($FRMO) FRMO Corp: The 2022 Crypto Winter and FRMO's vertically modular crypto conglomerate

If you're going to be outside the system, be outside the system

********** UPDATE 20231225: Some updated thoughts on the value of Winland Holdings (WELX) which is now at around $3.10/sh…

So let's say WELX has a total look-through ownership of 135BTC (75BTC on the B/S + the Mt.Gox claims that I assume is 60BTC) and that number is always slowly rising. At $45K market BTC price, that's $6.075MM; a bit less than 1/2 of WELX's $14.65MM marketcap (w/ $8.575MM remaining). Minus the ~$800K in cash, we get $7.775MM.

We can then look at the total inventory of mining rigs they operate (https://www.otcmarkets.com/otcapi/company/financial-report/385147/content) [w/ current (replacement) costs from googling the various machines]: “Winland Mining is the Company’s cryptocurrency mining business and currently operates approximately 195 Bitmain S19 95 TH/S [$1,295.00], 29 Canaan Avalon Miner 1246 90 TH/S [$720.00], 32 Bitmain S19 XP (average 140 TH/S) [$3,499.00], and 50 Bitmain S19 XP 141 TH/S [$3,600.00] cryptocurrency miners.” This totals to: (195*$1,295.00) + (29*$720.00) + (32*$3,499.00) + (50*$3,600.00) = $565,373.00; there's other misc equipment, but relatively small BV amount.

One way to value BTC mining companies —as has Bregman in past HK commentaries— is as a multiple of BV. Say, because I like HK and Bregman as management, we assign a 4x P/BV to this part of the business, so the mining biz is valued at ($565,373.00 * 4 =) $2,261,492. This market multiple is likely going to be some kind of function of BTC’s price momentum, IMO; Riot Platforms Inc’s P/B multiple is presently around 2.6x.

So w/ operating rigs, BTC, and cash, now we have $2.262MM + $6.075MM + $0.800MM = $9.137MM; ($14.65MM-$9.137MM=)$5.513MM of WELX's marketcap remaining unaccounted for.

Assuming Winland Electronics is the only part of the biz that actually brings in USD (everything else being mining and distressed crypto debt/claims investing), we'd have to see if that is worth the remaining ~$5.5MM in marketcap.

Revenue run-rate using last Q filing is ($1.157MM * 4 =) $4.628MM, so one would have to assign something like a (5.5/4.6~=) 1.2x P/S on the server/equipment monitoring business. Not too crazy IMO.

Let's say I give sales a 2x because, again, I like HK and Bregman as mgmt, so that would put total value of WELX's ongoing mining ops biz, BTC, cash, and Winland Electronics segment at: $2.262MM + $6.075MM + $0.800MM + ($4.628MM * 2) = $18.393MM; a (18.393/14.65−1=) 26% upside to current marketcap.

This amounts to a pretty good margin of safety for the kind of mgmt one is buying into, IMO. Everything else is just going to have to come from the optionality of BTC price appreciation (though one could argue that that is already be baked into the market BTC price to a degree).

Looking at EPS from the P&S business, rather than the revenue, closes this discount quite a bit, but still results in a slight margin of safety:

Thoughts on this POV? Left a lot of my math in so that anyone check it in case I messed something up (I'm typing this as Christmas music et al is going on right outside the room I'm in). Anyone know who Winland’s “major customers” A and B are?

While WELX provides their mining rig inventory (from which we can look at the hashrate and consumption of each rig type and derive their total hashrate and power consumption (assuming their rigs are run 24/7 in normal power mode)), we do not know their power costs, so it’s hard to project what their current mining profitability and BTC accumulation is going to be.

**********

Trigger warning to “value investors” (and my girlfriend): This post is going to be about Bitcoin.

“When David and Tom would start talking about Bitcoin or something, Greta and I would be like, ‘You’re being such Kens!’” said Robbie, adding she felt the same when the pair chatted about golf.

Ken, of course, is Barbie’s longtime boyfriend who historically has offered little depth or personality, and serves primarily as male eye candy. (The new movie also points to Ken as a symbol of the patriarchy, but a cryptocurrency column is probably not an ideal forum for that particular debate.)

—- https://fortune.com/crypto/2023/07/31/barbie-margot-robbie-bitcoin-big-ken-energy/

… But my own interest is Kenough for me and regardless of your thoughts on Bitcoin, it’s discussion is pertinent to any discussion of FRMO.

********** UPDATE 20230819: Now that I’ve actually seen the movie, I’d also add that the barbies were happier under the patriarchy, anyway **********

In this post, I plan to cover the 2022 crypto winter, the unique way FRMO is building and managing its Bitcoin operations which allowed it to come out of that year no worse for wear and how (while the relative size of their TPL and GBTC investments seem make them the main movers of FRMO’s market price) FRMO is slowly pulling together a little crypto conglomerate of their own that could be a fundamentally better vehicle for capturing Bitcoin’s value than simply holding an investment trust (or even spot ETF).

.

For more details on FRMO’s general stance on topic, I have compiled Chairman Stahl’s thoughts —and my own commentary— on the investment case for Bitcoin and certain other cryptocurrencies in the older post here:

($FRMO) FRMO Corp: The Most Important Things - Part 3.1: Bitcoin is the "better money"

“I think the key ingredient of that is focusing on what is the risk you’re taking. I think a lot of people get in a lot of trouble because they do a transaction and they don’t understand what the risk they’re assuming is when they do the transaction. What he taught me more than anything else was, look at the deal and figure out where is the vulnerabilit…

Table of contents

FRMO’s vertical yet modular Bitcoin business (skip to here for the most FRMO-specific stuff)

Some recent crypto developments

.

While Grayscale has been fighting the SEC in court to have it’s Bitcoin investment trust (GBTC) converted into a spot ETF1, several other high profile institutions have recently applied as well to launch Bitcoin spot ETPs including: Bitwise, BlackRock, Fidelity, WisdomTree, VanEck, and Invesco.2 An expected favorable outcome for Grayscale in the lawsuit and these recent applications by other traditional institutions have caused renewed interest/market-bullishness in Bitcoin.

.

Many regulated financial institutions around the world already offer —or are preparing to offer— various forms of digital asset trading platforms, products, and services such as: ICE’s (and subsidiary, Bakkt) trading and custody services, CME’s cryptocurrency options and futures offerings, and the Bank of New York Mellon’s digital assets custody platform (interestingly, the BNY is the oldest continuously operating bank in the US)3. This is all well covered in the 1Q2023 HK Commentary, see the section titled “Regulatory Environment for Cryptocurrency”.

This could not happen without a detailed, exhaustive review and approval process with the U.S. government, specifically through the Commodity Futures Trading Commission. —- https://horizonkinetics.com/app/uploads/Q1-2023-Commentary_FINAL.pdf

Not included in that commentary are the recent announcements near the end of 2022 of the London Stock Exchange’s Bitcoin derivatives trading services or (via its MaxxTrader subsidiary) the Singapore Exchange’s digital asset trading solution or the developments at Miami Holdings International (which is a material holding of FRMO and of which certain subsidiaries Stahl is a director)4 towards offering regulated digital asset trading products (via partnerships or acquisitions involving MidChains, Lukka, and LedgerX).5

Point being that, around the world, financial institutions are looking at the landscape and coming to the conclusion that —rather than shying away from crypto for fear of, say, a hammering down on crypto à la “Operation Choke Point 2.0”— it is worth it to invest the time and capital into going through their respective regulatory review processes to build out and market the infrastructure to support digital assets.

.

Meanwhile, the SEC has been actively expanding its staffing and resources related to cryptocurrencies.

In early 2022, the SEC has announced plans to boost the size of its Crypto Assets and Cyber Unit (CACU) by adding 20 investigators and litigators to focus on investigating cryptocurrency fraud and misconduct, nearly doubling the CACU department to a total staff of 50. Bitcoin’s uber-libertarian fans may have looked askance at this, but others in the space (including Stahl) appeared to view this mostly positively.6

You could take this in several ways: 1) The SEC is making additional incremental investment into cracking down on crypto in order to ramp up the pressure to ultimately facilitate its demise or 2) their behavior of actively increasing staff and resources dedicated to cryptocurrencies is indicative of a level of commitment to addressing regulatory and enforcement issues in the cryptocurrency space in expectation of dealing with these issues in an on-going manner, moving forward.

The new Congress is looking again at crypto-specific legislation, but Gensler believes that the SEC has all of the legal tools that it needs. Over the course of our discussion, he articulated a straightforward view of the agency’s reach — that pretty much every sort of crypto transaction already falls under the SEC’s jurisdiction except spot transactions in bitcoin itself and the actual purchase or sale of goods or services with cryptocurrencies. —- https://nymag.com/intelligencer/2023/02/gary-gensler-on-meeting-with-sbf-and-his-crypto-crackdown.html

“Foreign” currency risk: A look back at 2022

For those who believe that crypto is going to outperform the dollar, which I believe too, then it seems like the next logical step should be, well, why don't you borrow money in dollars to buy your crypto mining equipment, and you'll eventually pay back in appreciated currency, relative to your dollars, via your crypto investments? It makes so much sense, right? […] If you're bringing in investors with their capital, and that’s denominated in dollars, then you're implicitly trying to figure out, what will the price of bitcoin in relation to the U.S. dollar be at any point in time? Remember that debt is due on a certain fixed date. That’s why they call it fixed income. So even if bitcoin outperforms the dollar in the fullness of time, how do you know bitcoin is going to outperform during the life of the fixed income liability that you've assumed? You don't really know that, do you? —- https://www.frmocorp.com/_content/letters/2023_Q2_FRMO_Transcript.pdf, Murray Stahl

Imagine the Turkish economy was booming in 2021 and, encouraged by the mainstream headlines like “Bitcoin Lira Price Prediction: Can Bitcoin the Lira Reach $1,000,000 by 2025?”7, you had borrowed US dollars (which at the time were rapidly depreciating vs the Lira, anyway) to invest in Turkish business operations at the very start of 2022. That same year, the Federal Reserve started the most aggressive interest rate hiking operation since the 1970s, coaxing the EFFR from 0.08% to 4.33% by year end, and the Turkish lira fell 50% against the USD due to severe inflation and political and economic turmoil in the country8. In the simplified case of no interest expense and repayment of the loan due by around the end of 2022, your investments would have needed to improve their operating profitability at a corresponding rate up to 100% by year end, to make up for the 50% fall in the value of the currency you were collecting, in order for your initial plans to remain unchanged, else risk defaulting on the loan —and if you did have a floating rate loan, well rates just increased by orders of magnitude in this time, furthering your problems.

You took on foreign exchange currency risk in a volatile currency pair and suffered a left-tail event when your debts came due. This is essentially what happened with many real life Bitcoin miners —and their lenders— in 2022.

This instructional article titled “How to Finance a Bitcoin Mining Operation in 2022”, published by Hashrate Index on March 17 2022, would have been a useful guide for many that year:

… Instead, 2022 ended with many prominent miners in, or on the brink of, bankruptcy.

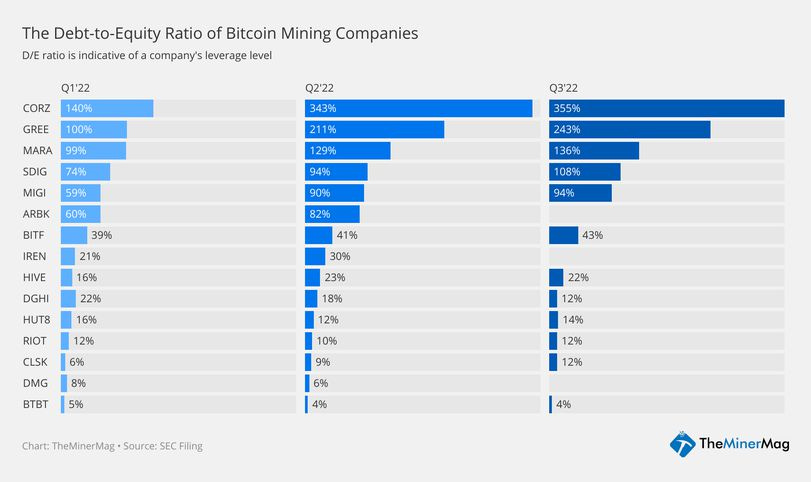

Core Scientific and Argo’s financial troubles could serve as a stand-in for the wider public mining stock landscape. Many of these miners took on debt in 2021 to finance operations while the market was hot, all while selling little-to-none of the bitcoin they mined last year. Now, with margins evaporating and payments due on these loans, these miners sold significant portions of their mined BTC at increasingly lower prices as the year progressed. —- https://www.forbes.com/sites/colinharper/2022/12/23/bitcoin-mining-in-2022-the-year-boom-turned-to-bust/

The liquidity crunch hitting digital-asset markets after FTX failed comes as low Bitcoin prices, soaring energy costs and more competition weigh on miners. Loans backed by the computer equipment, known as rigs, had become one of the industry’s most popular financing tools. Many lenders are now likely facing substantial losses since they can’t seize any other assets besides the machines, whose value has dropped by as much as 85% since last November. —- https://www.bloomberg.com/news/articles/2022-11-30/crypto-lenders-woes-worsen-as-bitcoin-btc-miners-struggle-to-repay-debt

The rate hikes in 2022 and the Bitcoin price crash, due to the collapse of the FTX fraud9 —that had much less to do with Bitcoin itself than with literal lying and fraud by FTX executives using their own FTT tokens— coupled with the subsequent sentiment- and liquidity-contagion effects across the associated (and many unassociated) crypto brokers, lenders, VC funds, et al who were affected, had an highly negative impact on Bitcoin miners; many were pushed towards bankruptcy. (Interestingly, from this incident, we also got to see a relatively contained experiment of what the 2008 banking crisis could have looked like without the intervention of governments10).

2021: Encouraged by the rapid rise in the price of Bitcoin relative to US dollars, the Bitcoin mining industry takes on greater leverage in order to invest in mining equipment.

March 2022: The Federal Reserve begins aggressive interest rate hikes in order to combat inflation11. This tightening of credit in itself was also seen as as a contributing factor to the FTX crash and the subsequent decline in Bitcoin's price12 —I suppose just on the fact alone that BTC can be viewed as a kind of long-duration bet (on this ‘startup’ asset class gaining mainstream acceptance).

November 11 2022: The collapse of the crypto broker FTX and the subsequent market meltdown caused a significant drop in the price of Bitcoin. As news of FTX's financial troubles circulated, Bitcoin's price fell by 20% in just the first weeks of the scandal. This drop in BTC against the USD narrowed profit margins for miners, who were already facing challenges due to the existing bear market brought on by the Fed’s rate hikes in addition to rising energy costs at the time, taking many mining operations to the brink of —or just straight up into— bankrupcty.13 This further lowered the price of BTC as miners sold off their held BTC in order to repay their USD debts —which further dropped the BTC/USD exchange rate and further narrowed profit margins for miners.

In short, the rise in interest rates, the decline in Bitcoin’s dollar pricing, and the FTX-induced market panic led to selling pressure among miners. Mining companies faced declining revenues and increasing operating (and interest) expenses, which further strained their financial situation. Many prominent miners were forced to sell their underlying Bitcoin holdings to meet financial obligations14; many miners (and lenders, alike) were forced into bankruptcy.15 These asset-sales and bankruptcies further exacerbated conditions in the crypto market that had their own ricochet effects that had to be worked through the crypto ecosystem.

FRMO’s vertical yet modular Bitcoin business

“In any event, we took these machines and we converted those assets, which have a relatively modest finite life, if you want to look at it this way, to bitcoin, which has infinite life. Let's look at it in an inflation sense. Imagine we were a gold mining company. But instead of mining gold and selling it, we're only selling enough gold to pay our operating expenses, and we’re keeping the remainder of the gold.

Let's just say we're a gold mining company in the year 1900, and that was our practice. We would sell enough gold to cover operating expenses and put the remainder in a vault. No company ever did that, with one exception, which was Goldcorp. It was a Canadian company that was ultimately acquired by Newmont, and Newmont ceased that practice, so the world has very limited experience with that practice. But let's just say there was a company in the year 1900 extracting gold and just left the gold in the vault, meaning on its balance sheet. What would be its net asset value today relative to a company with the same production that just sold all its gold along the way? I think the answer is obvious. It would be much, much higher.

In a sense, that's what we're trying to do. Now, it's a little more interesting in the case of crypto for the following reason. In the world of gold, if the price gets high enough, the world's going to extract more gold, so there will be a lot more supply. In the case of Bitcoin, no matter how high the price gets, only roughly 1.6 million more bitcoin are ever going to be mined. For the next 375 days, roughly, they're going to be mined at the rate of six and a quarter every ten minutes.

In 375 days, there are going to be 1.3 million coins left, and we know what the rate of production of those 1.3 million coins will be between that date—roughly a year from now—and the year 2140. So, there's a lot of scarcity value. It's called digital scarcity. If you can enforce digital scarcity, would that be a better tethering device for currency than gold? Obviously, the world’s fiat system is breaking down. I would argue that even though there's a lot to be said in favor of gold—and we have gold-related investments—there’s enormously greater potential for digital scarcity. That’s assuming it can be faithfully executed, which is still an open question, but I believe it can be done. We're building a company that is going to hold digital scarcity instead of gold scarcity.” —- Murray Stahl, https://www.frmocorp.com/_content/letters/2023_Q3_FRMO_Transcript.pdf 16

The purpose of this labyrinthine approach is not to be opaque, although this is the unfortunate effect; rather, the purpose is to explore new asset classes and new business opportunities in a gradual manner that limits risk and disruption. Risk is not merely the possible loss of capital. —- https://frmocorp.com/_content/letters/2019.pdf

While the majority of transaction-validation businesses in ‘Bitcoin land’ were getting killed and going bankrupt due to their ‘fiat land’ currency exchange liabilities. FRMO’s Bitcoin operations came out of 2022 generally unharmed. I wish the same could be said about their stock price, but such is the case when BTC’s dollar pricing drops at the same time that Texas Pacific Land Corp’s board of directors takes it’s own shareholders and fellow directors to court for having the gall to vote against unconstrained share dilution and acquisitions17.

.

My general understanding of FRMO’s vertically integrated Bitcoin business across the Bitcoin value chain:

(Note that HM Tech is not the only rig host used by FRMO, just their “default” and fallback solution. I'm also not 100% to what extent monitoring equipment for FRMO, CMSC, and HMT's mining operations is sourced specifically or solely from Winland, but I'd be surprised if Stahl isn't ‘eating his own cooking’ to a large degree here; I’ll have to ask about this at the next earnings call).

********** UPDATE 20230908: So I asked about this on the 2023 annual FRMO meeting (https://www.frmocorp.com/_content/letters/2023_FRMO_Transcript.pdf, see Questioner 10), Stahl says HK, FRMO, and HMT have never actually used Winland Electronic sensors in their mining operations, though Winland, CMSC, et al have had machine hosted and repaired at HMT as well as occasionally procuring machines from HMT. I’ve updated the graphic to reflect this. Why they do not use Winland products for this purpose is a bit odd to me as this seems like an obvious and synergistic application for that company’s otherwise-stagnant Products & Services segment to expand into. For example, Winland’s INSIGHT product is a SAAS (data center) environment monitoring solution that seems perfect for crypto mining operations and for allowing Winland to gain a kind of recurring royalty payment on the work and expansion of other miners if they were to adapt and market this tech for the purpose. **********

********** UPDATE 20240708: And do note that Stahl is indeed aware of and allowing Winland’s electronics business to stagnate, see Questioner 17 here https://www.frmocorp.com/_content/letters/2024_Q2_FRMO_Transcript.pdf **********

In Lawrence Cunningham’s “The Essays of Warren Buffett”, Warren Buffett and Charlie Munger —who, for their own part, have described Bitcoin as “rat poison”— describe the benefits of Berkshire’s conglomerate structure as generally being those of…

Capital Allocation: The conglomerate structure enables effective capital deployment across Berkshire to businesses with high growth potential and profitability.18 For FRMO, this comes down to your view on Stahl’s and HK’s capital allocation and investing decisions —I’m for it and would rather have him (and FRMO’s ability to also invest in private companies) making these investment decisions rather than myself.

Long-Term Perspective: The conglomerate approach supports decisions that prioritize long-term value over short-term gains. (See previous point).

Hands-On Management: Active involvement by Buffett and Munger ensures careful selection and monitoring of businesses. (See previous point).

Shared Resources and Expertise: Subsidiaries benefit from shared resources and operational expertise, boosting efficiency. (Note the graphic above).

Cultural Alignment: Berkshire Hathaway invests in and improves businesses with strong management teams and cultures. In the case of FRMO, management is able to influence their subsidiaries in a similar way; Windland holdings was initially a play by FRMO on the company’s high-ROIC environmental monitoring equipment and subscription business and only later began acquiring Bitcoin rights claims and mining equipment.19

Inflation Hedge: Certain portfolio segments at Berkshire like insurance and utilities can offer protection against inflation. At FRMO, inflation is a top-of-mind issue and Bitcoin is a direct part of that left-tail positioning.

Diversification: Berkshire Hathaway’s diverse portfolio of businesses helps manage risks from economic cycles and industry challenges. In terms of FRMO’s crypto operations, their subsidiaries vary across the whole Bitcoin value chain —from server environment monitoring to mining equipment and mining for their own account.

Market Volatility Resilience: A mix of businesses helps Berkshire Hathaway navigate market volatility more effectively. (See previous point).20

I likewise see these as the benefits of gaining my exposure to Bitcoin via FRMO.

.

In the 2021 annual meeting, Stahl mentions that

1) they had always planned to move FRMO beyond being an asset holding company —in order to have something that could generate cashflow even after they had eventually departed— and wanted to build some kind of operating business,

2) the type of business they eventually decided to pursue was Bitcoin and cryptocurrency (which is a bit ironic if your goal was to generate “cash”-flow), and

3) due to the predictable nature of the Bitcoin protocol block reward “halving” and the associated sporadic and unpredictable deflationary innovation within this fast-evolving industry (and corresponding obsolescence of existing generations of technology and equipment) that it incentivizes, they did not want to make singular, large capex spends when building up their crypto business.

The result was FRMO’s Bitcoin business being built or accumulated in small, experimental steps. (This step-wise approach to capex spending in their crypto investments also helped FRMO avoid taking large losses during the crypto crash the unraveling of the FTX scandal through 2022).

********** UPDATE 20240117:

“We didn’t know seven or eight years ago when you started the venture if crypto was a viable business or not. We just thought we knew enough about it to be able to make some reasonable assertions about it and make some money at. So that's what we ended up doing. And so far, it’s working out well.” —- Murray Stahl, FY2024Q2 earning call

**********

“But to put too much money in any new-generation equipment risks their obsolescence if a halving is approaching and, therefore, places in peril the whole cryptocurrency mining effort, so we can’t do that. So, we have to move in a step-by-step function in terms of capital investment. You’re taking a machine and operating it until it can’t operate anymore, until it’s worn out, and, effectively—we want to think of it this way—you’re converting it into cryptocurrency. You’re taking a temporal asset, one that has a limited life and for which it’s hard to judge the lifespan at point of purchase, to convert it into crypto.” —- https://www.frmocorp.com/_content/letters/2021_FRMO_Transcript.pdf

One of the drivers of investing the capital over time is the understanding – and anticipation - that to the cost of mining equipment changes significantly over time, relative to, amongst other factors, the current profitability of the equipment as well as the number of days to the next halving (which is less than two years away). Technology improvements and increased efficiency in each round of equipment innovation will continue to make older generation equipment less profitable and ultimately obsolete. —- https://uploads-ssl.webflow.com/62338ff96dab781ffa5fd112/62fbf51539096b2be5ee5bd1_CMSC%20Q1%202022%20Shareholder%20Update.pdf

Thus, when looking at FRMO’s various crypto investments, you should keep in mind that these should not necessarily be thought of as being separate from each other, but are most likely planned to eventually be operated or otherwise merged together in some integrated or mutually-supporting manner.

.

Winland Holdings (WELX): Data center monitoring, crypto mining, and crypto bankruptcy claims

Data center monitoring equipment and crypto mining (via Winland Electronics Inc. and Winland Mining LLC (which HK hosts on their behalf) under Winland Holdings (WLEX))

Winland Electronics Inc

While the earliest mention of “Bitcoin” in FRMO documents that I could find was in 2016, FRMO was already heavily involved with Winland as far back as 2014, before Winland was ever involved in cryptocurrency, with FRMO acquiring “greater than 5% [their stake at the time being 15%] of the Company’s outstanding common stock on November 14, 2014” and Murray Stahl sitting on the board of directors, per Winland’s 2015 annual report.

The earliest mention of Winland from FRMO themselves comes in the 2015 earnings call where it appears this initial investment was driven by the attractiveness of Winland’s main business, at the time, of environment monitoring equipment for data centers, server rooms, healthcare settings, and many other use cases, rather then anything directly relating to Bitcoin.

“Winland, small though it is, has a fairly high return on capital. It generates reasonable quantities of cash. We bought it when it was quite undervalued. Companies that are not in the indices and that no one knows about, are still out there and, every now and then, you can find them.” —- Murray Stahl, FRMO 2015 earnings call

The Q1FY2016 earnings call reveals their initial 15% stake was purchased at a discount to book value; “It earns a fee for monitoring and contacting the client in the event that something is amiss.”

Winland also appears to be a potential candidate facilitating FRMO’s long-planned (or at least jawboned-about) aspirations for converting FRMO into an operating company.

THÉRÈSE BYARS: "That’ll be my pleasure. The first one says, “Are there any updates to potentially becoming an operational business rather than just an owner of assets? Are there any updates that can be discussed with shareholders?” MURRAY STAHL: I alluded to it but I didn’t elaborate. The easiest path is to acquire 51% of one of our publicly traded subsidiaries. The company we have the biggest stake in right now is Winland, at about 29% [32% as of more recent earnings calls]. In the most recent quarter, we bought some more. So, if we end up going in that direction with one of our businesses, we’d acquire 51%, if we could, and conduct our operations via that entity. —- https://www.frmocorp.com/_content/letters/2022_Q2_FRMO_Transcript.pdf

“FRMO owns 30.8% of Winland. […] What we’ve been doing in FRMO is to nibble away, when we thought it was appropriate, at Winland shares. So, we’ve been buying Winland shares, and we thought that was the best use of the capital, given what was going on in the mining rig market” —- https://www.frmocorp.com/_content/letters/2023_Q2_FRMO_Transcript.pdf

Note that while FRMO owns that 32% of WELX (beneficially via FRMO co-founder Steve Bregman who sits on WELX’s board), the total controlling interest by Stahl’s Horizon Kinetics complex is closer to 46% as WELX CEO Matthew Houk is an HK employee and owns a 14% stake in the company (though this stake does not appear to be beneficially owned by FRMO or HK, so Houk himself controls the voting rights).21 He appears in the company’s list of directors as far back as the 2012 10K, when Winland was still filing with the SEC.

********** UPDATE 20240117:

My understanding had always been that WELX’s electronics business was being used as the primary method to fund the step-wise growth/expansion of the crypto mining segment. In the recent FY2024Q2 conference call, I asked about efforts that WELX may be making to grow the electronics side —which has long been stagnant— in order to contribute more the greater growth on the mining side. The answer that Stahl gave seems to indicate that the electronics businesses is no longer the primary driver of the mining LLC’s working capital, but rather FRMO itself fulfills that role, incrementally providing rigs to the mining segment in exchange for incrementally increasing FRMO’s ownership of WELX common stock. (I assume then that the electronics side is used mainly to cover WELX’s overall COGS and opex in order to allow Winland to accumulate and retain as much Bitcoin on their balance sheet as possible).

“In terms of the crypto business, FRMO has participated in many equity offerings, in Winland, and we have more enough capital in FRMO to provide for all of Winland's needs, so big difference between FRMO and Winland and Consensus is, in Winland, we raised money in really small stages and as we need it, and that money has largely come from FRMO.” —- Murray Stahl, FRMO FY2024Q2 conference call

**********

Winland Mining LLC

The history of Winland’s buildup of mining assets, orchestrated by FRMO and Horizon Kinetics, can be seen documented in their 2022 annual report:

On June 23, 2020, the Company, through its wholly-owned subsidiary Winland Mining, acquired 200 Bitmain S19 95 TH/S cryptocurrency miners from FRMO Corporation in exchange for 574,000 shares of the Company’s common stock. In connection with its acquisition of cryptocurrency mining equipment, Winland Mining entered into a services agreement with Horizon Kinetics LLC to engage with cryptocurrency mining hosting facilities on Winland Mining’s behalf and to support its cryptocurrency mining operations by performing certain services from time to time.

On September 1, 2020, the Company, through its wholly-owned subsidiary Winland Mining, acquired cash and cryptocurrencies of Horatio Mining LLC [that is, they acquired Horatio Mining in its entirety]22, a privately-held cryptocurrency mining company, from FRMO Corporation in exchange for 136,419 shares of the Company’s common stock.

On September 8, 2021, the Company, through its wholly-owned subsidiary Winland Mining, acquired 32 Canaan AvalonMiner 1246 90 TH/S cryptocurrency miners from FRMO Corporation in exchange for 52,560 shares of the Company’s common stock.

As of December, 2022 and 2021, Winland Mining owned 71 and 56 Bitcoins.

By attaching Bitcoin mining and HODL’ing to a business with existing USD cashflow operations, WELX’s mining operation serves as a kind of emergent Bitcoin spot ETF in that it should increasingly trade in correlation to the price of the BTC it holds, while (unlike a formal BTC trust or ETF that might exist) not having to sell off those BTCs for cash in order to pay management and operation fees —those fees instead coming out of the traditional operations of the business (in this case, Winland Electronics).

“One thing I should say about Winland is that it can be thought of almost like a quasi-bitcoin ETF. When you buy a bitcoin ETF, if there were a bitcoin ETF, you should be aware of the fee impact. Unlike a mutual fund or an ordinary ETF, bitcoin pays no dividends that can be used to pay the operator’s fees. Therefore, if there were a bitcoin ETF, the operator, each and every quarter or probably every month, would have to sell some bitcoin to pay the fees.” —- Murray Stahl, https://www.frmocorp.com/_content/letters/2023_Q2_FRMO_Transcript.pdf

For ease of explanation, consider a bitcoin ETF that exists in a steady state mode—no money coming in for new purchases, and no requests for redemptions—so that it owns a constant number of bitcoins. Except that it can’t own a constant number. An equity or bond ETF extracts its fees from the dividend or interest payments. But there are no bitcoin dividends or interest. A bitcoin ETF would have to sell sufficient bitcoin to pay the fee, so the per-share number of bitcoin would be in constant decline. Over time, the cumulative difference would be impactful. An operating miner that ‘banks’ its bitcoin earnings and accrues an evergreater balance sheet position, might be a superior vehicle. The potential market for such a vehicle could be very large. —- Steve Bregman, https://horizonkinetics.com/app/uploads/Q2-23-Commentary_FINAL.pdf

Winland Captial Corp.

(Code I used for this diagram can be found here)

WELX currently records $350K of “Cryptocurrency-related claims” on their financials that their Winland Capital Corp segment purchased. These are bankruptcy (turned “civil rehabilitation”) claims related to the collapse of the Japanese Mount Gox cryptocurrency exchange in 201423.

These claims could be worth multiples of this recorded value. The majority of these claims appear to have been purchased in 2018 (when USD/BTC price was around ); this is the earliest mention of “rights to payment” in Winland’s annual reports. Looking at the interim reports, Id’ say ~1/3rd of these claims where bought between Jan-June 2018 (BTC fell from $17K to $7.5K) and remaining ~2/3rds were purchased from July to the end of the year (BTC fell from $6K to $3K). Note that WELX made agreements to share certain portions of the bankruptcy claim payouts with the original claimants as a part of conditions they agreed to in order to acquire some of these claims.

In the 2018 annual letter, Stahl had this to say about Winland’s purchase of rights to payments:

“Recently, Winland has been investing in bankruptcy claims. These are generally bankruptcy claims that rank high in the credit hierarchy, but are not sufficiently large to attract the interest of bankruptcy workout funds. Indeed, sometimes bankruptcy workout funds actually will feel compelled to purchase these claims from holders merely to simplify an existing bankruptcy. History records that the returns from this type of investment are uncorrelated to major financial trends. The returns can also be quite high. However, it is not easy to obtain the claims. Simply finding the owners and establishing a dialogue is a time consuming process. We hope to be able to increase our exposure to this type of asset.”

In the FRMO 2020 annual letter, Stahl estimated that “[t]he value of Winland’s Mt. Gox trade claims is currently about $600,000, on a conservative basis.” FRMO’s fiscal year ends in August; USD/BTC was around $10K-$12K at that time, implying that Stahl thought that WELX had a reasonable claim to around 60BTC through the Mt.Gox trade claims. Given the current BTC price of ~$30K, that estimated value should now be up to $1.8MM ($600K * $30K/$10K = $1.8MM), ~5x the carrying value of the claims on Winland’s books and ~20% of WELX’s current marketcap. This does not even consider what could happen with WELX’s trading P/BV post-halving in 202424; current P/BV is around 3.5x (3x if you add in the possible 5x value of the Mt.Gox claims (3.5/1.20=3x)), but hit a multiple closer to 10x at Bitcoin’s peaks in 2021 —of course who knows how Mr.Market is going to capitalize WELX’s book value after having lived through the 2022 crypto winter (which, again, didn’t really have much to do with Bitcoin itself).

I haven’t done much work on this, but given Stahl’s past comment on the possibility of merging FRMO and WELX to transform FRMO into an operating business, buying WELX shares rather than FRMO stock could, in the long-run, be a path to essentially acquiring FRMO shares at a lower valuation. (I’d have to think about this more; I currently estimate FRMO’s true P/BV at around 1.5x).

(If that sounds interesting to you, note that WELX shares are very illiquid, so when/if you get into some shares, consider yourself locked in for better or, especially, worse).

“When we hear other who have looked at an inactive stock ask my three favorite questions —How are you going to buy it? How are you going to get out? What is going to make it go up?— we know we have the makings of a winner.” —- Lawrence Goldstein, General Partner of Santa Monica Partners LP, FRMO director

.

TBH, when I look at Winland’s history, I’d have to admit that I think that their acquiring of Mt.Gox Bitcoin claims was likely more due to the encouragement of director Thomas Braziel (co-founder and managing partner of 507 Capital) then anyone from HK. See https://www.yahoo.com/news/mt-gox-surprising-redemption-bitcoin-190418425.html; https://507capital.com/mtgox/.

Winland terminated it’s CEO in November 15, 2013 (https://www.otcmarkets.com/otcapi/company/financial-report/133577/content) and I do not see any sign of a CEO at the company until the company’s restructuring in 2018 when Winland Electronics changed to Winland Holdings and it was determined that “Thomas Braziel and Matthew Houk [a Horizon Kinetics employee] will serve as Co-Chairmen and Co-Chief Executive Officers of the Company.” They had both been directors since 2013 (https://www.otcmarkets.com/otcapi/company/financial-report/190095/content). The CEO title is later only assigned to Houk starting in the 2021 annual report (https://www.otcmarkets.com/otcapi/company/financial-report/325275/content) with Braziel apparently stepping down while running the Winland Credit subsidiary of Winland Capital Corp under his firm 507 Capital LLC according to a 1.5-and-20 management/performance agreement —presumably looking for more opportunities to invest in distressed (crypto) debt (of which there may be a fresh batch of opportunities coming out of 2022; https://www.wired.com/story/crypto-bankruptcy-markets-thriving-ftx-collapse/).

********** UPDATE 20240708: WELX’s current CEO Mat Houk, who is also an HK employee, came to run the company via gaining a controlling interest in the company shares in around 2015. As such, their control of WELX is not (directly) as a beneficial owner for HK. You can read more about Braziel and Houk’s acquisition of the company here (https://www.frmocorp.com/_content/letters/2015_Q3_FRMO_Transcript.pdf), here (https://www.frmocorp.com/_content/letters/2018_FRMO_Transcript.pdf), and here (https://www.frmocorp.com/_content/letters/2024_Q3_FRMO_Transcript.pdf, Questioner 23). Whether their strategy of using Winland’s legacy business cashflows to eventually fund other investments (eg. Bitcoin mining and crypto bankruptcy claims), while apparently letting that original business stagnate (we can see that revenues to the Products & Services segment have been basically flat since 2014 to 2023), was their intention all along or simply a pivot from a failed attempt at turning the primary business around, I’m not sure. **********

********** UPDATE 20241208: The management agreement between Winland Captial and Thomas Braziel’s 507 Capital LLC was actually terminated in July 2023. This may be just as well as I recently read a Wall Street Journal article where Braziel apparently admitted to mishandling shareholder funds for his sole personal benefit after getting himself into a position of a liquidating receivership for a company, after an investigation that began in January 2022 (https://www.wsj.com/articles/ftx-claims-broker-thomas-braziel-stole-1-9-million-from-a-receivership-for-personal-gain-court-says-d3375130). In fact, the last annual report on which he is recorded as an officer or director or as owning any shares in the 2021 annual report (https://www.otcmarkets.com/otcapi/company/financial-report/325275/content); thereafter he no longer appears as having any involvement with Winland. (See “"Note 15. Related Party Transactions”, https://www.otcmarkets.com/otcapi/company/financial-report/395999/content). **********

Digital Currency Group (DCG): Cryptocurrency asset management

Cryptocurrency asset management (Digital Currency Group (DCG))

In the 2QFY2023 FRMO earnings call, Stahl described DCG’s business thusly: “[A]s you've seen, have their challenges, obviously, but the core business is fabulous. What's the core business? It's a bitcoin investment trust [GBTC]. You know what the assets under management are, you can find that on the website in a second. You know what the fees are, and much of that goes right to the bottom line. So there are challenges in other aspects of the DGC business, as you can read in the journals, but we never got involved in lending out crypto or any of that stuff. We don't really believe much in it. In the future, I don't think you're going to see that sort of activity in general in the cryptocurrency world—that’s really something that's best done in banking.”

In a report on DCG earlier this year, “[i]n its annual independent stock valuation, DCG had an equity valuation of $2.2 billion, or a price per share of $27.93. ‘This appraisal is generally consistent with the sector’s 75%-85% decline in equity values over the same period,’ the report said.”25. Per the FRMO 2021 annual letter, “FRMO owns 353 shares of Digital Currency Group (DCG)” —they’ve owned this amount since initially investing in DCG’s series B raise in February of 201626. Putting these two pieces of info together (and factoring in the 77% increase in USD/BTC so far this year), I’d put the value of FRMO’s DCG stake at around $17450.94 (($27.93/sh x 1.77) x 353sh = $17450.94).27

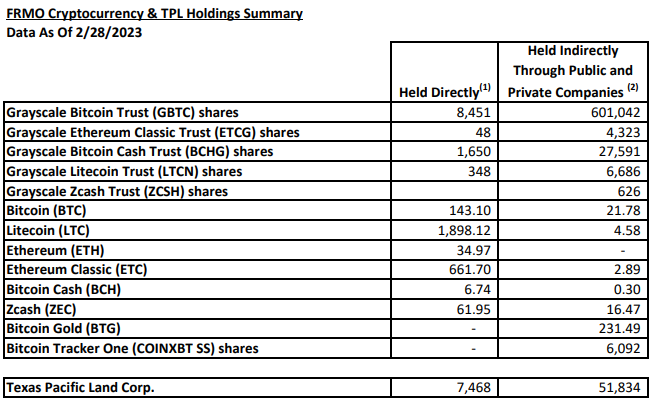

Grayscale Bitcoin Trust (GBTC) and de minimis niche cryptocurrency ownership

Aside from FRMO’s larger GBTC and direct Bitcoin and Litecoin holdings, they also hold de minimis amounts of various other smaller and less popular cryptocurrency holdings that have comparable monetary policies to Bitcoin, either directly or via Grayscale trusts (eg. Ethereum Classic, ZCash, Bitcoin SV, and Bitcoin Cash).

(https://www.frmocorp.com/_content/letters/FRMO%202-28-23%20Crypto%20Exposure%20Summary.pdf)

The logic in holding these smaller cryptos was enumerated in the 3QFY2021 earnings call (see “Questioner 5”). The basic idea is that the network effects of a crytpocurrency are/should be generally correlated to the value of it’s monetary policy; all of these smaller cryptos held by FRMO have similar monetary policies to Bitcoin; due to their obscurity or unpopularity after their forking from Bitcoin (or other parent crypto), they are akin to spinoff businesses that have been sold off for non-economic reasons (recall Joel Greenblatt’s “You Can Be A Stock Market Genius”)28 —you could say Stahl sees them as acceptable ‘comps’ to Bitcoin’s ‘business’.

Luckily for you, the answer is that these extra spinoff profits are practically built into the system. The spinoff process itself is a fundamentally inefficient method of distributing stock to the wrong people. Generally, the new spinoff stock isn't sold, it's given to shareholders who, for the most part, were investing in the parent company's business. Therefore, once the spinoffs shares are distributed to the parent company's shareholders, they are typically sold immediately without regard to price or fundamental value. The initial excess supply has a predictable effect on the spinoff stock's price: it is usually depressed. Supposedly shrewd institutional investors also join in the selling. —- “You Can Be A Stock Market Genius”, Joel Greenblatt

Furthermore, they have lower total supply as many of their owners’ private keys have since been “lost.” Stahl believes that when (not if) a BTC spot ETF is approved by the US, it will open the flood gates for other cryptocurrency spot ETFs; market liquidity will flood into crypto space; Mr.Market will be able to bring greater crowd-wisdom to bear in the space; these obscure cryptos should end up with similar total marketcaps to BTC due to their comparable monetary policies; just holding a few could then fetch a 400x return per unit of these cryptos (that have much lower un-lost supply and currently trade at tiny fractions of BTC’s price) when this correction does happen.

I’d actually prefer if FRMO owned their BTC directly rather than via GBTC as you get the added benefit of free intellectual capital of the Bitcoin development community in the case of the free alternative currencies you get in the course of hard-forks when ideological difference arise (as mentioned by John Pfeffer), but I do understand the logic in the sense that Bitcoin is still the mostly widely accepted with the largest network effects (by a large margin) and GBTC has had a rather large discount to NAV for some time now (though this was not always the case while FRMO was accumulating shares), so iff Bitcoin achieves some form of ultimate mainstream success mode, you could assume that it would eventually convert to a spot ETF and close that discount.

HM Tech (HMT): Mining rig procurement, repairs, and hosting

Mining rig procurement, repairs, and rig hosting, as well as mining for their own account (HashMaster (A.K.A. HK Tech LLC, A.K.A. HMT))

Not much to say about this one; Stahl covers HMT’s function within the Horizon Kinetics crypto mining complex well enough here:

“One is called HashMaster. We own, I think it’s 7.1%. Horizon Kinetics itself owns over 50%, so we obviously have a big stake in it. HashMaster does a number of things.” —- https://www.frmocorp.com/_content/letters/2022_Q3_FRMO_Transcript.pdf

“It's our default mining site, so if we don't want to or we cannot or we find it disadvantageous to be in other sites, we can always retreat to HM Tech. We've done that more than once when we couldn't get terms that we needed, and of course HM Tech repairs our equipment. Also, there's some HM Tech mining for its own account. […] We, ourselves, had equipment with hosting companies that were having difficulties, but we had the strategic ability to send our equipment to HM Tech. […] When you run your mining machinery at another mining or hosting company, you have to buy electric power on their terms, effectively through them. But, because we control HM Tech, we can buy electric power on our terms, so that's a pretty good thing to have.” —- https://www.frmocorp.com/_content/letters/2023_Q2_FRMO_Transcript.pdf

Consensus Mining & Seigniorage Corporation (“CMSC”)

“CMSC has an additional strategic dimension. This too, is not about the mining per se, but what the mining economics do. They have a transformative attribute. When CMSC buys a mining server, it is essentially paid for with its mined bitcoin reserve. That server has an operating life of several years, after which it is no longer profitable to operate. The business objective is to have earned enough bitcoin by that time to have paid for the server and its operating expenses and to have some additional increment of a bitcoin left over. That is, through the process of mining, to turn a given quantity of bitcoin into a bigger quantity. A finite-life, fully-paid-for server is converted into an infinite-life coin with digital scarcity value. If that process continues over time, more and more bitcoin will accumulate on the balance sheet. At a certain point, that becomes interesting. […] For ease of explanation, consider a bitcoin ETF that exists in a steady state mode—no money coming in for new purchases, and no requests for redemptions—so that it owns a constant number of bitcoins. Except that it can’t own a constant number. An equity or bond ETF extracts its fees from the dividend or interest payments. But there are no bitcoin dividends or interest. A bitcoin ETF would have to sell sufficient bitcoin to pay the fee, so the per-share number of bitcoin would be in constant decline. Over time, the cumulative difference would be impactful. An operating miner that ‘banks’ its bitcoin earnings and accrues an evergreater balance sheet position, might be a superior vehicle. The potential market for such a vehicle could be very large.” ~~~ Steve Bregman, https://horizonkinetics.com/app/uploads/Q2-23-Commentary_FINAL.pdf

In addition to S&B’s / HK’s own internal mining efforts, they have also merged certain of those activities into a new company called Consensus Mining & Seigniorage Corporation (CMSC) and is due to go public on the OTC Market’s OTCQX exchange tier around late 2023 early 2024.

On December 1, 2021, two of the Company’s Other Investments, HK Cryptocurrency Mining, LLC (“HKCCM”) and HK Cryptocurrency Mining II, LLC (“HKCCM2”) merged into a newly created Delaware corporation named Consensus Mining & Seigniorage Corporation (“CMSC”). —- https://www.frmocorp.com/_content/10q/FRMO_Corp_Q3_2022.pdf

“In the HK Cryptocurrency Mining LLC, the idea is to mine the cryptocurrency, then sell it that day. We accumulate the cash for a quarter, and then we pay it out as a dividend. Internally, we refer to that dividend as seigniorage, meaning we’re actually creating money—if you accept the idea that cryptocurrency is going to be money—and earning a margin on that.” —- https://www.frmocorp.com/_content/letters/2018_Q3_FRMO_Transcript.pdf

I could find not information on what exactly HK Cryptocurrency Mining II does/did, but I assume it’s the side of CMSC that mines and retains Bitcoin on its own behalf given that HKCM I sells its BTC, while transcripts show that CMSC does still hold BTC as well.

While their offices are in New York, CMSC contracts with miner hosting services across the country —which allows them to mine only in locations and at times when power is cheapest— and I believe, as noted in the previous section, use HM Tech as their backup mining host when they are unable to run mining operations under more favorable conditions at other hosting sites.

One last thing I’d like to add re. CMSC: As further evidence of S&B’s confidence in the mining operations and crypto space in general, it should be noted that while the initial investment in equipment for CMSC came from FRMO and HK, they never had CMSC repay that investment once the business actually started generating cash, but rather had FRMO and HK accept stock in the new company.29

.

More commentary on FRMO’s various larger crypto investments that I’ve just covered can be found here (especially in response to Questioner 7): https://www.frmocorp.com/_content/letters/2023_Q2_FRMO_Transcript.pdf

By my calculations, adding in the direct BTC and LTC holdings, these crypto assets make up around 10-11% of FRMO’s nominal TBV at the time of my writing this (it should be noted that, aside from GBTC and WELX, these investments are not carried on FRMO’s financials marked to market). My own estimate is that their crypto assets are actually around 20% of their nominal TBV.

.

Michael Mauboussin's might say that FRMO’s emergently vertical approach here was prudent given that they were getting involved in the Bitcoin space in the very early innings (since 2017) of the industrialization scale that we have today. The very loosely coupled nature of how these individual businesses seem to interact allows them to also create value in a horizontal manner, by generally operating selling to external customers independently, yet without FRMO running the risk of outsourcing too early in this industry’s development (which is why I think of their operations as “vertically modular”)…

Firms that are vertically integrated dominate when industries are developing because the costs of coordination are so high. Consider the computer industry in 1980. Most computer companies were vertically integrated to ensure that their products would actually work.

But as an industry develops, various components become modules. The process of modularization allows an industry to flip from vertical to horizontal. This happened in the computer industry by the mid-1990s. Modularization, which is not simple from an engineering standpoint, allows for standardization and the assembly of products off the shelf.

—- “Measuring the Moat” (2016), Michael Mauboussin

Indeed, there existed a non-trivial cost of coordination in the Bitcoin mining industry as FRMO was building it’s Bitcoin business. In recalling the creation of the mining LLC that were later merged to form Consensus Mining & Seigniorage Corporation (CMSC), Stahl noted their practice of having to make sure that the mining equipment they received actually functioned —or was configured— properly:

“[W]e made it a practice that if we’re going to buy mining equipment, Horizon itself, not FRMO, would by the mining equipment on behalf of the crypto funds, then use it for a month or so, taking on the risk that sometimes you don’t get such great equipment. After a month we’re satisfied that it’s good, and we would transfer it to the mining LLCs, and then they would pay us because we laid out the money.”

[…]

“Another kind of risk: a shipment of equipment we bought contained a virus. That’s something one should checked upon delivery, and we did check, but we missed that. The virus was placed there intentionally. The purpose of the virus was to steal, if I recall, 15%-20% of the cryptocurrency you mined daily. It was a small enough number that you might not notice it if you didn’t pay close attention.”

[…]

“[Y]ou should know that if you buy $10 million of equipment at a moment in time and you bought wrong—at the wrong moment—you’ve got a serious problem on your hands. That’s happened to a lot miners. We didn’t want that experience, so our intention as to buy in small lots. That way, if a purchase was problematic, and there have been such instances, it wouldn’t rise to the level of affecting the overall business profitability.”

—- https://www.frmocorp.com/_content/letters/2022_Q2_FRMO_Transcript.pdf

.

While there are other small hints of this kind of thinking across the FRMO earning calls, I’m not sure that the structure here was so much for the explicit purpose of vertical integration due to any kind of uneconomic cost-of-coordination, but rather more as a form of dollar (and labor/attention) cost averaging into the various crypto/Bitcoin sub-industries to experiment with where value could best be captured in the emerging industry...

“The obvious advantage of this scaling approach to investing in cryptocurrencies is that the investments are rather small and, in the event of failure, the FRMO balance sheet would not experience structural damage. […] New asset classes are a learning experience for everyone. If expanded in a gradual, deliberate manner, every employee in all of Horizon Kinetics can have the opportunity to develop new knowledge and skills in an environment free from the pressure of substantial loss of capital. The existing businesses continue much as before. Thus, in the event of an individual project failure, employees are at liberty to return to their former responsibilities, or perhaps transfer to another related more successful project.” —- https://frmocorp.com/_content/letters/2019.pdf

... What this does do is make FRMO the most responsibly managed (and management-aligned) diversified Bitcoin-industry “fund” that I can think of.

.

This process that Stahl and Bregman used to build out their Bitcoin operations once he had read the Bitcoin whitepaper and concluded that Bitcoin would be extremely valuable —in success mode— reminds me a lot of, Y-Combinator founder, Paul Graham’s essay on “How To Do Great Work”:

Though it sounds more responsible to begin by studying everything that's been done before, you'll learn faster and have more fun by trying stuff. And you'll understand previous work better when you do look at it. So err on the side of starting. Which is easier when starting means starting small; those two ideas fit together like two puzzle pieces.

[…]

Doing great work is a depth-first search whose root node is the desire to. So "If at first you don't succeed, try, try again" isn't quite right. It should be: If at first you don't succeed, either try again, or backtrack and then try again.

"Never give up" is also not quite right. Obviously there are times when it's the right choice to eject. A more precise version would be: Never let setbacks panic you into backtracking more than you need to. Corollary: Never abandon the root node.

Stahl mentions in the Q3FY2023 earnings call that they had to learn and move slowly into the Bitcoin space as there were no text books on the business and economics of the crypto industry at the time that you could turn to in order to fast-track or blueprint your entry —if there were, it would also likely have had to of been an already-mature (read as “competitive”) industry and FRMO might thus not have even been interested in pursuing any big investment plans in that area in the first place.

“If you don’t mind being wrong on the way to being right, you will learn a lot.” ~~~ Ray Dalio, “Hedge Fund Market Wizards”

.

“And it’s not just Digital Currency Group. It's every company in crypto, with the exception of us. […] Lots of companies threw a lot of capital at something that they ought not to have thrown a lot of capital at, and we had a completely different strategy.” —- Murray Stahl, https://www.frmocorp.com/_content/letters/2023_Q2_FRMO_Transcript.pdf

FRMO’s in-house repair business (which extended existing rig life), incremental/stepwise/dollar-cost-averaging capital allocation strategy, and lack of dollar debt in their operations (thus avoiding tying timed USD obligations and USD/BTC pricing volatility to their BTC mine-&-HODL operations) allowed them to come out of the 2022 “crypto winter” basically unscathed.

Other BTC miners were not so prudent and, as mentioned, took out USD loans to invest heavily in BTC mining equipment, encouraged by the boom in 2021, and found themselves struggling to meet those obligations when the Fed started its drastic interest rate hikes in 2022 and the FTX scandal crashed the broader market price of the BTC they were mining in ‘Bitcoin land’ to sell back to ‘fiat land’30 —not to mention that all of this investment was being carried out with the Bitcoin mining reward “halving” coming up around mid 2024, which threatened to make much of these current generation rigs about 50% less profitable just on that fact alone.31

Two kinds of profitability: If you’re going to go outside the system, stay out

As briefly mentioned earlier, Coinbase’s former CTO Balaji Srinivasan’s came up with the idea of “the network state” in his 2022 book by the same name and is a concept of a new type of political entity that is built on decentralized networks and enabled by technology, particularly that of blockchain and cryptocurrency (achieving a version Friedrich Hayek’s idea of privately issued currencies that compete in a free-er market of currencies than those offered by the oligopoly of traditional ‘fiat land’ countries). The network state is seen as a successor to the traditional nation-state, which is based on centralized power structures and physical borders; built on decentralized networks that are not limited by physical borders and can be accessed by anyone with an internet connection. The fundamental concept behind the network state is to assemble a digital community and organize it to crowdfund physical territory and it’s own accepted currency. The book essentially acts as a blueprint for bootstraping the foundations of a new kind of “country.”32

I find Balaji’s concept, on the whole, as seeming a bit naive and Utopian (a kind with the odd flavor of libertarian tech-bro wordcels)33, but the general idea is a useful mental model when thinking about Bitcoin and its allies; I think I’d more readily bet on something more like a “network culture” than a “network state” and is closer to how I think about it in my mind when I use the term.

I might phrase Stahl’s BTC-accumulating operations like this: If your genuinely bullish on the longterm success of the decentralized “network state/culture”34 of ‘Bitcoin-land’ and the digital scarcity thesis, why would you want to convert the profits from your Bitcoin-land operations back to the ever-debasing currency of ‘fiat-land’?

.

“My second reason the crypto mining companies got in trouble is by ignoring the whole point, the purpose of crypto. The whole purpose of crypto is to be outside of the dollar/fiat currency system. If you want to be outside of the that system and calculate everything in your business operations in bitcoin, then why would you reenter the dollar system to fund investments and be subject to the mutability of the dollar, even though you think in the long run bitcoin will do better than the dollar?” —- Stahl’s response to Questioner 15, https://www.frmocorp.com/_content/letters/2023_Q2_FRMO_Transcript.pdf

It should also be noted that, per the Q3FY2023 earnings call, 1) FRMO buys their mining rigs using BTC, not USD, and 2) they run their operations with little to no debt. I’m not sure how common this first part is/isn’t among BTC miners in general, but FRMO’s differentiation from other miners in the latter sense is self evident at this point. So, their mining operations run parallel to the dollar system; they pay for assets in BTC and get a return in BTC. Aside from energy costs, USD pricing volatility of BTC does not matter as much to their mining economics; it’s not about EPS, but about ‘BPS’; about BTC RoA; not about ROIC, but about ‘ROIB’. No “foreign” exchange risk. (Someone should ask them to report their Bitcoin operations separately using only BTC).

For example, BITMAIN is one of the world’s largest manufactures of ASIC mining rigs. I went to their website and clicked on a random product listing on the front page. Notice the various payment options, which include payment in BTC. This applies to all of the rigs on the site that I clicked on.35

********** UPDATE 20230908: On the 2023 FRMO annual earnings call I submitted a question relating to the apparent superfluousness of paying in BTC vs USD given that mining rigs (like the on shown above) are all priced in USD. Stahl claimed that the decision by FRMO is pay in BTC is not a company policy, but a requirement by manufactures that they get paid in BTC. Yet, clearly, it can be seen that BITMAIN accepts USD payment (as can be seen in the payment options in the image above) and is further detailed on their website. I will need to bring this up again at the next earnings call. **********

.

HK’s mining operations are not ‘conceptually domiciled’ in the USA or even ‘fiat land’ in general, but rather in the “network state” of ‘Bitcoin land’. Whether this developing ‘state’ will ultimately become a fully accepted, respected (as Stahl seems to anticipate), and participating part of the wider global economy is presently to-be-determined, but that is the bet that HK is making here —and the context in which they’ve been sizing their investment position and incremental capital allocations.

There is a common argument that Bitcoin mining operations do not produce (and that BTC is not) a productive asset (as often stated by the Berkshire’s Buffet and Munger). In my opinion, is somewhat akin to being an investor in August 11, 1965, and saying that the tiny island nation with no natural resources, a “malarial swamp with no assets” (in Charlie Munger’s own words)37, making up the economy of Singapore was worthless and did not represent any material productive assets; today Singapore is the leading financial centre in the Asia-Pacific. Stahl seems to believe that, in time, ‘Bitcoin land’ and BTC will similarly be seen as as good as —really, better than— gold or any other fiat currency in ‘fiat land’.

(https://fred.stlouisfed.org/graph/?g=18OUJ)

.

For further reading, a lot on this idea and how other miners got in trouble in 2022 is covered by Stahl in response to “Questioner 15” in the Q2FY2023 FRMO earnings call.

.

********** UPDATE 20240414: Lest anyone think that I’m purely a cheerleader for FRMO or the manner in which they’ve executed their Bitcoin business build-out, here are some specifically Bitcoin-related criticisms of FRMO:

Looking at the latest reports from Winland, they mined 56 BTC in 2021, 71 BTC in 2022, and only an additional net 75 BTC in 2023 due to selling of units in that year. Given management's past comments on the benefits of an operating Bitcoin miner that banks its bitcoin earnings and accrues that to its balance sheet vs spot ETFs that must ultimately sell portions of their holdings, why did Winland, which is effectively run by Horizon Kinetics, sell the majority of the BTC it mined in 2023, which ultimately resulted in realized losses on sales of Bitcoin per Winland's most recent annual report (Note 17)? How should shareholders think about the rate of accumulation of Bitcoin at Winland

In the past, management has mentioned that one of the main benefits of an asset-light hard asset company is the ability to invest counter-cyclically vs the wider industry that the asset-light hard asset company may be a part of. Perhaps I'm mistaken on this, but FRMO did not appear to make significant investments during the 2020 COVID market shocks nor in the 2022 crypto winter, despite the company's strong balance sheet. In 2020 management commented in a quarterly meeting that they did not see any opportunities to buy a whole operating business, yet Winland appears to be the target for that purpose and has been in FRMO's portfolio since around 2015. Why didn't FRMO use it's large cash balance in the depths of the 2022 crypto winter to finish buying out a majority stake in Winland? It does not appear as if doing so would have been a mutually exclusive contradictory decision to FRMO's stepwise strategy in buying new mining equipment. What kind of event would spur management into using the cash balance at the company if not a global economic shutdown or a 2008-moment in the crypto industry? It would have seemed that buying up the rest of a targeted 51% stake in Winland would have been only a small portion of FRMO's cash balance in the recent crypto winter.

Given the small relative marketcap scale of Winland vs FRMO, what is management's goal in rolling FRMO into Winland as an operating business vs doing crypto mining at FRMO itself at a scale commensurate with FRMO's size? Winland presently makes up around 2% of FRMO's total assets. How would this ever be of material value to FRMO?

How does management think about the lack of clawbacks of BTC in the case of fraud and how that hinders adoption? By this I don't mean the Bitcoin blockchain being hacked, but rather the much more frequent occurrences of people having their Bitcoin seed phrases, addresses, private keys, and subsequently their BTC itself stolen from them by tricking them into thinking they are a legitimate entity, hacking the user's personal computer, some other form of trickery, or just happening to see them entering their seed phrase on a wallet over their shoulder at a coffee shop. When it comes to adoption, despite its over 10 years of development, Bitcoin appears to leave little room for error and no consumer protections which makes it hard to imagine how mainstream Bitcoin adoption would work. Asked another way: Suppose one of the US Federal Reserve banks wanted to publicly hold Bitcoin and asked Horizon Kinetics to advise on how that Bitcoin should be received, stored, secured, and possibly transferred at a later time. How would you advise the Fed? How would you advise a household? With a lack of clawbacks, every storage mechanism and smart contract is just a bug bounty reward waiting for someone to discover code or social engineering that breaks it.

**********

********** UPDATE 20240602: You can see Stahl’s response to these questions in the FY2024Q3 conference call here (starting at Questioner 14): https://www.frmocorp.com/_content/letters/2024_Q3_FRMO_Transcript.pdf **********

.

Stahl is a director of the Bermuda Stock Exchange and of the Minneapolis Grain Exchange.

https://www.bsx.com/the-bsx-organisation-structure

“There are only a handful of big exchanges with futures and clearing licenses. I mentioned only a tiny subset of the types of products that are possible. There are more products conceivable than all the exchanges, with all their technology put together, can handle at the moment. It's going to be just an incredible experience.” --- https://www.frmocorp.com/_content/letters/2023_Q2_FRMO_Transcript.pdf

I’d note that I checked the old Goldcorp filings (see https://www.sec.gov/edgar/browse/?CIK=919239) (before the 2019 merger with Newmont) and could not actually find any evidence that they held any gold on their balance sheet as a part of their treasury (vs as finished goods, work-in-process, heap leach ore, and stockpiled ore), so IDK exactly what Stahl is referring to here.

“First, when we control a company we get to allocate capital, whereas we are likely to have little or nothing to say about this process with marketable holdings. This point can be important because the heads of many companies are not skilled in capital allocation. Their inadequacy is not surprising. Most bosses rise to the top because they have excelled in an area such as marketing, production, engineering, administration-or, sometimes, institutional politics […] The areas I get involved in are capital allocation and selection and compensation of the top man. Other personnel decisions, operating strategies, etc. are his [the CEO’s] bailiwick.” —- Warren Buffett in “Essays of Warren Buffett” by Lawrence Cunningham

TBH, when I look at Winland’s history, I’d have to admit that I think that their acquiring of Mt.Gox Bitcoin claims was likely more due to the encouragement of director Thomas Braziel (co-founder and managing partner of 507 Capital) then anyone from HK. See https://www.yahoo.com/news/mt-gox-surprising-redemption-bitcoin-190418425.html; https://507capital.com/mtgox/.

Winland terminated it’s CEO in November 15, 2013 (https://www.otcmarkets.com/otcapi/company/financial-report/133577/content) and I do not see any sign of a CEO at the company until the company’s restructuring in 2018 when Winland Electronics changed to Winland Holdings and it was determined that “Thomas Braziel and Matthew Houk [a Horizon Kinetics employee] will serve as Co-Chairmen and Co-Chief Executive Officers of the Company.” They had both been directors since 2013 (https://www.otcmarkets.com/otcapi/company/financial-report/190095/content). The CEO title is later only assigned to Houk starting in the 2021 annual report (https://www.otcmarkets.com/otcapi/company/financial-report/325275/content) with Braziel apparently stepping down while running the Winland Credit arm under his 507 Capital under a 1.5-and-20 management/performance agreement —presumably looking for more opportunities to invest in distressed (crypto) debt (of which there may be a fresh batch of opportunities coming out of 2022; https://www.wired.com/story/crypto-bankruptcy-markets-thriving-ftx-collapse/).

I’d also say that I don’t usually make a big fuss about “price” volatility when the underlying economics of the business are still good and especially when they are still paying me a dividend from such (which unfortunately FRMO does not do); from a bond/coupon POV, I just want to see a good yield-on-cost in the long run compared to the effective Fed Fund rate; ultimately, the time-weighted income you end up with is what really matters and I like to diversify that across time by getting back some of the value generated by the business up front.

What really gets me on tilt about pricing vol in this case is —aside from the natural thought of “OMG what did I miss about the investment thesis”— the retroactive face-palming when I see in those cases that I could have gotten the affected company at a significantly lower price than I initially paid when I’m already at a full position in that stock.

You can read more about the Mount Gox claims and the story behind them here:

https://blog.wizsec.jp/2021/02/mtgox-claim-calculator.html

https://en.wikipedia.org/wiki/Mt._Gox; https://www.coindesk.com/markets/2021/01/15/mt-gox-creditors-can-claim-90-of-bitcoin-left-in-bankruptcy-bloomberg/

https://www.acquired.fm/episodes/ftx-with-sam-bankman-fried-mario-gabriele

While some attribute Bitcoin’s historical tendency to rise after halving events simply to hype (https://money.com/will-bitcoin-halving-cause-cryptos-price-to-soar/), Stahl believes that the correlation is more fundamentals-based, having to do with the economics of mining Bitcoin (and its relationship to the alternative BTC-accumulation method of simply buying BTC in the market) which strongly centers around the predictable block reward halvings and its effects on the profitability of past- and current-generation rigs.

https://www.frmocorp.com/_content/letters/2021_Q2_FRMO_Transcript.pdf, pg.5-6

IDK if my calculations are right here. In the 2021 letter, Stahl notes that they own 0.05% of DCG’s SO. At an equity value of $2.2bn that would be a value of $1.1MM for FRMO (x1.77, that’s $1.947MM). Where is that report getting that per share value from? Did FRMO just get diluted from the “issuance to Genesis Capital creditors of a new class of DCG redeemable, convertible preferred stock” from that article?

Despite the corny title, the book is very interesting and one of the only books I know of (other than Maurice Schiller’s) that is so heavily focused on special-situation or event-drive investing.

Though this might not have been such a big deal at the time since, as Stahl himself even mentions, the actual useful life of this equipment tends to be around a depreciation schedule of 3 years.

An interesting critique of Balaji’s idea can be found here: https://www.protocol.com/policy/srinivasan-network-state

Taking the term here from former Coinbase CTO, Balaji Srinivasan, though I use it in a somewhat less strict sense than he appears to think of it in his book (https://thenetworkstate.com/).

Though I’d note that these rigs all appears to still be priced in dollars, not BTC, so Stahl’s argument has some holes I’ll have to ask about in the next earnings call.

Great piece. We love this company and it’s one of our top positions. We’ve considered writing it up but we’ll probs just send our readers here.