just described was used as part of the pitch for the de-SPAC combination that brought APi Group, one of the holdings in my portfolio that has now grown to be a relatively significant position is APi Group, public in 2019.

“I mean, like when I think about reshoring and things like that, my brain immediately jumps to the semiconductor space and the level of activity that you see going on with the Intels of the world and Micron and some of those other folks, and the capital spending that they have going on in the United States is very, very robust.” —- APi CEO, Russ Becker, 4Q2022 earnings call

This business would be a relatively asset-light2 beneficiary of such re-shoring and industrial capex investment trends in the US and Europe —with their recent acquisition of Chubb Fire & Security— and, given it’s relative size in my portfolio it’s grown to, I thought I would make a quick post on the business.

(As I’m about to actually post this, I’ll just say: I tried to make it quick).

History

All the basics of the business and it’s history are well covered in the VIC articles and investor presentation here —partly due to the high profile of the person who brought the company public, this stock is not exactly ‘unknown’— so I’ll try to spend only a small amount of time catching up on those things in this post3 (though I may refer back to them at times):

https://www.valueinvestorsclub.com/idea/API_Group_Corp/2719259235 (This one is a slightly out-dated as “[b]eginning with the first quarter of 2022, the Company has combined its Industrial Services and Specialty Services segments into one operating segment”, but it was the first thing I read on APi and still like it the most in terms of broad information content)

https://www.valueinvestorsclub.com/idea/API_GROUP_CORP/6376374163

https://www.valueinvestorsclub.com/idea/API_GROUP_CORP/5702076786

To add a bit for a longer look back at the company, APi Group Corporation has nearly a century of operating history. Founded in 1926 by Reuben Anderson, later joined by his son Lee Anderson in the early 60s, the company started as a small fire protection services provider in Minnesota and has since grown to become one of the largest providers of specialty services in North America; my understanding is that it was Lee who was largely responsible for ramping up APi’s self-funded, bolt-on rollup strategy around the 1970s and 80s that has continued to this day4.

In 2002, Russ Becker became the CEO of APi Group at age 35, succeeding Jeff Jessen —apparently Jessen was experiencing mental health issues and made the decision to petition Lee Anderson, who at this point was now only acting as APi’s Chairman, for Becker to take the spot despite his age5.

In 2019 —before the big SPAC boom of 2020-2021— APi Group Corporation was acquired by J2 Acquisition IV Limited, a special purpose acquisition company (SPAC) founded by Jarden veterans Martin Franklin, Jim Lillie, and Ian Ashken whose SPAC IPO’ed in 2017 on the UK’s LSE and domiciled in the British Virgin Isles; Russ Becker and APi's existing management team remained in place; Franklin, Lillie, and Ashken assumed Chiarman, Co-Chairman, and Director roles at APi Group Corporation, respectively; Becker was also made a director6.

Looking at the J2’s S4 filing is appears that Lee Anderson is no longer associated with APi Group in any major way, I don’t know the details on why. After the de-SPAC combination was completed, APi Group became a publicly traded company on the New York Stock Exchange under the ticker symbol APG7.

Some commentary on the J2 SPAC and the incentives structure

The repute of the company’s new chairman (which I will cover later), asset-light characteristics of the work, and —as the company continually likes to point out— the “statutorily mandated” nature of the business were interesting, but the thing that got me over the edge in terms of being interested enough to look further into the name was the way this UK SPAC differed from the US SPACs that were only just beginning to gain popularity in the market at the time that APG’s SPAC was launched. This was in terms of their Founder Shares —which in US SPACs often act like massive (relatively) free call options afforded to the SPAC sponsor:

In the US, a typical SPAC structure involved shareholders paying in $10 cash to receive one share + some portion of a warrant (1/4 warrant to a full warrant typically). The Sponsor puts up capital and then goes and finds a business combination. They receive large earn-out incentives for free in the US, and once an acquisition is announced, shareholders make a decision to redeem for cash in trust (the initial $10 + interest between the SPAC IPO and redemption date), getting to keep their warrant (or sell it to the market). While US SPACs can often create tremendous trading opportunities as well for technical reasons, management and shareholders are not always completely aligned as management gets free earn-out shares for completing a deal, often receiving a return of >5.0x their capital even if the stock doesn’t appreciate from $10.

UK SPACs are different. There are no free earn-out shares for investors, and there is also no redemption date that creates liquidity for investors at trust. Thus, you are in the same boat as Martin Franklin and J2 in this case, as they buy in at the same price you do with no extra incentives (in fact you are getting a discount at these latest levels). And with no redemption opportunity, it creates an incentive for certain investors to sell in the market, creating a liquidity event. —- https://www.valueinvestorsclub.com/idea/API_Group_Corp/2719259235

The SPAC sponsors, who collectively owned around 8% of the business, were sharing the same upside and downside economics as the other ordinary share investors —rather than the sponsor attempting to fund or promote the creation of a call option that they would have bought for fractions of a cent. (At times, the common shares traded below trust value, so you were actually getting a discount to the price they paid).

In “Warning the UK on Special Purpose Acquisition Companies (SPACs): great for Wall Street but a nightmare on Main Street”, the authors shed some light on some of the conflicting incentives between management and common shareholders when it comes to US SPACs. Typically, in the US, in addition to any common stock that a sponsor might purchase, SPAC sponsors pay a nominal $25,000 for X “Founder’s Shares” or “Promote”, where X = ‘whatever amount of total issued shares equals 20% voting power at the company’ (this also comes with dilution protection in the event of further capital raises, pre-deSPAC).

That is, they are paying a fixed $25,000 for 20% of a business that can be priced in the hundreds of millions or into the billions at the time of the de-SPAC IPO (recall that everyone else must pay the standard $10/sh for the common shares); this amounts to sponsors paying fractions of a cent for shares that come to trade at or above the $10 price level. These “Founder’s Shares” are usually subject to a lock-up period of the sooner of either 12 months or —what is essentially— a sustained ‘strike price’ of 15% above the trust value of $10/sh before being able to cash out on that huge spread on their Founder Shares.8

Also mentioned in that paper, “a handful of UK SPAC sponsors invested in SPAC shares solely on the same terms as IPO investors, and retained a majority of the equity post-IPO – these are different beasts to US SPACs and represent bespoke investment vehicles where the sponsor is seeking further (institutional) minority support to make acquisitions. The sponsor retains the majority of the upside and downside risk.”; they name AIQ Limited, Honye Financial Services Ltd, and Sivota plc. This was also the case —to a degree— with Franklin’s J2 Acquisition Ltd. From the S4 filing:

In connection with the initial public offering on October 10, 2017, we issued 121,000,000 of our ordinary shares, no par value, for gross proceeds of $1.21 billion. In addition, on October 10, 2017, we issued an aggregate of 32,500 ordinary shares to our non-founder directors for $10.00 per share in lieu of their first year cash director fees. Each APG ordinary share has voting rights and winding-up rights. In connection with the October 10, 2017 initial public offering and listing on the LSE, Mariposa Acquisition IV, LLC (the “Founder Entity”) purchased 4,000,000 preferred shares, no par value, for $40 million (the “Founder Preferred Shares”).

Founder Preferred Shares

In connection with the IPO, the Company issued 4,000,000 preferred shares (the Founder Preferred Shares) at $10 per share to Mariposa Acquisition IV, LLC (the Founder Entity) an entity controlled by the Founders.

That is, Mariposa Acquisition IV LLC, Franklin’s subsidiary through which he and the other J2 co-founders owned their Founder Shares and ordinary stock, paid the same as the initial price of the ordinary shares in the SPAC.

.

However, I’d also note that these Founder Preferred Shares owned by Franklin also entitle him to a 20% annual performance fee (or “dividend”, as it’s described in SPAC’s S4 filing) —something that you’d more typically see at a hedge fund than at an operating business— based on annual high-water marks of the stock price for the first 7yrs of the company, post-de-SPAC combination (starting from the SPAC’s IPO trust value of $10/sh). Note that that 20% is not just for the fraction of the company voting power embedded in the Founder Shares, but on the value of the total 141,194,638 common stock equal to the number of APG ordinary shares outstanding immediately following the APi Acquisition.

These were later converted to Series A Preferred Stock when the SPAC changed its jurisdiction of incorporation from the British Virgin Islands to the State of Delaware, but the terms remain the same; from the S4 filing:

Beginning in 2019, if the average stock price of our ordinary shares exceeds $11.50 per share for any ten (10) consecutive trading days of the calendar year, the holder of Founder Preferred Shares will receive a dividend in the form of APG ordinary shares or cash, at our sole option (which we intend to settle in shares). The first annual dividend amount will be equal to 20% of the appreciation, if any, of the average market price per share of APG ordinary shares for the last ten (10) trading days of the calendar year (the “Dividend Price”) over the Company’s initial offering price of $10.00 per share, multiplied by 141,194,638 shares (the “Annual Dividend Amount”). In subsequent years, the Annual Dividend Amount will be calculated based on the appreciated stock price compared to the highest Dividend Price previously used in calculating the Annual Dividend Amount.

[…]

Each Founder Preferred Share will automatically convert into one Ordinary Share […] immediately upon the last day of the seventh full Financial Year of the Company after completion of the Acquisition, or, if such date is not a Trading Day, on the first Trading Day immediately following such date (the Conversion Date).

[…]

141,194,638 shares, being a number of shares of APG Delaware common stock equal to the number of APG ordinary shares outstanding immediately following the APi Acquisition, including any APG ordinary shares issued pursuant to the exercise of APG Warrants, but excluding any APG ordinary shares issued to shareholders or other beneficial owners of APi Group, Inc. in connection with the APi Acquisition, which such number of shares is subject to adjustment as provided in the APG Delaware certificate of incorporation) (the “Series A Preferred Dividend Equivalent”).

(You can find more information about this by doing a word search for “Series A Preferred Stock” in the company’s 10K filings; examples can be seen in the SEC Form 4 filings here and here).

And if APG ever pays a dividend to us regular common stock shareholders, Mariposa will still get their pound of flesh on that value leaving the business to shareholder’s pockets:

In addition, if the Company pays a dividend on its common shares, the Series A Preferred Stock holders will also receive an amount equal to 20% of the dividend which would be distributable on 141,194,638 of common shares. —- APi 2022 10K

Furthermore, Franklin also entitled himself to a fixed management fee for co-chairing the APi board (in lieu of any other compensation as a board member)9:

Advisory Services Agreement

On October 1, 2019, APG entered into an Advisory Services Agreement with Mariposa Capital, LLC, an affiliate of Mr. Franklin. Under this agreement, Mariposa Capital, LLC agreed to provide certain services, including corporate development and advisory services, advisory services with respect to mergers and acquisitions, investor relations services, strategic planning advisory services, capital expenditure allocation advisory services, strategic treasury advisory services and such other services relating to APG as may from time to time be mutually agreed. In connection with these services, Mariposa Capital, LLC is entitled to receive an annual fee equal to $4,000,000, payable in quarterly installments.

This slightly greater than the combined total of Russ Becker’s base 2022 salary plus all of the directors’ combined compensation (including Lillie and Ashken).10 It’s even more than Becker’s base salary + STI cash comp for 2022. Of course he also owns a lot more APG stock then the rest; Franklin controlled 10% of APG voting power per the 2022 proxy; APG’s market cap at 2022 year end was $4.3bn; $4MM/yr would amount to a 1% management fee on the value of his voting power (4000000 / (4300000000 x 0.10) = 0.0093) —and will be an even smaller ratio going forward as APi grows.

.

In total, APG’s beneficial ownership in the S4 looked like this (Lillie and Ashken’s ownership stake being indirectly through their perspective LLCs each owning a 20% interest in Mariposa Acquisition IV LLC, the Founder Entity)11 12:

And looking at the common stock ownership today…

A quick note Viking Global Investors, LP

You may have noticed the other large beneficial owner in those previous tables, Viking Global Investors. They are a large, long/short, bottom-up, global equity fund founded in 1999 by “Tiger Cub”13 Ole Andreas Halvorsen that partnered with Franklin et al in 2017 to form J2 Acquisition, though I don’t think they receive any special treatment re. their ownership as it appears to be based wholly on ordinary shares (as opposed to the situations with Mariposa Acquisition and APi’s agreements with Mariposa Capital).

I don’t really have an opinion on them one way or another, but a flattering bio on Halvorsen and Viking Global can be found here:

Ole Andreas Halvorsen is one of the most successful Tiger cubs. Norwegian Halvorsen launched Viking Global at the end of 1999 with former Tiger employees David Ott and Brian Olson. Viking Global returned an astonishing 89% after fees in its first full year.Viking is a long/short global equity fund with a bottom-up stock picking approach. Brian Olson left Viking in 2005 and David Ott stepped down in 2010. Between June 2005 (when Ott became the CIO of Viking) and March 2010, Viking Global returned 119% vs. 11% for the MSCI World Index. Viking Global charges 1.5% management fees and 20% incentive fees from investors. Viking Global Equities lost 1.9% in 2008, gained 20% in 2009, and returned 3.8% in 2010.

I would note, however, that the fund’s public holdings over the most recent decade have had a history underwhelming returns, with an average return of 7.30% since its last 13F filing and a portfolio gain of 72.39% since June 2013 compared to the S&P 500’s 210.54% total return14. (Of course, if Howard Marks is to be believed, per his “Sea Change” memo, or Seth Klarman is correct in his declaration of a current “everything bubble”, then this streak of passive over active may be coming to an end with a new era of sustained elevated interest rates).

While the fund is not run in a particularly concentrated way, I would note that APG is among their top 10 positions, making up 3.5% of their public portfolio15.

Cliffwater Investment Advisory Services wrote a due diligence report on Viking Global and you can read the redacted version here for a bit more information if you’d like: http://data.treasury.ri.gov/dataset/96dcb86f-e97e-4b05-8ce2-a40289e477a6/resource/2b75c192-dabc-4e0d-98c4-9a4f80688156/download/Viking-Investment-Due-Diligence-ReportRedacted.pdf

The business

“It was just over three years ago that we first met Russ and discussed building a business together, primarily based on our view that a statutorily required services strategy is economically resilient, and that these activities were necessary no matter what the economic climate might be.” —- Martin Franklin, 1Q2022 earnings call

Again, you can learn a lot more regarding the operating segments of the business —and certain specific subsidiaries— via the links the History section of this post, but I will briefly go over them here as well.

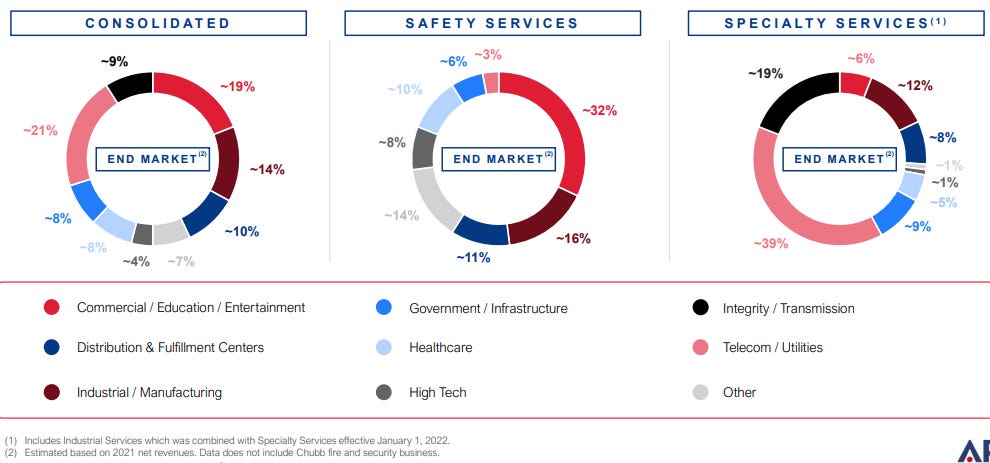

Life and fire safety

The life and fire safety business made up 70% of APG’s net 2022 revenues. APG is the largest provider of life and fire safety services in North America, Asia Pacific, and Europe. They offer a wide range of services, including design, installation, inspection, monitoring, and service of fire protection systems, HVAC systems, and entry systems. APi services a variety of industries and facilities, including commercial, education, healthcare, high tech, industrial, and special-hazard settings.

.

When you walk into a commercial building, you may not think about the fire sprinkler system or fire alarms hidden in the ceiling; these systems and services are all generally mandated by the government to be installed and maintained by businesses. While the majority of rules about fire sprinkler systems come from local jurisdictions and municipalities, the National Fire Protection Association (NFPA) is the main organization that sets the standards for fire safety including fire sprinkler system requirements. According to Regulation NFPA 13, established in 1896, all newly constructed commercial buildings that are 5,000 square feet or larger are required to have fire sprinkler systems. In addition, any remodels that add square feet to an existing commercial building so that its footprint is 12,000 square feet or more mandates installation of a fire sprinkler system.16

In the US, I believe that public schools are generally required to practice fire drills at least twice a semester —it’s been a while for me. APi Group's Life and Fire Safety business may have helped to install the fire alarm system used in any particular school’s fire drills (eg. via their 1GPA subsidiary). APG also provides detection and alarm systems as well as emergency and exit lighting devices.

If you work in a high-tech facility, you may have a fire suppression system that uses a special type of gas to extinguish fires. APi Group's Life and Fire Safety business may have helped to design, install, and maintain that system; for example, foam, gas, and wet/dry chemical suppression systems.

With the recent APi acquisition of the Europe-based Chubb, I will also mention that the same government regulations that mandate the installation, maintenance, and monitoring of fire safety systems in the US, generally, appear to have European counterparts as well. For example, The Building Regulations for England and Wales states in part that, "The building shall be designed and constructed so that there are appropriate provisions for the early warning of fire.”17

.

Profits here are tied to the pricing and pass-through of material and labor costs as well as to contract volumes (which APi measures through labor hours).18

.

Other than initial installation of sprinkler systems —where a large capital expense per project is the cost of copper— the inspection, servicing, and monitoring aspects of the fire safety business are relatively “asset-light” —this phrase was used by management at least once in the last four or five earnings calls— with costs mostly being that of skilled labor and subcontracts (so are also less likely to be disrupted by AI and automation). These latter sub-segments also have the favorable characteristic of representing recurring contractual income. Working capital is primarily affected by changes in total accounts receivable, accounts payable, accrued expenses, and contract assets and contract liabilities, all of which tend to be related and are affected by changes in the timing and volume of work performed.

From the 2022 10K:

“We also have a stable cash flow profile driven by our focus on recurring services-based revenue and our asset-light business model, which requires minimal ongoing capital expenditures (which are typically approximately 1.5% of total net revenues). The mission-critical nature of our services and regulatory-driven inspection requirements provide predictable, recurring revenue stream opportunities. Maintenance and services revenues are less cyclical, and are reasonably recurring due to the consistent renewal rates and deep customer relationships.”

“We believe maintenance and service revenues are generally more predictable through contractual arrangements with typical terms ranging from days to three years, with the majority having short durations and are often recurring due to consistent renewal rates and long-standing customer relationships.”

‘Labor intensive contracts usually drive higher margins than those contracts that include material, subcontract, and equipment costs. […] an improved mix of inspection, service, and monitoring revenue, which generates higher margins, and growth within the Safety Services segment.’

Specialty services

Generating 30% of net 2022 revenues, APi Group's Specialty Services business provides of infrastructure services and specialized industrial plant solutions. They offer a diverse range of services, including the installation, maintenance, and repair of critical infrastructure such as underground electric, gas, water, sewer, (electricity and fuel) transmission, and telecom infrastructure. Their customer base includes public and private utilities, communications companies, industrial plants, and government agencies.

Specialty Services is recognized as one of the top five firms in North America for specialized services, as reported by industry source ENR (Engineering-News Record); which Wikipedia claims (without citation, I will add) is “one of the construction industry's most authoritative publications and is considered by many to be the "bible" of the industry.”

With 40% of the segment catering to the telecom market, they are well-positioned in an acyclical industry with tailwinds from emerging use cases for 5G, cloud computing, and blockchain systems19.

The Specialty Services segment mitigates contract risk and raw material/input mismatch risk due to the relatively small project size and short contract lengths APi typically handles. Per Russ Becker at the 2Q2022 earnings call, the “average project size is approximately $5,000 in our largest segment, Safety Services, and $75,000 in Specialty Services”; per the 2022 10K, APi “derives net revenues primarily from contracts with a duration of less than one week to three years (with the majority of contracts with durations of less than six months) which are subject to multiple pricing options, including fixed price, unit price, time and material, or cost plus a markup.”

Similar as with the Fire Safety segment, their Specialty Services prioritizes integrity services, which are statutorily required, ensuring a stable revenue stream.

“[W]e remain focused on growing the integrity side of pipeline transmission, which is statutorily driven, as transmission companies are required by law to maintain their existing pipeline systems to ensure they are safe.” —- APi CFO Tom Lydon, 1Q2021 earnings call

.

As with the Fire Safety segment, profits here are tied to the pricing and pass-through of material and labor costs as well as to contract volumes (which APi measures through labor hours).

.

Excess earnings estimated from APG’s contractual backlog are recorded in the 10K under intangibles in their consolidated financial statements, but unfortunately contracts are not broken down into segments or sub-segments (so far as I can find). As Becker points out in the 4Q2022 earnings call: “And when we first started talking about backlog, we reminded everybody that, that's actually not the greatest metric to measure us by. And because with the processes that we have from a project selection and customer selection, we actually wouldn't mind seeing our backlog shrink a little bit because it would show —it would demonstrate to us that we're being more disciplined with the work that we pursue. And the quality of the backlog is going to have better margins in it as we work our way through 2023.”

That is, given APG’s overall strategy, what you would want to see is this contractual backlog 1) growing, yes, but 2) that growth being from more contracts related to the higher-margin fire safety servicing and monitoring work (and the inspection work that APG uses to launch cross-selling opportunities); this would indicate that APi’s go-to-market strategy is working. This info is not currently dis-aggregated in the 10K, so we must rely on the earnings calls.

Strategy

Decentralized

“We believe our practice of conferring significant authority upon the management of our subsidiaries has been important to our successful growth and has allowed us to be responsive to opportunities and to our customers’ needs. We seek to maintain business continuity within our subsidiaries while identifying and implementing operational efficiencies, cost synergies, and integration of organizational processes across these companies.” —- APi Group 2022 10K

“We work every piece of our business. It's like having multiple children in your family, right? And I've heard Jim use this analogy a number of different times and every one of your kids is in a different place. And not every kid is as healthy as the other one, and you still need to give them all the right level of attention. And I think that's a really good analogy when you look at a company like us with 20-plus businesses and across it.” —- Russ Becker, 1Q2021 earnings call

Franklin’s previous Jarden Corporation, operating in the consumer products industry, adopted decentralization to manage a diverse portfolio of brands across different sectors. By allowing each brand to operate autonomously, Jarden subsidiaries were able to make decisions tailored to their specific markets. A similar decentralized approach existed at APi Group long before Franklin’s involvement and was significant factor in J2 selecting APi as the company they ultimately combined with.

The advantages of a decentralized organizational model include enhanced agility, as decision-making is streamlined and responsive to market changes. The idea is that ,in a decentralized structure, employees have greater autonomy and ownership which aligns incentives towards fostering creativity and innovation. Local market knowledge also becomes a strategic advantage, as decentralized units can tailor their growth strategies to specific customer preferences. Additionally, risk diversification is achieved through the operation of multiple decentralized units, minimizing the impact of challenges on the overall organization as well as allowing for the possibility of the many small experiments across units to find larger success and propagate through the organization.20

However, challenges accompany decentralization; Coordination can become complex, resulting in inconsistencies, duplicated efforts, or conflicting strategies.

APi has spent millions on leadership programs for the purpose of training employees to lead business units, branch offices, or large departments within operating companies and APi Group. In the 1Q2022 earnings call, Becker notes that “We have spent approximately $30 million on leadership development over the past five years, and plan to continue to invest in and support our leadership development culture, which we believe empowers the leaders across our businesses, drives business performance, and increases future cross selling opportunities. This investment is unique in our industry, and we believe that it is a competitive advantage.”

Per the 2022 10K, APi businesses “benefit from direct access to the APG network, which facilitates organizational sharing of knowledge and best practices, increases collaboration across our businesses and develops cross-brand solutions which foster enhanced experience, quality, and efficiency.”

.

(The 10K also indicates that the structure of the company encourages a “business-owner mindset”. I’d like to believe it, but I need to see more on the specific compensation incentives at the branch and unit levels before repeating that line with my whole chest.)

Rollups/bolt-ons

Analyst: “You obviously have a record for acquiring smaller assets in the mid-single digit EBITDA, Chubb and SK in the low teens. Can you help us understand how you're able to increase deals at substantially lower multiples for these assets, especially given the current environment and what private equities pay for these things these days?”

Lillie: “[…] And we still see opportunities in that 4x to 6x range. I would say that the difference for us is that we feel that we have a very compelling story to tell and that we are a very attractive home for many of these smaller, family-owned businesses that are looking to sell their company and sell their company not only to help them with the long-term exit but also find the right place for their employees.” —- Co-Chairman Jim Lillie, 3Q2021 earnings call

Franklin and the Jarden team appear to be attempting to replicate their previous Jarden success by scaling up the decentralized roll-up growth strategy that was already present at APi Group long before the de-SPAC combination that brought it public.

The rollup strategy works in several ways: 1) APi is able to find good businesses that can be bought at good prices for the amounts that they can afford to internally finance at the time, or 2) acquirees are optimized/rationalized by APi management who have experience integrating 85+ bolt-ons into APi since 200521 and 3) earnings from smaller acquirees that are bolted-on to APi then have the benefit of adding to APG’s P/E valuation multiple. These acquisitions are regularly reported in APG’s 10K in a “Business Combinations” note in the consolidated financial statements.

@marketeuphoria, who initially shared with me a lot of interesting info on the business (and authored the Jan 2023 VIC article cited at the beginning of this post), referred to this last point as “the additional arbitrage opportunity that exists by immediately porting a ~7x EBITDA business into one valued at ~10x (potentially higher).”

(Of course you also have to wonder about if this is just an accounting trick vs an actual value add worthy of a markup on the subsumed acquiree and their contributing earnings; do ostensibly lower-quality earnings deserve to be capitalized at a higher multiple just because they’re now under the APi brand? If you fill a nice house with cheap garbage is that house really more valuable? Really reliant on management’s acquisition acumen and the permeation of APi’s culture in this regard.)

(https://s201.q4cdn.com/155847588/files/doc_presentation/2019/08/62ab4-investor-presentation-aug-2019.pdf ; it would have been nice to see a fuller history here, especially how they behaved in 2008)22

.

These rollups have also resulted in a business that is diversified across many geographies, industries, and customers.

“We have repeat revenue from a diverse set of long-standing blue chip customers who are spread across a variety of end markets and geographies with low concentration. [...] We serve customers in both the public and private sectors, including commercial, industrial, distribution and fulfillment centers, manufacturing, education, healthcare, telecom, utilities, transmission, high tech, entertainment, and government. Our customers range from Fortune 500 companies with diverse, worldwide operations to single-location companies. We have low customer concentration with no single customer accounting for more than 5% of our total net revenues for 2022.” — https://s201.q4cdn.com/155847588/files/doc_financials/2022/ar/APG-2022-Annual-Report_Final.pdf

.

From the great compiler and summarizer Michael Mauboussin’s 2022 “Capital Allocation” paper:

“Deals between companies with similar operations generate healthier results than those that seek to transform the business. With operational deals, the core businesses of the target and the acquirer are related. […] Companies with specialized M&A teams generally outperform those without dedicated professionals. These teams are made up of employees who spend the majority of their time analyzing the industry, competitors, customers, and possible targets.”

… “Operational deals” had already been APi’s primary focus for decades and, with the joining of the Jarden veterans, APi now has an expanded dedicated M&A team beyond Becker.

GTM inspection-to-monitoring cross-sell pipeline

“We continue to build a national and coordinated inspection sales force to drive our go-to-market strategy of selling inspection work first, which we believe will lead to further service revenue growth. In most cases, our inspection work is covered by statutory requirements. Nearly all facilities that have existing life safety systems are required by law to have that system inspected on an annual basis, regardless of whether the facility is filled the capacity or empty. Historically, for every dollar of inspection revenue, we have the opportunity to generate between $3 and $4 of service work.” —- Russ Becker, 4Q2020 earnings call

APi Group's go-to-market strategy in Safety Services is to sell inspection work first, as it estimates that for every dollar generated from inspection work, it believes it can generate $3-$4 of service and monitoring revenue; all of this work is statutorily mandated for businesses. The company's goal is to have 60%+ of its revenue coming from inspection service and monitoring (which they were able to achieve in 2022); Becker remarks in the 4Q2022 earnings call that “[w]e achieved our goal of growing inspection revenue 10% plus and continue to drive towards our goal of 60% plus of total net revenues coming from inspection, service and monitoring”.

Inspection and service revenue have a higher gross margin than contract revenue, and monitoring revenue has an even higher gross margin. Per the 4Q2022 earnings call with Becker, “on average, inspection and service revenue generates approximately 10% higher gross margin than contract revenue, and monitoring revenue generates approximately 20% higher gross margin than contract revenue.” (I believe “contract revenue” here is referring to the Specialty Services segment). The company's strategy is to win inspection contracts in order to try to cross-sell servicing and monitoring work to increase wallet-share per customer. The company's focus is on growing inspection, service, and monitoring revenue through its market-leading brands and operational efficiency.

The Jarden vets

As mentioned, J2 was founded by Sir Martin Franklin (UK/US), Jim Lillie (US), and Ian Ashken (UK). They are most well known for the shareholder returns they produced as the founder, CEO, and co-founder/vice-chairman of Jarden, respectively. The company returned a 32% IRR for 15 years to produce a 500-bagger before being acquired by Newell Rubbermaid in 2016.

For a quick history of Jarden itself, I think this description of the company, from the “Factual Background” section of a memorandum opinion from a court case (where it appears several shareholder funds sued Jarden for selling to Newell at too low a price), should suffice. (The document also includes and interesting discussion on valuation, if your interested).

Jarden traces its origins to Alltrista Corporation, a company that was spun off in 1993 from Ball Corporation’s canning business. In 2000, Martin Franklin and Ian Ashken acquired Alltrista after having initiated a stockholder campaign to unseat Alltrista’s board and senior management. By 2001, Franklin and Ashken served as Alltrista’s Chief Executive Officer and Chief Financial Officer, respectively, and renamed the company Jarden. In August 2003, James Lillie joined the Jarden team as Chief Operating Officer. Their shared goal was to create the “best consumer products company in the world.”

Franklin served as CEO and Chairman of the Board until 2011, when Jarden reorganized its management structure. The Company created the “Office of the Chairman,” comprising Franklin as Executive Chairman, Ashken as Vice Chairman and CFO, and Lillie as CEO. As a result of this reorganization, Franklin surrendered direct control of Jarden’s day-to-day operations, but remained chiefly in charge of capital distribution and M&A activity. Lillie and Ashken took over the day-to-day operation of the Company. Ashken also maintained a dominant role in Jarden’s financial planning and acquisitions.

As a holding company, Jarden maintained a unique, decentralized structure. Its various businesses functioned autonomously, allowing them to pursue outside opportunities and synergies. The respective business unit heads exercised full control over the development of their individual strategic plans. Even so, the businesses stayed in constant communication with Jarden senior management regarding operations.

[…]

The strategy included targeting: (i) category-leading positions in niche consumer markets; (ii) with recurring revenue and margin growth channels; (iii) robust cash flow characteristics, including substantial EBITDA multiples; (iv) a successful management team; and (v) strong transaction valuations, with value-generating presynergies.

[…]

Jarden pursued a two-pronged growth strategy, focusing on internal growth and growth via acquisitions.35 In this regard, management set a goal of 3 to 5% annual internal revenue growth,36 10 to 15% earnings per share (“EPS”) growth, 3 to 5% organic top-line growth, 7 to 10% EBITDA growth and 20 to 50 basis points of gross margin growth.

[…]

Given its impressive results, it is not surprising that Jarden’s stock performed well and traded efficiently. In 2012, Jarden joined the “S&P 400.”43 By the end of 2015, Jarden’s market capitalization topped $10.2 billion, placing it among the top 20% of all US publicly traded firms.

Jarden Corporation was a successful consumer products company that sold some of the most basic household items, such as twine, jars, playing cards, and kitchen gadgets “founded” by Sir Martin E. Franklin in 200123. Franklin is a British American businessman —and triathlete— who served as Jarden's chairman and CEO from 2001 to 2011, and as its executive chairman from 2011 to 2016, when James E Lillie became Jarden's CEO24. Franklin's success with Jarden was due in part to the successful capital allocation employed in his roll-up strategy, which involved acquiring smaller companies to create a bigger consolidated one with a broader range of products and services25. Franklin's success with Jarden also resulted in significant returns to shareholders. According to an article in The New York Times, Jarden's stock price rose from $1.50 in 2001 to $50 in 201526. Franklin sold the business to Newell Rubbermaid in 2016 for a combination of cash and stock that amounted to a share price paid of around $59.21/sh for Jarden27. For each Jarden share, Newell Rubbermaid paid $21 in cash and 0.862 of a share in Newell Rubbermaid.28

Hopefully, Franklin will be able to recreate this performance with a similar roll-up strategy at APi Group.

Also, I wonder —looking at this chart now— how much of Jarden’s pricing gains were due to the zero-bound interest rate environment that followed the 2008 GFC (keep in mind that the Fed Funds rate is now around 500bps)? Even Franklin admitted that the multiple that Jarden was sold for was quite high. From that same memorandum opinion:

Franklin believed the $60.00 offer represented a 13.5x EBITDA multiple, “a high multiple, by any standard, for our business . . . [and] the highest multiple, by far, our company would have ever traded or been valued.”

.

The price tag of the Jarden sale represented a 24% premium to where Jarden’s stock was trading before The Wall Street Journal reported the companies were in deal talks.29 Franklin owned about 6.7 million shares of Jarden, according to S&P Capital IQ, around the time of the deal, worth more than $400 million at the deal price of around $60 a share. Jim Lillie stood to receive about $87 million in cash and stock for his Jarden stake and Vice chairman and President Ian Ashken to receive around $117 million in cash and stock for his stake, based on Newell’s stock price at the time. In addition, Franklin was in line to receive $132 million in cash, stock and benefits as part of a golden parachute deal at Jarden, while Lillie and Ashken were in line to receive as much as $65 million each if their contracts aren’t renewed within two years after the deal, according to Jarden’s proxy.30

Recall from the S4, Mariposa Acquisition IV —through which the ex-Jarden team bought the majority of their APi stake— owned 13,333,333 total shares (including the Founder Shares) which, at trust value ($10/sh), amounted to a $133.333MM investment from Franklin, Lillie, and Ashken. Just to put these Jarden vet’s stakes in some relative terms, given Lillie and Ashken each own ~20% of Mariposa via their respective LLCs, then that would put Franklin, Lillie, and Ashken’s initial cost basis in APG at around 23% (0.70 x $133.333MM / $400MM = 0.23), 31% (0.20 x 133.333 / 87 = 0.31), and 23% (0.20 x 133.333 / 117 = 0.23) of their total base Jarden gains, respectively —not insignificant amounts even considering market compounding they may have had on those initial Jarden gains between then and J2/Mariposa’s 2017 IPO

.

Franklin has gone on to found other successful companies, including Element Solutions Inc. (ESI, up 60% since its de-SPAC) and Nomad Foods (NOMD, up 40% since its de-SPAC)31; a less successful names here might include Whole Earth Brands (down 60% since its de-SPAC) [Whole Earth Brands has the rather awkward stock ticker of FREE, making it a bit hard to quickly search for (try typing “free stock” in Google)]. (I could imagine simply putting 1pps of a portfolio into each of these individual stocks, including APG, and holding that collective position as a synthetic/mental “Martin Franklin ETF”).

********** UPDATE 20230707: I was recently corrected that FREE was not a Franklin de-SPAC, but rather was a de-SPAC sponsored by, Canada-born, Irwin Simon. Franklin does own a large stake, though, and recently offered to buyout the business.

https://ipo-edge.com/whole-earth-brands-ride-the-wellness-wave-alongside-legendary-dealmaker/

https://www.sec.gov/Archives/edgar/data/1753706/000110465920079050/tm2023499d1_ex99-1.htm

https://www.just-food.com/news/investor-martin-franklin-eyes-full-takeover-of-whole-earth-brands/

Thanks to @TheLoneWolf58 on Twitter.

**********

.

If their general vision for J2 Acquisition Ltd. wasn’t apparent from the name itself, Franklin and co’s intention with the J2/APi Group de-SPAC combination was to leverage their capital allocation experience from the Jarden rollup operation to support/foster a scaling up of the pre-existing rollup strategy that characterized APi’s M&A activity for many decades, creating a Jarden 2.0.

They appear to be doing just that as 3yrs later APi closed a deal to acquire the largest European fire safety inspection and monitoring business, Chubb.

I basically look at their role at APi as similar to that of portfolio managers of an permanent capital, long-only, activist, buy-and-hold, private equity fund of life/fire safety inspection and servicing and monitoring businesses; that fixed-and-20 fee schedule that the Franklin and the Jarden-exs set up for themselves within Mariposa Capital and Mariposa Acquisition IV LLC via the Advisory Services Agreement and Series A Preferred Stock seems to me to indicate that Franklin et al view it this way as well, to some degree.

Whether you believe the Jarden gang are the right people for that job is another question, but I like the general model of APi’s businesses and believe that the Jarden veterans and Becker are going to do a much better job of building and managing a portfolio of such businesses than I would be able to put together.

I’d guess the plan, in terms of general separation of responsibilities, is largely something like this…

(With the Jarden team —I assume— consulting with Becker and the operating team as in-house experts for enhancing investment decisions).

Also…

Also, they have their own podcast: https://www.apigroupinc.com/about-us/building-great-leaders-podcast

(I thought season 1, episode 2 might be interesting as it is with CEO Russ Becker in the depths of the COVID shock in March of 2020, but he never bring it up (possibly because the episode was recorded before the economic shutdown); I’d maybe recommend episode 7 and 8 on that front).

The episodes I’ve listened to haven’t my kind of thing (they don’t go much into the day-to-day operations as much as I’d be interested in), but they’re there. At the very least, they could be looked at as evidence of the APi putting a meaningful effort into being intentional about cultivating a culture of leadership within the company (which, as noted earlier, makes sense given the decentralized way that APi operates).

Commentary

The market for safety inspection/servicing/monitoring is generally commoditized so, despite being a statutorily mandated service for customers, there is not much in the way of pricing power for APi's Life/Fire Safety segment in particular vs peers (whether one is bidding for contracts or “proposing on opportunities” as management says); this idea of thick competition seems supported by the fact that there've been so many similar businesses for APi to acquire throughout the years.

Given these underlying commodity characteristics, I don’t totally get how APG’s GTM inspection-to-services-and-monitoring pipeline really “differentiates [APG] from our peers and ultimately creates a stickier client relationship that we believe leads to recurring revenue, higher margins, and growth opportunities” (per 2022 10K). Well, I suppose the strategy might make them different, but there is no obvious moat that stops other businesses from copying APi’s model here.32

There are relatively few barriers to entry in many of the industries in which we operate, and as a result, any organization that has adequate financial resources and access to technical expertise could become a competitor. In each of our segments, we compete with a number of companies, ranging from small, owner-operated businesses operating in narrow geographic regions to large companies with national and international scale who have significant financial, technical, and marketing resources. —- APi Group 2022 10K

Rather, it seems volumes (of projects/contracts) is where APi must extract value (and the volumes are constrained by personnel to do the work, so there is a limit to the degree of operating leverage for the business).

.

The recurring nature and relatively low capex of the work (which gives the business it's “strong margin and cash flow profile”) once a customer is acquired makes this function, on an individual project/contract/customer level, a bit like investing go-to-market SG&A dollars into profitably acquiring short/mid-term annuities. My understanding is that individual contracts are typically relatively short-lived (6-36 months), which I'd assume makes taking/losing market share in any area a bit of a constant battle. Some portion of this SG&A may be more aptly considered capex rather than opex, from an accrual accounting POV, given the recurring nature of customer cash flows related to successful sales efforts.33

.

From what I can tell, the main way that APi creates value for shareholders, then, is by management's capital allocation acumen in M&A of bolt-ons of similar recurring-revenue businesses purchased at good prices and with cost-takeout/synergy opportunities (eg. the recent Chubb acquisition); a strategy similarly used at Jarden:

The strategy included targeting: (i) category-leading positions in niche consumer markets; (ii) with recurring revenue and margin growth channels; (iii) robust cash flow characteristics, including substantial EBITDA multiples; (iv) a successful management team; and (v) strong transaction valuations, with value-generating presynergies.

This is in addition to, from a share price perspective, taking advantage of instantly bolting an acquiree, purchased at a lower valuation, on to APi's higher-valuation-multiple marketcap —the EBITDA multiples arbitrage mentioned earlier.

(I assume this dynamic is pretty similar for the Specialty Services segment as well; these services are described by APi as “mission-critical” and, to my understanding, further supported by a tailwind of aging infrastructure and shortage of specialized skilled labor required for performing the work).

.

Despite contract loss rates being low whenever they've talked about them in conference calls, switching costs appear to be basically very low or non-existent; I don’t see —and maybe I’m missing something— any structural advantage that APi has over competitors in this regard.

I have some question in this regard: Do installation companies —further up the value chain than APi— not already have existing sales forces in order to get these install contracts (which are an even greater expense for customers than inspections / monitoring) that could be used for similarly sniping inspection contracts? Does install work by peers not have any kind of lock-in effects? Eg. are inspections not contracted as part of installs? Are there common proprietary switching costs, eg. were only the installer co. can properly do an inspection for certain proprietary systems they installed?

On APi’s GTM sales strategy for getting additional inspection business to then cross-sell servicing and monitoring work, I'd assume this high retention that APi reports combined with the low switching costs I perceive for customers goes the same for competition as well and acts as a similar pro/con. (And it's not like a GTM strategy focused on sniping inspection work to cross-sell services and monitoring work is proprietary or exclusive to APi either, though APi's scale may be an advantage to some degree).

Is it that customers are generally yours to lose in this space and APi just happen to be the ones willing/able to spend the most to be out there spotting and polling for when a customer is contemplating switching from their current vendor?

I’ve seen arguments that peers are too much larger for APG target customer projects to move the needle. Just looking at high level numbers, I do see that only about 50% of the peers used in comps analyses have similar EV and marketcap to APG (FIX, EME, DY) and all have around the same EV/EBITDA multiples, though APG outspends them all on SG&A except for EME where they're about the same. Yet, “who would be APG's most noteworthy competitor” seems hard to answer as there are not great direct comps to what APi Group is doing.

.

I just hope that management will have the discipline to pivot this roll-up to a FCF-thrower if/when scale becomes an issue down the road; I am not a fan of buybacks over dividends as a preferred method of return-of-capital and I’d be more upset if Mariposa Acquisition started taking their “dividend” in cash vs stock awards in the Form 4s. In any case, Franklin’s previous willingness to sell Jarden gives me some confidence that management isn’t simply going to get caught up in empire-building here and some kind of conversion of business into actual cashflows for investors is somewhere in the future.

.

I will also say that having performance awards for company execs directly tied to “meeting a share price target” (per APG's April 2022 proxy and 10K) seems a bit... IDK… not fundamentals-based.

The Company has issued Time-Based Restricted Stock Units ("RSUs"), Performance-Based Restricted Stock Units with EBITDA-based performance conditions (“PSUs”), and Performance-Based Restricted Stock Units with share-price targets ("MSUs"), which are independent of stock option grants and all generally subject to forfeiture if employment terminates prior to vesting. —- APi Group 2022 proxy statement

Market Performance-Based Restricted Stock Units

The MSUs entitle the recipient to shares of the Company's common stock if specified market conditions are achieved. During the year ended December 31, 2022, the Company approved and granted 444,926 MSUs with certain share-price targets. Total MSUs granted during the year ended December 31, 2022 had a weighted-average grant date fair value of $16.31. The MSUs will vest 100%, if at all, on the later of March 9, 2025, the third anniversary of the grant date, and the date that such performance condition is satisfied (but no later than March 9, 2027). —- APi Group 2022 10K

I can get slightly more comfortable with the price-target-based comp after looking at the vesting period of the MSUs in the 2022 10K, but yeah... I still think, on net, that it just counts as hair on the stock that should be considered when determining position sizing etc. So many biographies of successful business-people mention ‘focusing on what you can actually control’ and this PT-based comp just seems like such a Munger-esque anti-pattern.

I am reminded of the old Buffett comments on not wanting to set compensation based on something outside of management's control.

Of course, this all makes more sense when recalling that Franklin holds all of the Series A Preferred Stock which entitles him to a hedge-fund-esque performance fee/“dividend” based on the stock price’s continual rise above previous YoY price levels… Who doesn’t want a higher stock price? Though the real issue is that of non-fundamentals-based incentives.

Also, given the asset-light business model, I would think a greater / more direct compensation link to FCF be better adjEBITDA. (Whenever I see EBITDA targets as highlighted components of comp plans, I can't help recall Munger's ‘EBITDA = Bullshit’ quote).

.

I’ve seen many discussions on APG make note of the fact that they were able to remain cashflow positive even during the economic shock of the COVID-19 lockdowns in 2020, this was mostly due to the “working capital release” at that time. I would note that the WC release to FCF appears to have been due to AR draining as no/lower new revenues were coming in. Thus AR making its natural way to the FCF line. That's doesn’t seem like a good (or bad) thing, but just a final flush that could have gotten bad if the economy did not reopen. Basically, IDK that the WC release dynamic is a positive (or negative) attribute. (Unless just meant to highlight the asset-light quality of the business).

I kind of think of these AR items like capacitors to the business machine that can smooth the flow of power/capital to the business if there are quick, temporary shutting off of “electricity”.

A capacitor can help smooth out quick temporary power loss to a device by storing energy in an electric field. When the power is lost, the capacitor releases this energy, providing a small amount of power to the device until the power is restored.

A capacitor is an electrical component that stores energy in an electric field. It is made up of two conductors, separated by an insulator. When a voltage is applied to the capacitor, electrons move from one conductor to the other, creating an electric field. The amount of charge that can be stored in a capacitor is determined by its capacitance.

When the power is lost to a device, the capacitor can release the stored energy, providing a small amount of power to the device until the power is restored. This can help to prevent the device from fully shutting down and losing data.

Valuation commentary

Factoring in the Chubb acquisition and subsequent cost take-outs on that business that management has planned, the most recent VIC writeup estimates a cumulative growth rate of (1.2bn/660MM-1=)82% over 3yrs (or a 27% annual EBITDA growth rate). I do wonder, though, if this future envisioned in the valuation is already priced into the stock?

Just as a way of initially trying to make explicit the assumptions baked into the exit multiple used in the writeup, I used a very simple, directionally-'good-enough' (IMO) model starting from…

LTM FCF/sh=$0.80/sh (not assuming the FDSO number used from assuming conversion of the preferred stock),

a 10% discount rate,

taking the 80% EBITDA to FCF conversion ratio as ‘good enough’ to just bake in EBITDA assumptions as a proxy for FCF ones,

and working backwards to see what growth and terminal rates and lengths could get me to the existing share price,

… I see a growth stage of 27% for 3yrs and a terminal stage of 4% for 32yrs (ie. assuming that APG only exists for 35 more yrs, though I do get it that the longevity of the biz has proven itself very Lindy when considering APi’s near century of existing operating history) is one combination that does work to produce the $20-$22/sh price that APG had long been hovering around, YTD (at the time I was drafted this quick model), until around June —perhaps due to the rising tide of AI euphoria34 lifting all ships.

(https://gurufocus.com/stock/APG/dcf)

We can use the 2025 normalized EPS estimates to see how the current price is being determined relative to those estimates. Here, I use…

a discount rate of 11% (Rf+Re=5pps+6pps),

the 2022 normalized EPS as the starting value to apply the growth stage to,

a growth period of 4yrs (extrapolating the available estimates out by 1yr),

and a 15.5% EPS CAGR (based on the average 2022A-2025E EPS estimates (I only have TIKR which uses the avg estimates from S&P CapitalIQ if there are more than set of numbers)).

… I then just adjusted the terminal stage period to whatever got me closest to the current price. So, these are the assumptions that we can assume are baked into the APG stock price:

(I wonder how this would change from an adjROIC (capitalizing some amount of SG&A related to APG GTM strategy) POV re. APG’s P/E multiple and a simple DCF valuation?)

Putting on a bullish hat, I’d say that even if APG is trading at FV right now based on the simple modeling (wherein Chubb turnaround meets expectations and APG remains static forever more or S&P CapitalIQ estimates play), you are still getting the upside of future (and extremely probable and larger) bolt-on M&A by the Jarden gang for free.

Legendary, Franco Nevada founder, Pierre Lassonde has talked in the past about the merits of paying a DCF FV for the existing business on deals that totally discounted/ignored implicit upside optionality as part of the strategy they employed when initially building the company w/ other gold royalty businesses.

Ultimately, I think of APG like a diversified portfolio / PE “fund” of statutorily-mandated fire and life safety businesses with some very reputable insider owners —though I certainly look askance at some of their compensation— but (future M&A that Becker and the Jarden gang may find in the future) I think the stock is likely trading around fair value at this time, so I see no reason to add to the existing position for now (especially given the lack of a dividend cash-back despite management’s lauding of APG’s asset-light nature).

I like APG as a…

decentralized (making it more like a diversified portfolio of pseudo-independent businesses)…

and diversified (across geographies and client industries)…

industrials-sector-beneficiary portfolio…

of (mostly statutorily-mandated) Life Safety businesses,...

that is relatively asset light —well, capex light (unless you include some portion of SG&A as a capital expense, which may rightly be the case given their GTM strategy)…

and currently not having the optionality to the many future M&A investments by Franklin and co factored into the price;

all of which is managed by well-regarded and mostly aligned management.

.

I’d be a much more enthusiastic buyer if they included a dividend; that lack of distributions somewhat tempers my desire for averaging into the stock for larger pps allocations for the time being, but I’m fine letting the position ride out to whatever concentration it’s going to get to in the portfolio from the existing cost basis.

You can hear a bit about this happening at the higher levels in the interesting interview here with Harald Malmgren and Nic Glinsman:

I say “asset-light” vs capex-light because APG’s rollup strategy means that there’s assuredly going to be significant capex spend going forward for the foreseeable future; that is, once they pay down the debt from their recent Chubb purchase (which was funded through a combination of cash on hand, perpetual preferred equity financing, and debt) to more comfortable levels.

As many of you know, we held an investor event on November 17 to provide a thorough walk-through of Chubb as well as our continued path of deleveraging swiftly to our targeted range of 2 to 2.5x net debt to adjusted EBITDA, and our continued focus on thoughtful incremental M&A —- Martin Franklin, 4Q2022 earnings call

For even more reading on the overview of the business, see….

More info about the messed up incentives of (US) SPACs can be found here:

https://www.sec.gov/news/statement/crenshaw-spac-20220330

https://www.skadden.com/insights/publications/2022/01/court-of-chancery-issues-spac-related-decision

https://seekingalpha.com/article/4165641-primer-on-spacs

https://corpgov.law.harvard.edu/2018/07/06/special-purpose-acquisition-companies-an-introduction/

Per the 2023 Proxy: https://www.sec.gov/ix?doc=/Archives/edgar/data/1796209/000119312523126303/d472160ddef14a.htm#toc472160_26

Sir Martin does not receive any additional compensation for services as a director in light of his affiliation with Mariposa Capital, LLC, which provides advisory services to the Company in exchange for a fee.

https://www.sec.gov/ix?doc=/Archives/edgar/data/1796209/000119312523126303/d472160ddef14a.htm

1350000+75000+90000+58750+80000+90000+21250+85000+85000+(100005×7)+175005+190005+158755+180005+190005+185005+185005 = 3898820

Per the S4:

Note 15. Related-Party Transactions and Investments

Sir Martin E. Franklin, a Founder and Director, is a beneficial owner and the manager of the Founder Entity and, as such, may be considered to have beneficial ownership of all the Founder Entity’s interests in the Company. Entities affiliated with James E. Lillie, also a Founder and Director, hold a pecuniary interest of 20% in the Founder Entity. Entities affiliated with Ian G.H. Ashken, also a Founder and Director, hold a pecuniary interest of 20% in the Founder Entity.

This (Mariposa Acquisition IV, LLC’s) amount consists of (i) 9,333,333 APG ordinary shares and (ii) 4,000,000 APG ordinary shares issuable upon conversion of Founder Preferred Shares, which are convertible at any time at the option of the holder into APG ordinary shares on a one-for-one basis. The reported securities are held by Mariposa Acquisition IV, LLC. MEF Holdings, LLLP, the general partner of which is wholly-owned by the Martin E. Franklin Revocable Trust of which Mr. Franklin is the sole settlor and trustee, holds a limited liability company interest in Mariposa Acquisition IV, LLC and, as a result, may be deemed to have a pecuniary interest in 4,176,928 APG ordinary shares and 1,728,400 APG ordinary shares issuable upon conversion of Founder Preferred Shares held by Mariposa Acquisition IV, LLC.

This is mentioned as the main growth drivers that APi saw in the 4Q2022 earnings call.

https://smallbusiness.chron.com/advantages-decentralized-organizational-structure-603.html

https://penpoin.com/decentralized-organizational-structure/

This last link contained an interesting case study of one of the risks of decentralized organizations:

Arthur Andersen was a large, decentralized accounting firm with offices located throughout the world. One or more partners operated each office independently. In 2002, Arthur Andersen had 85,000 employees worldwide. The firm was indicted in March 2002, and later found guilty, for obstructing justice by shredding tons of documents related to its audit work for Enron Corporation. As a result, Arthur Andersen agreed to cease its accounting practice in the United States in August 2002. By 2005, only 200 employees remained at Arthur Andersen to wrap up the dissolution of the firm.

Although the entire firm was indicted and found guilty of obstruction of justice, the decision to shred documents was made at the Houston office, where the bulk of the shredding took place. This serves as an extreme example of the disadvantage of decentralizing an organization. Decisions left to the division managers (“partners” in this case) can have a negative effect on the entire organization.

The 2019 presentation claims 50+, but in a later 2022 presentation (https://s201.q4cdn.com/155847588/files/doc_presentation/2022/07/37d06-api-presentation-for-cjs-conference_final-july-12-2022.pdf) they us the number 85+ “accretive acquisitions successfully completed since 2005”; I used the 2019 presentation slide in the post only because it included a chart of the selected acquisitions up to that point.

Though I’d note that, even if APi management had the heroics to go out and buy during the GFC, apparently many private owners in APi’s business were reluctant to sell. From a 2008 interview with the previous Chairman Lee Anderson:

“We’re looking at opportunities all the time, although it’s slower now. In a downturn, contrary to what you might think, companies aren’t offering themselves for sale. They probably don’t want to sell because they wouldn’t get the price they think they’re worth.”

You can read a bit on the aftermath of the sale to Newell here: https://www.thecorpraider.com/2018/03/19/newell-brands-and-uncle-carl/

I will note that, in a discussion I had with @marketeuphoria on twitter, the idea was brought up to the effect that the small size of the individual projects pursued by APi in addition to APi’s scale make their niche too small for larger players to care about —as taking share in this space does not move the needle for larger comps; per Russ Becker at the 2Q2022 earnings call: the “average project size is approximately $5,000 in our largest segment, Safety Services, and $75,000 in Specialty Services”. At the same time APi’s own size makes them the big fish in a small pond relative to other businesses chasing the same work as themselves. I’m not really sure how I feel about this argument for now, but I thought I’d mention it.

More on this topic of capitalizing certain typical opex items for certain business models, as discussed by Michael Mauboussin, can be found here: https://acquirersmultiple.com/2022/04/michael-mauboussin-financial-statements-one-size-does-not-fit-all/

<TODO: Note to self, look into APG’s margin profiles when capitalizing portions of their GTM SG&A. Does this improve margins and ROIC?>