($FRMO) FRMO Corp: A uniquely managed OTC jockey-stock hedged for inflation and with incoming catalysts

Fair value for a great company with some baked in options

Note: I initially wrote this post as a shortened version of a longer-form post on the same stock (which I have still updated from time to time) when I was initially playing with the idea of posting to the website Seeking Alpha. While I really appreciated the free and helpful editorializing process that came with that, I found the editing UI to be hard to work with and also wanted the freedom to write a bit leaning towards the for-myself vs for-others end of the spectrum, so ultimately decided to continue writing on this substack instead. The long-form post can be found here:

($FRMO) FRMO Corp: A uniquely managed OTC jockey-stock hedged for inflation and with incoming catalysts

Table of Contents Quick Pitch Ready for what the indexes aren’t Management Asset breakdown Upcoming events Risks Conclusion Quick Pitch "One reason some people no longer resist the idea of inflation is because they’re hearing about it in the news. Others have begun to notice it in their daily li…

Management is well reputed, transparent, and aligned with shareholders, owning ~32% of the company w/out taking a salary.

New non-independent board members being added for the first time ever signals potential for significant changes / enhanced value creation.

Big bets on inflation + crypto (of which they were one of the early "institutional" adopters) w/ plans to spin out and expand their crypto mining operation. The new board members should help accelerate this.

Presently a Pink Current OTC stock, but mgmt is planning on up-listing (eventually). The new board members should help accelerate this.

P/TBV currently slightly above mean, but — as a bet on non-transitory inflation and crypto (eventual) supremacy — fairly valued may be an acceptable entry price for this owner-operator stock making moves.

Overview

Quick pitch

FRMO Corp is a relatively unknown / underfollowed investment holding company owned and operated two very smart value investors (Horizon Kinetics (HK) founders — of TPL fame — Murray Stahl and Steve Bregman (S&B)1) whose ownership structure in the company aligns them well with shareholders. They were one of the early "institutional" adopters of bitcoin (back in 2015) and have been warning about — and positioning for — (energy) inflation since before it was cool. You can look at the active share of any of their managed mutual funds to see that they are certainly not following the crowd. They recently expanded their BoD with new non-independent members (which I don't recall they have ever done before) and have announced the intent to spin off their crypto mining operations with plans for expansion as well as the potential of (an eventual) up-listing to a major exchange.

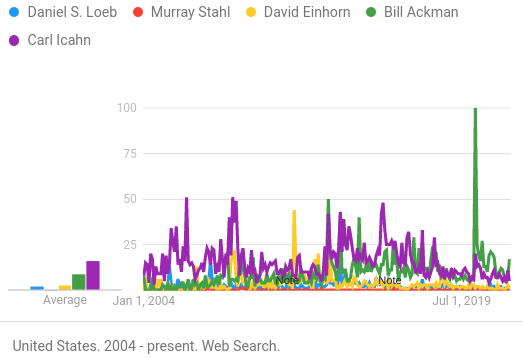

Here is how little attention people are are paying Stahl (the red line hugging the very bottom of the graph is relative search interest in FRMO’s founder vs other better-known holdCo and reinsurance investors)…

… vs how well the market treats Murray Stahl (here, in relation to the various other investor reinsurance companies and holdCos)

5yr CAGR

FRMO (Stahl / Bregman): 20%

IEP (Ichan): -1.6%

TPOU.L (Loeb): 16.2%

GLRE (Einhorn): -20.3%

PSH.L (Ackman): 16.8%

BRK.A (Buffett / Munger): 12.6%

SPY (Reddit / grandma / The Fed / me): 16.2%

10yr CAGR

FRMO: 17%

IEP: 4.3%

TPOU.L: 11.5%

GLRE: 10.4%

PSH.L: 2.9% (7yr CAGR)

BRK.A: 14.4%

SPY: 15%

17yr CAGR (was as far as the data on the site I was using would go)

FRMO: 11.2%

IEP: 4.4%

TPOU.L: 8.3% (14yr CAGR)

GLRE: -7.8% (14yr CAGR)

NA

BRK.A: 9.9%

SPY: 8.5%

As a bet on inflation, FRMO offers returns that beat or meet the market w/ much lower correlation than any category indexes while also hedging against all the other economic paradigms that the market is not positioned for. Overall, while fairly valued relative to historical P/TBV (well w/in 1 stdev from the mean), if you are going to bet on inflation remaining more than transitory (and for crypto to continue it's extreme and conviction-testing rise), fairly-valued may end up being an acceptable entry price to have that allocation stewarded by these unique, owner-operators planning some value accretive moves.

*UPDATE 20221117: We can also use HK’s headline mutual fund, the Paradigm Fund, as another proxy for Stahl’s investing outperformance vs the stock market over the longrun:

Management

Since it’s founding in 2001, FRMO’s management have owned ~32% of the company (16% each held by Stahl and Bregman) and this stake — at least from past comments regarding Stahl’s stake around 2012 — represents roughly 20+% of their personal net worth. Furthermore, S&B take no salary or other form of compensation apart from the returns to their equity stake — riding in the same boat as the rest of FRMO common shareholders with not management fees, stock options, performance bonuses, etc.

Finally, management intends to hold this investment for the long haul. In past shareholder meetings, Stahl has stated that he intends to hold his shares until he dies at which point they would go to his children to run a charitable family foundation —the liquidity of shares being one of the main reasons Stahl has mentioned for running FRMO as a publicly tradable company in the first place. IMO, shareholders getting the same capital allocation thoughtfulness as if the Chairman/CEO were running the operation for their own children — which in this case, he really is — is a pretty good setup2.

*UPDATE 20220909: From the 2022 annual shareholder meeting proxy (https://materials.proxyvote.com/Approved/30262F/20220725/NPS_514395.PDF)…

… we can see that ~75% of the company shares are owned by the officers and directors of the company, themselves — making it more likely that the shares will trade based on the underlying value of the business in the medium/long-term vs trading on systematic risks as aggregated and commodified securities in general with the rest of the highly index-controlled market.

Ready for what the indexes aren’t

Here are the past 5 and 10 year 12-month rolling correlations between some of the major category ETFs vs the S&P 500 vs a Horizon Kinetics mutual fund KMKNX (the one which I believe is most like the Polestar and Multi-Strategy LPs that make up ~50% of FRMO’s TBV — based on past comments by Stahl — as well as having a more similar makeup to FRMO itself when considering their ownership of TPL via Horizon Kinetics Hard Assets (FRMO’s OTC price was not available in the data on this site)):

Notice that all of the major category ETFs (ex. EEM) are nearly 90-100% correlated to the index (including both value and growth ETFs, interestingly), while the HK fund was about as correlated as the emerging markets fund though at a far greater return — matching or beating the S&P. So we see FRMO management providing the most non-correlated performance that can match or beat the market (and unlike the Kinetics fund unitholders here, FRMO shareholders get this management for free).

Furthermore, FRMO is positioned for the segments of the economic quads that the broad market and — by extension, as we’ve just seen — all of the other category indexes (which are invested mostly in the deflation+growth paradigm) are not ready for.

Inflation+Growth

$TPL (44% of TBV)

TPL has been a concentrated holding of FRMO’s for a long time and Murray Stahl’s involvement dates back to the mid 80s (and HK first started accumulating shares in the mid 90s). He also now sits on the board of directors after fighting his way on in 2019 and pushing for TPL’s conversion from a trust to a C-corp (you can see about when this started happening by the large uptick in the graph below near the beginning of 2021). It’s a large O&G royalty streamer in Texas that fits into Horizon’s “hard asset“ inflation beneficiaries theme of companies that benefit from increased dollar costs while not themselves getting hit on the other side by capex inflation. Below are the returns of TPL vs other royalty streamers and oil funds over last 10yrs (all of which would have a negative return today if held through the same period (despite the oil crash of 2014, so imagine what it would look like if oil were to actually take off)):

Steve Bregman had a lot of interesting things to say about the current energy inflation situation and TPL (and other “hard assets“) in HK's 3rd Quarter Commentary in 2021 (see “Why can the coming inflation be severe?“ and “Why will the energy price reaction be severe?“) and in 2019.

In terms of things to look for, I mainly sum it up / look at it like this:

Supply constraints

Aggressive ESG policies by Dem. Congress / White House

OPEC+ refusing to release significant reserve supply

Lockdowns (which killed a good number of O&G businesses)

Continued under-investment by O&G industry post-2014 oil bust (exacerbated by increased debt and equity financing difficulties due to ESG trends amoung banks and investors)

Demand pulls

Gov stimulus (eg. the US recently passed the $1.2T infrastructure bill and France recently introduced a fuel subsidy to offset rising costs)

An economic recovery or growth

General fossil fuel demand in-elasticity

Inflation+Contraction

"The reason Bitcoin is successful is that its distribution allows for it to be used as a store of value. It was designed to appreciate in value and to become harder to produce. Therefore, its intrinsic value is supposed to rise. One Bitcoin now is worth roughly $430." — Murray Stahl, https://horizonkinetics.com/app/uploads/December-2015_Cryptocurrencies-An-Emerging-Asset-Class.pdf

$GBTC (15% of TBV)

I've read the commentary by Howard Marks, Murray Stahl (and similarly bullish investing notable Bill Miller who starting buying BTC around the same time as Stahl), and Matt Huang and still cannot fully buy in to either camp, but the asymmetric long term reward/risk of holding bitcoin in a success scenario + the fact that I just find it interesting does seem to merit some kind of allocation (I personally am allocated such that a total zeroing out of FRMO’s GBTC position represents a 2pps VAR for my portfolio).

This is how Stahl (and many other’s Bitcoin bulls nowadays) look at Bitcoin: As a fiat debasement bet without having to be long any side of a particular fiat trading pair; as the best bet on a store of value when/as the world economy falls into the inflation-contraction section of the economic quadrants.

We’re used to saying that bitcoin goes up or bitcoin goes down, and I do it, too. But it’s wrong and I need to remind myself to stop doing it, because bitcoin doesn’t go up and bitcoin doesn’t go down. Everybody should turn the bitcoin charts upside down. If you turn them upside down, what it would show is the value of the dollar in relation to bitcoin. When bitcoin “goes up,” what’s actually happening is the dollar is going down in relation to bitcoin, and the euro is going down in relation to bitcoin, as well as the Swiss franc, as well as sterling, as well as the yen, and so on. Basically, bitcoin is a long-oriented way of shorting fiat currencies. Why do you want to short them? Because, altogether, they are clearly losing purchasing power., https://www.frmocorp.com/_content/letters/2020_Q3_FRMO_Transcript.pdf

Be it as a global Ponzi scheme, digital gold, or the next step in modern finance, I don’t think anyone believes Bitcoin is going to move anywhere near sideways from here on. Murray Stahl thinks BTC has a good shot of reaching $1M per coin or more. In either case, I think that Stahl is going to do a better job at monitoring that outlook — and positioning for it — with a more informed and level head than I would.

Deflation+Contraction

"He thinks of cash differently than conventional investors. He thinks of cash as a call option with no expiration date, an option on every asset class, with no strike price.", (Warren Buffett’s biographer Alice Schroeder)

And then, beside the other securities we own, FRMO has cash, which is a strategic asset, in and of itself. It has the extraordinary feature that its true value or purchasing power is highly elastic; it rises as the prices of other assets decline, because a fixed amount of cash can then buy more of some other asset or business. You’ve got two of possibly the most strategic inflation beneficiary assets you can think of with the bitcoin and the cash. I don’t think you can find another business with those exposures., https://www.frmocorp.com/_content/letters/2020_Q3_FRMO_Transcript.pdf

Cash (20% of TBV)

FRMO has a rather large cash horde and given the currently high state of equity valuations (which Stahl mentions in the 2019 annual letter), I'm comfortable with the amount of dry powder S&B are holding on to right now (though in hindsight it would have been nice if they spent a bit more of it in the depths of 2020 crash (see “Questioner 2“)).

Just as a little experiment, we can play around with what the value of a dollar from that cash horde would be if S&B were to invest it in the future:

Here I assume that the money just sits there for 5 years while discounting at 11% (the 17yr CAGR for FRMO) and then is spent to compound that same 17yr CAGR over the next 5 years. We see that the present value of such a dollar would be worth 3x (so from this POV, the 20% cash holding would contribute a (0.2 x 3) - 0.2 = 40% gain to FRMO's BV and lower the P/BV to ~2.3x). I wouldn't go so far as to actively mentally adjust that into FRMO's TBV, but it's an interesting POV to play around with (in any case, I think 1 FRMO dollar is worth more than 1 dollar (SPAC premiums-to-trust come to mind here)).

Note that because of the concentrations of investments at FRMO, it’s wouldn’t be that hard to manually recreate their current holdings in a portfolio yourself, mind you, but what you can’t recreate their thinking and conviction (would you have bet on TPL in the 80s when Stahl discovered it or bet on Bitcoin back in 2015 when Google Trends shows BTC’s relative interest was at just 3 vs today’s 13x at 40?). Besides, this isn’t an ETF or MF, remember they’re working for free here.

Catalysts

* FRMO holds a lot of small bets that management believes offer worthwhile call options in success mode, but here I’m looking from a event-driven POV.

Consensus Mining

"[...] we have these investments in the various cryptocurrency mining companies. And I'm pleased to report that we are bringing those investment, we're consolidating those LLCs and we're bringing it public. So, there's going to be a public listing and direct listing for what we call or what we will call consensus mining, which is going to be a publicly traded mining company and it's going own a fair amount of cryptocurrency.", FROM's (FRMO) CEO Murray Stahl on Q4 2021 Results - Earnings Call Transcript

https://www.frmocorp.com/_content/10q/FRMO_Corp_Q1_2022.pdf

FRMO recently announced in October that they are going to spin off their crypto mining operation into a public company called Consensus Mining. This intent could have been sniffed out by listening to Stahl's comments on FRMO's crypto mining operations in the recent 2021 annual letter in August:

"The challenge for FRMO is to convert its disparate cryptocurrency exposures into an actual operating company that will be valued on its produced profits and not merely on the basis of the aggregate value of its individual parts. This would be a big change for FRMO, since it would itself become an operating company with actual employees and all of the complexities that actual operations entail.", https://www.frmocorp.com/_content/letters/2021.pdf

The operation is carried on the balance sheet at-cost as $1.4M and makes up just a small amount relative to FRMO’s total assets (which also does not include a breakout of the market value of the various cryptocurrencies mined and held by FRMO). It's a development that's worth mentioning that could be worth $0 or could actually turn out to be something, but we can try to see how the market might value such a spinoff.

Again, the crypto mining assets’ BV doesn’t really amount to much relative to FRMO’s TBV, but we could really bump this up to something meaningful by applying a market multiple to the BV of this line item. As Bregman states in a recent HK commentary regarding cryptocurrency mining companies:

"A price-to-book value multiple would be a more meaningful comparator. Indeed, book value seems to be how investors are pricing these companies. Price relative to property and equipment (P&E), perhaps adjusted to exclude cash and cryptocurrency holdings, might be an even better way, because for some of the miners, book value includes very large intangible assets. On a price/book value basis, the six companies I took a quick look at, including Hive Blockchain Technologies (HIVE), which has a $1.2 billion market cap, trade between 2.0x and 8.4x their June 30th book value. Leaving out the lowest-valued one, Cleanspark, the range is 3.7x to 8.4x. Of course, this is an industry in rapid development and flux, which can distort some of these valuations.", https://horizonkinetics.com/app/uploads/Q3-CVALUE-Review_FINAL-1.pdf

Just applying the adjusted range extremes, we could have a market value of the crypto mining operation of between $5.2M to $11.8M (a 2-6% increase in FRMO’s total TBV).

By the way, from the 4Q2021 earnings transcript, we can also get a view of how much cryptocurrency FRMO directly holds that could be going along with the crypto mining spinoff:

"And here's what we own directly without being the funds. We own 110.4 Bitcoin real Bitcoin; it comes from our mining ownership. Basically, we're always mining, so we're always increasing that. [...] We have mind and we continue to hold 1,060 Litecoin. We have mind and continue to hold 35 Ethereum, and we have mind that continue to hold 661.7 Ethereum Classic. And we have mind and continue to hold 58.9 Zcash. [...] And then Winland Holdings; so, we own, we min[e]d this quantity 39.1 Bitcoin itself. And then there's a separate we acquired through and that through buying up a partnership, we acquired 7.4 Bitcoin, that's why there's sanction there. So, you have to add together 39.1 and 7.4 to get our whole Bitcoin exposure. We owned 14.9 shares of liter coins I should say of Litecoin.", FROM's (FRMO) CEO Murray Stahl on Q4 2021 Results - Earnings Call Transcript

The transcription here is not the best, but the numbers roughly jive with the 2021 annual letter which I believe was released just a few months prior to this shareholder meeting — in Aug 2021 — which shows a cryptocurrency inventory of...

So according to this call, we have…

BTC: 110.4

ETH: 35

Litecoin: 1,060

...and the rest I'm not going to go through the trouble, since Bitcoin and Ethereum are the main attractions here.

Though note that the value of the cryptocurrency held by FRMO is already factored into their B/S under the Equity Securities line (so I don’t think this is really a hidden value that could be re-rated by going along in a spinoff):

Questioner 9

Where on the balance sheet can we see the cryptocurrencies that FRMO has mined? I assume it is in cash and cash equivalents, but I am not sure.

Murray Stahl — Chairman & Chief Executive Officer

Well, to tell you the truth, before this call, I had to ask the accountants, and they had to look it up. […] it had to be booked with the equity securities. That would be logical because GBTC is clearly a security and that’s part of it. So, the answer is that it is booked under Equity securities, at fair value.

https://www.frmocorp.com/_content/letters/2020_Q3_FRMO_Transcript.pdf

But as this is not broken out anywhere in the financials, we can estimate the approximate value of these coin holdings manually given the inventory numbers from the transcript and approximate market values of the various coins:

So that gives us a more encompassing value of FRMO's mining operations as:

Cryptocurrency market value = (110.4x$60000 + 35x$4300 + 1060x$225)

= $7M (~3% of FRMO’s TBV)

(Note I’m using very approximate/rounded market values — as of Nov 16 2021 — for each cryptocurrency here and these values may be very different in just a few weeks)

So at the moment, this spinoff would not seem to really move the needle on FRMO’s TBV, but Stahl comments in the 4Q2021 transcripts that they are planning to use the direct listing to fund expansions of the business (one of the new board members that FRMO recently brought on — Alice Brennan — has extensive experience in M&A). I see this as a "heads I win, tails I don’t lose" kind of situation for them.

Planned Uplisting

The promise of an FRMO uplisting from the pink sheets to a major exchange has been a cause for excitement and disappointment for FRMO shareholders for a few quarters now (search “plans to move from pink sheet“ here)

The added visibility as well as the ability for other institutional buyers (who may otherwise be unable to hold OTC stocks) will surely be a significant tailwind to FRMO's stock price — S&B large ownership stake in the company may be an issue — though just based on historical pattern matching, a stock moving to a higher liquidity exchange tends to either be positive or a non-event — yet another “heads I win, tails I don't lose situation”. Despite the delays in the uplisting, I'm still confident that this is not a matter of if, but when and even more so likely now because of (again)...

New Board Members

In the 4Q2021 meeting, Stahl mentions lack of time and being too busy as a reason for the stalled uplisting. FRMO recently added three new non-independent members to it's BoD (all remaining six are independent) that Stahl plans to offload some work onto. These new board members may help to provide the extra intellectual energy required to manage an FRMO uplisting and in any case signal an increase in activity at FRMO that — just in terms of the never-before rarity of this situation for FRMO and general pattern matching — may present other value-catalyzing events.

Risks

Inflation is indeed transitory (particularly energy / oil price inflation)

US government outlaws crypto or simply regulates it to death

Stahl and/or Bregman leave FRMO; Considering past comments by Stahl at shareholder meetings, the only way this would likely happen is in a body bag

(A note on uplisting: I mentioned uplisting as a possible value catalyst, earlier. However, one thing that I have to make note of is that FRMO currently trades a ~3x premium to TBV. It could be argued that this is because there is a lot of baked-in optionality on top of that TBV as well as certain assets being held at-cost on FRMO's B/S (eg. the unrecognized value of FRMO’s crypto mining operations), but in any case it should be pointed out that other, more well known, investment holding companies like Pershing, Greenlight, Third Point, and Berkshire all trade at around closer to 1x TBV). Though I’d also point out that IEP — whose price action has historically been the most similar to that of FRMO the best out of the other holdCos mentioned here — does trade at an abnormal premium to book value).

Conclusion

"It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.", Warren Buffett

So we have management that…

Relatively unknown due to FRMO’s OTC status

Collectively owns 32% of the stock

W/ an ownership stake that represents a significant percentage of management’s net worth

Takes no salary or new shares

Intends to hold over a generational time horizon

(and was one of the first to bet on cryptocurrency)

… running a portfolio that is…

The non-correlated to the market vs all category indexes, while still matching or beating its returns

Allocated towards inflation for both economic expansion and contraction

… that recently added new board members which will directly benefit the company’s plans for…

Spinning off their cryptocurrency mining operations as a direct listing to fund further expansion

Uplisting FRMO from OTC Markets to a major exchange

Perhaps the inflation we are seeing now is truly transitory as the Fed claims and the bond markets are signaling rightly about the transitory nature of the inflation affects of QE or maybe this time is different and supply chain woes will last longer than ivory tower economists are expecting (still fighting the previous war of demand-pull inflation while to today is about cost-push) and the oil industry's long under-investment in new development and infrastructure after the oil crash in 2014 is finally coming to bite everyone in the butt and that ESG really does mean that "energy stops growing".

I think both outlooks are still pretty plausible right now and really don't know which narrative is going to be the future that will happen, but I think as far as being a trustworthy steward for a portfolio’s inflation allocation, FRMO is a smartly inflation-hedged holdCo that is managed by some very smart independent thinkers that have a proven track record of apt investments with a focus on the longterm time horizon and are well aligned with shareholder interests (FRMO essentially get's S&B's intellectual capital output for free given that they take no compensation beyond the value creation on their own large equity stakes). And, while currently trading around mean historical P/TBV, they have some potentially catalyzing events coming up and averaging into this position could prove cheap in hindsight even at its historically-average multiple.

HK founder Peter Doyle is also a significant holder of FRMO stock, but is not have an active role at FRMO to my knowledge.

UPDATE 20220909:

From the 2022 annual shareholder meeting proxy (https://materials.proxyvote.com/Approved/30262F/20220725/NPS_514395.PDF)

The section on management in the previous post on FRMO goes into the exact quotes and reference link a bit more.