($GEO) Geo Group: Trump admin thriver, durable under Democrats

Quick commentary on an obvious Trump admin beneficiary that might not do too badly under a Democrat admin either

Ticker: GEO

Marketcap: $2060.70MM

Price: $15.30

PT: $26

Payback period: 1 - 4yrs

Upside CAGR: 70 - 14%

Downside PT: $14.40

Downside CAGR: -5.37 - -1.5%

.

Intro

These walls private prisons are funny. First you hate them, then you get used to them. Enough time passes, you get so you depend on them.

“In response to voter rejection of funding for new prisons and orders by federal judges to relieve overcrowding, some states turned to private companies to build new prisons. Private prison arrangements are attractive to state officials in part because the companies are able to build prisons quickly and without the need for voter approval.” ~~~ https://www.hamiltonproject.org/publication/paper/the-economics-of-private-prisons/

(https://www.aclu.org/news/immigrants-rights/unchecked-growth-private-prison-corporations-and-immigration-detention-three-years-into-the-biden-administration; https://www.aclu.org/news/immigrants-rights/more-of-the-same-private-prison-corporations-and-immigration-detention-under-the-biden-administration)

.

As the US Presidential election day nears, I thought I’d do a quick post for a related idea I’ve been playing with.

When thinking about companies that are hated, yet selling at a reasonable value or being sold for non-economic reasons, what’s happened with private prison operator GEO seems like a pretty good example of what one would be looking for.

(https://investigate.afsc.org/company/geo-group)

I look at this long list of non-economic-based divestment of institutional money from GEO and am reminded of Nick Sleep’s Nomad partnership letters (https://igyfoundation.org.uk/wp-content/uploads/2021/03/Full_Collection_Nomad_Letters_.pdf):

“We consider ourselves contrarian, value-based investors. Ordinarily what we are buying is hated and reasonable value. When investments go from hated and reasonable to despised and cheap something is normally up in the markets.”1

Furthermore, I’d wager that this company, on even a quantitative level, screens rather poorly for non-fundamental reasons as well —adding to it’s mispricing. I subscribe to the stock data service TIKR (which supposedly uses S&P Capital IQ, a major data source used by many institutional investment firms and hedge funds, to get their primary stock/financial data). The data that they have on the primary data feed is severely incomplete: income statement data that only starts at the EBT line (eg. no info on revenues, opex, interest payments, SG&A, etc); balance sheet data missing many line items from 10K (even as simple as AR); cashflow statement that does not include capex, debt issuance or repayments, etc. That is, TIKR’s —and so I assume S&P Capital IQ’s— B/S and CFS data cannot be used to accurately arithmetically derive their own stated net totals and rather just grab the right answer externally to plug into the aggregates without having any of the line item details that would actually add/subtract to those totals; a majority of I/S data is simply missing. (I will note that their Secondary Data source option for the stock is much more complete, yet even then, the many numbers appear to be inaccurate (eg. missing capex figures or EBITDA numbers that do not match GEO’s own nominal or adjusted reporting of those same metrics)).

As another bullish signal, GEO founder/Chairman George Zoley recently upped their holdings, by around 7%, at prices not too far from where we’re at right now (https://www.sec.gov/Archives/edgar/data/923796/000095017024096460/xslF345X05/ownership.xml).

.

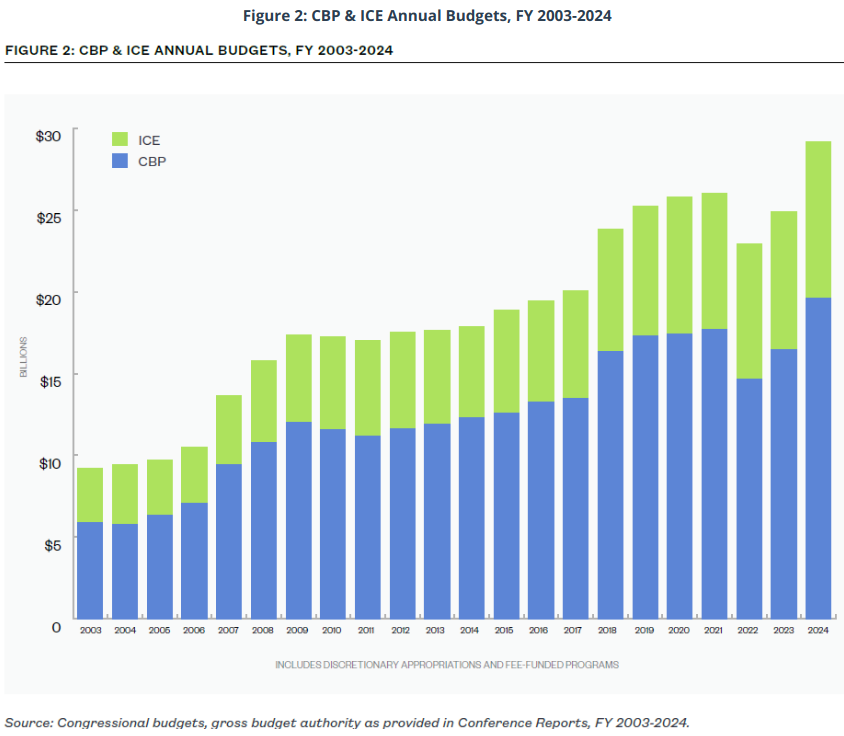

Meanwhile, customer spending continues to grow at a CAGR of around 5.4%/yr:

“Since the creation of DHS in 2003, ICE spending has nearly tripled from $3.3 billion to $9.6 billion in FY 2024 (Figure 2). Much of this funding has gone to increasing the agency’s ability to hold immigrants in detention around the country, to electronically monitor noncitizens on “alternatives to detention”, and to carry out deportations.” ~~~ https://www.americanimmigrationcouncil.org/research/the-cost-of-immigration-enforcement-and-border-security

Looking at the graphs below, we see that ICE budgets either increase or remain stable through both Democrat and Republican administrations.

Meanwhile, GEO revenues themselves have grown at an average (and similar CAGR) of around 7%/yr (vs the 2.6% inflation rate in the same period).

.

Business

GEO Group is a company that specializes in the ownership, leasing, and management of secure facilities, processing centers, and reentry facilities. They primarily operate in the US with additional operations in Australia, South Africa (via South African Custodial Management Pty. Ltd., SACM, and joint venture, SACS), and the UK through a joint venture, GEOAmey.

(GEO 2024Q2 earnings slides)

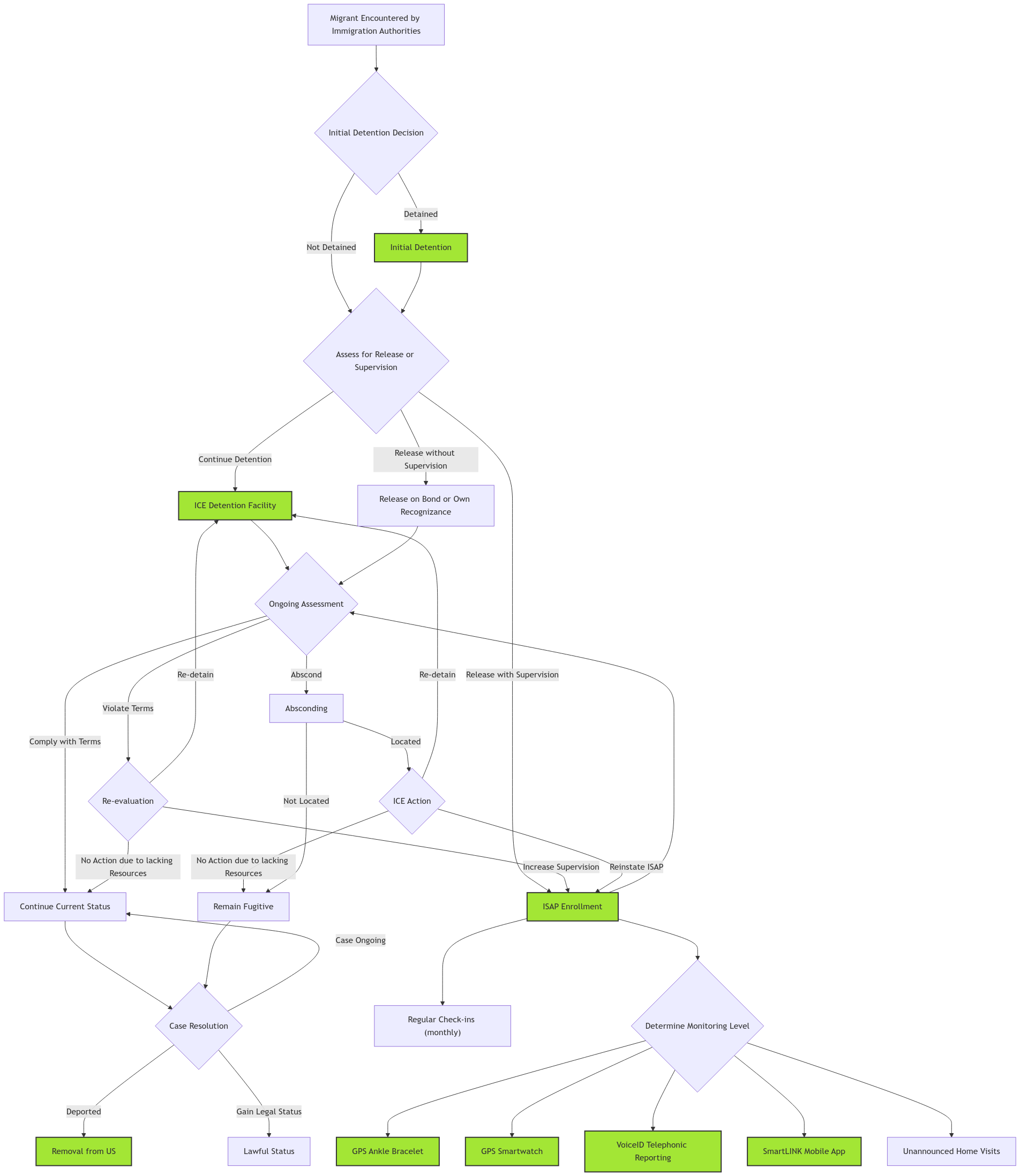

The ways in which someone moving through the US justice system might interact with GEO’s contracted services looks something like this (GEO services in green)…

(My understanding is that the vast majority of GEO’s facilities, including those under BOP and USMS contracts, house illegal immigrants convicted of Federal crimes (https://wearegeo.com/dispelling-myths/transparency/; https://www.geogroup.com/GEO-statement-on-President-Biden-DOJ-EO)).

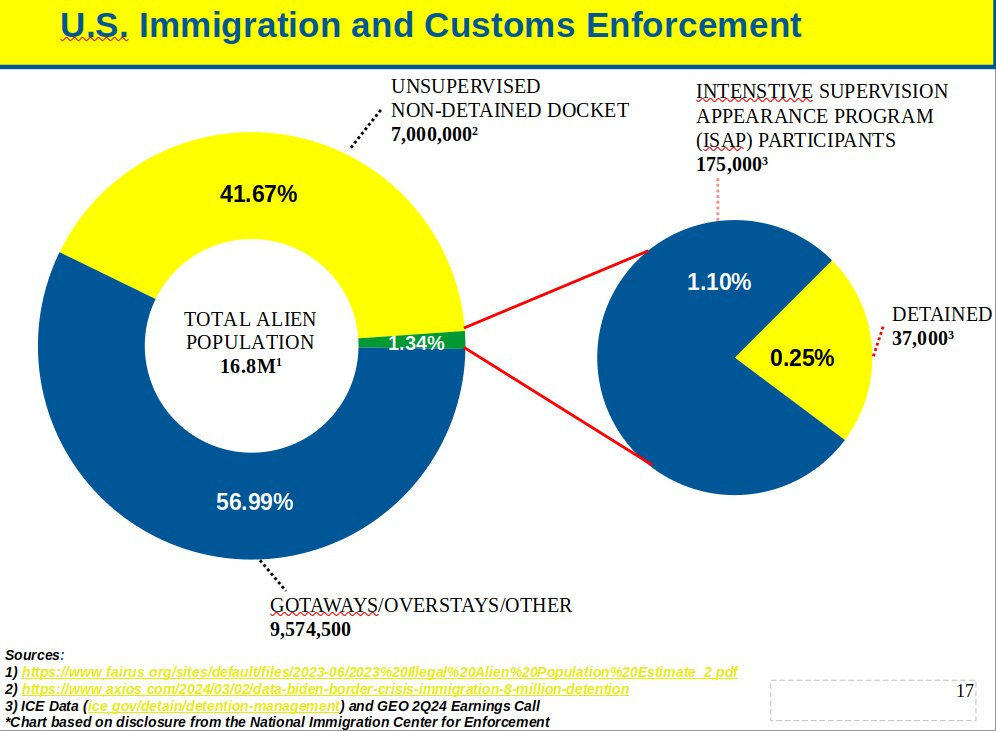

Through their subsidiary BI Inc. (acquired by GEO in 2011), they are also the exclusive electronic monitoring provider for ICE’s Intensive Supervision Appearance Program (ISAP), the largest alternative to detention (ADT) program operated by ICE. BI Inc. has been the main (sole?) case management and monitoring services operator for the program since its inception in 2004 (https://investigate.afsc.org/company/geo-group; https://www.americanimmigrationcouncil.org/research/alternatives-immigration-detention-overview), so unless the US goes with an open-borders policy, there’s not a huge risk of product/service substitution for GEO as they manage the largest alternative to detention program. BI Inc, like the rest of GEO’s business segments, also has contracts with state and local community corrections agencies across the United States.

So far as I can tell, BI’s ISAP contract has never been subject to any competitive bidding process since the time they won it and the existing contract has simply renewed and expanded with BI remaining the exclusive manager of the program. Sticking with BI as the ISAP program evolves would make sense as their experience operating the program would naturally make them most qualified —an advantage that only compounds and entrenches them over time— and least disruptive-to-continuity choice for such a high-profile and operationally complex program.

While this segment makes up less than 20% of GEO’s revenues, the business is asset-light and the electronic monitoring segment has made up 40%-60% of their operating income since the segment has been dis-aggregated from the re-entry services segment.

How does someone crossing the US border come to into contact with GEO’s detention facilities, secure transportation, or electronic monitoring (EM) services? My understanding is that is goes something like this (where GEO services are again in green)… 2

.

Why it’s cheap

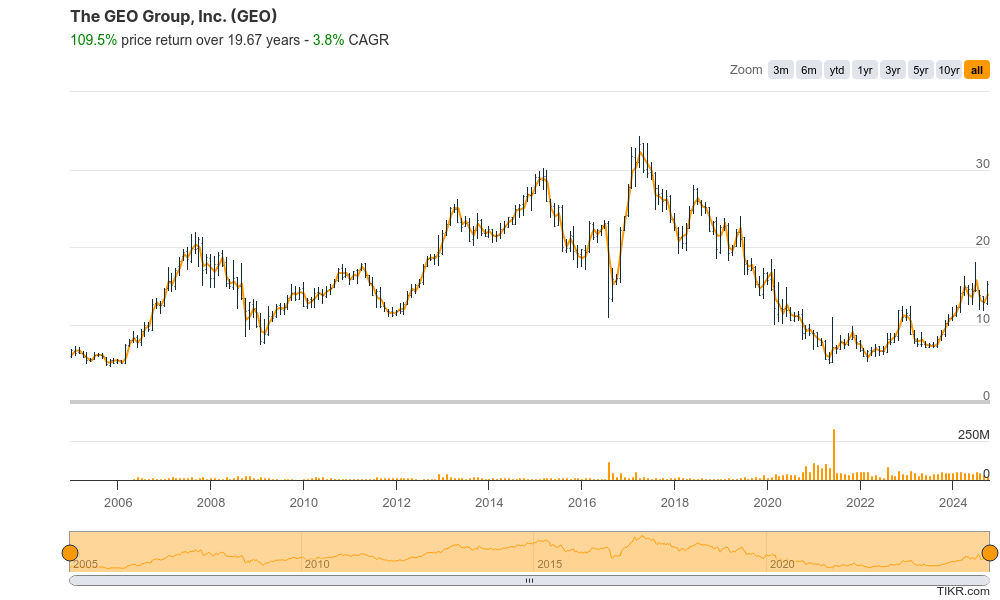

My understanding of GEO’s stock price decline from 2017 to present day is that it was mainly driven by concern over the company’s growing debt burden and subsequent stalling of the dividend, which suffered several cuts before being completely discontinued by 2022.

Adding to GEO’s troubles, on January 26, 2021, President Biden signed Executive Order 14006 which banned the renewal the Department of Justice’s contracts with private prisons operators (https://www.nbcnews.com/news/nbcblk/biden-s-order-terminates-federal-private-prison-contracts-here-s-n1255776; https://www.wakeforestlawreview.com/2023/01/president-bidens-executive-order-14006-a-positive-but-likely-fleeting-attempt-to-address-the-injustice-of-private-prisons/; https://www.geogroup.com/GEO-statement-on-President-Biden-DOJ-EO). While this did not affect GEO’s ICE contracts, it has lead to the near-total loss of their contracts with the Federal Bureau of Prisons (BOP). Meanwhile, it appears that the US Marshals Service (USMS) has been able to circumvent this EO by going indirect to continue contracting with GEO (https://www.aclu.org/press-releases/u-s-marshals-service-evades-biden-executive-order-to-end-contracts-with-private-prisons-aclu-obtained-records-indicate; https://www.motherjones.com/politics/2023/12/warren-private-prison-us-marshals/).

Shorty thereafter, on April 7, 2021, the company announced it was suspending its quarterly dividend payments “with the goal of maximizing the use of cash flows to repay debt, deleverage, and internally fund growth” and that “the Board of Directors has determined to undertake an evaluation of GEO’s structure as a REIT” (https://investors.geogroup.com/node/9961/html#d166890dex991.htm). On December 2, 2021, the Board of Directors “unanimously approved a plan to terminate GEO’s REIT election and become a taxable C Corporation, effective for the year ended December 31, 2021. As a result, we are no longer required to operate under REIT rules, including the requirement to distribute at least 90% of REIT taxable income to our stockholders, which provides us with greater flexibility to use our free cash flow.” (https://www.sec.gov/ix?doc=/Archives/edgar/data/923796/000095017024023181/geo-20231231.htm)

So we see changes in political climate and subsequent regulation leading to a material loss in business for the company, which led to a cutting of the dividend and reconsideration (and later termination) of GEO’s REIT status. Aside from the end of the dividend and REIT status likely causing a selloff by yield-focused investors, the situation probably also highlighted concerns about GEO’s growing debt burden and leverage ratios and contributed to further stock decline.

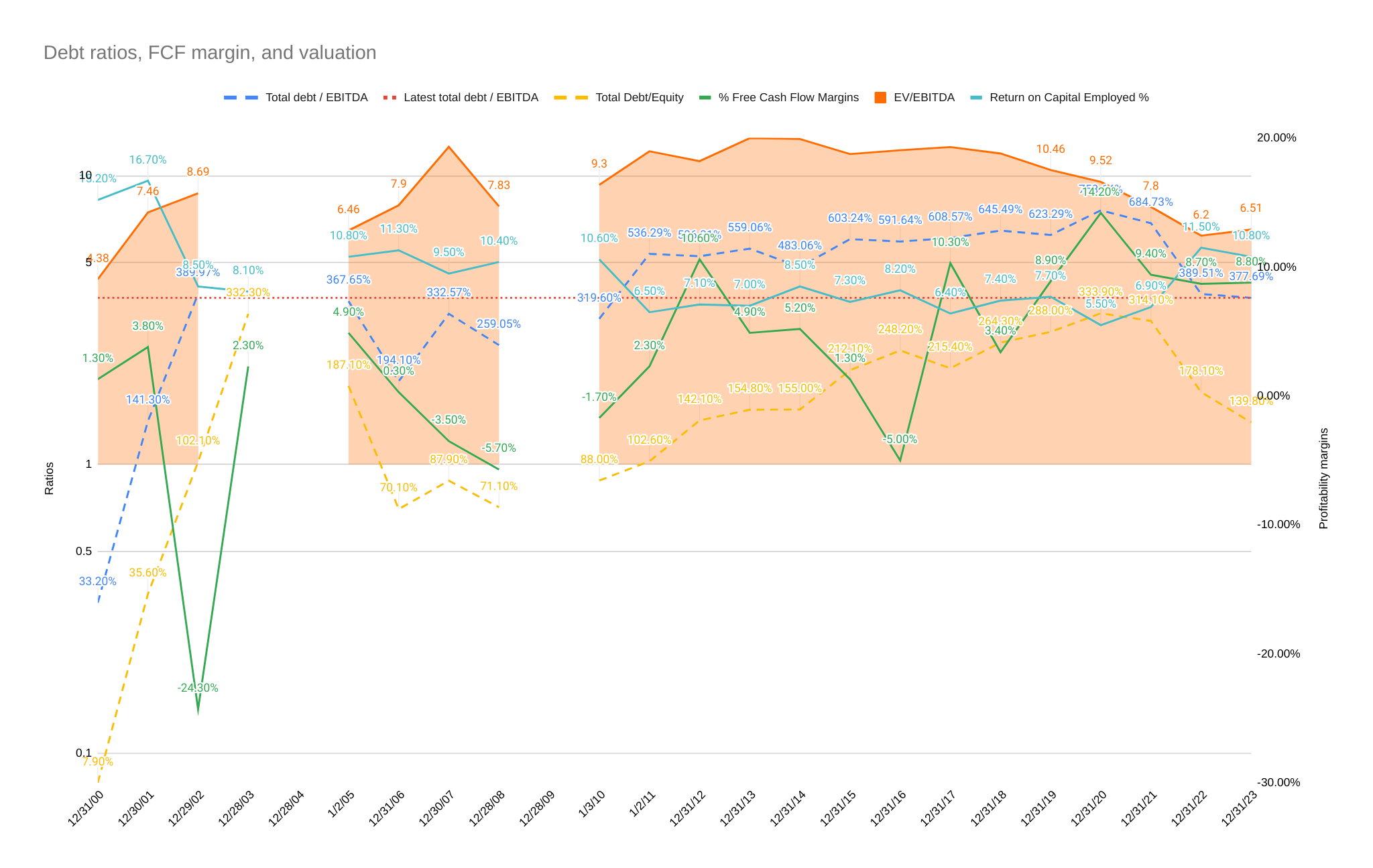

Since then, GEO’s deleveraging efforts appear to have paid off and the company’s debt ratios are near the lowest they’ve been in over 10 years. Furthermore, in 2024Q2, the company refinanced the majority of their existing debt with further-out maturities and a lower average interest rate. Here is a comparison of their new capital structure vs their pre-refi one…

(See sections “4. FAIR VALUE OF ASSETS AND LIABILITIES” and “Financial Condition”, https://www.sec.gov/ix?doc=/Archives/edgar/data/0000923796/000095017024093922/geo-20240630.htm)

We see a slight decrease in total liabilities (by $36,511,000), simplification of debt structure, and extension of debt maturities. Also note that, while the value-weighted interest rate for the various liens and notes under the new structure is slightly higher then the old (now 9.42% vs previous 8.52%), the new credit facility agreement now makes up 77% of debt (vs previous 51%) and is based on a floating-rate SOFR+3%, so the company is benefiting from the recent Fed rate cuts more than they would have under the old capital structure and reduces their total interest expense.

“The weighted average interest rate on outstanding borrowings under the Credit Agreement as of June 30, 2024 was 9.46%.” vs “As of December 31, 2023, we had no borrowings under our revolver, and approximately $75.8 million in letters of credit which left approximately $189.2 million in additional borrowing capacity under the revolver. The weighted average interest rate on outstanding borrowings under the Credit Agreement as of December 31, 2023 was 12.35%.” (https://www.sec.gov/ix?doc=/Archives/edgar/data/0000923796/000095017024093922/geo-20240630.htm; https://www.sec.gov/ix?doc=/Archives/edgar/data/923796/000095017024023181/geo-20231231.htm). Using these numbers for the credit facility, we get a new average weighted interest rate of 9.43% vs 10.30%.

Meanwhile, management has discussed the desire to return capital to shareholders again (per the 2024Q2 earnings call). The new refi gives management the ability to retain excess cash flow for “restricted payments”, eg. dividends or buyback (so long as debt/adjEBITDA remains under 3.5x), per 2024Q1 call —something they apparently could not do under the previous arrangement. 3

“In addition to pushing out our maturities and lowering our average cost of debt, the recent refinancing transactions have given us greater flexibility to explore options to return capital to shareholders. Under our new credit facility covenants, we will be able to retain 25% of excess cash flow until September 2025 and 50% of excess cash flow after that date as long as our leverage remains between 2.5 and less than 3.5x adjusted EBITDA. This would give us the ability to use our cumulative retained excess cash flow for restricted payments, such as dividends or share repurchases as long as our total leverage remained below 3.5x adjusted EBITDA. Under our new senior notes indenture, we will have an initial restricted payments basket of $125 million, which will increase over time by 50% of net income.” ~~~ GEO CEO Brian Evans, 2024Q1 earning call

If management actually believes their own $45/sh NAV valuation (I’ll get back to this later), then I’d expect them to go for buybacks over dividends at the stock’s current price.

Here we see that debt ratios have been falling to decade lows (dotted lines), while FCF margins and ROCE have remained positive and been steadily rising to decade highs. Meanwhile, the company is cheaper on an EV/EBITDA basis than it’s been in over 10 years.

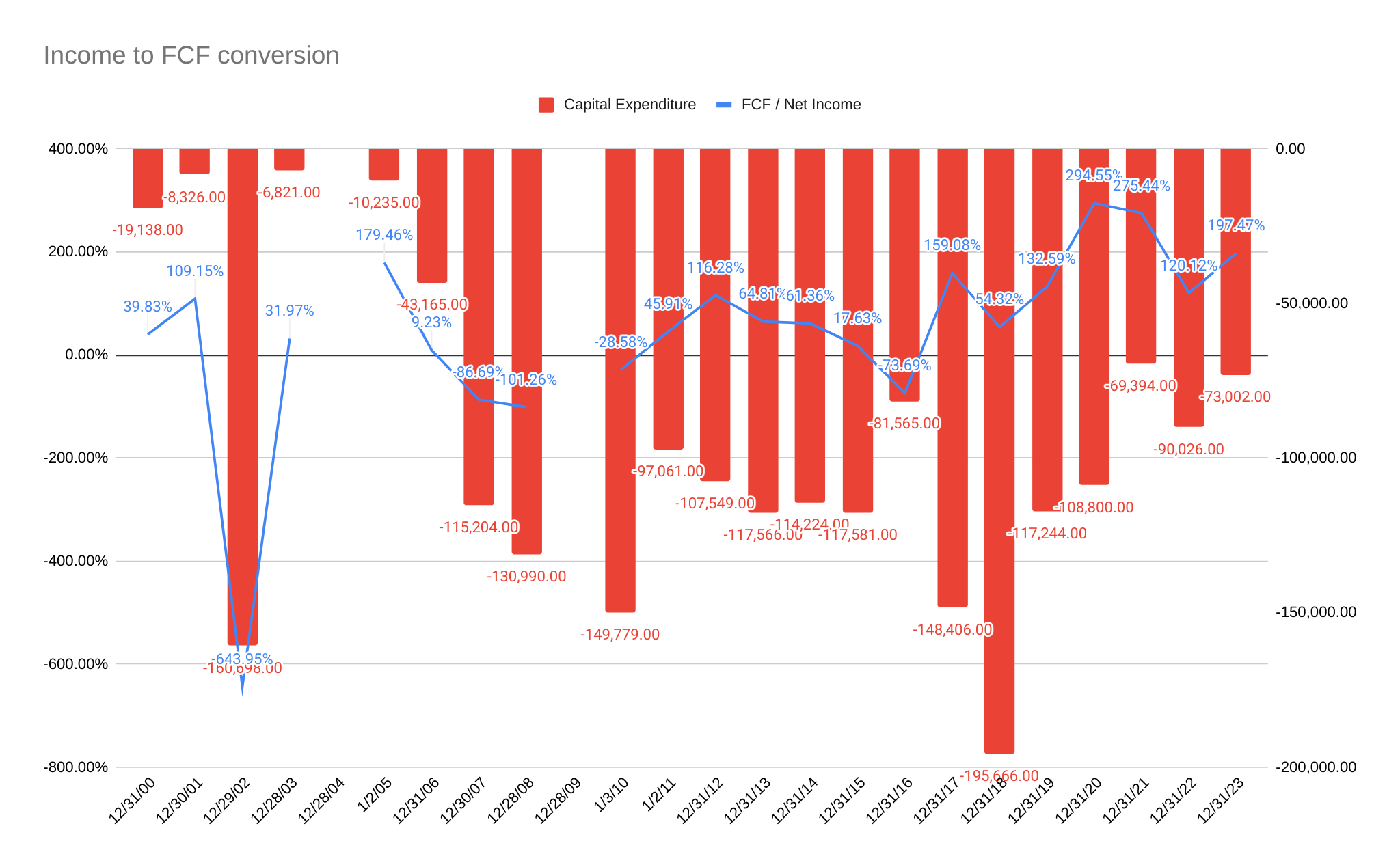

At the same time, FCF conversion on net income has been improving due lower spending on growth-capex projects and the completion of expansion projects in Australia from 2017-2020 as well as asset dispositions from 2021-2023 of less productive assets that likely reduced total maintenance-capex needs (eg. the sale the company’s youth business, Abraxas, and certain real estate assets 4).

.

Here’s some quarter-by-quarter stats on the business through some of the past periods of general market volatility. Notably the company remained CFFO positive through the 2008 financial crisis and CFFO and FCF positive through 2020, with ROCE remaining positive throughout both periods. (I just thought it was interesting, but wouldn’t read too much into it).

.

Examining some other periods of stock price declines in the company’s history, my interpretation is this…

2010-2012: I’m not totally sure on this one; it could be due the near 2x increase to GEO’s debt ratios during this period —and the initiation of the dividend at that same time may have been been cause for worry among shareholders concerned with the company’s capital allocation policies. There were also several controversies involving the company that all happened within a short time of each other in that period that may have contributed to negative investor sentiment (see https://en.wikipedia.org/wiki/GEO_Group#2010s).

2015-2016: Under the Obama administration, the DOJ announced plans to phase out the use of private prisons for federal inmates, stating that it would not renew its contracts with private prison contractors and causing GEO’s stock price to fall by around 40% that same day. However, this announcement was later rescinded by the Trump administration in 2016 (https://digitalcommons.molloy.edu/cgi/viewcontent.cgi?article=1139&context=etd; https://www.migrationpolicy.org/article/profiting-enforcement-role-private-prisons-us-immigration-detention; https://www.npr.org/sections/thetwo-way/2017/02/23/516916688/private-prisons-back-in-mix-for-federal-inmates-as-sessions-rescinds-order).

.

Valuation(s)

Prediction markets have Trump at around a 50% chance to win the Presidency (GEO’s external tailwind bull case), so you can paste that into your Kelly ratios and size appropriately (https://ballotpedia.org/Prediction_markets_in_the_2024_presidential_election; https://blogs.cfainstitute.org/investor/2018/06/14/the-kelly-criterion-you-dont-know-the-half-of-it/). Though, I recall that the prediction markets had Trump favored to win in 2020 and turned out to be wrong, I’d probably disregard anything that isn’t pretty close to 50/50 at the time of my writing this.

My simple PT is a 40% discount to management’s own estimated NAV of $45/sh. I use this discount to account for any actual liquidation of such niche assets, though I get that regulations and NIMBY-ism likewise make these same assets very hard to replicate. This gets us to around $27/sh and I use a default downside floor price of the BVPS, $9.43/sh (https://investors.geogroup.com/news-events-reports/presentations). My simple upside probability is 50% chance of a Trump 2024 win x 80% chance of company’s continued successful execution of deleveraging ==> 40% bull case probability.

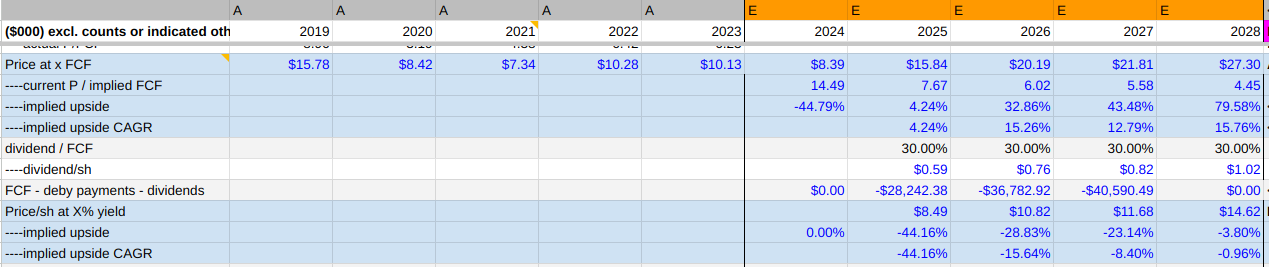

I’ve been playing with unit inputs in a simple model of the business as well to check if I can work backwards from fundamentals to a similar confirming PT without having to make too heroic of assumptions under a Trump admin and that target does seem achievable. At 8x FCF (around the same multiple the stock traded at before the COVID global shutdown and pre-2021 Biden EO), we don’t need to project too much to get to $26/sh (or 14.30% CAGR).

Here, we assume a Trump win, resulting in just the reactivation of BOP facilities (9,732 idled beds, per 2023 10K) at 2019 occupancy rate (92%, implying 8953 added active beds) without any other additional ICE detention5 or USMS bed activation (+/- some arbitrary churn) as well as projecting declining unauthorized immigrant population. Rising ISAP enrollment is based on an expectation of stricter enforcement policies to result in higher conversion of the remaining unauthorized alien population into ISAP participants.

Keep in mind that there are lots of assumptions and simplifications here, so I just try to make them explicit and I’m mainly just using this sheet as a guide / tool to play around with numbers to see how the magnitude & direction of outcomes are affected vs current price. Also wanted to keep things very simple so can easily plug in a minimum set of key actuals (or run-rates) as they come out going forward.

.

Even if Trump doesn’t win the White House in November, I think GEO’s future looks basically fine as the deleveraging strategy has been playing out well, with debt/EBITDA at it’s lowest in over 10 years, and management discussing return of capital options for 2025 that could re-rate the stock (though the B/S improvements are already a kind of return of capital iff it can translate into greater distributable FCF/sh).

Furthermore, getting unauthorized immigration under control is a bi-partisan issue and Federal funding trends appear correspondingly positive.

“A majority of Americans (54%) say that “controlling and reducing illegal immigration” should be a very important foreign policy goal for the United States, up from a previous all-time low of 42 percent in 2018.” ~~~ https://globalaffairs.org/research/public-opinion-survey/democrats-and-republicans-starkly-divided-immigration-policy, May 2024

(https://www.progressivecaucuscenter.org/federal-spending-on-immigration-examining-key-programs-and-impacts; https://www.americanimmigrationcouncil.org/research/the-cost-of-immigration-enforcement-and-border-security)

Given the stability of USMS detention populations (per GEO 2024Q2 presentation), a possible return of BOP contracts as well as trends in illegal immigration enforcement/budgets are the main inflection point / drivers for growth of GEO’s business.

.

I also played with the numbers to see how a status quo situation under a Kamala Harris White House admin might play out with a more lax border policy (though one should keep in mind that the US ultimately runs on Congressional consensus rather than a Monarch-In-Chief)…

Here we model declining active bed growth and growing unauthorized immigrant population, while ISAP enrollment percentage remains status quo. We see that the numbers are not too catastrophic; a 2028 PT of $14.40/sh (or -5.37% CAGR).

.

Democrat policies towards immigration could also end up being just as, if not more, accretive to GEO’s sustained FCF/sh than a Trump admin and the company could see a win-win situation no matter who’s President in 2025. A southern border continuing to lean more towards the “open” side of the spectrum would mean even greater immigration court backlogs and necessitate improvement & expansion of ICE detention and ATD programs like ISAP which “after years of expansion, decreased by 39 percent in FY 2023, due in part to court orders and a lack of resources.” (https://www.fosterglobal.com/blog/justice-delayed-immigration-courts-drown-in-backlogged-cases/; https://www.migrationpolicy.org/article/biden-three-immigration-record).

“[T]he immigration court’s backlog of cases has risen every single year since FY 2007. […] Despite the demand, as of the first quarter of FY 2024, there were only 725 immigration judges across the entire country for an average of nearly 5,000 cases per judge. So long as Congress continues to supercharge enforcement at the expense of adjudication, these backlogs will likely persist, and the funding poured into enforcement will not produce the results intended.” ~~~ https://www.americanimmigrationcouncil.org/research/the-cost-of-immigration-enforcement-and-border-security

“Democrats broadly favor policies that make it easier for immigrants to legally come to, and stay in, the United States. But moderates (55%) more than liberals (24%) see controlling and reducing immigration as a priority.“ ~~~ https://globalaffairs.org/research/public-opinion-survey/democrats-and-republicans-starkly-divided-immigration-policy

“To respond to the record migrant encounters in fiscal year (FY) 2022, which were topped the following year, the Biden administration fundamentally changed its policy on border enforcement. […] One year on, the challenge has persisted.” ~~~ https://www.migrationpolicy.org/article/biden-three-immigration-record

(https://www.bbc.com/news/articles/c0jp4xqx2z3o)

The main difference in this scenario, between a Trump admin vs Kamala admin, is that between a bigger slice of an existing/declining pie or a bigger pie (and hoping GEO’s slice grows proportionally).

Here we project consistent continued growth of unauthorized alien population with small increased in ISAP enrollment over time —in addition to a few added active beds to model additional ICE detention activation— for a 2028 PT of $27/sh at 8x FCF.

(This would actually be a preferable outcome IMO as, in the course of doing research on this company, I’m starting question the efficacy of private prisons vs government-run facilities —not even in terms of cost efficiency, rehabilitation, or recidivism reduction (which is rather irrelevant given that GEO’s facilities almost exclusively hold unauthorized aliens convicted of federal crimes), but in simply ensuring officer and inmate safety. 6 Meanwhile, the benefits of ATD seem a lot clearer in addition to being a higher-margin business for GEO.)

It should be noted that “an increase in enrollment in ATDs over the last decade has not corresponded with a significant decrease in detention numbers” (https://www.americanimmigrationcouncil.org/research/alternatives-immigration-detention-overview), so monitoring services could go up with bed occupancy related to ICE contracts remaining stable rather than being substituted by the former. By segment, the 2023 EBIT margins for GEO were: secure services & detention, 18%; electronic monitoring (EM) being the most profitable at 50%; re-entry services, 18%; international, 6%. GEO’s EM segment is both higher margin as well as less socially offensive, so growth of the EM business is a way to improve overall ROIC and reduce the company’s political risk at the same time —improving the overall attractiveness of the business.

Of course, if a more lenient WH admin allows unauthorized immigrants to simply cross into the US and join the already large ranks of non-detained, unsupervised, and gotaways rather then adding to ISAP participation, then obviously GEO’s EM segment is not going to benefit from their presence in the US. Similarly, high rates of absconding could call into question the utility of existing ATD programs (https://cis.org/Feere/Should-Congress-Continue-Funding-ICEs-Alternatives-Detention).

.

As shown my initial model, the benefit to GEO from a Trump admin would come if the “concepts of a plan” for his presidency ultimately expand the currently small fraction of the undocumented population that is detained or monitored in the US (less than 2%) to cover a larger portion of the country’s substantial population of unauthorized non-detained/unsupervised/gotaways (https://www.foxnews.com/politics/over-98-illegal-immigrants-not-under-federal-supervision-analysis ; https://www.pewresearch.org/short-reads/2024/07/22/what-we-know-about-unauthorized-immigrants-living-in-the-us/).

For example, during Trump’s previous term as President, he signed two executive orders aimed at increasing ICE enforcement actions.

“Executive Order 13767 included plans to tighten enforcement along the U.S.-Mexico border, increase the use of detention in order to end “catch and release” of migrants pending their removal hearings, and expand detention capacity. The desired scale of this expansion was revealed in a leaked White House memo calling for a doubling of people in immigration detention to 80,000 per day. Further, Executive Order 13768 reversed Obama-era policies by prioritizing all unauthorized immigrants for enforcement, in addition to reviving Secure Communities and pushing for new agreements allowing state and local law enforcement to enter into partnerships to assist ICE in immigration enforcement.” ~~~ https://www.migrationpolicy.org/article/profiting-enforcement-role-private-prisons-us-immigration-detention

A Trump admin would also likely mean a reversal of the Biden 2021 EO dictating that the US DOJ not renew contracts with privately operated detention facilities, which caused the drying up of GEO’s business with the US BOP. This EO appears to be responsible for the majority of GEO’s currently idle facilities (just based on inspecting the facility names in their 2023 10K “Asset Impairments” section). A resuming of operations at these facilities at average occupancy and per diem rates, management estimates, would have increased 2023 EPS by “approximately $.28 to $.33 per share based on our average operating margin“ (or around a 40%-50% increase to 2023’s actual $0.72 diluted EPS) (https://www.sec.gov/ix?doc=/Archives/edgar/data/923796/000095017024023181/geo-20231231.htm).

.

FYI: While not a very large holding for me in terms of current cost basis, I have call options around the $12-$15 breakeven range that, in terms of the underlying if exercised, would be a significant percentage of my portfolio. Given that we know the timing of a major inflection point for the business (here, the 2024 election outcome), I think options are a better way to play this. Though, again, despite any price volatility that may result from an presumably less favorable WH candidate winning the election, I think that GEO could still ultimately be a good buy in the long-run.

To paraphrase Presidential candidate Kamala Harris:

“We’re talking about the significance of the passage of time, right? The significance of the passage of time. So, when you think about it, there is great significance to the passage of time in terms of what we need to do to

lay these wirescompound capital. What we need to do tocreate these jobsconfirm or falsify our value thesis playing out. And there is such great significance to the passage of time when we think about a day in the life of ourchildrenportfolios.”

.

Catalysts

Trump election victory in November 2024

Reinstatement of the dividend

Continued deleveraging

Risks

Trump loses in November, Kamala and Democrat establishment wins and increases (rather than holds steady) political pressure on remaining private prison business with BOP

Kamala/Dems win and decrease ICE funding

Trump wins and either fails to follow through on hard-line immigration enforcement policy or attempts to follow through, but implementation becomes a quagmire

Basically, anything that ultimately results in anything that ends up greatly impeding GEO’s deleveraging or dividend plans.

.

.

Post update 20241113

So, there it is…

(https://apnews.com/article/election-day-trump-harris-white-house-83c8e246ab97f5b97be45cdc156af4e2; https://www.nbcnews.com/politics/2024-election/trump-says-no-price-tag-mass-deportation-plan-rcna179178)

… and he’s not even been sworn in yet.

The way I see it, the company’s capital structure is much improved, with leverage ratios lower than they’ve been in over 10 years, and is now in a better position than it’s ever been from a government environment standpoint. At the 2024Q3 earnings call, Chairman George Zoley thought that the incoming Trump admin’s more aggressive stance on immigration could mean the company is looking at “a potential doubling of all of our services, whether it’s in the detention segment, in the transportation segment, as well as the ISAP program […] So we’re looking at maybe March as the additive funding for this fiscal year.” The stock’s previous all time high around $30 may just be a reasonable floor for 2025 if the Trump admin is actually able to get all the funding from Congress that they feel necessary for their immigration policy (though I’m not planning on adding to my position, FYI).

Post update 20241216

GEO looks to be exiting survival mode and gearing up for “potentially unprecedented future growth opportunities.” Brian Evans served as GEO’s CEO from Jan 1, 2025 and announced that he would be retiring at the very end of the year on Dec 31, 2024. He is being replaced by J. David Donahue on Jan 1, 2025 (https://www.sec.gov/Archives/edgar/data/923796/000119312524279667/0001193125-24-279667-index.html; https://www.sec.gov/Archives/edgar/data/923796/000119312524074555/d717730ddef14a.htm#toc717730_4).

Evans’ experience was primarily in finance as he served as GEO’s CFO from 2009 to 2023 before his CEo appointment. Meanwhile, Donahue —who GEO is bringing out of his 2020 retirement in order to fill the CEO role— was more focused on operations and the company. To me it seems like GEO appointed Evans in 2024 for his financing experience as GEO faced an uncertain future and needed a fiance person to make sure they could keep the ship solvent and work on paying down debt; Evans was “instrumental in successfully executing the Company’s strategy for three secondary public offerings of equity; the execution of multiple financing transactions; and the successful completion of major business transactions”.

However, now that Trump has won the 2024 elections and will be the incoming President in 2025, it seems like GEO is swapping CEOs for someone with more operational experience as it looks like operations will be heating up bigly in 2025. Additionally, GEO promoted a former ICE COO Daniel Ragsdale as Senior Vice President, Contract Administration and Compliance, further hinting at heightened focus on ICE opportunities. Today, the company also announced a $70MM investment in expanding capacity for ICE-related services, while also exploring the sale of under-performing state-owned facilities; again, emphasizing the focus on ICE operations.

Stephen Miller, Trump’s deputy chief of staff is predicting that Republicans in Congress could get a budget reconciliation bill (which only requires a simple majority vote and Republicans now control all of Congress) to Trump’s desk by the end of January or early February. (https://thehill.com/homenews/administration/5033341-trump-prioritizes-immigration-policy/; https://www.crfb.org/papers/reconciliation-101)

The way I see it, the loss of the BOP contracts from the Biden EO was already priced into the stock’s depressed price and the stock’s recent upswing seems based —for the most part— on an expectation of greatly enhanced ICE operations. I actually like GEO more as an ICE-focused contractor vs the more politically risky business of detaining US citizens (who, for example, tend to have more ties to people in the US that can actually vote and participate/dissent in government to a greater degree); I think government demand for enforcement of immigration laws and the country borders is generally going to be pretty consistently non-zero, thus so too demand for GEO’s ICE-based services without too much need to for diversification into domestic detention services. (Though I do still think that private contractors’ profit-motive (and loss aversion) do have the ability to be better stewards of US prisoners iff incentives and enforcement mechanisms were better configured and managed than they appear to have been handled thus far; BTW, more onerous regulations help to entrench incumbents, so there’s a win-win element there as well).

Post update 20250222

https://www.pogo.org/investigations/private-prison-giant-hired-ice-detention-chief

https://www.npr.org/2025/02/21/g-s1-50100/senate-budget-resolution

https://www.cbsnews.com/amp/news/senate-republicans-budget-plan-vote-a-rama/

https://immigrationimpact.com/2025/02/21/gop-budget-reconciliation-plan/, “This expansion in capacity is exactly what Tom Homan, Trump’s “border czar,” has called for.”

“[T]he Senate is expected to begin the process for passing a budget reconciliation bill, a somewhat obscure Congressional procedure which allows a funding bill to pass both houses of Congress with only a simple majority threshold. […] Senate deal will reportedly include at least an unprecedented $175 billion for immigration and border enforcement, nearly six times the latest annual budget of Customs and Border Protection (CBP) and Immigration and Customs Enforcement (ICE) combined. […] This expansion in capacity is exactly what Tom Homan, Trump’s “border czar,” has called for. He is seeking at least enough funding to detain 100,000 people at any given time”.

Playing with the model, I’d up my base case PT —if the reconciliation package is passed— to around $32. This assumes that GEO is contracted for a similar proportional share of Homan’s 100,000+ requested additional detention beds as their detention operations usually are of ICE’s custody operations budget line (consistently around 60% after the 2021 Biden EO that limited GEO detention operations to ICE). The real uptick would come from seeing how these funds may be allocated to ISAP ATD, which GEO is the exclusive manager of and has much higher margins for the company. This could put GEO in the $50-$60 range. If the percentage of the US illegal alien population simply went from the current 2% to 4.5% (which could be funded at a $6 per diem per person if just half of the similar proportion as with regular appropriations budget that flows to ICE ATD (3.9%) goes to ATD from the Senate reconciliation package as well), in addition to hosting the extra requested beds, I have GEO at around $43.

Here I just set...

- The “change in active beds” to the amount implied by GEO's expected share (based on their implied 2024 share of ICE's ERO > Custody Operations line item) of the 100K requested beds.

- The “ISAP count / total alien pop” percentage such that is approximates the implied annual participants at $6/day based on my estimated % of supplemental reconciliation funding to go to ICE's ATD.

From another POV, the supplemental funding is projected to add $0.450bn/yr-$1bn/yr to GEO’s usual revenues. At a historical mean EV/Sales multiple of 2x, that would put GEO’s EV at $43/sh-$51/sh or a mktcap of around $31/sh-$39/sh after subtracting debt and adding back cash —which coincidentally lands right in between the modeled PT— with that value climbing up as mgmt is able to pay down debt.

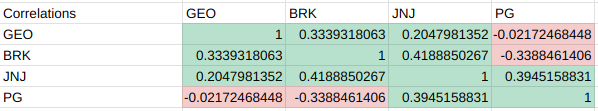

I had also previously assumed that the company also benefited from its business drivers being rather un-correlated (or anti-correlated) to the rest of the general economy and business cycle, but a basic analysis of their revenues and cashflows from operations (vs my general market proxies: BRK, JNJ, and PG) had mixed results. Based on this, the most I’d say is that GEO’s correlation to the general economy is just “pretty low.”

For more info, see “Section 6.05 Restricted Payments” here (https://www.sec.gov/Archives/edgar/data/923796/000119312524110253/d764760dex103.htm, GEO’s revolver credit facility agreement), sections 4.7 and 4.8 here (https://www.sec.gov/Archives/edgar/data/923796/000119312524110253/d764760dex43.htm, the 10.25% notes) and here (https://www.sec.gov/Archives/edgar/data/923796/000119312524110253/d764760dex41.htm, the 8.625% notes). The new revolver agreement can be compared to the older one here (https://www.sec.gov/ix?doc=/Archives/edgar/data/0000923796/000095017023004713/geo-20221231.htm).

Ravenhall Correctional Centre Project in Australia and Perry County Correctional Facility in Alabama in 2022 (per 2022 10K).

Vacant Land in South Dallas County, Texas, and Colorado + Albert B. Robinson Assessment (per 2023 10K).

Despite GEO making up 42% of the total 90% of ICE processing/detention bed capacity that is contracted to private sector operators (as of the 2024Q2 earnings call).