($RCG) The RENN Fund: A diversified and discounted permanent-capital nanocap with a lot of optionality (and a few private companies), being run for free by smart allocators.

They don't get paid until you get gains... well, barring more rights offerings.

“If I was running $1 million today, or $10 million for that matter, I’d be fully invested. Anyone who says that size does not hurt investment performance is selling. The highest rates of return I’ve ever achieved were in the 1950s. I killed the Dow. You ought to see the numbers. But I was investing peanuts then. It’s a huge structural advantage not to have a lot of money. I think I could make you 50% a year on $1 million. No, I know I could. I guarantee that.” —- Warren Buffett, 1999

Intro

The RENN Fund ($RCG) is a discounted, permanent-capital, nanocap with a lot of optionality and several private company holdings (that you couldn’t get exposure to in an open-ended fund or ETF with greater liquidity requirements and fluctuating share counts) being run by a smart allocator with Munger’s “fiduciary gene” who doesn't get paid until you get significant gains from current market value. This uncorrelated close-ended fund is managed by an intelligent stock picker with a track record of beating the market and is currently buying shares on the open market every week. The fund’s management is forgoing any compensation until the stock price is around 80% higher than where it is right now.

(Of course, you’ll have to be able to stomach an extreme-impact key-man risk centered on someone who —by most government measures— is considered a senior citizen)1.

I recently wrote a post regarding the investor pessimism that allowed Warren Buffett to accumulate more shares of his permanent capital vehicle, Berkshire Hathaway, at an extreme discount in the 1970s, while he was still relatively unknown to the investing public at large…

… A situation similar to the Buffett/Berkshire one existed (and still exists as I'm writing this) when asset management firm Horizon Kinetics (HK) took over management of the closed-ended (read as: permanent capital) RENN Fund around 2H20172 with HK founder Murray Stahl himself as the new CEO, while the fund was initially planning on going through with a 2H2016 liquidation plan by its original management team due a persistent and massive NAV discount and general decline in NAV since the fund's inception3 4; Stahl is the chief investment officer of HK’s billion dollar Paradigm Fund and has beaten the market quite handily since it’s inception...

Though, unlike the situation of Buffett/Berkshire in the 1907s, I believe that Murray Stahl and the Horizon Kinetics brand should have been relatively well known by investors by the time they took over (though he is currently not at the same level of fame as, say, Icahn, Klarman, or Buffett —I’d guess his name recognition is probably more around the level of Charles Akre).

I’ve written a lot more on Stahl here:

However, the fund still traded at a large —though lesser than with the previous management— discount to NAV for a good while after Horizon Kinetics officially took over; this was despite the signal of confidence of HK agreeing to a backstop where it would purchase all unsubscribed shares from the rights offering5 it had planned as part of the change in management and, furthermore, abstaining from any management fee until NAV exceeds $25MM, a 66% increase from the $15MM NAV the fund currently has6.

Note that the management fee will only apply to asset above the $25MM floor (eg. when NAV reaches $26MM, HK will only charge a 1% fee on the additional $1MM over $25MM). To me it seems like Stahl is not planning on NAV remaining anywhere remotely close to where it is presently and they are certainly incentivized to get NAV much much higher than just that base watermark.

Currently, the fund trades at a 15% discount to NAV at the time of my writing this... so the base case upside could be around 80% (of course, put whatever time horizon and subsequent IRR on that as you see fit) —until then, Stahl and HK are working for free.

Assets

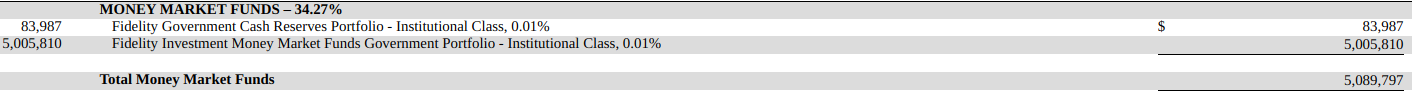

The fund also has 33% of assets in money market funds that —aside from capping the downside to around a still-painful-if-it-did-happen 66%— now provides significant interest income given the drastic interest rate hikes we've seen so far. So keep in mind that if you wanted an X percentage point position explicitly in equities for a portfolio, then you’d really have to put X/(1-0.33) pps into this position to compensate for the cash portion.

The fund also has significant capital loss carryforwards (CLCFs), not recorded on the balance sheet, from the previous management losses that amount to nearly the entire existing nominal NAV of the fund7 (if you'd like, adding this to $15MM NAV brings the discount on the CEF to around 30%). These CLCFs are particularly useful since CEFs must distribute all of their income and capital gains to shareholders8 (like with mutual funds)9 and the CLCFs can be used to reduce to the taxable portion of those distributions inasmuch as they can be used to offset any capital gains portion of those distributions:

Meanwhile, Stahl has been filing SEC Form 4s showing open market buys almost every week on the CEF for himself and his various HK/FRMO entities (and his spouse)10. In total, Stahl has so far bought up 6.7% of all outstanding shares11 and “[he] does not receive compensation from the Fund for either role except for his indirect benefit from Horizon Kinetics Asset Management LLC’s management fee” nor do any of the other directors12.

(From what I can tell, the buying appears to be correlated to the end of the initial COVID19 market shock and with the lead up to the Stahl-led conversion of the Texas Pacific Land Trust into a c-corp entity. Let me know if there is some other, more relevant, event I’m missing. I wonder, given the relatively small per-transaction volumes, is this just the investor equivalent of chumming the waters to net retail investors into the fund? Note that the amounts in which he’s buying are usually very small in terms of individual transactions, so he appears to be dollar cost averaging in a quite conservative, though consistent, way (I’m buying in a similar manner so long as the extent of the NAV discount persists).)

You will need to make up your own mind on what kind of premium/discount to NAV is justified, but simply taking HK's headlining $1.13B Paradigm Fund as a proxy for what we can expect for the CEF...

… I’d say the fact that Stahl is consistently generating alpha warrants some non-zero premium rather than a discount —or at least warrants trading much much closer to NAV; clearly the market disagrees, though I haven't been really able to figure out why, full disclosure; I think that the magnitude of the discount represents quite overly pessimistic sentiment.

Looking at the performance of the Paradigm Fund since it’s inception in 200013 vs the S&P 500, we see an alpha of about 520bps, so I'd think that the CEF should —from a long-term POV, assuming that Stahl still has ‘the right stuff’ to pull off similar alpha as with the Paradigm Fund in this new economic and interest rate environment— trade for a 520bps premium to NAV (or 270bps if we deduct the annual 150bps audit and (currently-non-existent) 100bps management fees).

On the subject of fees, this was the fund’s income and expenses in the December 31, 2022 annual shareholder report14:

At the time, they had 33% of assets (or $5MM) in money market funds15 and rates started the year at around 1.5% and were steadily rising all throughout 202216. As I write this, the money market rate is now around 4.5%, so the fund's interest income should be closer to around 3x this amount ($5MM*0.045 = $225K) vs the last reported value, going forward. Just looking at the money market investment and TPL, iff interest rates and TPL's dividend rate17 remain static from here, the annual income for the fund for 2023 should be closer to around...

($5MM × 0.045/yr) + (1908 shares × $13/yr) = $249804.00

… This should cover most of the fund’s annual expenses going forward that total to around $240K and are largely fixed costs —with anything extra being distributable to shareholders or available for reinvestment.

The fund also includes a exposure to Stahl's private equity investments in Big League Advance LLC18, Diamond Standard Inc19, and Miami International Holdings Inc20 that you wouldn’t have access to by simply following the funds holdings reports every six months and copying their holdings on your own.

“A recurring theme in our answers to these questions will be that an asset manager should want to be an asset manager and investor, not an asset gatherer. You don’t want to invest money just for the sake of charging people a fee on it, and you don’t want to invest money in businesses unless you foresee a suitable rate of return in relation to the risk. It’s not easy to do that in the context of a mutual fund or other vehicle in which investor funds flow in and out whenever they like. In that regard, you might be interested to note Horizon Kinetics is involved in making a bid for a closed-end fund called the RENN Fund.” —- Murray Stahl

“The RENN Fund is a closed-end fund, and that’s one of the reasons we established control. It’s an ideal structure for investing in a private company like Diamond Standard, because we don’t need to maintain daily liquidity for redemptions, the way a mutual fund or ETF does. […] If it works, think about the RENN Fund, being a very small fund, but with exposure to an asset class nobody else has—if it works, it’s going to be more than meaningful to the RENN Fund. It’s going to be a very, very big deal.” —- Murray Stahl

These securities are illiquid and appear to be accounted for at their book value (rather than any kind of DCF or other method that would take any kind of longterm profit-generating potential into account)21. The weighted average marketcap of the fund’s investments is around $300MM (when setting the marketcap of the money market funds and private equity holdings to $0). The fund’s top 10 holdings are shown below and can give you a greater sense of what they are investing in:

(The most recent annual report mentions investments in “grantor and passive foreign investment companies (PFICs).” I was concerned about any pass-through implications from the CEF to shareholders re. PFIC reporting responsibilities, but emailing HK about this issue with the fund they say that: “All tax adjustments (and filings) for securities held by the fund (PFIC, REIT, etc.) are picked up at the fund level. Shareholders only receive a 1099 for the gains, if any, they receive.”)

“Just understand that, generally speaking, we’re buying hard assets. If you look at what’s in the RENN Fund—it’s not entirely true but it’s largely true— they’re primarily hard assets. Hard assets have a specific meaning for us. It means a company can benefit from an increase in revenue without a concomitant requirement for a capital expenditure. If you have a business that’s growing, usually you need to hire people, usually you need to buy plant and equipment. When your plant and equipment wears out, you have to replace it. It’s true of almost every business. Sometimes the people who run those businesses make incredibly astute judgments, and sometimes they’re not so astute, because we’re all human beings and we’re all fallible. The hard asset is a genre of company where you don’t have to make that decision. It’s not 100% true, but it’s almost entirely true; we can make believe it’s entirely true despite a bit of exaggeration: cash flow really belongs to the shareholders. That makes a unique genre of company. In the case of hard assets, because of the optionality and the fact that you get the cash flow as a shareholder, you should always be buying them—unless the asset trades at some excessively elevated valuation.” —- Murray Stahl

Stahl is patient (perhaps to a fault, possibly owing to the fact that he’s already rich (and he’s stated in the past that he didn’t start his, now billion-dollar, asset management business with the intention of getting extremely wealthy in the first place)) and I’m comfortable sitting on these start-ups alongside him for the chance to catch a significant wave from out of left field.

“When these new businesses come in, there are huge advantages for the early birds. And when you’re an early bird, there’s a model that I call “surfing” – when a surfer gets up and catches the wave and just stays there, he can go a long, long time. But if he gets off the wave, he becomes mired in shallows.” —- Charlie Munger, https://janav.wordpress.com/2013/07/08/surfing-a-wave/

I think this makes for a pretty good level of diversification in the portfolio across the spectrum of possible economic paradigms.

(Above are some of my notes on RCG’s various holdings. Also notice that RCG owns their BTC interest through a ~1% stake in GBTC and, at the time of my writing this, GBTC trades at a ~40% discount to NAV, so their actual claim to BTCs is about (1/(1-0.40)-1=)67% larger than their mark-to-market carrying value represented by the GBTC stake).

The fund's trading price also has a low correlation to the broader market and is also —advantageously or disadvantageously, depending on how you look at it— very small at the moment, nanocap in fact, with just $15MM NAV. I'd be a much happier buyer if the discount grew to cover the stake in either TPL —a stock which seems to be a mandatory standard in any vehicle Stahl or HK set up22— or Apyx Medical23, the latter of which was a scandal-fraught holdover from the previous management and I don't understand why the fund still holds it today.

You could also take a simple method of thinking of the CEF discount in terms of years-of-fee-expenses, in which case the current discount gives you a rebate of (12/1.5=)8yrs of fees as you wait for Stahl to execute on getting the fund to $25MM (and as I mentioned, this admin fee should be much smaller, if not non-existent, going forward).

My not liking Apyx —which is a holdover position (previously Bovie Medical) the fund has retained from before Stahl and HK took over management— is mainly for the CEO’s questionable history were he (Charlie Goodwin) was directly named in a medical remuneration scandal at his previous company, Olympus (ticker: OLYMY), where he was VP of Sales for the Gyrus segment at the time, where the issues were centered around (see the footnote)24 25. Did he really have knowledge of the issues? Seems like it. He was VP of Sales for the Gyrus segment and the scheme was directly related to selling medical equipment; the complaint accuses that Gyrus’ fraudulent practices after the acquisition26 by Olympus were “firmly entrenched in the Gyrus business model prior to the Olympus acquisition, and continued unabated following the acquisition with the full knowledge and endorsement by Olympus executive management.”27

So now with Goodwin heading Apyx, are patients really getting the best treatment option for their situation or is there another scandal / whistle-blower situation waiting for patients and APYX (and RCG) shareholders down the road? It's not as if the company looks great beyond this integrity issue either. The company has negative CFFO —though little debt— and has been getting by on cash from the sale of its “Core” electrosurgical and cauteries business in late 2H201828 that netted the company around $69MM (which it's been running through ever since and looks to be enough to cover one more year of APYX's short-term liabilities + average capex before they're on their own again). My only bit of comfort on this is that the existing NAV discount covers the exposure of the fund's APYX stake.

(You can read an interesting —sponsored— study on Apyx’s helium plasma technology, here).

********** Inline update 20230908: I asked Stahl about APYX at the 2023 FRMO Corp annual shareholders’ meeting (https://www.frmocorp.com/_content/letters/2023_FRMO_Transcript.pdf). What this prompted him to mention was that, as part of the agreement for Horizon Kinetics to take over management of the RENN Fund, they had to agree not to sell APYX without approval of the previous management; I suspect he wasn’t aware of Goodwin’s past. Bottom line seems to be that they are stuck with this position, come what may. The fund’s discount to NAV makes a lot more sense to me in this light, to be honest. I think I’m going to reserve my dollar cost averaging into the fund at above the 20% discount mark —or whatever APYX’s percentage of the fund happens to be at the time— going forward. I’d like to know: Is that agreement expected to last indefinitely? For example, if previous management’s stake (Russell Cleveland’s) in the fund drops below a certain percentage, should they still have this kind of control over such a larger portion of the fund's capital? At what point does fund management have an overriding fiduciary duty to deal with the position based solely on it's fundamentals on behalf of other minority shareholders? **********

I have also been following the FitLife turnaround story and generally like the numbers I see (growing ROIC and FCF/sh with a low float); I initial ran into FitLife while trying to screen for OTC-specific companies exhibiting characteristics of 100-bagger stocks as described in Chris Mayer’s book of the same name —FitLife, while not a software business, also exhibits many of the financial characteristics that meet the requirements for companies of interest according to famed Constellation Software’s criteria for VMS acquisitions29. In any case, I’m fine to get exposure to the stock through the fund; it also has a bit of a call option on mass skepticism of the establishment medical industry (as the fallout of 2020 may have a greater critical mass of people coming to lose trust in government/MSM-backed “experts”).30 A nice summation of FitLife’s turnaround so far can be found on the tweet thread here.

Beyond this, I don’t have any real opinion, bullish or bearish, regarding the remaining individual holdings one way or another. Though I will note that there seems to be some controversy31 around Big League Advance’s business model, but I don’t really get it; BLA is not too different from a music label or payday lender except, in the case of BLA, they don’t get paid unless the “musician” becomes a star or the “borrower” gets paid —I don’t see the issue here. Furthermore, these deals are not being forced onto players so far as I can tell and simply exist as new options where there previously was none.

********** Inline update 20230620: FitLife has issued a press release today announcing that that they have submitted an application for the listing of its common stock on the Nasdaq Capital Market. At this same time, along with Murray Stahl’s usual buying of the CEF shares, SEC Form 4s have dropped showing that Director Doug Cohen, fund Treasurer and HK COO Alun Williams, and fund VP and HK General Counsel Jay Kesslen have also recently added to their shares; I believe this to be a good signal amidst the noise of the Stahl’s regular buying here.

At the same time, the fund’s discount to NAV has increased from the 15%, that existed when I initially wrote this post, to around 25%, nearly covering the entirety of the fund’s TPL or money market position. **********

The way I see things is the incentives are aligned, Stahl is smarter than me (he certainly has more (and more access to) info on TPL that any other investor being a member of the company board and HK owning around 20% of the company), I’m getting that intellectual capital for free, and I actually really like that the fund has a large money market position; this last point may not be to everyone’s taste, but given the rate shocks of 2022 and the risk of the Fed going full Volcker on inflation and long-duration assets, it’s an opportunity cost I’m willing to take —in any case, I’m comfortable letting Stahl manage my cash for free as it earns interest at rates not seen in 20 years.

Stahl also runs a public investment vehicle outside of the Horizon Kinetics complex, FRMO Corp, which I've written about here:

($FRMO) FRMO Corp: A uniquely managed OTC jockey-stock hedged for inflation and with incoming catalysts

Table of Contents Quick Pitch Ready for what the indexes aren’t Management Asset breakdown Upcoming events Risks Conclusion Quick Pitch "One reason some people no longer resist the idea of inflation is because they’re hearing about it in the news. Others have begun to notice it in their daily li…

FRMO comprises around 20% of Stahl’s net wealth, while my understanding is that the rest is managed within HK. One thing I like about RCG (vs FRMO) is the way these different vehicles will be treated in the long-run; while RCG is a CEF within the HK complex and would ostensibly remain managed by HK once Stahl is no longer around —hopefully that scenario is still a long while away and that Bregman, Doyle, and the culture put in place along the rest of the firm will still produce interesting ideas— Stahl has mentioned that FRMO is planned to be passed on or merged with some other asset manager they have confidence in to run the show their own way; in the Q2FY2023 transcripts I asked about FRMO succession plans and Stahl had this to say:

“Why don’t we want to make them employees of Horizon? Because we want to see what they would do unconstrained by us. If they're our employees, whether we give them total freedom or not, they're going to be operating under our constraints even if only implicitly. […] They've got to be running their own show. So, maybe a way to do it is, they're someone already running their own show, doing whatever they're doing. Maybe, when the time comes, we would merge FRMO with whatever their enterprise is, and now they're going to run the show. And they'd be unconstrained by us, other than the fact that we respect what they're doing, but they're different people, and maybe that's the way it should be. So that's the way I see it happening.”

If the incentives at FRMO weren't so aligned with shareholders (ie. Stahl and Bregman simply own a majority of the common stock along with shareholders, taking no cash compensation or options), I would be much more concerned than I am presently; I don’t think Stahl is planning to screw FRMO shareholders in the end (himself being one of the largest ones).

As it stands, FRMO's long-term destination may be very different than RCG's and I think owning both is a good way to diversify end-points (while remaining in permanent capital vehicles, vs, say, investing in some HK mutual fund as opposed to RCG) while still benefiting from Stahl's intriguing investment ideas.

Risks:

Stahl’s insider buying frequency, yet cumulatively amounting to a rather small portion of his total net wealth, could simply be intended as a lure to bring more AUM for the fund; personally, I doubt it and think Stahl wouldn’t bother doing this; I think he’s a manager that has, as Charlie Munger puts it, the “fiduciary gene”.

Other than the strong insider buying signal produced by Stahl’s buying, the fund screens rather poorly as it is illiquid, has a spotty longterm track record of income generation, ROA, and TBV growth (iff your screening window is weighing in the periods before Stahl took over management of the fund and a boringly average CAGR if looking at the time since HK’s takeover), and is quite concentrated in it’s positions. For my part, I find these to not be an issue (as neither long-term risks nor forward-looking risks) and chalks these up as more of the “why is this cheap?” side of things rather than the “risks” side.

The main macroeconomic view of the fund is “a shift from declining interest rates and minimal reported inflation to static or slightly rising rates and inflation well above trend.”32 (I think it's also rather impressive to note that this statement was made in mid-2020, before the drastic rate hikes of 2022). So, if you don’t agree with that view —or don’t want that probability hedged by Murray Stahl— then you wouldn’t want to invest in the fund; however, I can't help but think of the Steve Jobs quote (which also reminds me a lot of Andrew Carnegie's) that “[i]t doesn’t make sense to hire smart people and then tell them what to do; we hire smart people so they can tell us what to do.” I could also understand how the fact that HK is basing investments on any particular top-down, macro view at all33 could be unattractive to any investors that have read Seth Klarman’s “Margin of Safety”; “By way of example, a top-down investor must be correct on the big picture (e.g., are we entering an unprecedented era of world peace and stability?), correct in drawing conclusions from that (e.g., is German reunification bullish or bearish for German interest rates and the value of the deutsche mark), correct in applying those conclusions to attractive areas of investment (e.g., buy German bonds, buy the stocks of U.S. companies with multinational presence), correct in the specific securities purchased (e.g., buy the ten-year German government bond, buy Coca-Cola), and, finally, be early in buying these securities. The top-down investor thus faces the daunting task of predicting the unpredictable more accurately and faster than thousands of other bright people, all of them trying to do the same thing.”

Stahl is 69 years old. While the guy is very wealthy and thus likely has access to very great healthcare, it’s something to sweat over. In any case, HK co-founder Steve Bregman is five years younger and gives the fund a bit a bench to lean on in case anything unfortunate should happen with Stahl. IDK for sure how impactful it would really even be if Stahl were no longer at the fund, as they could just resume its liquidation plans and close the discount spread that way —so you’d still have some upside. This statement from Stahl in a 2018 “Value Investor Insight” interview also gives me a bit of solace that he’s certainly not going anywhere if he has any say in it: “From the first day I did this until today, 99% of the time I enjoy it. I like the intellectual challenge. I like writing the research. As with any job, there are certain days I don’t like it that much, but happily those days are few and far between. As long as I’m still welcome and physically able, I contemplate doing what I’m doing until they carry me out one day.” Furthermore, this may simply be an unavoidable trade-off when attempting to balance longevity and wisdom when running an organization. I am reminded of Charlie Munger’s comments in the “Becoming Warren Buffett” documentary on running an HQ: “The ideal way to run a headquarters is to have one man, preferably over 80, sitting in an office by himself. Anything else is pure frippery.” —so, in ten years time, maybe the RENN Fund will be in an even better management position with Stahl (still) at the helm.

********** Inline update 20231207: I found this article from Mutual Fund Observer, where they look at the trailing results of various funds following the departure of such funds’ famous founding managers, to be particularly relevant to this concern: https://www.mutualfundobserver.com/2023/08/the-unfortunate-manager-the-ill-timed-bus-and-you/. “[W]e looked at the performance of a handful of famous eponymous funds following their founders’ departure, whether through retirement, death, or dismissal. In pretty much all cases, funds flourished – at least in terms of continuing their traditional risk-adjusted performance – in the years immediately following their founders’ departure. […] In almost all instances, funds perform credibly in the years (two to seven, in our survey) following the departure of their founding manager. They might or might not reach the heights of excellence seen under The Great Man’s guidance, but they do not betray their shareholders.” In any case, I think that the NAV discount would be a hedge in such a scenario as it provides another way to win even if there were some personnel issue that affected HK’s ability to continue to manage the fund in the sense that the fund could be liquidated —as it was originally going to do before HK took over management— at a profit to shareholders. **********

As I’ve already complained in the past regarding FRMO as well, Stahl did not deploy much of the large cash balance during the massive market drawdown around march of 202034; though he did begin buying RCG shares for himself / HK entities around that time, it appears more related to TPL events than any overall market pessimism. My point being, if the market shocks caused by the COVID-19 pandemic in 2020 where not enough to get Stahl to use significant portions of their cash balance —when many, certainly in the MSM, thought that the world was literally ending— then what is? I’m more OK with this state of affairs now that interest rates are no longer zero-bound and are rising, but it’s something to consider. What is Horizon Kinetics waiting for? Based on comments by Steve Bregman in the 4Q2022 HK Commentary (plus the fact that the general HK view seems to be that the last four decades of the economy have been a historical fluke), I’m suspecting it could be for this 👇 to normalize —so some monk-like patience (and plenty of good diet and exercise on Stahl’s part) may be required:

https://www.longtermtrends.net/market-cap-to-gdp-the-buffett-indicator/; You can alternatively play around with the data here: https://fred.stlouisfed.org/graph/?g=ZvPP HK’s Bregman did have this to say in a letter drafted during the market panic of March 2020: “This may prove to be an excellent time to purchase equities, but based on valuations, compounding off the prior index highs will be challenging, and likely modest in real terms, after inflation.” Though I’d also note that —aside from the fact that that statement does not preclude at all the possibility of opportunities in individual stocks (vs indexes)— mid/smallcap stocks are currently trading around the cheapest valuations they’ve been at since the 2020 March COVID shock and the 2008 GCF which seems like the perfect kind of opportunity set for this small fund —of course, as HK has mentioned in previous commentaries, the fact that aggregate P/E ratios for most indexes are based on the harmonic mean35 and thus provides greater sensitivity to lower P/E samples in a set and create the perception of an index being cheaper than it really would be if we simply added the GAAP earnings of the companies divided by the total market cap (on a index percentage basis) to get a view of the total earnings yield earned by the index.

A bit more color on the fund’s disinclination to buy anything during the 2020 crash can be found in the FRMO transcript here, where Questioner 8 directly asks Stahl about this.

Concentrated positions in TPL (and to a lesser extent APYX and FTLF). Honestly, the thing I’m most concerned about is APYX and their CEO's involvement in the aforementioned medical remuneration scandal at his previous company; asking management about this issue, they simply said they ‘continue to view APYX and being undervalued’; well, at least they are (now?) aware of the situation. I could totally be on board with a position relating to plastic surgery, but I don’t get why they have such a large position in this company in particular; perhaps I’m the one missing something here. In any case, the present discount could be seen as netting out the APYX position —with a few more discounted pps to spare— so that’s another way of looking at it.

One small piece of consolation is that Goodwin does own 4% of APYX's shares outstanding as of the 2022 proxy36, which at current market prices amounts to around 3x his annual cash compensation.

The fund would have to grow to a much much higher NAV in order for the fees to really mean anything to Stahl and HK. Thus, they could let the fund languish and not be too hurt by things; heads they win, tails they don’t lose. I think this concern is allayed somewhat by the fact that Stahl has been buying stock on the open market, himself —though, even in this case, I’m not sure that the total stake is a meaningful amount to Stahl (around $700K). To put this in perspective, Stahl has stated in the past that FRMO (with a current market cap of $350MM), which he owns ~16% of, makes up ~20% of his total net wealth37, so he’s worth at least ($350MM*0.16*(1/0.20)=)$280MM, so the total direct and indirect ownership makes up just 0.25% of this. I can’t really even say that Stahl and HK’s reputation is at risk, since I’m not totally sure how many people even know this CEF exists, let alone keep it on their mental radar given how tiny the fund is (of course, this could also be construed as a bull case for why the fund is cheap in the first place).

Manipulating NAV growth via rights offering dilutions. The period ending 201938 saw $2.2MM added to the fund via rights offering (starting the year with $3.452MM in their MMF allocation and ending with $4.999MM)39 and 202240 saw $2.1MM added to the fund (starting the year with $3.523MM in their MMF allocation and ending with $4.907MM)41. Investors were forced to subscribe to maintain their existing economic interest in the fund while the fund was able to step ever-closer to HK's $25MM NAV watermark all without having to produce any actual returns to shareholders. I don't know how I feel about this; I get that they need maintain a war chest of capital to make new investments, but by this mechanism HK advances their own economic interests at a much greater clip than shareholders. The fund started 2019 with NAV of $8.476MM and ended 2022 with $14.851MM, an increase of $6.375MM. The rights offerings in 2019 and 2022 added ($2.2MM+$2.1MM=)$4.3MM to the fund or 67% of the fund's NAV increase for the 2019-2022 period. The only thing that gives me comfort here is that Stahl directly and indirectly owns about 5.33% of the fund (about $600K at current prices), which is much less than how much the management fee would be ($10,000.00/yr) once NAV crosses the $25MM mark to, say, $26MM, so I assume the economic interests of management are ultimately aligned with shareholders.

Unfortunately, because CEFs distribute all of their net income, there is no other way for the fund to finance new positions or reinvestment (aside from drawing on their money market reserves). At the very least, the terms of the rights offerings in both the Feb 8 2019 and Jan 21 2021 cases were such that existing shareholders had the opportunity to 1.33x their existing shares at a discount 10% below the prevailing (for a net discount of 34% in 2019 and 23% in 2021)42.

HK launched the INFL actively managed ETF in January of 2021 and has created many more since then. In the Q2 FY2022 FRMO conference call, management mentions that they are also “in the process of converting one of our mutual funds to an ETF”43 where management previously “believed that you can’t do active management in ETFs, that ETFs were exclusively passive instruments.” HK became the manager of the closed-ended RENN fund before this time, in 2017. Given these developments with ETFs at HK, I wonder if management sees the need for closed-ended funds as diminished or obsolete? Will RCG get less attention from management going forward? I’m pretty sure that the creation of new ETF units does not dilute existing unit-holders’ stakes in the underlying businesses either as authorized participants by the ETF are just buying proportional underlying shares of stock per the ETF’s tracking index of active manager’s specified mix of stocks when they are bundling creation units.44

‘They’re sitting on 30% of their AUM in cash / money market funds; why should I pay fees for them to just sit on interest-bearing cash? I can do that myself.’ To this I would just note that HK themselves are not taking any management fees on the fund (until AUM reaches $25MM) and I’m pretty sure the existing expenses are mostly fixed and don’t go to HK (eg. the fund’s largest expense comes from accounting and administration which is performed by the auditor Tait, Weller & Baker LLP and UMB Fund Services, respectively), so it’s currently not quite the ‘heads we win, tails management doesn’t lose’ kind of situation that it might appear at first blush (and again, I’d note that Stahl is buying on the open market consistently). One way to think about this is that the portfolio is structured in a barbell-like way where 1/3rd is in secure short-term money market funds, around 1/3rd is in a proven anchor tenant (TPL), while the rest is scattered across various small bets on entrepreneurial, private, or pre-revenue companies as selected by Stahl.

I could be missing something; maybe missing something really concerning the the annual shareholder reports or something —do let me know if you find anything. Aside from the fact that most CEFs typically trade at a discount, which I think is not warranted here given the CEO and brand recognition of HK, one simplistic answer could simply be that the fund’s holdings are too illiquid for arbitrageurs to get involved by shorting the underlying positions45.

The RENN Fund Inc. website that appears at the bottom of all of their annual reports (www.rencapital.com) does not work for me regardless of what web browser I use, IDK what is up with that.

Note: I am long RCG.

Further reading:

.

Post update 20250614:

June 11 2025, the fund published an 8K stating…

On June 5, 2025, the Board of Directors (“Board”) for the Fund approved certain changes to the Fund’s corporate governance documents and its Board of Directors as described herein.

Based on the recommendation of the Nominating and Governance Committee, the Board unanimously approved changes to the Fund’s Code of Ethics, effective immediately. A copy of the updated document is attached as an exhibit and is incorporated by reference.

Additionally, the Board accepted the resignation of Murray Stahl as a Director of the Fund, a position he held since July 2017. Mr. Stahl will, however, continue to serve as the President, Chief Executive Officer and Co-Portfolio Manager for the Fund. In connection with Mr. Stahl’s resignation, Douglas Cohen was appointed as the Chairman of the Board. With Mr. Stahl’s resignation, the size of the board is now set to 5. ~~~ https://www.sec.gov/Archives/edgar/data/919567/000139834425011723/0001398344-25-011723-index.html

The new Code of Ethics document (https://www.sec.gov/Archives/edgar/data/919567/000139834425011723/fp0093901-1_ex991.htm) also has a new section for “Personal Securities Trading” that was not present before (https://www.sec.gov/Archives/edgar/data/919567/000139834425005309/0001398344-25-005309-index.html, exhibit-1), which adds pre-clearance and trading restrictions for independent directors to trade securities related to the fund.

Asking Horizon Kinetics certain questions I had about the board changes, they replied that Stahl’s main reason for resigning from the RENN BoD was to relieve some of the responsibility from serving on multiple boards (he was on as many as 6 boards at the time). ISS, the leading proxy voting firm, refers to this as overboarding.

While, Stahl will no longer serves on the board, he will continue to attend board meetings and participate as a management representative, however he will have no vote on board matters. He will also continue to manage the fund on a day-to-day basis. IR’s position was that Stahl’s resignation also further enhances the independent nature of the board, as his spot will now be filled by Douglas Cohen who has assumed the role of the independent Chairman.

Stahl continues to buy shares of the fund on a daily basis as can be see from his public filings and this was pointed out to me as a sign that he remains committed and invested. However, I’d note —as I did when I originally wrote this article and is still applicable today— that Stahl’s total stake in the RENN Fund today (845,822 shares, https://www.sec.gov/Archives/edgar/data/919567/000143774925020279/xslF345X03/rdgdoc.xml) makes up around just 0.8% of what I estimate to be his total net worth (which I estimate at around $280MM).

Stahl is around 69 (see the proxy statement, here), compared to the 65 age limit that designates someone as a senior under Medicare and the 62 limit for Social Security.

https://www.sec.gov/Archives/edgar/data/919567/000106299316011802/schedto.htm

https://www.sec.gov/Archives/edgar/data/919567/000089180417000147/rf70595-pre14a.htm

https://www.sec.gov/Archives/edgar/data/919567/000139834418003872/fp0031803_ncsr.htm

As you are aware, at a special meeting of shareholders held on June 29, 2017 (“Special Meeting”), the Fund approved a new investment advisory agreement with Horizon Asset Management LLC (“Horizon”), which modified the Fund’s investment objectives and principal investment strategies. Formerly, the Fund pursued its investment objective of income and long-term capital appreciation through investing in emerging growth companies, particularly with small and micro-cap companies. Since the Special Meeting, the Fund’s objective has been to achieve above-market rates of return through capital appreciation and income, but it no longer pursues this objective primarily through investments in emerging growth companies. Instead, the Fund has pursued its objective through a long-term, value oriented investment process that may invest in a wide variety of financial instruments, including common stocks, fixed income securities including convertible and non-convertible debt securities or loans, distressed debt, warrants and preferred stock, exchange traded funds, and other instruments. Additionally, as part of the new investment advisory agreement, Horizon is paid no management fee on net assets less than $25 million; Horizon’s fee is 1.0% on net assets above $25 million.

https://www.sec.gov/Archives/edgar/data/919567/000113379616000261/0001133796-16-000261-index.html

The Board has unanimously adopted and approved a Plan of Liquidation and Dissolution (the “Plan”) subject to the approval of the Fund’s shareholders at the 2016 annual meeting of shareholders (the “Annual Meeting”). The Board weighed a variety of factors, including (in no particular order):

·the Board recognizes that the Fund does not have sufficient assets to economically continue as a fund. The expenses of the Fund are too high for the Fund to continue to operate economically;

·anticipated benefits to all shareholders that would result from liquidation, particularly the return of the net asset value of the Fund’s shares to shareholders in the form of distributions of cash and securities;

·the Board notes that the Fund has been trading at a significant discount to its net asset value for an extended period of time;

·the recommendation of the Fund’s investment adviser and its management team; and

·possible alternatives to liquidation.

Based on these considerations, among others, on balance, the Board–consistent with the recommendation of Fund management–determined that liquidation and dissolution would be the best option.

You can see the old website of the fund here: https://web.archive.org/web/20180612024623/http://www.rencapital.com/

https://www.sec.gov/Archives/edgar/data/919567/000139834418016401/fp0037003_n2a.htm

https://horizonkinetics.com/app/uploads/RENN-Fund-Inc-Rights-Offering-December-2021.pdf

In the original 2017 proxy vote, HK only said they would purchase min(10%, $1MM) of unsubscribed shares of the initial rights offering, however they later (Dec 19 2018) changed this to all unsubscribed shares (and again in another rights offering in 2021):

“Stockholders on the Record Date may purchase shares not acquired by other Stockholders in this Rights offering, subject to certain limitations discussed in this Prospectus. Additionally, Horizon Asset Management LLC (“Horizon”) will purchase any shares not otherwise acquired by other Stockholders in this Rights offering.” —- https://www.sec.gov/Archives/edgar/data/919567/000139834418016401/fp0037003_n2a.htm

Additionally, Horizon has entered into a backstop agreement with the Fund, whereby Horizon will purchase all remaining unsubscribed shares, if any, after the Initial Subscription and Over-Subscription periods by shareholders —- https://horizonkinetics.com/app/uploads/RENN-Rights-Offering-Press-Release_December-2018.pdf

“Horizon is not paid an advisory fee on net assets less than $25 million and thereafter will charge a management fee of 1.0% on net assets above $25 million.”

Also note that the fund does already charge auditing (the bulk of existing fees, which don’t go to HK, but to Tait, Weller & Baker LLP) and other administrative fees, but those should be generally fixed (https://corpgov.law.harvard.edu/2022/11/02/twenty-year-review-of-audit-and-non-audit-fee-trends/) and become a relatively smaller percentage as the fund’s assets grow in time.

https://www.sec.gov/Archives/edgar/data/919567/000139834422005648/fp0073605_ncsr.htm

https://www.sec.gov/Archives/edgar/data/919567/000139834419004244/fp0039850_ncsr.htm

https://www.ici.org/cef/background/bro_g2_ce#Taxes

In order to avoid the imposition of federal tax at the fund level, a closed-end fund must meet Internal Revenue Service (IRS) requirements for sources of income and diversification of portfolio holdings, and must distribute substantially all of its income and capital gains to shareholders annually. Generally, shareholders of closed-end funds must pay income taxes on the income and capital gains distributed to them. Each closed-end fund will provide an IRS Form 1099 to its shareholders annually that summarizes the fund’s distributions. When a shareholder sells shares of a closed-end fund, the shareholder may realize either a taxable gain or a loss.

https://www.sec.gov/Archives/edgar/data/919567/000139834422018185/fp0079129_ncsrs.htm

The Fund intends to comply with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its net investment income and any net realized gains to its shareholders. Therefore, no provision is made for federal income or excise taxes.

Based on total number of securities beneficially owned in latest Form 4 (476559 total shares) as of my writing this and the total shares outstanding of 7015786.

You can see the breakdown of total director ownership as of the July 2022 definitive proxy here:

(Russell Cleveland is the fund’s original CEO)

The Fund does not pay any fees to, or reimburse expenses of, its Directors who are considered “interested persons” of the Fund. Directors who are not interested persons of either the Fund or its investment adviser, Horizon Kinetics Asset Management LLC, currently receive no fee but are entitled to out-of-pocket expenses for each quarterly meeting attended. For the fiscal year ended December 31, 2020, the aggregate compensation paid by the Fund to each Director, and the aggregate compensation paid by any other funds in a Fund Complex with the Fund to each Director, is set forth below:

Which is essentially a venture fund betting on up-and-coming athletes, https://bigleagueadvantage.com/about/

I’m very skeptical on this bet in general, but I also was not buying BTC in 2016 like Stahl was, so there’s that.

While not as large a holding as the rest of the PE investments in the fund, security exchanges collectively make up a 2% position —note that MIAX and the other PE holdings are values based on precedent transactions, not a market valuation.

You can determine for yourself searching for “Quantitative Information about Level 3 Fair Value Measurements” in the June 2022 annual report for the fund here: https://www.sec.gov/Archives/edgar/data/919567/000139834422018185/fp0079129_ncsrs.htm

As an example, the Horizon Kinetics Internet Fund has a ~20% position in TPL (an oil, gas and land royalty business). I don’t totally see a clear argument —at least to the extent that TPL is so heavily weighted in the fund— that this company is “participating in the growth of the Internet” or providing “new kinds of services or products made possible by development or improvement of Internet-related technologies”; yes, I know they are exploring hosting Bitcoin mining operations, but 20% of the fund, really?

Whose new CEO was named in a bribery scandal at his previous company:

https://www.mcall.com/2016/03/02/olympus-to-pay-646m-over-kickbacks-and-bribes-to-doctors-hospitals/

https://policymed.typepad.com/files/olympus-second-amended-complaint-2-4-16.pdf

The Feb 2016 complaint: https://policymed.typepad.com/files/olympus-second-amended-complaint-2-4-16.pdf, see starting at #4 and #5.

(Also see part “D. Gyrus' Kickback Scheme” in the link)

https://www.mcall.com/2016/03/02/olympus-to-pay-646m-over-kickbacks-and-bribes-to-doctors-hospitals/

This is apparently just the tip of the iceberg of the issues that were going on with Olypmus, see https://en.wikipedia.org/wiki/Olympus_scandal#Background

https://policymed.typepad.com/files/olympus-second-amended-complaint-2-4-16.pdf, pt.20

By virtue of its acquisition of Gyrus and its retention of senior Gyrus management, Olympus assumed liability for Gyrus' pre-acquisition operations as successor in interest. Olympus is liable for the unlawful conduct that has seamJessly continued post acquisition.

https://policymed.typepad.com/files/olympus-second-amended-complaint-2-4-16.pdf

Goodwin’s LinkedIn page even includes that he was “[i]nstrumental in leading and overseeing the integration of two disparate cultures following the Olympus acquisition of Gyrus ACMI to meet productivity and operating objectives.” It appears the integration was in the opposite direction, if anything.

https://www.csisoftware.com/about-us/being-acquired

FitLife has a 40% gross profit margin, 2019-2022 revenue CAGR of 14%, EBIT margin expansion CAGR of 16%, FCF/sh CAGR of 20%, LTM revenue of $32MM and EBIT of $6MM, and trades at around 2.5x TEV/Revenues —though FitLife’s industry is a lot less niche than what a typical Constellation Software target software company.

********** UPDATE 20230618: This would be especially more likely if RFK is speaking the truth and his presidential campaign actually causes that idea to gain begrudging acceptance by the public. You get a good amount of his POV on the subject from the first hour of the interview here: **********

From the 2020 semi-annual shareholder report: https://www.sec.gov/Archives/edgar/data/919567/0001398344-20-018256-index.html

********** UPDATE 20230521: Though I would just like to note that this particular macro view of higher FFR and more inflation is apparently very non-consensus and I’m very comfortable with have Stahl be the allocator hedging my money on this macro view. **********

Between December 31, 2019 and June 30, 2020, the fund’s money market position shrunk by about $60K and by about $350K between June and December 2020. Just from this they appear to have only deployed 2% of their NAV in the year of 2020.

https://www.sec.gov/Archives/edgar/data/919567/0001398344-20-005731-index.html

https://www.sec.gov/Archives/edgar/data/919567/0001398344-20-018256-index.html

https://www.sec.gov/Archives/edgar/data/919567/0001398344-21-006354-index.html

https://www.frmocorp.com/_content/letters/2012_FRMO_Transcript.pdf

All my money is managed by Horizon Kinetics, other than my checking accounts, and you can consider my house as part of my net worth. […] So, I would say, all together—I probably shouldn’t disclose my net worth, but I would say maybe—this is off the top of my head—let’s say at least 20-plus percent of my net worth is in FRMO. Of course, that fluctuates on a daily basis, so you’ll need to view that accordingly.

(Note this was in 2012.)

https://horizonkinetics.com/app/uploads/RENN-Rights-Offering-Press-Release_December-2018.pdf

https://horizonkinetics.com/app/uploads/RENN-Rights-Offering-Press-Release-final-12-08-21.pdf

https://cefdata.com/funds/rcg/

In both cases, shares traded at a discount to NAV and so the subscription price per share in the offerings would have been “90% of the average closing market price per share over the three days of trading leading up to and including the expiration of the Offering” (ie. an additional 10% discount to the existing market rate discount to NAV at the time).

I believe this refers to what were formerly the Kinetics Medical Fund and Alternative Income Fund

https://horizonkinetics.com/app/uploads/Horizon-Kinetics-ETFs-SAI.pdf

https://web.archive.org/web/20210122002825/https://kineticsfunds.com/funds/

(Jan 2021)

(Now in 2023)