Portfolio Review 20220606, semi-annual: When consistently average beats The Average

Semi-annual portfolio review, June 2022

Now that we are halfway through the year, it seems like a good time to do a review of the portfolio and performance.

Performance

*UPDATE 20221224: Updated performance comparisons with Schwab’s new performance tracking charts.

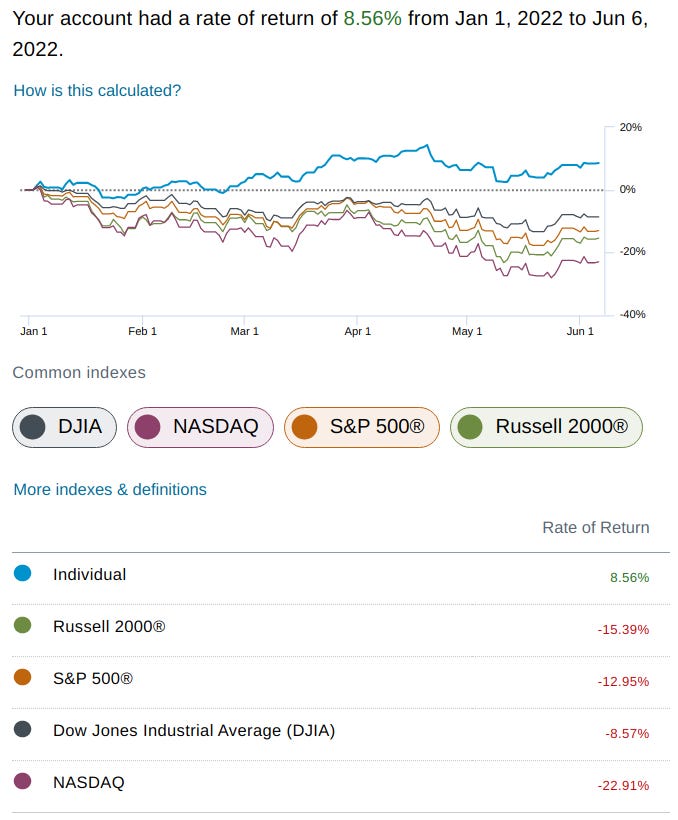

Here is my YTD and 3yr annualized performance (this time period chosen only because early 2019 is around the time I started actively managing my account and learning about investing)1:

Not too bad in comparison IMO — though I am getting thoroughly smoked by the S&P commodity index — but we’ll see how things play out in the long run.

(Note this YTD performance is not accounting for the “hidden” gain in USD purchasing power —due to the significant inflation around the rest of the world relative to the USD— from my significant cash position)

Positions

Because of how the portfolio is set up, IDK that it would be really useful to go over individual top 10 positions since a lot of positions are smaller and set up as “mini ETFs” that are intended to capture general thematic flows across a heuristic probability surface — basically, just Kelly ratios based on my finger in the wind — of what I perceive to be more or less likely general outcomes, so I think it would be better to go over the sectors of most exposure + some smaller positions I think are interesting (so you’re going to be seeing a bit of the top and bottom of the portfolio). I list of few of those things here — with the approximate current portfolio allocation (as well as percent gain (averaged, when grouped as a basket)) and some brief commentary about each one:

Cash — 20pps (+7%)

Apart from the reasons for cash I wrote about in a previous post…

…I just am not really seeing anything particularly interesting to invest in (at the kind of price I’d be interested in) at the moment. I’v been carrying a lot of cash since around the 2020 COVID crash — wherein I hedged the long side of the portfolio with some SPY and TSLA puts, while clearing out names I was no longer interested in, before largely sitting out of the market during the ensuing recovery in rest of 2020 (I have regrets, yes2). I basically survived the crash totally unscathed, but also most of the gains, and have been much more slowly adding to positions starting around late 2020 — which can be seen dragging down the 3yr IRR in my performance. As you will soon see, this cash allocation has been the only “volatility-hedge” that’s been working for me so far, despite my attempts to prep for it well before the market actually ran into the Fed rate hiking and market panic we’re seeing at the moment.

$ABRTX — 12pps (-15%)

I initially bought ABRTX as volatility insurance around early/mid 2021. My thought was that it could serve as a low carry-cost way of getting a call option on any vol in the future vs something much more path dependent (and tax-complicated) like the VIXY ETF. ABRTX is an actively managed fund that moves between short/long vol via SPY and VIX futures, which I initially thought was interesting because it meant that the short-vol index they were tracking was something that was highly concentrated in highest-valuation names/sectors (tech et al). Despite this bubble appearing to have popped a good bit in the past months, ABRTX has done poorly given the rather orderly / relatively low-vol nature of the decline since January3 — riding their SPY futures down with the market4.

Through the various vol spikes throughout the year, ABRTX has had an annoyingly low “VIX-beta”. Other then the large cash position, this has been the biggest drag on performance. I’ve been looking for other vol beneficiaries in the meantime5.

This has been one of those unfortunate situations of being in the right ballpark on the trade (long-vol), but wrong on the execution.

$BSM + other oil royalties — 20pps (+45%)

BSM is the largest position in my basket of oil royalty et al businesses that I’ve been building up since around mid-2021. I like the geographic — as well as the natgas6 vs crude — diversification, it has more net royalty acres than many other public oil royalty businesses, and has it’s oil prices hedged at around $667 for the rest of 2022 (which will help in case there is major demand destruction this year and creates a drag8 on FCF that creates a nice opportunity to accumulate more shares at a price that should prove to be cheap in case the long-energy thesis does end up winning out in the long run (such that the drag of this year won’t matter too much)). The general idea behind the long-energy thesis that I’m basing this basket can be found here:

$UAN + other ag bets — 13pps (+40%)

I’ve not really written much about my bets on ag-related stocks, but it’s not too much different from my bet on energy-shortages and general inflation, above. I may try to write something more on this in the future, but now I’ll just say that — relating back the to energy-shortage theme — ammonia is derived from natural gas. You can read more about this and other problems in the ag sector here:

$WPM + other gold ETFs — 7pps (+5%)

Other than WPM, I also have positions in FTCO and the OUNZ/GLD ETFs. Not much to say here, just another inflation allocation (and a bit of a volatility buffer) — though much smaller than the other commodity sector bets given gold’s more spotty history as an inflation hedge. Honestly, these paper gold ETFs may be a better vol hedge9 (vs an inflation hedge) than the other ways I’ve been trying to do it — I still need to think about it a bit more.

$FRMO — 5pps (-10%)

FRMO has been banging the drum on inflation and energy shortages since before 2020, but also did a good job of calling the inflation and energy issues that come out of the 2020 lockdowns very early on and have been one of my favorite companies to read about. My interest in the company is one of the main reasons my larger exposures are what they are (a bunch of inflation hedging businesses). I also use the FRMO position as a way to get managed exposure to Bitcoin — given management’s great interest in the cryptocurrency space (whose recent decline has been a major drag on the stock price as of late).

$VIRT — 3.5pps (-15%)

Similar to ABRTX, I initially bought VIRT as a call option on vol and wrote about it here:

Since then, in terms of portfolio vol insurance, it’s been doing mostly not great; failing to get any spiritual support from the VIX spike in April — and instead falling with the rest of the exchanges (similar to ABRTX)

(Though not as hard as the high-flying tech stocks, certain other exchange peers, and long bond funds that are still getting hammered significantly worse, YTD).

$HQI — 2pps (+5%)

The business model is interesting and I have some things to say about this company, but have not really had the time to write about in a way that is more articulate than what’s in my google docs notes. Basically, it’s an interesting, low opex / maint. capex business model — paralleling Horizon Kinetics’ “asset light, hard assets“ inflation beneficiaries model — with lots of room to grow out of it’s microcap status. The post here is a good general overview of the business and CEO:

The position is smaller than I’d normally do at the moment, but I’ve been very tepidly accumulating on dips below $15-14/sh.

$GBTC — 1pps (-5%)

If you know Bitcoin, you know about GBTC. IDK how much there is to say about at it the moment — and I’m currently working on writing something about BTC in general in relation to the series of $FRMO posts I’m working on — so I think I’ll wait until then to really go much into the general topic. What I will say is that the price of BTC is down ~60% YTD (along with the rest of the market turmoil) and on top of that GBTC trades at a discount to NAV of the underlying BTC of ~30% (ie. you can buy $20K BTCs for $14K), so if you believe in the logic for a longterm, non-zero BTC allocation, GBTC may be the cheapest and simplest way to get it — and now would certainly be an opportune time (given that there is the call-option value of the SEC approving the conversion of GBTC into a spot ETF as well). IMO, longterm, either BTC goes to zero and takes GBTC with it or BTC gets broad acceptance as a store-of-value and goes up many multiples (while the discount closes and maybe at this point the spot conversion is approved). The asymmetry is clear; what’s not as clear is the position sizing of this call-option bet, but I figure I have some pps to spare given how well the portfolio is doing vs the rest of the market. As the market continues to experience turbulence, I plan to average into the position a bit more (eg. in weekly 25bps increments) until the cost basis gets to around 3pps of the portfolio.

$BVNRY — 0.5pps (+5%)

Bavarian Nordic A/S is a company in Denmark — the stock ticker here is an ADR — that specializes in a vaccine for monkey pox. This first came to my attention around mid May when reports like these started popping up10:

You can read more fully articulated version of this interesting/concerning trend in the article here:

For my part, I literally just googled something like “Who makes monkeypox vaccines“ and Bavarian Nordic was one of the only/top hits — aside from an existing alternative called ACAM2000 which just on the face of it appears inferior to Bavarian’s product in some major ways11.

JYNNEOS is the only FDA-approved non-replicating smallpox and monkeypox vaccine for non-military use. In November 2021, the U.S. CDC's vaccine committee unanimously voted for JYNNEOS as an alternative to ACAM2000 for primary vaccination and booster doses. —— https://www.precisionvaccinations.com/vaccines/jynneos-smallpox-monkeypox-vaccine

Better yet, they are a rather small company (13.67 DKK or ~$2B USD), so a large influx of vaccine orders around the world as governments — and their people, within whom’s amygdalas a particular kind of behavior has been ingrained over the past 2 years — jump back on the vaxxed-earth campaign would be a big deal for the business.

I see this as a call option on a monkey pox “outbreak” — or could be nothing (and you can see I’ve sized the position as such).

Conclusion

As can be seen, I’ve been very lucky / good-enough — I like to think a combination of both — at adhering to Buffett’s #1 rule of ‘not losing money‘, but this can always change (I think of Hemingway’s “The Old Man and the Sea“). Hopefully, if the inflation trade sours, I’ll be able to read ahead and avoid it, though I doubt it (I’ll more likely be needing a wellness check from the police than a congratulations if the inflation trade turns).

GLTA

If I were to include a performance comparison from before 2019, you’d see that — unsurprisingly — the performance was about the same as the S&P 500 benchmark.

I had been reading the Horizon Kinetics / FRMO publications — as well as other energy-shortage alarm-raisers — for some time into 2020, so was already well aware of the energy-shortage thesis, but needed to take my own time to get more comfortable with the idea (esp. after my PTSD from the tracking policy change that caused my USO oil fund call options expire nearly worthless despite having bought them at the bottom of the oil-negative crash in 2020). Had I stayed more logical, gotten over the sunk cost of the USO failure + gotten more comfortable with the long-energy thesis sooner, I did have a shortlist of stocks and position sizes that would have been really great to ride from 2020 up to this very day.

*Update: This article came out the day after publishing this post and I think its discussion on recent volatility is relevant to the performance of ABRTX as well as VIRT: https://realinvestmentadvice.com/investors-are-terrified-so-why-arent-they-selling/

“Despite the recent selling pressure in the market over the last couple of months, volatility remains subdued, suggesting little panic in the markets.“

I was considering the 20yr bond fund TLT as a volatility hedge at the time of buying into ABRTX as well, but decided against it due to the duration risk at a time when I was expecting inflation — and subsequent rate hikes — on the horizon. While bonds and other long-duration bets are getting hit by the Fed’s rate hiking right now, so far going with ABRTX hasn’t really saved me from the drawdowns that a regular 60/40 stocks/bonds portfolio are feeling right now.

I’ve been going over this 2020 study of economic factors’ correlation to the VIX that I had seen when earlier trying to look for other vol beneficiaries and trying to find businesses that benefit from these factors:

There is also the dormant optionality w/in US natgas bets centered on the idea of US natgas prices moving multiples higher when US natgas export capacity hits a certain floor level that causes the surplus (previously supported by natgas exports from Canada and Mexico as well as domestic production being trapped in the US due to low export capacity) in the US to fall into a deficit wherein the excess demand must now compete with the — much higher — free market prices the rest of the world is subject to. I can’t find a good singular source to link here ATM to highlight this idea, but anyone can look it up (the idea has been around since ~2015 so far as I can tell).

The MLP structure/taxes is also likely a factor preventing certain institutional fund flows, but unlike the hedges this drag is likely to remain with the stock for the long term (unless BSM converts like VNOM did in 2018).

I recall that Marcus Frampton — CIO of the Alaska sovereign wealth fund (the Alaska Permanent Fund) and author of microcapletter.com — uses the IAU gold ETF in a somewhat similar manner.

“I prefer pairing long positions in micro cap and OTC stocks with a Gold ETF - this positioning reflects, in a bar-bell fashion, how speculative these small stocks are, provides a large portfolio position in an asset that is defensive and inflation protected, and enables a portfolio manager to engage in frequent rebalancing (i.e., trim stocks on strength and buy gold, add to stocks on weakness funded from selling gold). It has been said that “diversification is the only free lunch” in investing; I would argue that this type of portfolio rebalancing is the other free lunch as it adds return and reduces volatility.“ —— Microcap Letter (Inaugural Edition)

Note that I don’t think ZeroHedge is a great source of news, but it does in this case convey the general trend I’m trying to highlight here. You’d have to look more into it, but my recollection is that the person who runs ZeroHedge is the son the a Russian propaganda minister or the like.

How is JYNNEOS different from ACAM2000? From what I can tell, the difference is basically that…

Because ACAM2000 is replication-competent, there is a risk for serious adverse events (e.g., progressive vaccinia and eczema vaccinatum) with it; myopericarditis also occurs with ACAM2000 (estimated rate of 5.7 per 1,000 primary vaccinees based on clinical trial data), but the underlying mechanism is unknown (7,8). In 2019, FDA licensed JYNNEOS, a replication-deficient MVA vaccine, for prevention of smallpox or monkeypox disease in adults aged ≥18 years determined to be at high risk for infection with these viruses. —- https://www.cdc.gov/mmwr/volumes/71/wr/mm7122e1.htm (emphasis added)

Furthermore, the administration of ACAM2000 is very different to a typical shot that you’d get a your local pharmacy:

ACAM2000 is administered differently than the typical "shot" associated with most vaccinations. A two-pronged stainless steel (or bifurcated) needle is dipped into the vaccine solution and the skin is pricked several times in the upper arm with a droplet of the vaccine. —- https://www.fda.gov/vaccines-blood-biologics/vaccines/acam2000-smallpox-vaccine-questions-and-answers (emphasis added)