Ticker: FNV

Marketcap: $20610.23MM (USD)

Price: $107.25

PT: $135

Payback period: 1 - 4yrs

Upside CAGR: 26% - 6%

Downside: $105

Downside CAGR: -2 - -0.5%

Intro

Franco-Nevada (FNV) is the largest 1 gold-focused royalty company in the world and in fact is generally credited as the originator of the gold royalty business model2 3. FNV operates within an oligopoly and their business model provides direct exposure to gold, silver, oil & gas, and other commodities while being extremely low-leverage and asset-light.

In November 2023, copper miner First Quantum Minerals (FQM) suspended operations at their Cobre Panama copper mine, operated by subsidiary Minera Panama, S.A. (MPSA), after a renegotiated deal with the Panamanian government resulted in disruptive protests/blockades/attacks 4 that were impeding supplies to the site and were later followed by Panama’s Supreme Court ruling FQM’s operating license invalid 5, which prompted the Panamanian government to order that the mine be closed 6.

The mine closure resulted in FNV releasing an adjusted projection of total gold equivalent ounces (GEO) production for 2023 that represented a decline in expectations for the year by 9%7 8. The royalty stream that FNV had in place for FQM’s gold and silver byproducts from their copper mining operations constituted 25% of FNV’s revenues in 20229. FNV’s stock price has since fallen by about as much since the mine closure and is now trading at an EV/EBITDA multiple below its COVID19 lows of March 2020 and below where it traded in the year that the Cobre Panama project first started making actual deliveries to FNV (which was early July 2019)10.

(To all you Munger fans about to criticize my use of EBITDA, I’ll just note that FNV has no debt and the vast majority (if not all) of the spending that US GAAP-adjusted data on FNV has marked as “capex” is actually growth (not maintenance) capex that the company is spending on new royalty/streaming investments, so I think EBITDA is a fine proxy for FNV’s discretionary free cashflow in this case).

The stock appears to be trading as if the Cobre mine will remain closed permanently. Given that the mine accounted for 5% of the country’s GDP 11 (just behind the Panama Canal’s 6.5% of GDP, which facing it’s own problems), I don’t think the closure will be permanent or even for very long. In any case, you’re at worst paying fair value at current prices with a, then free, call option on the Cobre mine reopening.

.

I won’t be getting much into the issue of the “true value” of gold in this post. I’ll just say that if one wants exposure to gold in their portfolio, I think that gold royalty companies are the better way to get exposure vs mining ETFs and even physical ownership (perhaps this last point indicates what side of the fence I lean more towards in the “value of gold” discussion). With that said, I think paying fair value right now for the original grand daddy of the gold royalty business model, with a free (or, as I believe, ‘not priced in’) call option on a resolution to the Cobre situation, is a pretty good way to get asset-light gold exposure for a diversified portfolio.

Also note that my portfolio holds around 20% of its capital in money market funds, so I’m not exactly short the US dollar here.

.

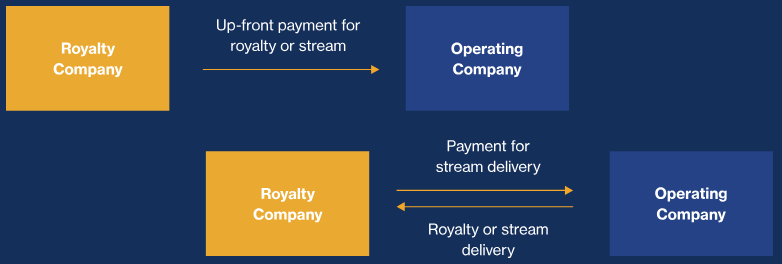

Obligatorily brief description of what gold royalty companies do

A royalty represents a payment made to a royalty holder by a property owner or mine operator, this payment is either made via a percentage of the revenues or profits generated from the property, often in perpetuity (I’ve also heard these being called “pure royalties”)12. Payment may might also be made as a percentage of physical minerals or byproducts produced from the property, streamed to the royalty owner at some agreed-upon price or arranged discount to spot prices (these are called stream-based or streaming royalties)13. (Unlike revenue-based royalties, streams typically have some finite life 14). Royalty companies may also own working interests in which they are responsible for a share of the costs (eg. operating and environmental management/stewardship expenses), while getting a portion of the earnings in return.

“Streaming deals are normally focused on specific commodities produced by a particular project, such as precious-metal by-products from a base-metals project. In return for this up-front cash payment (the “deposit balance”), the streaming partner secures a share of future production at an agreed-upon discounted price, which may be fixed or alternatively a floating percentage of the prevailing spot price. Thus, miners receive payment on delivery for streamed physical volumes. [R]oyalty deals are normally commodity agnostic and based on overall project revenues; the royalty company never actually “sees” the commodities that the mine produces, but rather just receives a share of the revenue generated (the royalty). In effect, streaming deals are settled by the physical transfer of metal while royalty deals are settled with cash.” ~~~ https://www.mckinsey.com/industries/metals-and-mining/our-insights/streaming-and-royalties-in-mining-let-the-music-play-on

You can read more details on the different types of royalty agreements in FNV’s annual report here: https://www.sec.gov/Archives/edgar/data/1456346/000155837023004112/fnv-20221231xex99d1.htm#EXPLANATIONOFROYALTIESSTREAMSANDOTHERINT

One could think of royalty companies as private equity firms that provide financing to mining companies and landowners in exchange for royalty agreements. Royalty companies tend to be the highest-cost-of-capital option for miners/operators and these deals are most commonly done with companies that —due to reasons that may be individual (eg. too much existing leverage) or macro (eg. an ESG-induced drought of institutional financing options)— find it unfavorable to raise capital via the traditional equity- or debt-markets15. This dynamic tends to give royalty companies some counter-cyclicality relative to the rest of the commodities industry, since the times where the industry is under duress presents lots of additional opportunities for royalty companies to deploy their considerable cashflows —keep in mind that these kinds of businesses tend to have very little debt (FNV has none) and virtually no need for any maintenance capex.

From a more positive POV, royalty deals allow operators to avoid fixed cash payments altogether (vs debt) and allows mining company shareholders to avoid dilution for funding that may only pertain to a specific asset/property in a miner’s larger portfolio (vs equity funding). In many cases (such as with streaming agreements where the operator’s primary focus is in mining, say, copper with the gold & silver in the deposit being extracted coincident to that copper extraction), deals with royalty companies can also be more mutually beneficial as the operator gets initial or on-going financing and a guaranteed buyer for the byproduct of their projects. “Mining companies have resorted to these types of agreements for construction work, expansion of current operations or to obtain funds for the repayment of outstanding debt with formal lenders.” 16

(https://www.goldroyalty.com/why-grc/royalty-and-streaming-101/)

Given that FNV’s main commodity of focus is precious metals, their economics tend to also have a level of counter-cyclicality against the rest of the general market as well, making them an even more attractive addition to a diversified portfolio. Below I graph FNV’s cashflows from operations vs Berkshire, Johnson & Johnson, and Proctor & Gamble (as proxies for the general market). (Note that unlike FNV, JNJ and PG have significant maintenance capex requirements that are not reflected here; I would have used their FCF numbers, but wanted to keep everything fair).

(Note that I ignore the 2007-2008 change in CFFO for FNV from their IPO in the chart) 17

The way I see it, royalty mineral rights and streaming rights are akin to owning the gold (or whatever other commodity the company focuses on) in a vault, in this case the vault is the subsurface of the earth itself (so the storage is basically free and perpetual).

(Side note: I assume that during the Great Depression that, when the ownership of physical gold was banned in the US by President Roosevelt’s Executive Order 6102, the ownership of stocks in and adjacent to the gold industry were not banned and the order seems to have a cutout for companies mining and refining gold —though who knows how gold royalty interests would have been treated as that business model came to popularity with FNV’s founding in 1983, well after the time the executive order was issued in 1933 (repealed in 1974)). 18

Keep in mind is that royalty agreements are typically perpetual claims on the property/land/resource itself (“interest in land” vs contractual rights between specific parties)19 20 and supersedes the lease on the land of whomever the operator is that happens to be doing the actual mining at the time. If the current operator goes bankrupt, then whoever next obtains that lease or property will still have to abide by the royalty agreement if they continue extracting resources21 22.

Aside from the possibility of the value of the gold in the royalty company’s “vault” rising with the rest of the gold market, the amount “stored” can also magically “grow” as more mineral deposits are discovered by the operators on the land and as new technologies (the R&D costs of which are borne by the operators or adjacent businesses) make existing deposits more profitable (either by increasing yields or reducing extraction costs). So, royalty companies pay for royalties and streams, while also gaining free leverage from near-perpetual call options on higher commodity prices and volumes.

“And so I looked I went through my numbers and I said, well at the very worst I'm going to get my money back. […] And then what happened is about a year and a half later that property was sold. The operator sold the entire property to Barrick [Gold] and needless to say, Barrick proceeded to discover Gold Strike 23, which made up, now, 50 million ounces of gold and the rest is history” ~~~ Franco-Nevada founder, Pierre Lassonde, on FNV’s first royalty (I believe the popular consensus at the time was that the property contained only 500,000 oz of gold)24.

(As of April 2023, around 62% of FNV’s various royalty and streaming assets were still in their exploration phase25, leaving lots of room for surprise upside in deposit discoveries that may not yet be priced into the stock).

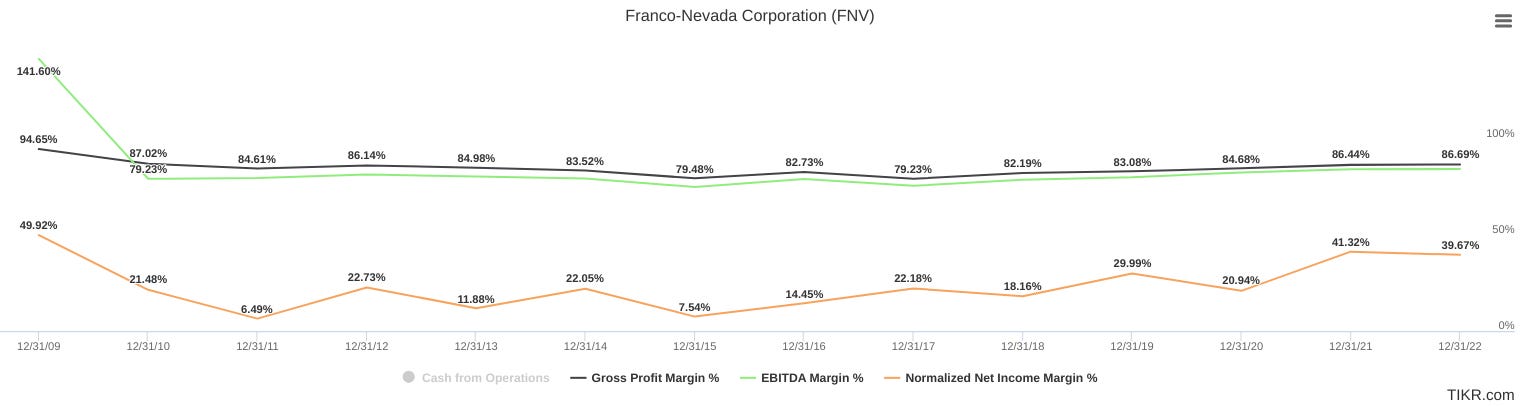

Operators pay the royalty business in cash (or in a discounted portion of the extracted resources) in exchange for permission to extract that gold from the “vault”, while the royalty businesses doesn’t have to lift a finger other than to draft purchase agreements and cash checks 26. FNV had only 40 full time employees (+5 part-time contractors) as of 2023Q1 supporting the company’s USD$20bn market cap and generating cashflows from operations of $999.50MM in 2022 27. EBITDA margins in the 70%s and 80%s for royalty companies are the norm, with FNV sporting the highest margins among the big 3 royalty companies (the others being Wheaton Precious Metals and Royal Gold).

“How many businesses in the world are there where you can acquire a capital asset [such as mining equipment], which has a limited life, and convert it into a permanent asset? You can’t do it in energy, because the reserves have to be consumed. You could theoretically do it in gold or silver, even, if you wanted to hold all the gold in your balance sheet and not sell it. It’s just that we can’t find a business like that to acquire, because nobody does that. If there were a company that did that, we would be very interested. The closest version you can find are the royalty companies, where you look at the future earnings stream. For a gold-based royalty company, there’s gold in the ground, but it’s going to be converted into cash.” ~~~ Murray Stahl, FRMO FY2023Q3 conference call (https://www.frmocorp.com/_content/letters/2023_Q3_FRMO_Transcript.pdf)

.

While there are many gold royalty companies today, I think that FNV, WPM, and RGLD actually form a kind of oligopoly in the gold royalty industry in terms of access to deal flow for new royalties.

“The smaller companies all need to find a royalty that will anchor them. In the case of Franco-Nevada, it was Goldstrike, where the deposit went from 500,000 oz gold to now having produced 40 Moz gold. Until that anchor is found, it’s a really difficult business because the deals are small, and the payouts are very uncertain. As a result, I think many junior royalty companies will not survive.” ~~~ Pierre Lassonde

“Royalty companies today, there’s probably 50, 60, I don't know the total but somewhere in there, essentially mirrors the mining business, that’s it. You know, like, you got to have two or three that are very large company, you know, 10 plus billion market cap, and then you have the midsized in the the 1 billion, 5, 7, 8 9, and then you have like 50 that are the small minos they’re really, really small and most of those are not going to survive. Most junior exploration companies don't survive, so the same model. There’s been very few acquisitions of royalty companies by royalty companies, there’ve been very few mergers. Each one is still very much independent. The big ones are all well run and the they have good assets, so I think they got to be there for the duration.” ~~~ Pierre Lassonde

“[T]he industry remains very consolidated, with the top three players —Wheaton Precious Metals, Franco-Nevada Corporation, and Royal Gold— representing approximately 80 percent of the total value of streaming-and-royalty contracts as defined by volume of gold equivalent ounces (GEOs).” ~~~ https://www.mckinsey.com/industries/metals-and-mining/our-insights/streaming-and-royalties-in-mining-let-the-music-play-on

********** UPDATE 20240529:

FNV gains a kind of scale advantage as well in that their increasing size and cashflows enable them to better absorb their deal flow and despite FNV’s size —of around a $27bn marketcap— they still go after smaller deals that might otherwise turn out to provide an ‘anchor royalty’ to smaller or mid-sized would-be competitors. (Of course, not all royalty financing in exclusive, but FNV’s size allows them to provide financing to these smaller projects with a smaller impact to their overall bankroll). As just one example of many, their recent 2023 annual report notes that they acquired a 1% NSR on Gold Candle Ltd.’s (“Gold Candle”) Kerr-Addison project located in Ontario for a purchase price of $10MM (which amounts to just 0.037% of FNV’s marketcap and (10/991.20=)1% of their 2023 cashflow from operations) (https://www.sec.gov/Archives/edgar/data/1456346/000155837024003443/fnv-20231231xex99d1.htm#GENERALDEVELOPMENTOFFRANCONEVADASBUSINES). Perhaps this practice is simply keeping in mind the call-optionality aspect of royalties on gold projects that played into FNV’s own original anchor royalty, Goldstrike, in the Carlin Trend that catapulted the company to the dominant position it enjoys today. Whatever the case, it’s clear that FNV is not so content to leave much scraps for smaller comps.

What kind of scale advantage to call this exactly? IDK.

“Just the language of what you said — is this ‘really’ scale economies, and you mentioned earlier, blurring the boundaries, stretching the boundaries and so on. That’s where you get into the ill-structuredness (of reality), and where you want to blur the boundaries — in a sense, the more you stretch it, the more the use becomes metaphorical or analogical.

[…] And so it’s helpful to think of this in the case of Nike — you know, a higher amount of advertising because they’re (spending) 10-12% [the standard budget across all athletic apparel companies observed in the discussion] of a large number. Is that economies of scale or just scale? It doesn’t really matter. It is what it is. If you try to pigeonhole it into economies of scale or not economies of scale, you miss the Nike case, the actual Nike case and (the) reality with its advertising, with some aspects of economies of scale, and other things that are just scale, but whatever it is, it’s not about do you pigeonhole this under the concept of economies of scale? It’s what’s going on with Nike that didn’t go on with the other companies.

A key principle is that the reality comes first, and concepts are used to help you understand reality, not the other way around. For too long, we’ve had concepts at the top, and then cases that illustrated the concept. “‘Economies of scale’, here’s an example, here’s another example.” And then you discard the cases. In a messy, ill-structured, real world, it’s reversed! It’s the case that’s on top, and each case has different concepts.” ~~~ https://commoncog.com/focus-on-the-cases/

**********

.

Because of this attractive business model, royalty companies tend to trade at a premium to other types of businesses in the gold mining industry.

FNV history

Founded by Pierre Lassonde and Seymour Schulich in 1986, Franco Nevada IPO’ed on the Toronto Stock Exchange in late 2007 and later listed on the US NYSE in 201128. FNV is generally recognized as the originator of the gold royalty business model (or at least the first to make the model successful on a large scale). They are the largest royalty and streaming company in the world and their royalties collectively cover around 66,200 square km of as of December 2023 29, a little larger than the state of West Virginia; imagine if every square kilometer of the state were covered in some kind of project that was extracting, or planning to extract, some discovered combination of gold, silver, oil, and gas. That’s Franco Nevada.

(Mineral streaming deals are recognized as originating with Wheaton River Minerals, now Wheaton Precious Metals, in 2004). You can listen to some interesting interviews with FNV’s remaining founder Pierre Lassonde on the companies founding, here and here.

“So the whole story of the royalty businesses is interesting because the original company Franco Nevada was created simply for Seymour and I to be able to go ski and play poker in Nevada and being able to write the trip against our taxes, that's the plain reality. And then we raised two million dollars most of which was our own money, but then like a lot of friends’ money and we said well what heck we’re gonna do with the money? Now you know we had a problem. And so the first year and a half we participated in a bunch of exploration programs that of course all turned to zero. Then I was writing the annual report and I went to Seymour’s office and I say “Seymour, all I have to do, all I have to say to the shareholders is that I'm losing their money and you and I are the biggest shareholder and we’re the biggest dummies.” So, we started sort of a brainstorming session right there in his office about it like “well what else we can do in this business that’s different?” and he [Seymour] being from the oil and gas business at one point just said, he just floated it off, he said “well in the oil and gas business there’s royalties, like, aren't there any in the mining business?”… ” ~~~ Pierre Lassonde, The Norther Miner CMS 2018

********** UPDATE 20240204: I also just ran across this interview with Lassonde from a few weeks ago that I thought was pretty interesting. He talks about FNV’s founding (understandably, he tells the story generally the same every time across many interviews), as well as his views on the state of gold prices, Bitcoin, and some other interesting topics.

**********

Here is Franco-Nevada’s total compounded return since it’s IPO (which was right around the start of the 2008 market crash) up to November 2023 vs the standard market indexes and gold ETFs (note that the NASDAQ is heavily concentrated in tech stocks like Nvidia, Apple, Google, Tesla, etc whose stock prices have seen tremendous growth over this past decade and have been major drivers of the index’s performance):

(https://www.franco-nevada.com/about-us/our-company/default.aspx)

.

Below, we can see the mineral, geographic, and royalty-type diversification of FNV’s portfolio:

(Some may be turned off by the exposure to oil and gas that FNV has dipped their toe into. I happen to like it, but it’s very understandable why that might turn someone off from the stock when they’re looking for a “gold royalty” company.)

Note that due to recent events, Central America revenue exposure is actually now significantly smaller than 27% as Cobre Panama made up 75% of FNV’s Central America revenues in 2022 30.

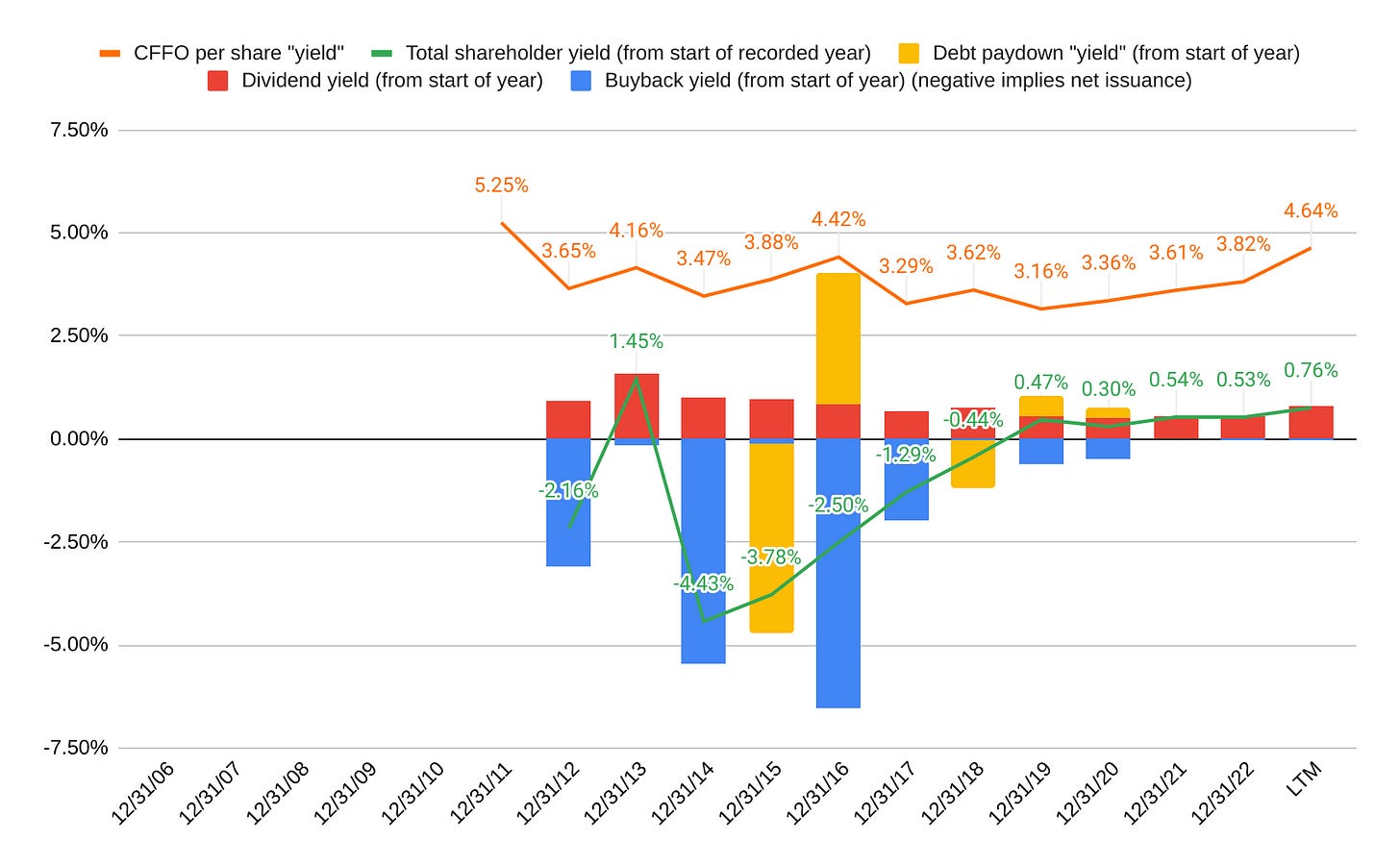

I think it’s also interesting to see how FNV’s cash gets spent. Note that most of FNV’s “capex” spending is on making royalty investments (TIKR.com seems to put these values under capex whereas FNV’s annual report uses the more general “investing activities”), so really I think cash from operations is a better measurement of FNV’s “free” cash than the FCF that TIKR reports (which is cash from ops. minus their accounting of capex)31.

Notice that if we overlay this investment activity (capex, the blue in the graph) with changes in gold prices, we see that FNV is able to use their cash generative business model to be very opportunistic during times of stress in the rest of the gold industry (eg. with capex spiking into 2015, when gold miner stock neared their bottom, continuing into 2020, as gold and gold miners started to rise again, and as gold and miners started falling in 2021). FNV has no debt and has only ever carried any debt in 3 of it’s 16 year history as a public company.

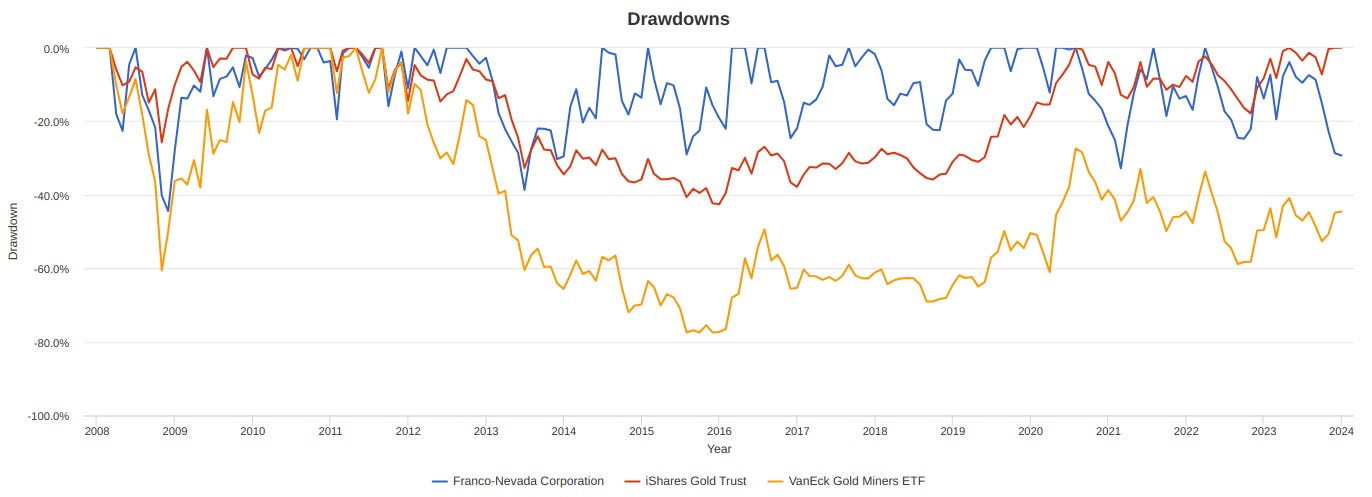

(https://www.portfoliovisualizer.com/backtest-portfolio?s=y&sl=4Ol0DIpuYPctQpuIs4DiZn; peak-to-peak drawdowns in FNV, IAU, and GDX)

“My final thing is to be in companies who are able to seize opportunities when others don’t even see them or aren’t able to seize them.” ~~~ Pierre Lassonde

One might ask: why, if FNV is so cash-generative, did they need to do such large stock issuances in the 2014-2017 period in order to do deals 32? I’m not totally sure, to be honest. I assume the reasons were to take greater advantage of the distressed period that the rest of the gold industry was facing at that time. In any case, regardless of their financing mix, we can see that in the 3- and 5-year periods after these equity financing rounds, the CFFO/sh has not left investor’s share of operating cashflows negatively diluted. (Not shown here is that FNV also did not carry any net debt except for in the years 2015, 2018, and 2019).

Looking at the company’s ROIC, given that most of FNV’s “capex” spending in is on making royalty investments and their “asset base is primarily comprised of non-current assets such as our royalty, stream and working interests, and investments, while our current assets are primarily comprised of cash and cash equivalents and receivables”33, it makes a bit of sense to give their invested capital some turnaround time. (Though I’d note that FNV’s ROIC had been steady and positive since their IPO and was beginning to inflect on the first Cobre deliveries, until the present issues at that mine cropped up (as we will go into later)).

Below I chart FNV’s incremental return on capital (ROIIC) on a 2- and 3-yr lag based on the writings of Michael Mauboussin.

(https://www.morganstanley.com/im/publication/insights/articles/article_returnoninvestedcapital.pdf; here we see a formula for a 1yr lagging measurement of ROIIC; “One way to dampen the noise is to calculate ROIIC over three- or five-year periods. In the case of a three-year rolling ROIIC, you take the change in NOPAT over the last three years (Year3 NOPAT – Year0 NOPAT) and divide it by the change in invested capital, again with a lag (Year2 invested capital – Year-1 invested capital).”)

Eg. from the POV of a rolling 3yr ROIIC, the additional NOPAT by end of 2016 (compared to what is was at end of 2013) is thought of as being generated by the additional invested capital that was put into the business between the start of 2013 to the end of 2015. (So the 2016 3yr ROIIC is calculated as (NOPAT2016-NOPAT2013)/(IC2015-IC2012)).

Overall, we see that FNV does indeed create net value for their shareholders over time. Of course, it’s not just about what you’re getting, but what you pay for it…

.

Right now FNV is trading at a historically low multiple and appears to be fully pricing in an expected future where the Cobre Panama remains closed indefinitely.

(FNV started trading on the NYSE in 2011 at around a 15x EV/EBITDA)

.

Since 2013 to today, FNV stock has traded around the current EV/EBITDA multiple in only 15 of the past 49 quarters (30% of all past quarters since the US listing), with most of those instances occurring around FNV’s initial US listing period.

(FQM’s first deliveries to FNV from Cobre Panama where in the 2nd half of 2019. Protests and blockades to the site started in October 2023, (https://www.reuters.com/markets/commodities/first-quantum-cuts-ore-processing-amid-port-blockades-2023-11-13/). The dip in 2022 seems to have corresponded with declining gold prices from 2020 to the end of 2022. 34)

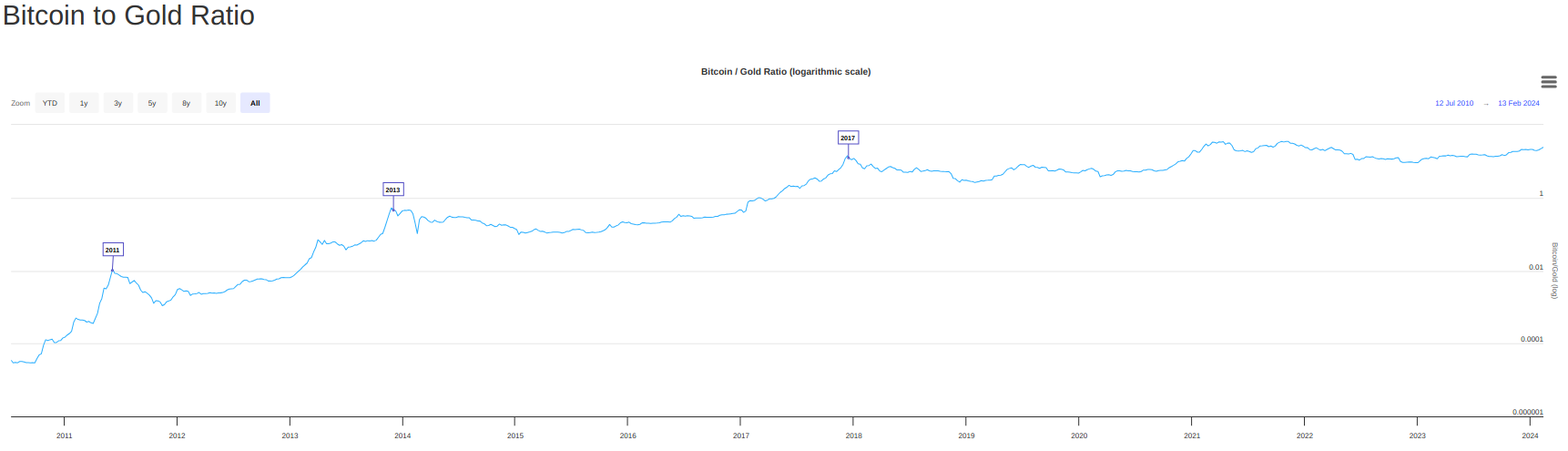

Relative to the price of gold, FNV shares are cheaper than they’ve been since 2018, the year before the Cobre mine started deliveries to Franco Nevada (for a more solid reference point, one would need to look further back to 2016). You if you had a 1oz gold bar, you could trade it for slightly more shares of FNV today than you could have during the March depths of the 2020 COVID pandemic. (Note that I wouldn’t do this kind of simplistic comparison for a gold miner or some other business further down the gold industry value-chain, but —as I mentioned earlier— FNV is basically just a big buried vault of gold with very little opex or (maintenance) capex that just monetizes it’s “vault” over time, so I don’t the comparison here with gold bars is missing too much nuance).

(Gold price used here is the inflation adjusted end-of-year average closing price per oz for each year compared to quarterly FNV stock price; I couldn’t find more detailed gold data that I could line up with the quarterly prices).

Cobre Panama

(https://franco-nevada.relayto.com/e/2023-asset-handbook-fokmo6c7tstte/bFfSCruV38; Cobre Panama)

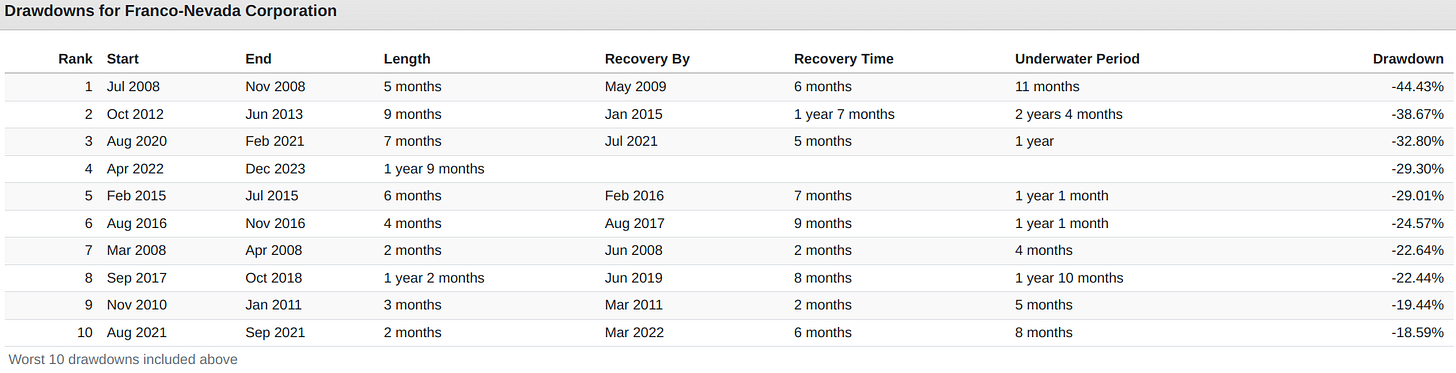

The recent events around the Cobre Panama site have caused FNV stock to fall ~22% which, just for a sense of scale (noting the Cobre drawdown is not itself a peak-to-trough one), would put it among the top 10 of the stock’s worst peak-to-trough drawdowns in the stock’s history 35. FNV is now trading below it’s March 2020 COVID19 EV/EBITDA lows and below where it traded in the year that the Cobre Panama project first started making actual deliveries to FNV (in July 2019).

Cobre Panama is the one of the world’s largest copper mines 36 and is the largest copper mine in Central America accounting, for 1.5% of global production of the metal 37. From the 2022 annual report, Cobre Panama makes up just 5% of FNV’s total estimated gold mineral reserves, but around 41% of FNV’s total silver mineral reserves 38. The Cobre Panama deal with FNV was initially struck in late 2012, but only started producing in 2H2019 39 —giving one a sense of how long it can take a copper mining project to go from planning, to construction, to production.

.

The original deal documents and subsequent incremental deals with Cobre Panama mine interests can be found here in addition to more recent summaries from FNV’s 2022 annual report and Asset Handbook published in April 2023:

https://www.sec.gov/Archives/edgar/data/1456346/000110465912058881/0001104659-12-058881-index.html (August 20, 2012, initial press release);

https://www.sec.gov/Archives/edgar/data/1456346/000110465912061432/0001104659-12-061432-index.html (Official SEDAR copy of FNV’s purchase and sale agreement for the Cobre stream, see attachment EX-99.2);

https://www.sec.gov/Archives/edgar/data/1456346/000155837017006974/0001558370-17-006974-index.html (2017 incremental deal w/ FQM);

https://www.sec.gov/Archives/edgar/data/1456346/000155837018000174/0001558370-18-000174-index.html (2018 incremental deal w/ KORES);

https://franco-nevada.relayto.com/e/2023-asset-handbook-fokmo6c7tstte (FNV’s April 2023 Asset Handbook, see “Precious Metals: Central America and Mexico”)

.

FNV’s streaming deal for Cobre lasts until 2057 and automatically extends in successive 10yr increments for as long as there are active mineral exploration or development operations on the site. 40

“Franco-Nevada has two precious metals streams with slightly different terms:

• Fixed Payment Stream – Effective since 2015 and applies to First Quantum’s original 80% interest in Cobre Panama. […] As of November 2022, the current ongoing payment of the Fixed Payment Stream is fixed per ounce payments of $450.59/oz gold and $6.76/oz silver with a 1.5% annual inflation factor.

• Floating Payment Stream – Effective March 2018, Franco-Nevada (Barbados) Corporation added a new precious metals stream which increased its coverage to 100% of the ownership of the Cobre Panama operation. The Floating Payment Stream applies to First Quantum’s 10% indirect interest acquired from LS-Nikko Copper Inc. and KOMIR’s 10% indirect interest. […] The Floating Payment Stream ongoing price per ounce for deliveries is 20% of the spot price for the Mineral Reserve life at the time and higher thereafter.”

One can read the articles-2 and -3 of the original purchase agreement between FNV and Inmet for more details (if you click the link, just keep in mind that luxco1, luxco2, and IFC are all just Inmet subsidiaries and everything should be relatively easy to read from there).

.

Rather than reproduce what has already been written on this issue, a pretty succinct history the Cobre Panama issues between FQM/MPSA and the Panamanian government from 1996 up to around March 2023 can be found in the 2022 annual reports from FQM here (https://s24.q4cdn.com/821689673/files/doc_financials/2022/q4/Q4-2022-FQM-Management's-Discussion-Analysis-FINAL.pdf, see “Supreme Court of Panamá Proceedings”; https://s24.q4cdn.com/821689673/files/doc_downloads/2022-annual-report/AIF-2023-FINAL.pdf, see “Cobre Panamá” (or “Supreme Court Ruling on the Constitutionality of Law 9”)) and from FNV here (https://www.sec.gov/Archives/edgar/data/1456346/000155837023003927/0001558370-23-003927-index.html, EX-99.1, “Portfolio Updates”). 41

For the issues as they occurred in 2023, here is a timeline of events after the initial suspension order from the Panama government in late 2022:

On January 26, 2023, the Panama Maritime Authority (the “AMP”) issued a resolution that required the suspension of concentrate loading operations at the Cobre Panama port, Punta Rincón.

On February 23, 2023, as a result of the AMP’s refusal to permit copper concentrate loading operations at the port, FQM subsidiary MPSA suspended ore processing operations at Cobre. FQM initiated legal action alleging Panama was violating the existing contract. Operations were temporarily halted in Q1 2023 during the dispute.

March 8, 2023, FQM announced that MPSA has agreed and finalized the draft of a [new] concession contract (the "Proposed Concession Contract") with the GOP for the Cobre Panama mine. The Proposed Concession Contract would have an initial 20-year term, with a 20-year extension option and additional extensions for the life of mine. The Proposed Concession Contract was subject to a 30-day public consultation process and approvals by the Panamanian Cabinet, Comptroller General of the Republic and the National Assembly. MPSA received authorization from the Panama Maritime Authority and concentrate loading operations at the Punta Rincón port resumed to normal levels, with MPSA remobilizing workforce to full staffing levels.

The Refreshed Concession Contract provides for an initial 20-year term with a 20-year extension option and additional extensions for life of mine. The Refreshed Concession Contract is expected to be presented before the National Assembly of Panama in the legislative term that commences on July 1, 2023, after having gone through a public consultation process and receipt of all required prior governmental approvals. The Refreshed Concession Contract was subject to a public consultation process that started on March 24, 2023. During this period, the Refreshed Concession Contract was made available to the general public in Panama through an online platform for a 30-day period. The GOP, with participation of First Quantum, held three open forums in surrounding communities, with the last one occurring on Monday April 24, 2023. The forums were attended by citizens of the Republic of Panama and they received direct and in-person explanations of the Refreshed Concession Contract from the GOP, led by the Ministry of Commerce and Industries (“MICI”). The principal economic terms of the Refreshed Concession Contract are set out in First Quantum’s Management Discussion and Analysis for the three months ended March 31, 2023. (https://www.sec.gov/Archives/edgar/data/1456346/000155837023007701/0001558370-23-007701-index.html, EX-99.2, “Portfolio Updates”)

The Company and Panama agreed to a new Concession Agreement contract in March 2023 which, following due public consultation and regulatory signoff, was approved by contract law 406 by the National Assembly on October 20, 2023 42.

But this was not the end of the drama and the new concession agreement quickly led to large and disruptive protests across Panama 43.

On October 29, spurred by public protests led by the Panama’s largest construction union (SUNTRACS), educators (ASOPROF union), indigenous groups, and young activists calling for the revocation of the mining contract, Panama’s President then called for a referendum on the contract 44. Panama’s Supreme Court admitted several lawsuits challenging the constitutionality of Law 406 45.

A very interesting thought, https://x.com/YellowLabLife/status/1719043194334109922?s=20; I believe that FQM’s mining union is Utramipa (https://www.bnamericas.com/en/news/cobre-panama-urges-govt-to-draw-up-roadmap-for-workers) I’d note that the US International Trade Administration cited corruption as Panama’s biggest challenge in 2023. 46

SUNTRACS members faced retaliation by the Panama government and some members had their bank accounts frozen. 47

November 20 2023: FQM reports that “MPSA, in accordance with its contractual obligations to the Republic of Panama, made a tax and royalty payment on November 16, 2023 of $567 million in respect of the period from December 2021 to October 2023. This payment is one of the largest ever tax and royalty payments in the history of the global copper mining sector and is the largest fiscal payment ever made in Panama.” 48

November 28 2023: “Panama’s Supreme Court unanimously held Tuesday that the 20-year concession for the Canadian Cobre Panamá copper mine was unconstitutional.

In its judgement, the courts found that Law 406 of October 20, 2023, which granted the mining concession to Minera Panama, the Panamanian subsidiary of Canadian First Quantum Minerals, was unconstitutional and struck down the entire law. The law would have created a new 20-year contract for First Quantum’s Cobre Panamá mine. Canadian First Quantum acknowledged the judgement.” 49

December 1, FQM initiates international arbitration following the court ruling 50.

In December, Panama started the process for Canadian miner First Quantum’s Cobre Panama mine’s “definitive” closure following the official notification for the miner to end operations. FQM claims that no legal basis for pursuing a closure plan was provided to them. “To date, MPSA has been unable to engage formally with the Government to clarify the legal situation and associated environmental obligations.” 51

Jan 3 2024, Utramipa, the union representing workers at Cobre Panama warned of Suntracs’ plan to invade the site. Utramipa requested government support to protect the site, citing past incidents of violence and potential environmental risks. 52

Jan 15, 2024: FQM cuts spending, pauses dividend, and puts smaller mines up for sale in effort to free up cash to as they deal with the Cobre situation. Cobre Panama accounted for around 50% of FQM's in 2022. With the mine now closed, credit rating agency Fitch Ratings believes that, while FQM will be able to cover all capex, interest payments, and maturities due in 2024, they will not have sufficient liquidity to repay its USD1.05 billion bond ahead of its due date in April 2025, without obtaining refinancing in some form, even after budget trimming and potential equity stake disposals. 53

.

Even actor Leonardo DiCaprio lent his weight to the anti-mining movement and reposted this video in support of the protests on his Instagram account:

(First Quantum was founded in 1983 under the name Xenium Resources and, despite the 2007 Canadian IPO, FNV was actually founded by Lassonde and Schulich in that same year, making both companies well over 25 years old. Why, then, why is Leonardo DiCaprio trying to screw them?) 54

.

Worst case scenario, IMO, the Cobre mine remains closed and you’ve ended up paying fair value for the stock at today’s prices. Though, I’d still expect some additional selling from current holdouts in the event that no resolution is reached for the Cobre/FQM situation by the start of June 2024 55, the month when the Panamanian government is expected to publish their official mine closure plan, as people get hit with the “oh damn, it’s really happening” feeling.

On the other hand, copper exports from the shuttered Cobre mine accounted for 5% of Panama’s GDP in 2023 and were projected to be the government’s largest source of revenue just behind the Panama Canal (which accounts for 6.5% of Panama’s GDP) 56.

By the way, the revenue generation from the canal is also expected to face issues going forward. “El Nino” events in eastern Pacific Ocean (which cause reduced rainfall for Panama’s lake systems) have been lasting longer due to climate change57, causing longer dry seasons for Panama lake systems (currently causing the worst drought 70 years)58, resulting in limited water supply to move ships through the Panama Canal’s lock system, causing less total throughput (less ships and less cargo per ship), which ultimately results in less revenues generated from the canal 59 60. Any long-term solutions to address the issues with the canal are going to require a lot of money to get done. 61

Given these issues, the revenues forfeited from keeping Cobre Panama closed should be in even greater focus for Panama’s government.

.

In a similar vein, one could argue that there is an added element of counter-cyclicality upside to an investment in FNV from the angle that a global recession in 2024 could push the Panamanian government to re-evaluate the importance of keeping Cobre up and running and those government royalties coming in.

.

I think that the FNV stock is currently priced as if the mine closure is permanent. From this POV, the stock is trading at about fair value and you’re getting the free call option on a positive surprise in the Cobre situation. IMO, there will be a new deal for the mine to reopen —and sooner rather than later. From this POV, the stock is trading at around a 20-25% margin of safety —not life changing, but an attractive time to build a position in in the king of gold royalties.

Valuation

I think this situation with Cobre is likely fully priced in now. The gold/silver royalty stream accounted for 18% of FNV’s revenues in 2021 and 17% of 2022 revenues 62. The stock has since fallen a commensurate 22.5% at the time of my writing this. (I know I’m saying “commensurate” even though I’m pointing at topline figures as a proxy for how the stock price should move, but again keep in mind that FNV’s EBITDA margins are around 80%-85%, with no/negligible debt, and the vast majority of their “capex” simply being from funding new royalty deals. So, I think that EBITDA is a fine proxy for FNV’s discretionary free cashflow here and thus a not-too-crazy proxy for how the stock price should move).

********** UPDATE 20241218: “We’re very hopeful that the mine will return to operation, and it is -- has the potential to be a tremendous contributor to us. If and when it comes back at its full operating rate, that would be roughly a 30% increase in our GEOs and revenues. So we still believe it's a tremendously valuable asset. I think the full value of it has been taken out of our stock. So I think the -- probably the best optionality you can get in the royalty industry today is a free option on Cobre Panama coming back online.” ~~~ Paul Brink, FNV CEO, FY2024Q3 earnings call **********

.

Assuming the Cobre Panama reopens, I’d expect cashflows from operations to basically end up around the same as 2022. Using LTM63 CFFO/sh of ($987MM/192.12MMsh=)$5.14/sh (as opposed to FCF/sh which subtracts capex which, as I mentioned earlier, should really be labeled as “investing activities” for FNV) and 2020-2022 CFFO CAGR of 11.5% (to account for the ramp up in Cobre Panama operations that started stream deliveries to FNV in 2H2019), we can use a simple DCF model to get a value of $135 (a 25% upside)…

(https://www.gurufocus.com/stock/FNV/dcf; I assume an Re=7% and Rf=5% in the model. Note this Rf is based on money market yields (~5%) rather than 10yr UST yields (~4%), so the value could actually be somewhat higher.)

… which is not too far from the average price of $140 that FNV stock traded at starting at the beginning of the first Cobre Panama stream deliveries in 2019 (skipping forward to after the March 2020 lows due to the global COVID19 panic) until the October 2023 shutdown of the Cobre mine, so I think using CFFO is somewhat validated here.

(Note also that the mean analyst estimate for FNV’s 2024 CFFO is $1034.36MM which, at current shares outstanding, would imply a 2024 CFFO/sh of $5.38; slightly higher than the estimate I use above).

The FNV Q4 results should be released in March, but in the meantime we can get an estimate for what 2023Q4 revenues are going to look like in light of the Cobre shut down by looking at its contributions to FNV’s revenues in the past 3 quarters of 2023 (see the 2nd attachment to each quarterly filing (EX-99.2) and search “Revenue By Asset”):

Q1 https://www.sec.gov/Archives/edgar/data/1456346/000155837023007701/0001558370-23-007701-index.html ($54.5 from Cobre, $276.3 total)

Q2 https://www.sec.gov/Archives/edgar/data/1456346/000155837023014003/0001558370-23-014003-index.html ($71.7 from Cobre, $329.9 total)

Q3 https://www.sec.gov/Archives/edgar/data/1456346/000155837023018351/0001558370-23-018351-index.html ($67.3 from Cobre, $309.5 total)

Ignoring the changing price of gold (which bounced around a range of $1800-$2025 per oz in 2023), we can get a rough Q4 estimate by taking the average total revenues less the average Cobre contribution…

==> 2023Q4 revenue = avg(276.3,329.9,309.5) - avg(54.5,71.7,67.3) = $240.73MM w/out Cobre

********** UPDATE 20240308: With FNV’s Q4 numbers now released (https://www.sec.gov/Archives/edgar/data/1456346/000155837024002504/0001558370-24-002504-index.html), we can see this Q4 revenue estimate turned out to be a bit pessimistic (with actual Q4 revenues coming in at around 26% above the rough estimate I used here).

**********

With this, we can use the assumptions below to see what FNV might look like if Cobre Panama were to remain closed indefinitely:

2019 CFFO margin = 617.70/841.70 = 73%

Estimated 2023Q4 revenue = $240.73MM

==> 2024 run rate w/out Cobre = ($240.73MM*4) = $962.92MM

==> Estimated 2024 CFFO = $962.92MM * 0.73 = $702.93MM

==> 2024 CFFO/sh = $702.93MM/192.12MMsh = $3.66/sh

Using a 2013-2018 CFFO CAGR of 11.3% to ignore growth from the Cobre mine streaming deliveries in 2019 and onward, we get a simple DCF model of about $105/sh for FNV…

(https://www.gurufocus.com/stock/FNV/dcf; I assume an Re=7% and Rf=5% in the model. Note this Rf is based on money market yields (~5%) rather than 10yr UST yields (~4%), so the value could actually be somewhat higher.)

… which is pretty close to current prices (and around where it traded in early 2020 when the Cobre stream deliveries had only just begun), indicating to me that the stock is essentially fully discounting Cobre Panama ever opening again —and that if that were the case, what you’re paying right now is basically just around fair value.

.

*UPDATE 20240327: This little section is actually an update after being inspired to play around with this idea of looking at multiple-implied expected growth rates from a snippet of the Made In Japan post here, but I’m not formatting in the way I normally do for updates as to avoid visual clutter, since already a bit cluttered with the equations. (Note I am using number as they were on Feb 2, 2024).

Looking at the terminal value formula (https://corporatefinanceinstitute.com/resources/financial-modeling/dcf-terminal-value-formula/)…

TV = (FCFn * (1+g)) / (WACC - g)

… we can use the risk-free rate (Effective Fed Funds Rate) for WACC, call it r, and replace FCFn with whatever other profit value measure, E, we think is most appropriate for the business and solve for TV/E (using an appropriate corresponding TV value metric for E, eg. EnterpriseValue/FCFF or Marketcap/FCFE), lets call this ratio m(=TV/E) for “valuation multiple”, to get an idea of what kind of valuation multiple FNV should (theoretically) be trading at given a particular (perpetual) growth rate or vice versa:

m = (1 + g)/(r - g), solving for g, we have g = (m*r - 1)/(1 + m).

Taking my presumed 2024 ex-Cobre run-rate CFFO of $962.92MM and FNV’s current EV of $25982MM, we get a forward 2024 EV/CFFO multiple of around 27x. With an EFFR=5%, this implies a priced in CFFO growth of 1.25%. So basically, from this POV, the market expects longterm growth from here to basically be zero; I think this is overly pessimistic and, again, not considering the possibility of Cobre Panama ever reopening. (Note that for the preceding ten years from 2008 to 2018, right before Cobre deliveries started being received in late 2019, FNV’s CFFO/sh CAGR was 8.86%).

The question(s) to ask when looking at if this much lower implied long-term growth rate is justified is: “Has anything about FNV’s business fundamentally changed?” and/or “is Cobre never re-opening?” I think the answer in either case is no.

(Then again, maybe an implied terminal/perpetual growth rate of near zero is totally justified for a business like FNV that relies on making continual investments in what are ultimately —even factoring in the call optionality of new resource discoveries at a given location— depleting assets (ie. mining royalties and streams) and the limit).

.

(There’s still some unknowns and, while I think the existing price is already fair, who knows how the market will react if the mine closure continues on and pushes FQM into a solvency crisis. There’s is also of course the issue of how gold prices are going to move, but I’m not even going to try to make any kind of prediction on that and will assume they remain relatively stable around current prices.) 64 65

Closing

Some other thoughts when looking at the Cobre issue:

The mine closure may present an opportunity for FNV to get a better deal with FQM if they come under enough financial stress while they work to get the mine operating again. I wonder if FQM’s capital issues due to the closure present an opportunity for FNV to provide some level of additional financing in exchange for a better royalty deal.

“Cobre Panama is a key asset to the company accounting for around 50% of FQM's EBITDA and 45% of its copper production in 2022. […] Fitch estimates a cash position of USD1.1 billion at end-2023 and EBITDA of USD1.9 million in 2024, which we believe will be sufficient to cover all capex, interest payments and maturities due in 2024. However, Fitch believes FQM will not have sufficient liquidity to repay its USD1.05 billion bond ahead of its due date in April 2025, without obtaining refinancing in some form, even after budget trimming and potential equity stake disposals.” 66

“Challenges, she [BMO analyst Jackie Przybylowski] added, would arise if Cobre Panama remained halted for 80 days in 2024 [March 21, 2024], as this would draw First Quantum’s cash down to zero at the bank’s current commodity and cash outflow assumptions. […] The primary goal of the government and courts today appears to be calming the protests […] We are optimistic that this approach will be successful, and that protests around the Cobre Panama port will subside, with mining operations likely to resume relatively quickly if protests are lifted.” 67

“Franco-Nevada (Barbados) Corporation, a subsidiary of Franco-Nevada, contributed a total of $1.36 billion to the construction of Cobre Panama.”, https://franco-nevada.relayto.com/e/2023-asset-handbook-fokmo6c7tstte

Does FNV have a claim to any kind of reimbursement for their contribution towards Cobre’s development from the stream deals if the mine is ultimately closed? 68 I wonder if the government-ordered shut down falls within the Force Majeure considerations of the termination section (article 6.2) of the original Cobre stream purchase agreement (where their definition of Force Majeure is redacted) and how that affects the “Repayment of Payment Deposit” article (6.3) of the agreement. I’d look at articles “3.1 Payment Deposit” and “11 Seller events of default” for info on the situation of a possible default of FQM, as well as articles 2.4 and 2.5 re. Uncredited Balance.

“People seem to think that the supreme court decision will be the end of the matter, but it won't... Panama's exposure in international arbitration is massive [..] The country’s mining chamber head Zorel Morales set at a minimum $50 billion what the country would pay if it loses arbitration…” 69. Would FNV have a senior claim on that $50bn to get their $1bn deposit back from MPSA/FQM?

From the stream purchase agreement: “Subject to Section 12.2, if by the expiry of the Initial Term or earlier termination of this Agreement, the Seller has not sold and delivered to the Purchaser an amount of Refined Gold or Refined Silver sufficient to reduce the Uncredited Balance to nil, then the Seller shall pay such Uncredited Balance to the Purchaser within 30 days after the termination date, and shall provide a detailed calculation of the Uncredited Balance.”

Under the expropriation article (8.12) of the streaming agreement “Inmet Parties shall deliver to the Purchaser [Franco Nevada] the Purchaser’s proportionate share of any compensation received by the Seller or any of the Inmet Parties for such Expropriation within 30 days after receipt of such compensation by the Seller or any of the Inmet Parties, [Calculation and process provisions redacted].” (https://www.sec.gov/Archives/edgar/data/1456346/000110465912061432/a12-19631_1ex99d2.htm, article 8.12)

********** UPDATE 20240210: From FNV investor relations to a question I had asked about the possibility of FQM/ MPSA going bankrupt: “Franco-Nevada’s interest in Cobre Panama is secured by a pledge of the entity shares which owns Cobre Panama (MPSA). If First Quantum went bankrupt Franco-Nevada would have first right over the assets within that company.” This seems to be corroborated by the initial press release and purchase agreement between FNV and Inmet (before it was acquired by FQM). **********

What happens to FNV’s streaming deal if FQM is taken over by Barrick Gold? “The crisis has drawn attention from rival Barrick Gold Corp., which Bloomberg reported earlier this month has approached some of First Quantum’s top shareholders to gauge support for a potential takeover.” 70. Articles 8.8 and 8.9 of the original FNV Cobre agreement seem to indicate that Inmet cannot transfer the Cobre mine project without FNV’s approval and or alter the MPSA’s shareholder agreement in any way that affects FNV’s royalty stream. (I’m mostly looking at articles 8.8(d), 8.8(e), and 8.9(f)).

It’s possible that it’s better for the stream to be halted now and that gold remain buried, while geopolitical events continue apace and possibly raise gold prices, so FNV’s stream of precious metals can sell (be be credited) at even higher prices later.

There is the possibility that the price of gold rises in the intervening time while the Cobre situation is worked out, thus making FNV’s Cobre Panama stream all the more valuable when the mine does eventually resume operations. FNV is missing out revenues from the mine closure, but it isn’t bleeding out servicing any liabilities like FQM is and can stand to wait around. Meanwhile, FQM has enough liquidity to make it to at least through Q1 2025 71.

They say gold is more a hedge for political chaos than for inflation and elevated levels of political chaos seem to be well in the cards for the future…

… and 2024 also happens to be an election year for the world’s primary (arguably only) superpower.

.

Potential outcomes:

Cobre Panama remains closed indefinitely beyond 2024, in which case you’re simply paying fair value at today’s prices.

“Lawyers contacted by mining.com said both the Panamanian government and First Quantum are now in a “tricky spot” since Cortizo’s administration passed a bill on Nov. 2 banning all new mining concessions and extensions. That could prevent the two parties from negotiating a new deal.” 72

IMO, some way, some how, a deal with be renegotiated with FMQ with tweaks to deal with all stakeholders and operations will resume. Copper ore accounts for 75% of Panama’s exports and Cobre Panama accounted for 5% of GDP which I think will incentivize FMQ and the government to seek a compromise 73. Whatever the compromise for FQM, I don’t see it affecting FNV’s streaming deal —as the renegotiated concession agreement with FQM and the Panama government in March 2023 did not affect FNV’s deal with FQM either.

“People seem to think that the supreme court decision will be the end of the matter, but it won't... Panama's exposure in international arbitration is massive [..] The country’s mining chamber head Zorel Morales set at a minimum $50 billion what the country would pay if it loses arbitration, and said uncertainty around First Quantum's project could also spook investors. J.P Morgan warned this month that the odds of Panama losing its investment-grade rating would rise significantly if the contract is revoked.” (https://www.usnews.com/news/world/articles/2023-11-26/panama-protesters-attack-workers-of-canadas-first-quantum-mine-union)

The need for the revenues that the Cobre mine brings in for the Panama government is also likely emphasized by the issues with Panama’s other largest single source of government revenues, the Panama Canal. 74

Ongoing uncertainty could persist until Panama's elections in May 2024. The mining contract will be a key issue political issue until then. 75

First Quantum could seek compensation for Cobre’s closure based on commercial treaties between Panama and Canada? The company spent about $10 billion developing the Cobre mine, which had accounted for almost half the company’s revenue. I’d expect FNV to at least get back their ~$1bn deposit from FQM that went towards Cobre’s construction. 76 “When does Cobre really ‘count’ as being officially ‘permanently shut down’?” is something that I think is going to be something to consider here re. the purchase agreement with FNV and FQM/MPSA —this will likely be something determinable when/if the Panamanian government releases an official closure plan in June 2024. 77

.

Dates of interest:

February 24, 2024: This is 90 days after First Quantum sent Panamanian authorities a notification of intent to start international arbitration proceedings on November 26, 2023, which were “a formality required by international treaties, with the purpose of opening a dialogue period of at least 90 days between the parties.” 78

May 2024, Panama elections; after which there may be greater possibility for renegotiation between FQM and the new government if Cobre mine is still closed after this time. 79

June 2024: This is ostensibly the expected date for the Panama government to present a formal closure plan for Cobre. 80

FQM debt due April 2025 81

Catalysts

Positive resolution on Cobre Panama mine by 1H2024

Not so much a catalyst, but something that could be interesting to keep an eye on, would be how FQM and the Panamanian government deals with the SUNTRACS union elements of the on-going protests.

A renewed global interest/demand in/for natural resource projects and securing raw materials as a part of the global reconfiguration taking place should increase precious metals byproduct stream deal flow for FNV as more copper projects seek various forms of funding. Gold and silver is a common byproduct of copper mining, so a global elevation in demand for funding and securing of electrification- and green-technology inputs would simultaneously create more opportunities for FNV (and the others of the ‘big 3’) to acquire streaming royalties. 82

An interesting XTwitter thread on copper from mining billionaire Robert Friedland: https://x.com/robert_ivanhoe/status/1724831201456951648?s=20; https://x.com/robert_ivanhoe/status/1726694831114813796?s=20

Fed pivot raising price of gold as real rates drop (I don’t think the Fed will, but if they did, gold and FNV would benefit).

Higher for longer rates would make debt financing less attractive to mining operators and could drive greater demand for alternative financing source like those provided by royalty companies like FNV in the long-run.

.

Will you get rich quick by buying on this current weakness? Unlikely. Though, I really don’t think you’ll go anywhere near broke either… Well, unless Bitcoin really does end up being the new consensus digital gold all the way up to the Central Banking level or gold bugs of the world revert back to some even more primitive form of money —I own both. (And at some point in the future, we may be mining asteroids and extracting gold from there as well, so there’s that next Spanish Price Revolution to consider 83. There’s also the tail risk of the global warming causing previously-unexplorable terrain to be accessible and surveyed to revealed to have some massive gold deposit that crashed the price of gold.)

Will you be able to get exposure to the gold market with the most profitable business model in the industry with FNV? I definitely think so —and with a free call option on Cobre as well.

(https://en.wikipedia.org/wiki/Rai_stones; Money so safe you can leave it out for public display)

(https://www.ovex.io/blog/behold-the-ancient-stone-money-of-yap/; One of the early iterations of the blockchain. “[T]he physical location of a stone was often not significant: ownership was established by shared agreement and could be transferred even without physical access to the stone. Each large stone had an oral history that included the names of previous owners.”, https://en.wikipedia.org/wiki/Rai_stones#Use_and_value)

(https://www.longtermtrends.net/bitcoin-vs-gold/)

.

I’ve been accumulating shares by averaging in over time since the price hit USD$105/sh (as well as a de minmis amount of portfolio bps on LEAP call options).

“In the case of hard assets, because of the optionality and the fact that you get the cash flow as a shareholder, you should always be buying them —unless the asset trades at some excessively elevated valuation. We’re buying a little bit every single day because we’re not going to pick the high point and low point. There are just too many variables involved. When you trade securities and you think that you know what the high point and low point is, bear in mind that there are 253 trading days in the year and only one high price for the year and only one low price for the year. Who knows what day that’s going to be reached? You’ve got a 1 out of 253 shot of being right and I don’t like those odds. Therefore, I basically buy every day. On the days when the price is really low, the cash that we spend has a lot more purchasing power. Over time—say it’s a form of dollar averaging—you get the harmonic mean price and it’s usually a good deal.” —- Murray Stahl

.

.

Random ramblings on gold…

“Value is what people perceive it to be, and nothing more.” ~~~ Michael E. Gerber, “The E-Myth Revisited”

I wonder where gold falls within Maslow’s Hierarchy.

IMO, it would somewhere in the 2nd level from the bottom (security of: property/resources).

.

From the Wheaton Precious Metals 2023Q3 presentation:

(https://s21.q4cdn.com/266470217/files/doc_presentations/2024/Jan/31/24-2-1-february-corporate-presentation-final.pdf; https://www.wheatonpm.com/Investors/presentations/default.aspx)

.

IMO gold is at best a static speculative inflation and political-chaos hedging commodity, but one that has a market historically supported on the back of a global consensus spanning across many different cultures and eras of civilization 84; a global consensus that has show its great Lindy-ness and is still engaged in today by individual investors all the way up to the level of world’s central banks 85.

I find Warren Buffett’s thoughts on gold vs productive assets (from Berkshire’s 2011 annual letter) pretty convincing in this debate:

“Ideally, these assets should have the ability in inflationary times to deliver output that will retain its purchasing-power value while requiring a minimum of new capital investment. Farms, real estate, and many businesses such as Coca-Cola, IBM and our own See’s Candy meet that double-barreled test. Certain other companies — think of our regulated utilities, for example — fail it because inflation places heavy capital requirements on them. To earn more, their owners must invest more. Even so, these investments will remain superior to nonproductive or currency-based assets. Whether the currency a century from now is based on gold, seashells, shark teeth, or a piece of paper (as today), people will be willing to exchange a couple of minutes of their daily labor for a Coca-Cola or some See’s peanut brittle. In the future the U.S. population will move more goods, consume more food, and require more living space than it does now. People will forever exchange what they produce for what others produce.” ~~~ https://www.berkshirehathaway.com/letters/2011ltr.pdf

At the very least, one could look at gold like another form of currency that competes with any other. It’s a currency that lacks an interest rate (which might not be so bad when real rates on other currencies are negative), but also one that has no central controls over its supply —currently being generally fixed/capped with regards to the total naturally occurring supply on earth— and its transmission.

If you’re thinking this sounds a lot like Bitcoin —or its aspirations— I say: Yeah, kinda.

“The paintings that he sold became more than just paintings —they were fetish objects, their value increased by their rarity. […] He watched their doubts about the prices of the art evolving into more acute doubts about whether he would let them buy it.” ~~~ from Robert Greene’s “48 Laws of Power” and S. N. Behrman’s “The Days of Duveen” (after listening to David Senra’s “Founder’s”)

.

“To me, it’s a dispute with no purpose, because gold can never be a substitute for bitcoin, and bitcoin can never be a substitute for gold. You could say that they’re both stores of value. I think that’s fair. But they are stores of value for entirely different contingencies.

For example, if you’re worried about conventional inflation, no matter what rate you forecast, I think crypto is superior to gold. The reason is that if gold prices rise to a certain level and the technology of mining gold improves, theoretically, it’s possible to extract more gold, and history certainly confirms that behavior. If gold is used as a form of money, you could actually get a form of debasement with gold, even though it’s not through a centralized authority.

In classical inflation, cryptocurrency—perhaps bitcoin—is the winner. However, gold is also a store of value in an entirely different contingency. Let’s say we had a situation in the world akin to the Second World War—some type global conflict. Cryptocurrency is dependent upon the internet. The internet can’t exist without telecommunications cooperation among all the countries in the world. If you really believed there was something analogous to World War II happening, how would you be able to move your currency? You wouldn’t be able to do it. Gold had the faculty that you could hide it, you could disguise it, you could bury it. In the necessary circumstances, you could move it to a neutral country like Switzerland, for example. If you believed there was going to be some serious political unrest in the world, I wouldn’t recommend buying cryptocurrency; I’d recommend you buy gold.

We don’t know if we’ll have classical inflation, or whether we will just have continual debasement at the current rate. We don’t know if we’ll have a serious political problem or not. Logically, you want to prepare for all contingencies and, therefore, I would say gold is complementary to bitcoin, and bitcoin is complementary to gold. It’s not either-or.” ~~~ Murray Stahl, https://www.frmocorp.com/_content/letters/2019_FRMO_Transcript.pdf

********** UPDATE 20241219: On the complementary nature of gold vs Bitcoin, I was recently reading a paper examining Bitcoin as an inflation hedge (https://pmc.ncbi.nlm.nih.gov/articles/PMC8995501/#abs0002). One of the things they look at is Bitcoin price vs gold price impulses in response to positive shocks in various other macro variables from 2010 to the end of 2020. What we see is that Bitcoin and gold act nearly exactly opposite in response to these various variable shocks, with Bitcoin acting as a hedge against expected- and realized-inflation shocks (latter not shown in the chart below) and gold (implicitly) acting as a hedge against the general market shocks and volatility spikes (and being less affected than Bitcoin by rate shocks).

(The x-axis is in increments of weeks after a positive shock of 1 stdev. in a single week in the given variable and y-axis is the cumulative percent movement in Bitcoin and gold price over time after that initial shock; value of 0.01 represents a 1% change in price; the yellow 90%-confidence-bands are based on running multiple simulations of the model and taking the 5th and 95th percentile results of the smallest and largest values to trace the bands).

Note that the paper uses a vector auto-regression model to generate these impulse lines and bands, yet does not present any kind of goodness-of-fit information about the model itself, so who know how much confidence can really be put into the relationships being shown here; I’m not that well versed in statistical analysis, but I’m pretty sure there is nothing stopping them from, or obviating the usefulness of them, doing this (eg. a simple R-squared scoring). The paper provides various robustness checks in the appendix attachment to show that the results are consistent across different configurations of the model, but this doesn’t necessarily mean the model fits the data well. Eg. the VAR can give internally consistent results across configurations, yet fail to be capturing the actual relationships in the data. In any case, we also see that the Bitcoin-vs-Rates and Gold-vs-Inflation 90%-confidence-bands cross from negative to positive, so even more so it’s hard to have confidence in any correlation or anti-correlation of those relationships. **********

.

On gold as a hedge against some Doomsday apocalypse scenario, I think it might be better to study the Soviet revolution, the USSR Perestroika period, and decaying/post-USSR mafia state for a more realistic case studies of societal breakdown and how onw could navigate that. Perhaps some basic research on the various countries that offer citizenship through birthright or businesses investment (eg. Brazil or Sweden) would be useful.

.

Some interesting writings on gold:

https://horizonkinetics.com/app/uploads/INFL-Semi-Annual-Letter-2023_APPROVED.pdf (see “Surprise 5 – Precious Metals”);

https://web.archive.org/web/20220410163031/https://static1.squarespace.com/static/5eff6e898853fb43f159bd0f/t/5f0fc95af4baae4ad468e43e/1594870107759/Micro+Cap+%26+OTC+Stock+Letter+April+2020+vFINAL.pdf (see “Macro Thoughts” and “Portfolio Construction & Tracking the Performance of Ideas Discussed Here”)

.

If your reading an article on FNV, I assume you also have some passing interest in TPL, Texas Pacific Land Corp. I’m a fan of Murray Stahl, founder of Horizon Kinetics which also wons 20% of the oil royalty company. It shouldn’t be much of a surprise then that I also keep loose track of Pierre Lassonde’s gold pure/streaming royalty company. I’ve written about the similarities between Stahl and Lassonde in an old post here.

Post update 20240308:

FNV just released their 2023Q4 numbers (https://www.sec.gov/Archives/edgar/data/1456346/000155837024002504/0001558370-24-002504-index.html) and included mention that they were pursuing arbitration with the Panama government for damages associated with the ordered shutdown of Cobre Panama. “We are pursuing legal avenues to protect our investment in Cobre Panama. We have notified the Ministry of Commerce and Industries of Panama (“MICI”) of our intent to initiate arbitration pursuant to the Canada-Panama Free Trade Agreement. As announced to MICI, Franco-Nevada presently and preliminarily estimates its damages to be at least $5 billion, subject to further analysis and development.” Note that FNV’s total dollar investment towards Cobre was about $1bn (https://franco-nevada.relayto.com/e/2023-asset-handbook-fokmo6c7tstte), so this would represent a 5x return on their investment if they were awarded this preliminary amount —of course, the payout schedule would affect the exact IRR here. Also note that despite the Cobre setback, FNV is guiding for total GEO (gold equivalent ounces) sales in the 480,000-540,000 range (which is about in-line with 2023 results, which itself was above the starting-year 2023 guidance numbers despite the unexpected shutdown at Cobre near the end of that year). (See https://www.sec.gov/Archives/edgar/data/1456346/000155837023003927/0001558370-23-003927-index.html; https://www.sec.gov/Archives/edgar/data/1456346/000155837024002504/0001558370-24-002504-index.html)

Also, something I generally like to do when looking at businesses is to look at the executive compensation breakdowns and look at how concrete/comprehensible and relevant-to-fundamentals or -FCF-drivers they are, but didn’t really think to do that when initially writing this post as it didn’t really seem relevant to the main thesis for the investment at the time, but you can see the most recent disclosures on this here: https://www.sec.gov/Archives/edgar/data/1456346/000155837024004211/fnv-20240328xex99d1.htm#STATEMENTOFEXECUTIVECOMPENSATION_445869

Post update 20240401:

Given the recent run-up in gold prices, I thought this video from Jeff Snider was interesting.

Many people find his deflation warnings to be a broken clock at this point (that, so far as I’ve tracked it, hasn’t been right since it broke), but I appreciate his knowledge of the banking system and the way he supports his hypotheses with empirical data. This sets him apart from some other macroeconomics commentators who more heavily rely on insinuations or, at the very least, fail to provide sources for their claims and interpretations of events. (Though he often fails to mention base rates when talking about changes in various data series, which makes the weight of some of the observations he brings up more ambiguous and is really just a big pet peeve of mine). Also related: https://wolfstreet.com/2024/04/01/office-cre-mess-keeps-getting-worse-the-massive-repricing-underway/

Post update 20240716:

Since the time I originally wrote this article in the beginning of 2024, FNV stock has gone up 24% from $105/sh to $131/sh, right about where I had initially valued the business. However, this rise was primarily due to the rise in gold prices (20%); the FNV/gold sh/oz ratio of how many shares of FNV (essentially just a big vault of gold stored underground) an oz of gold could buy you is still the same as when I originally wrote this post, at 18x.

Rate cuts, expected later this year, could further boost gold prices and FNV’s stock in kind (https://www.axios.com/2024/07/11/rate-cut-expectations-spike; https://seekingalpha.com/news/4124828-gold-settles-at-all-time-highs-citi-sees-potential-for-continued-gains-to-3000). Note that the Fed Funds Rate has been 5.33% this whole year and yet the CME FedWatch tool shows that the cumulative probability predictions (https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html) for any kind of rate cut by now started the year much more optimistic before capitulating, so continued disappointment would not be a surprising outcome as we approach September.

Interestingly, if rates remain at current levels or rise further, it would make royalty/streaming companies like FNV even more attractive to miners as a source of financing whereas debt would become more expensive and equity financing even less effective as markets price higher discount rates into their DCFs. As FNV CEO mentioned in a FY2023Q2 earnings call: “For many operators and developers, royalty and stream financing is currently the lowest cost of available capital with high rates, debt financing is expensive, and there's little depth in the market for new issue gold equity.”

*As another side note on the subject of rates, gold and real rates historically tend to move inversely to each other (https://www.longtermtrends.net/gold-vs-real-yields/)…

(Gold vs Real yields (inverted))

(Note that the apparent matching of curves in this image by shifting and/or scaling axes does not *necessarily* indicate that, for example, inverse real rates could be used to create a well-fitting linear regression curve against gold prices; IDK where I’d get the data to do this at the moment. Also note that this latter chart does not imply that gold and rates are at risk to snap back or revert, as the chart is showing historical correlation of *movements* rather than, say, historical parity of *values* —unless a linear regression model did indeed show that inverse real rates significantly predicted gold prices, then maybe you could make a mean-reversion case about the recent divergence if it could be explained by factors that were mostly temporary (though it would be based on the hypothetical regression line, not the line in this chart).)

… yet, currently, real rates and gold price have risen in tandem since March of 2022. One could say that this was due to the Russian invasion of Ukraine that caused geopolitical volatility (for which gold is historically seen as a safe-haven / beneficiary asset against), while also greatly raising inflation (re. energy, metals, and raw materials from Russia and grain and fertilizer from Ukraine) that in turned spurred a reaction from the Fed to begin rate hikes. It could also be the case that correlation breakaway in gold prices is indicating bearishness on real rates by central banks —either due to easing inflation or, more concerning, a move to deflation caused by economic weakness.

Adjusting my original Cobre-reopening-contingent price target to account for this year’s rise in gold prices would put it at a target of $156/sh (=135x1.20). This is assuming gold prices remain the same, which is a rather important caveat, but my cost basis is in the $105/sh area (I’ve not bought more shares just because my PT moved up, in this case).

Panama’s new President, Jose Raul Mulino, was elected in May and was sworn into office on July 1. Unlike other candidates, Mulino has been seen as less adversarial to the Cobre project and his election has been interpreted as a positive sign towards the possible reopening of the mine (https://www.reuters.com/markets/commodities/first-quantum-seek-dialogue-with-new-administration-panama-over-cobre-panama-2024-05-06/; https://archive.ph/JZBMY). Both the Panama government and First Quantum have strong economic incentives to come to the negotiating table here and I think some kind of settlement will be negotiated within, say, 12 months or before the end of 2025.

Post update 20240804:

Well, looks like any re-opening for operations is not going to be this year; there go my call options. https://www.reuters.com/markets/commodities/first-quantum-minerals-jumps-6-panama-plans-mine-environmental-audit-2024-07-02/; https://www.mining.com/web/panama-vows-to-talk-to-first-quantum-in-coming-months-on-shuttered-mine/; https://www.reuters.com/markets/commodities/first-quantum-ceo-does-not-see-cobre-panama-mine-re-opening-this-year-2024-07-24/; https://www.reuters.com/markets/commodities/first-quantum-copper-mine-not-government-agenda-this-year-panamas-mulino-says-2024-07-25/

Post update 20241126:

In a recent interview (https://www.mining.com/panamas-president-blames-previous-govt-for-first-quantum-mine-crisis/), the new Panamanian President seems to be positioning for a political justification for a re-opening of the Cobre mine in 2025.

He frames the mine closure as a result of political incompetence of the previous admin rather than fundamental issues with the mine (claiming that “[t]he mine paid the price for accumulated national discontent”), which could set the stage for revisiting the decision.

In the same interview, he also highlights the issues with balancing Panama’s social security funding (https://latinoamerica21.com/en/informality-after-the-social-security-reform-in-panama/) —which would obviously benefit from a re-opening of the mine, which was 5% of Panama’s GDP, the largest single contributor in the country just behind the Panama canal.

The President is promising an international audit of the mine (ie. conducted by experts that may be less influenced by Panamanian social sentiment) that could provide the social proof to address public concerns around the extent of Cobre's environmental impact.

If this plays out as expected and Cobre is re-opened, I’d wager that FNV hits $155 by end of 2025 is not too crazy given current gold prices for a present CAGR of around 26%.

Post update 20250220: