When prices get "real" and The Great Re-Everything'ing

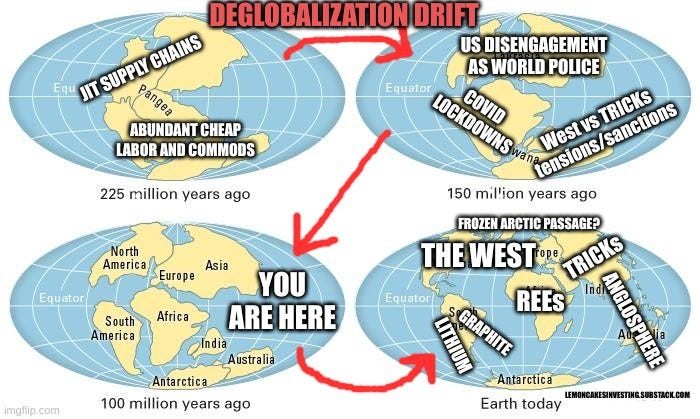

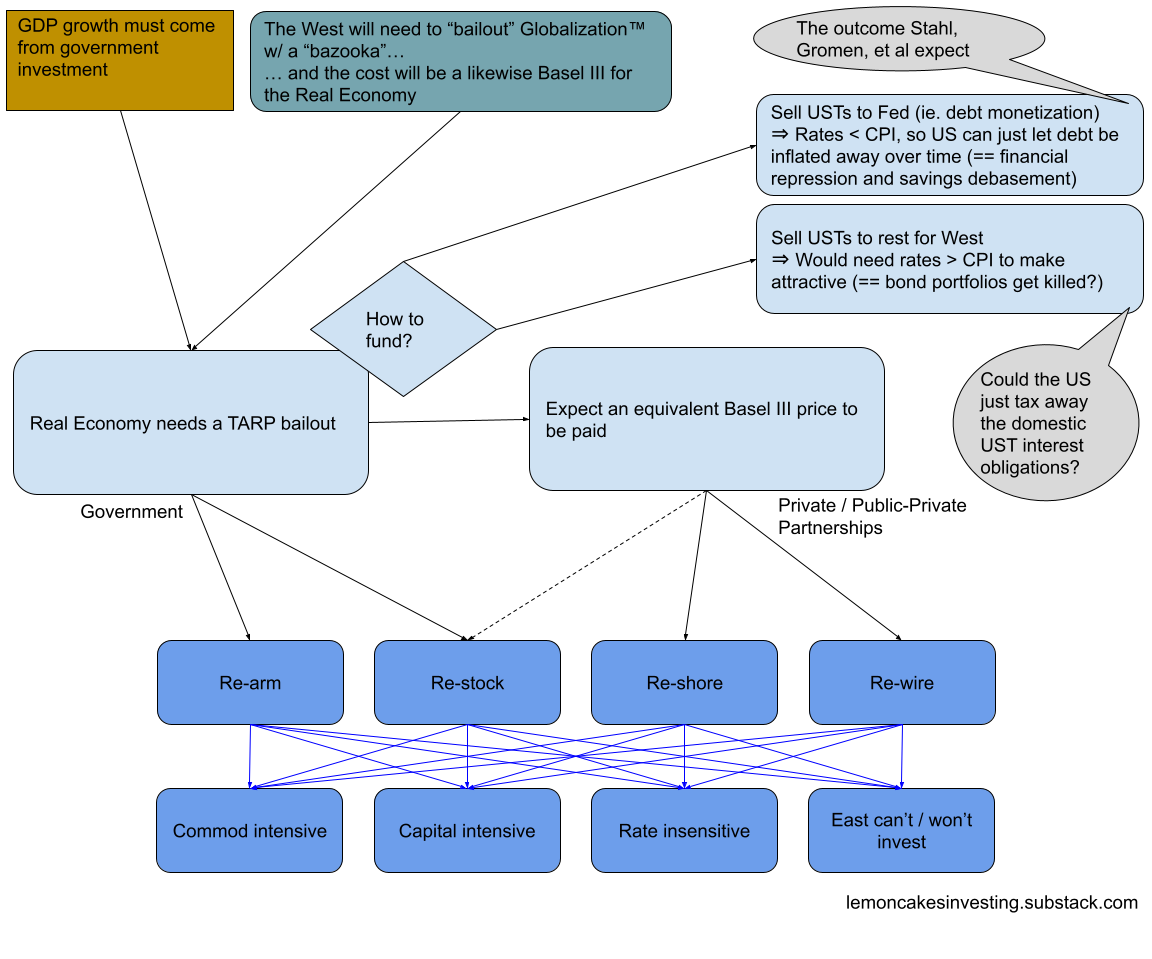

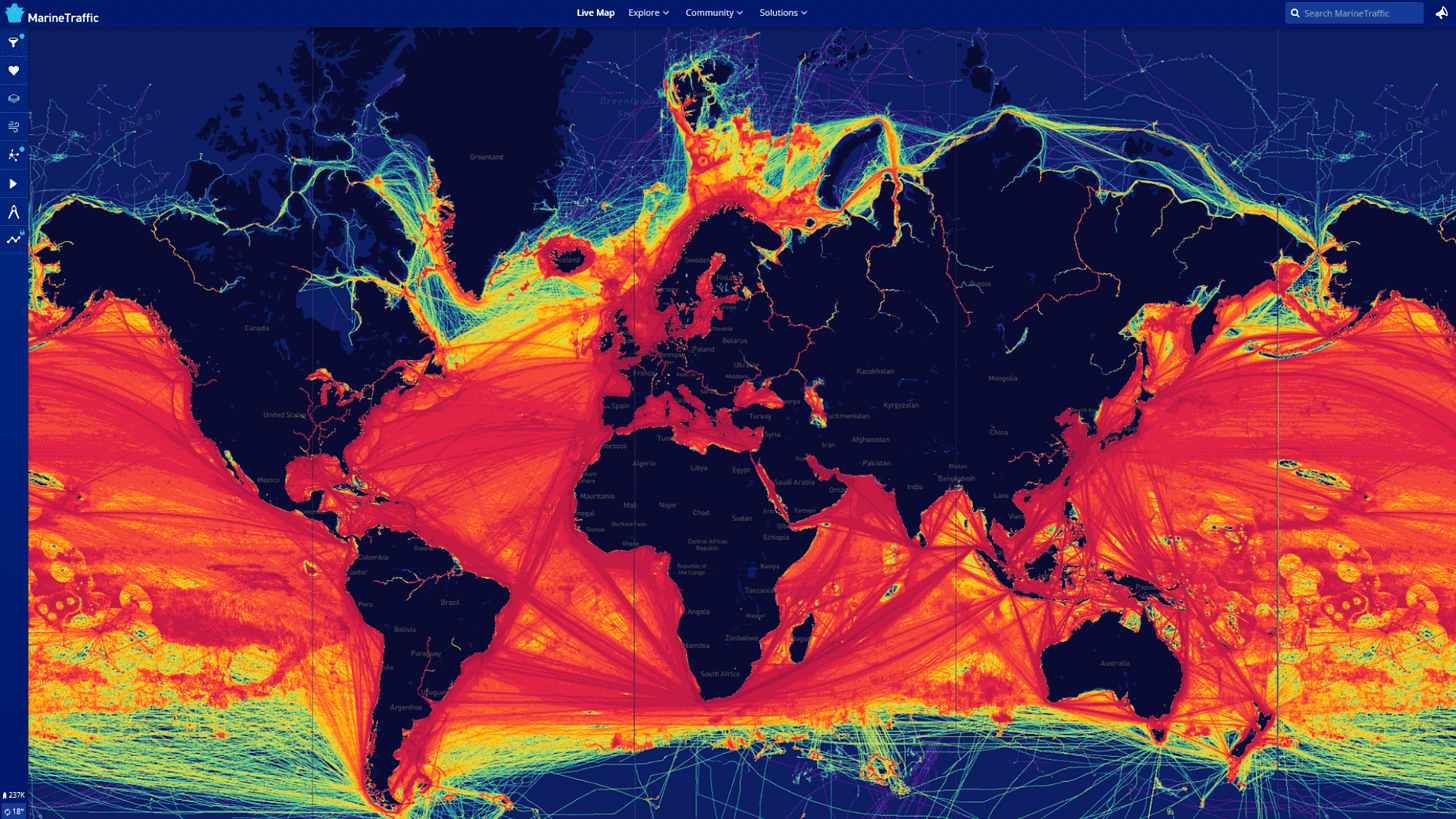

Pozsar’s Bretton Woods 3 and the Deglobalization Thesis, but in picture format

So, I just finished reading Zoltan Pozsar’s Bretton Woods 3.0 (BW3) follow-on articles “Money, Commodities, and Bretton Woods 3” (MC&BW3) as well as “War and Industrial Policy” (W&IP) and — while I have a few questions about the ultimate conclusions — wanted to make some quick notes1.

I find that diagramming things out, making some kind of conceptual map, or creating a flow chart is helpful for being able to see the relationships between things all at once2. In this case, I think it’s useful for compressing the full narrative of what Pozsar is suggesting into a more digestible format that can be comprehended without having to scroll around a PDF, read multiples passages, and keeping in your mind what concepts relate to / interact with each other or what the overall narratives are every time you want to reflect on the idea. This way you can free up mental RAM to question what’s actually being proposed or think about knock-on effects.

In this post, I’m going to tend towards using as little words as possible and just use some brief text to try to give enough info to understand the diagrams — which kinda cheat in this text-minimalism restriction because they have a lot of text themselves, but is also another argument against simply rewording the same ideas in a linear text block.

It should also be noted that I am not a macro expert, I just happened to read these things and thought they were interesting and actually strongly relate to FRMO’s Murray Stahl’s inflation thesis in various places (FRMO being one of my larger investment positions, else I normally wouldn’t bother too much with macro forecasts).

BW3

Western central banks cannot close the gaping “commodities basis” because their respective sovereigns are the ones driving the sanctions. They will have to deal with the inflationary impacts of the “commodities basis” and try to cool them with rate hikes, but they will not be able to provide the outside spreads and won’t be able to provide balance sheet to close “Russia-non-Russia” spreads. —- Zoltan Pozsar (Bretton Woods 3)

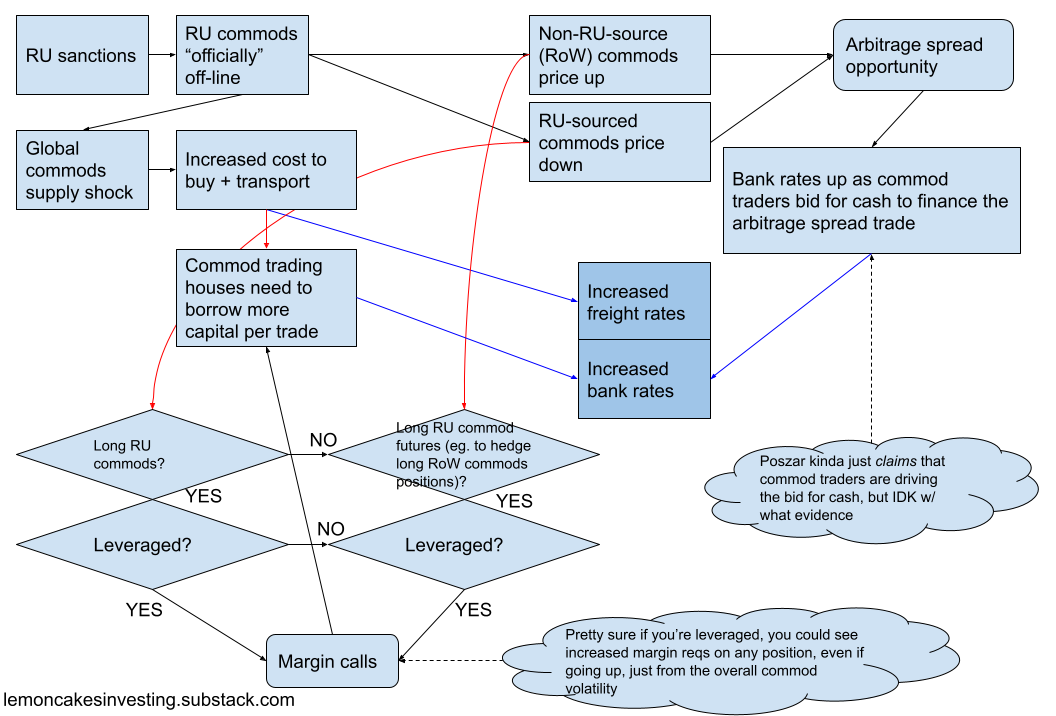

The commodity arbitrage spread…

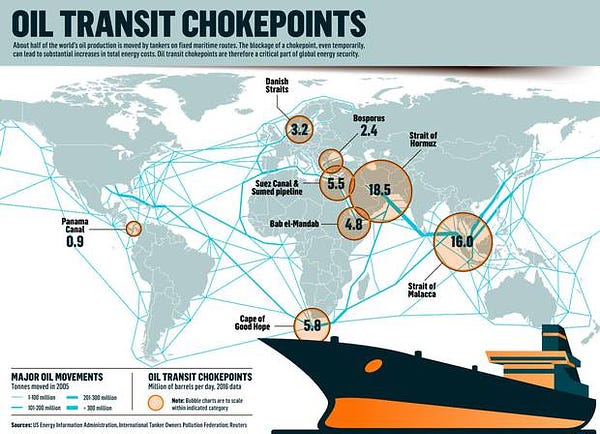

Russian sanctions are the straw that broke the camels back of globalization and is now creating a commodities supply shock — resulting in increased shipping and credit rates (and thus higher inflation) — and an overall cost spread on commodities that is going to have to be closed. Whoever the arb trader is, funding this “trade” will require capital and shipping capacity, thus raising interest3 and freight rates for the rest of the world (RoW). (As in the BW3 article, I use red arrows in the diagram for final effects in the financial economy and blue for in the real).

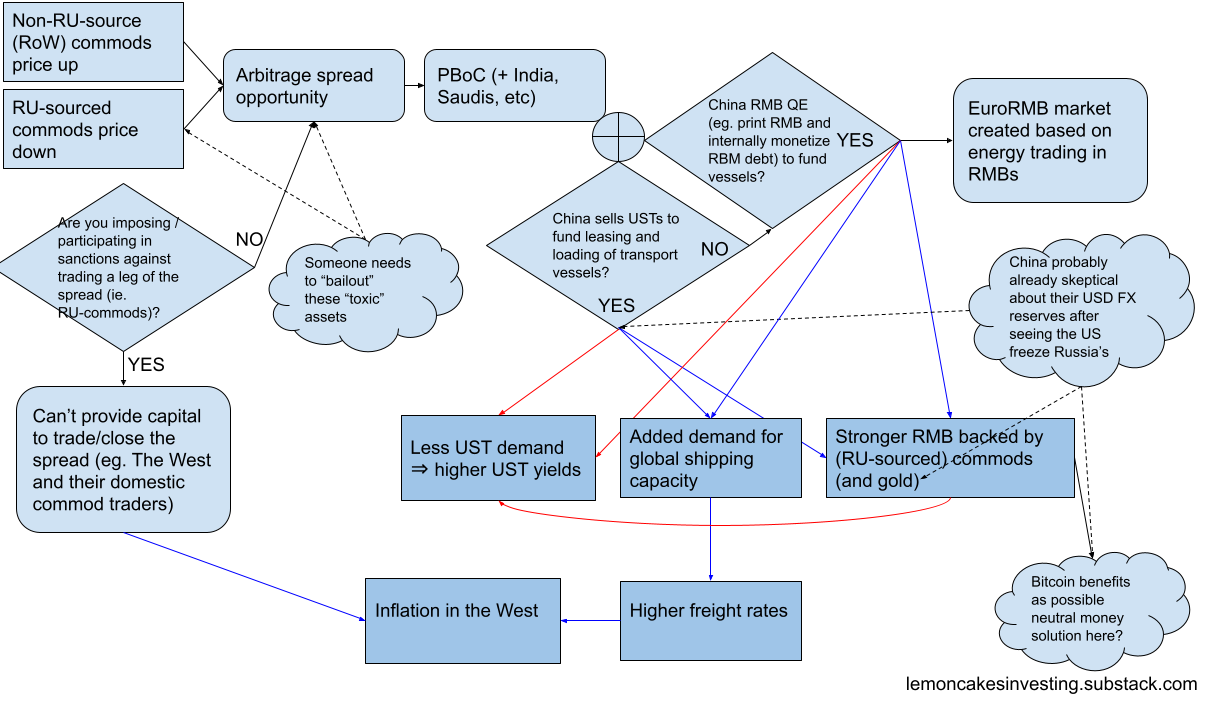

… and who can and can’t trade it

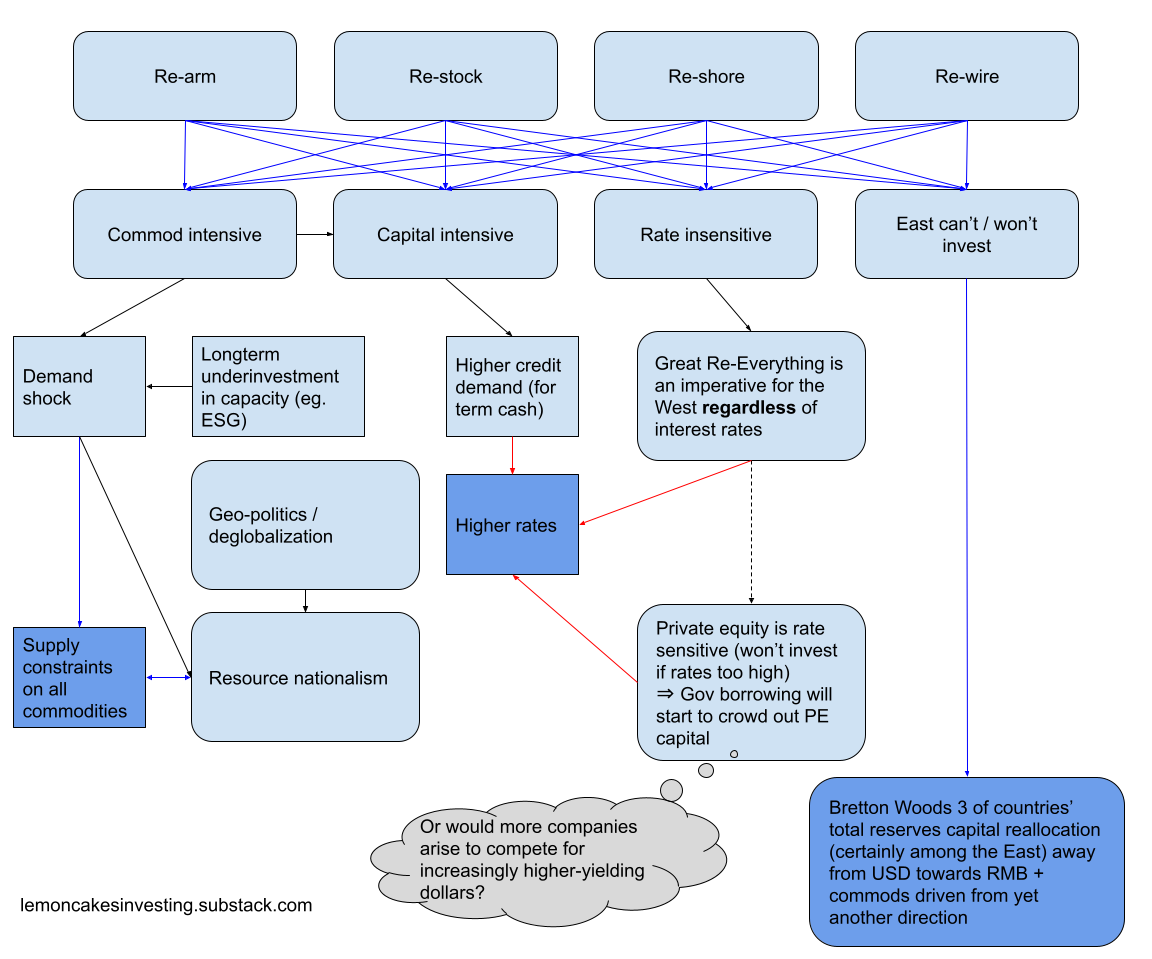

Who can close this spread, how, and what does it mean for the financial and real economies? Pozsar likens RU commods to 2008’s sub-prime collateral and the RoW’s commods to prime. Global commodity markets are going to need a 2008, TARP-like bailout program to provide the capital to buy these “toxic” assets and stop the whole system from collapsing; this bailout concept will come up again later in a larger context. Pozsar sees only the People’s Bank of China — given that the West is the one imposing the spread via sancions in the first place — as being capable of providing this capital in sufficient amounts. This scenario ultimately leads to a strengthened Chinese RMB, a weakened USD, and general inflation in the West as well as a shift in global FX reserves as — from what I can tell — the world reallocates towards greater RMB and commodities demand as it becomes the new “petro-dollar”/Eurodollar (in this case, the commod-renminbi), Pozsar’s titular Bretton Woods 3 shift. I don’t think China will ultimately succeed in the end, but the point is their going to try.

You can see a debate on this BW3 with Pozsar and Perry Mehrling (who’s are mentioned in the BW3 article, but I didn’t cover because it comes up in greater detail later) here (timestamp 1:04:25 in the Spotify version, but the times are all different depending on the platform, IDK why)…

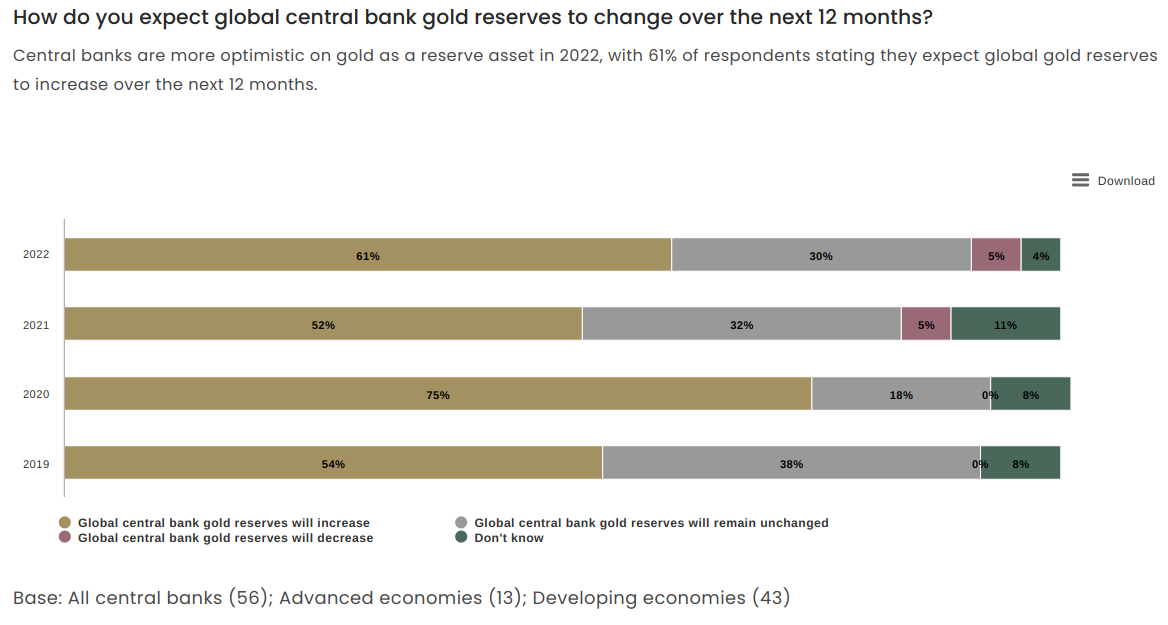

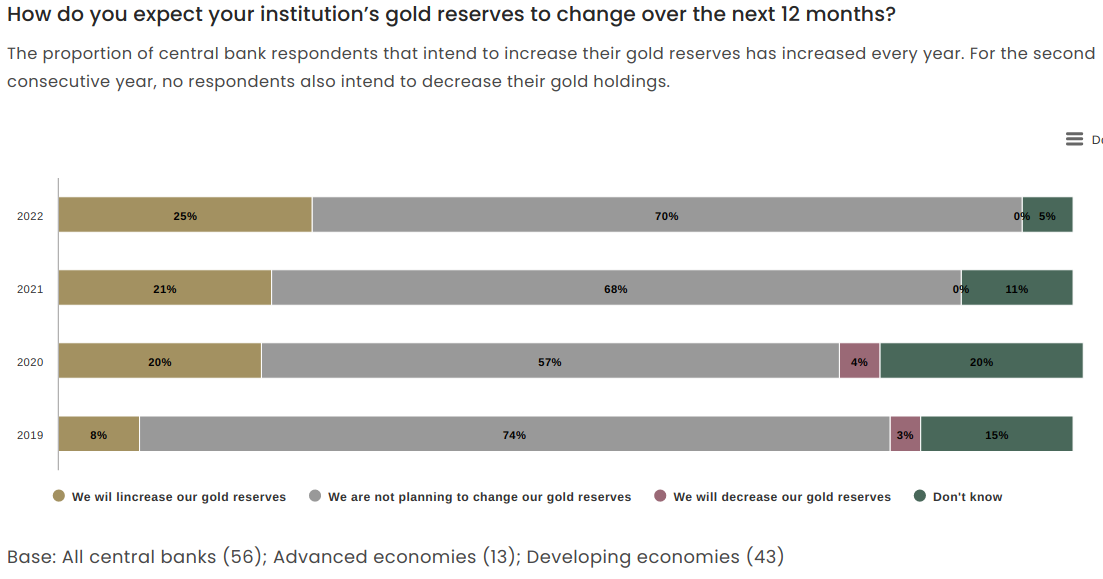

…where he kinda clears up some confusion around his BW3 thesis near the end by explaining that he’s predicting a reshuffling of countries “reserves” towards a greater allocation to commods/gold4 from FX reserves (particularly USTs and other Western money claims) — either by selling down their USD claims to acquire commods or by printing RMB to acquire commods (either way, their total reserves mix shifts to a greater commodity allocation). This is also mentioned in his later MC&BW3 article. Though, I wonder if this is just goal-post moving after there’s been time for his BW3 theory to get some pushback (as seems hard to not interpret Pozsar’s BW3 thesis in this initial way from reading the initial BW3 article) — even Murray Stahl seems to interpret it this way answers a question re. Pozsar in the Horizon Kinetics 2Q2022 commentary.

(Before this podcast came out, I had written a bit on my own doubts regarding Pozsar’s BW3 commod-backed-RMB conclusion — as it was commonly interpreted at the time — and have included that commentary in the footnotes)5.

There’s an interesting review of this discussion and links to other interesting resources here.

.

Another thing I thought was interesting was that Mehrling brings up the idea that the US (and global) COVID response was equivalent to war financing and he analogizes the current period to the post-WW2 economy — which was an analogy similarly made in a past Horizon Kinetics commentary, though HK had a less optimistic outlook on this fact6 than Mehrling's unbothered take in the interview.

There was recently an interview with inflationista Luke Gromen where he commented at some length on this Pozsar-Merhling interview that I think is interesting:

M,C,&BW3

The price level was an afterthought for the past 25 years. Unlike crises related to par, interest (bases), or FX rates, there were no major price-level related crises over the past 25 years. If anything, the problem was persistently low inflation, which central banks tried to counter very hard through aggressive balance sheet policies (QE) with limited success. —- Zoltan Pozsar (Money, Commodities, and Bretton Woods 3)

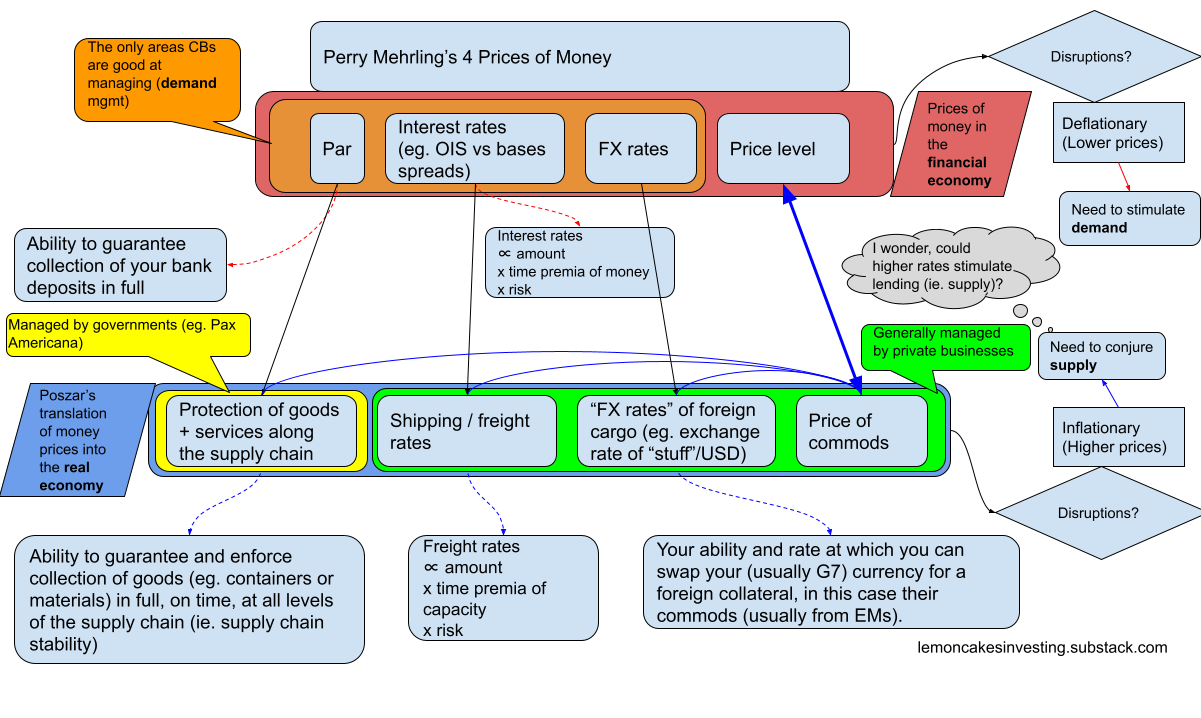

The “real” price of money

In “Money, Commodities, and Bretton Woods 3”, Pozsar covers Mehrling’s model of “The 4 Prices of Money” and the price level crisis at present. Pozsar’s main observation is that “price level” is the price of commodities. This is then used to link the financial to the real economy and is then analogized further to link/liken the other “prices of money” to the real economy. Using the “price level of money (in the financial economy) = price of commods (in the real economy)” as a starting point, we then have…

Par (financial) = Ability to guarantee collection of payments and deposits in full and on time

Par (real) = Ability to guarantee collection of goods in full and on time (eg. supply chain secutiry)

Interest rates (fin.) = the value of the amount, amount of time, and risk being taken on in lending credit to someone

Interest rates (real) = freight rates = the value of the amount, amount of time, and risk being taken on in lending shipping capacity to someone

FX rates (fin.)

Disruptions across the “real” prices of money

Given the trends of deglobalization — and the resulting commod price instability and geo-politicization of supply chains — discussed in the original BW3 article (and covered in more detail in MC&BW3), there are several conclusions reached:

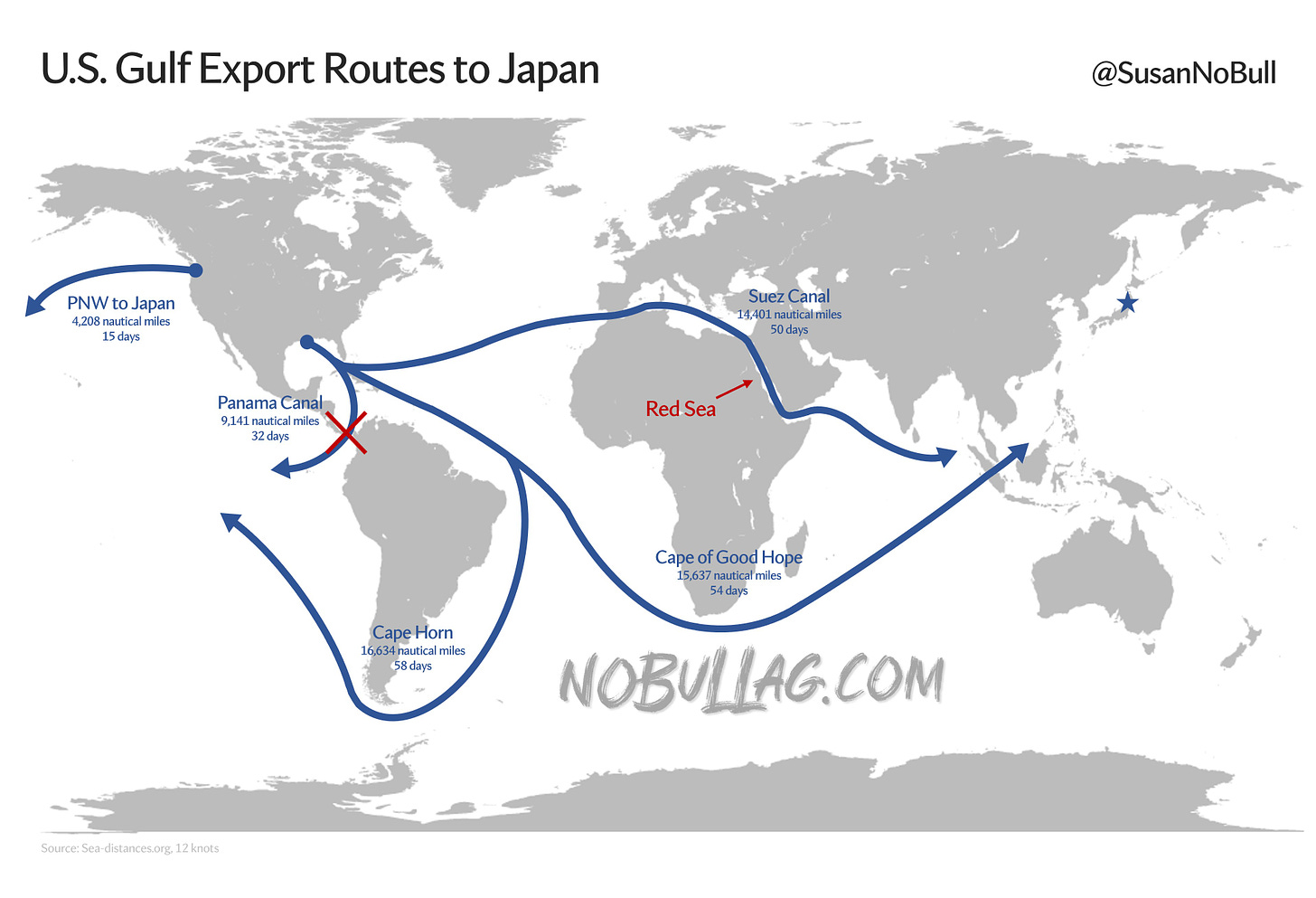

Shipping and credit rates will rise as reconfiguration decreases the efficiency9 and increases the length of supply chains, eg…

Nikkei documents how Greek tanker fleet is transporting Russian oil and conduct ship-to-ship oil transfers on the sea https://t.co/6wjuMlxmmm

Nikkei documents how Greek tanker fleet is transporting Russian oil and conduct ship-to-ship oil transfers on the sea https://t.co/6wjuMlxmmm(UPDATE 20221104: Just wanted to add these two additional tweets above as the headlines were too good and from a very interesting shipping account I follow)

There will be a greater need for the West to re-invest in global military engagement to enforce “par” values in the real economy and reestablish Pax Americana.

And the demand for US/G7/“outside” money claims (eg. USTs) for FX reserves will be reduced as countries focus on commodity stability and thus shift their capital allocation towards commodities and Chinese RMB (the currency Pozsar believes is going be the one used to ultimately close the commodities “basis spread” he points out in the original BW3 article).

All of which spell higher inflation for the West.

W&IP

If the US government is planning to once again become the arsenal of democracy, then the existing capabilities of the US military-industrial base and the core assumptions that have driven its development need to be re-examined. —- The Return of Industrial Warfare

“War and Industrial Policy” is where Pozsar brings describes his view of the deteriorating state of globalization: Why it’s happening, what is it resulting in, how will the West respond (which ties into The Malmgren Strategic Institute’s view on reshoring, rewiring, and Industry 4.0, which I may cover in another post) — and of course how it relates into his Bretton Woods 3 prediction.

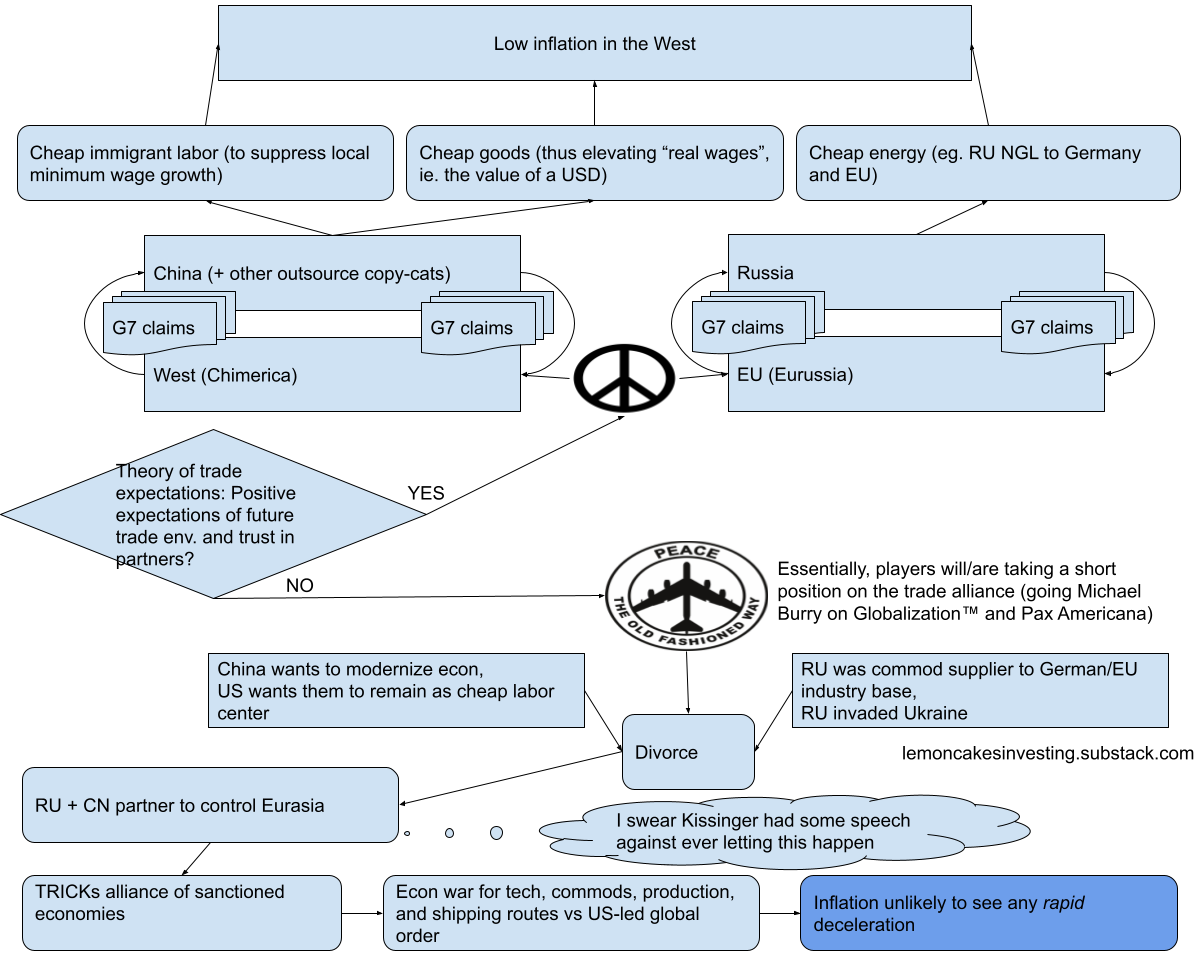

Global divorce and the big short on Globalization Inc.

How it was: Low inflation in the West was supported by export inflationary factors overseas to overseas to take advantage of cheap labor and goods provided by China which lowered costs and increased real wages in USD (relative the to cheap goods) as well as cheap/plentiful commodities supplied by Russia to the EU industrial base further reducing costs. The general Angloshphere paid CN and RU in their various G7 claims (eg. USD, Euros, Yen, etc) and CN and RU recycled those back into the Angloshphere.

How it is: China increasingly no longer wants to be the US’s/world’s factory (my understanding is that China wants to move that job (even more so than previously) to Africa and benefit from it themselves) and Russia invaded Ukraine, so the EU/US is mad at them and everybody is breaking up.

What’s left is the common-law Anglosphere vs a RU/CN-led TRICKs alliance of sanctioned economies (Turkey, Russia, Iran, China, and North Korea) — possibly including BRICS countries — who are increasingly apathetic towards the ideas of pure, rational, free trade based on mutual advantage and more interested in a more emotional-, political-, and historical-grievance-driven competition for control of tech, commods, production, and supply chains (and weaponizing the elements they already control in the meantime) that will ultimately spell long-term inflation for the West. Many have pointed out this looming “big short” on globalization for a good long while, but it seems that it is now entering mainstream public and political consciousness and proportionally increased action should be expected.

From online sources I follow, this unrestricted economic warfare and breakdown of supply chains in the background by Pozsar’s TRICKs faction has been building for a good while (eg. as early as 2015-2013).

Invoking Volcker and Real Economy’s Minsky Moment

He prevailed by delivering shock therapy, driving the economy into a deep recession to persuade Americans to abandon their entrenched expectation that prices would keep rising rapidly. —- NY Times (on Paul Volcker’s fight against inflation)

After getting the “transitory inflation” prediction wrong and invoking the name of the 1980s inflation fighter Paul Volcker, the Fed has backed itself into a corner and can only save face by rate-hiking the economy into a depression (note that we are already in a technical recession) and the only way out is going to be government investment10.

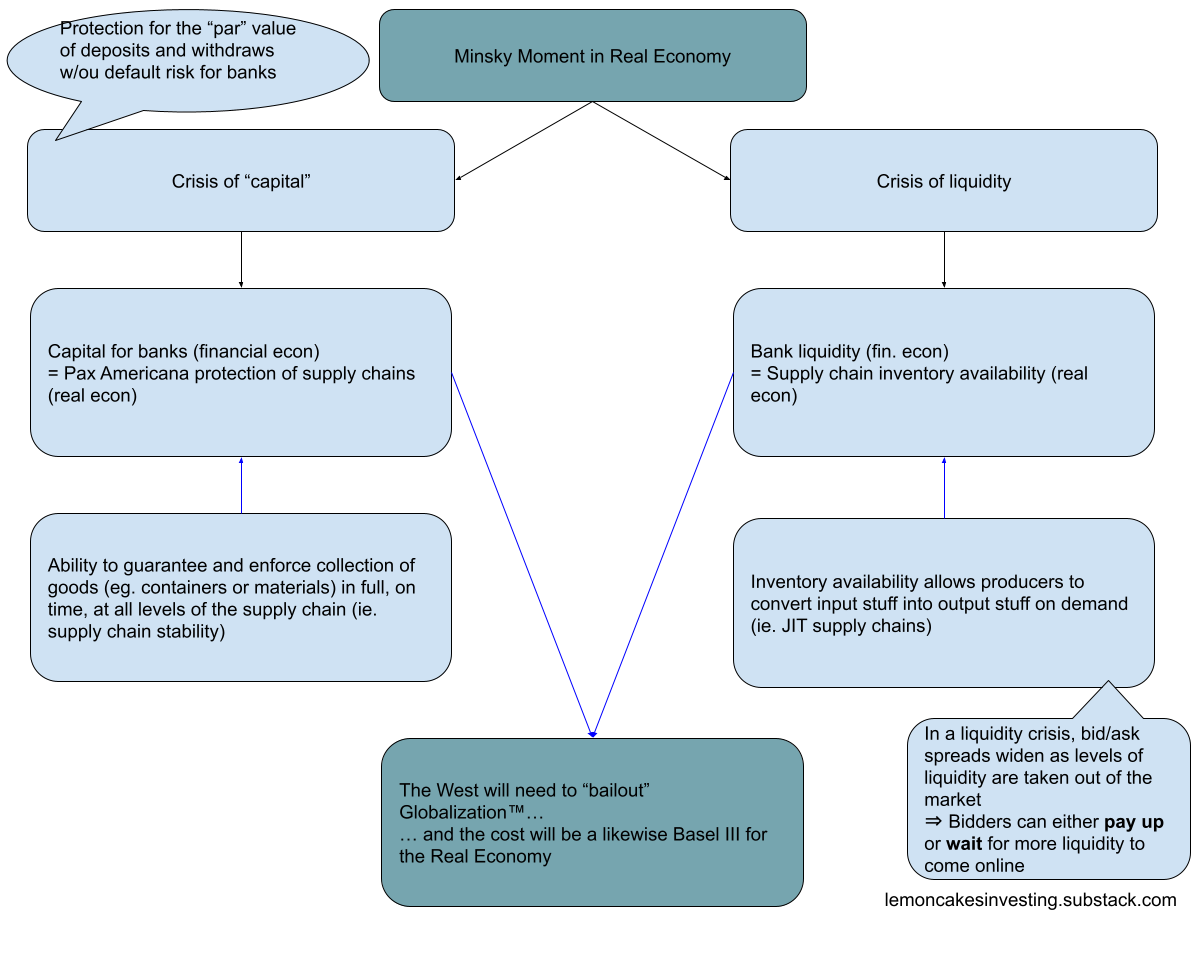

Meanwhile, the West’s longstanding technophile focus on high-tech military equipment and Just-In-Time supply chain / inventory management has culminated in a Minsky Moment for Globalization in both the military and commercial sectors in a “capital” and “liquidity” crisis akin to 2008’s GFC as we see now to state armies fighting each other with low-tech tanks and artillery (what would seem closer to 4th or 3rd generation warfare) and locking up major commodities and supply chains in the process.

(UPDATE 20221106: Just saw these news stories above and thought they fit too well in this section not to come back and include them)

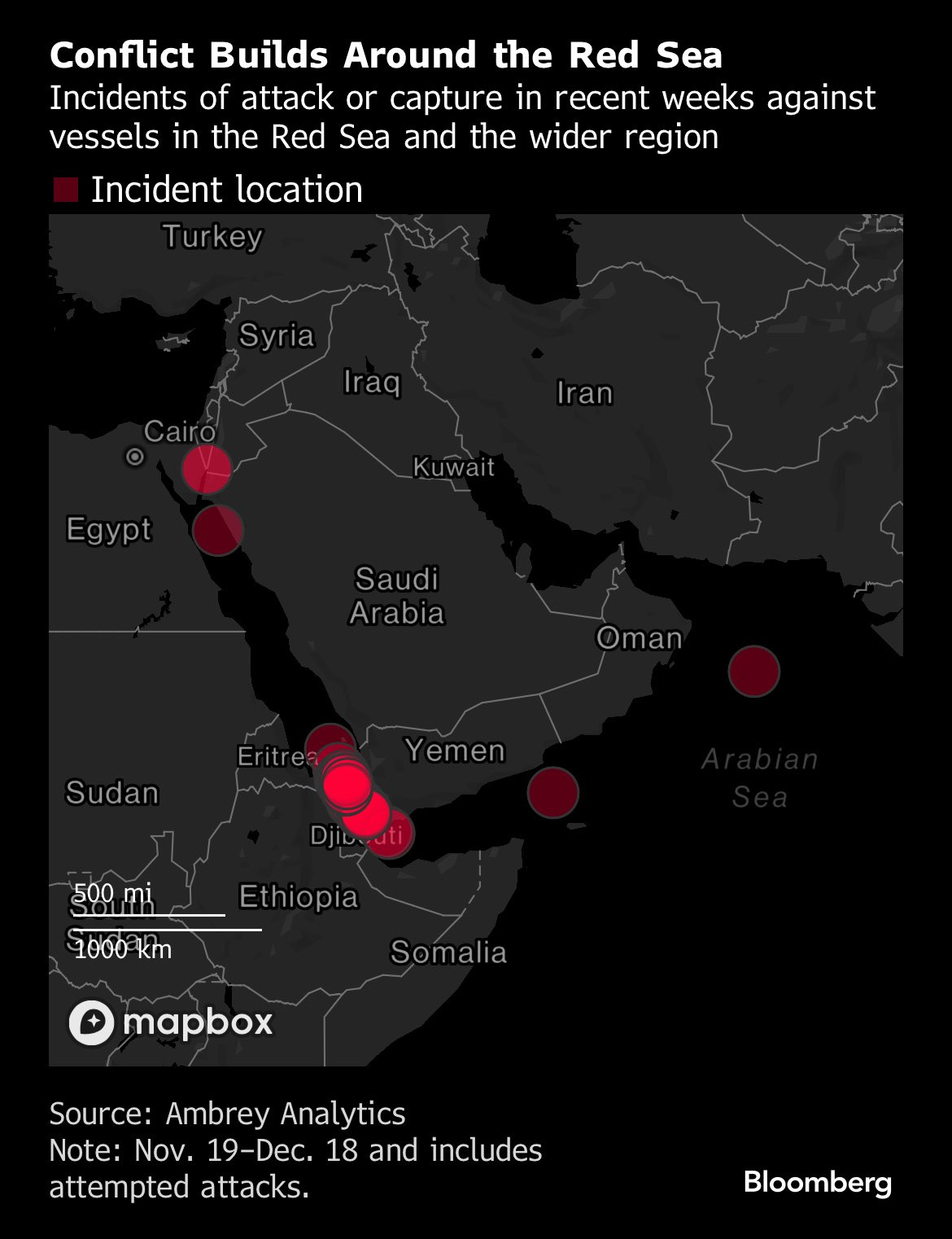

********** UPDATE 20231218: More examples of supply chains breaking down as USA and allies re-configure and enemies of Pax Americana take pot shots.

https://x.com/SusanNOBULL/status/1736709264607944801?s=20 (Javier Blas is the author of the interesting “The World For Sale”)

https://www.freightwaves.com/news/red-sea-chaos-could-boost-tanker-and-container-shipping-rates; “Longer voyage distances should boost rates. Diversions around Africa are driven by ongoing attacks on commercial shipping by Yemen’s Houthi rebels near the 20-mile-wide Bab-el-Mandeb Strait.”

https://www.ft.com/content/0a9887be-87df-4dcc-bdf5-38ee31cfe6b8; https://www.reuters.com/technology/cybersecurity/britains-national-grid-drops-china-based-supplier-over-cyber-security-fears-ft-2023-12-17/

**********

With great TARP (for the real economy), comes great Basel III

The second crucial assumption is that industry can be turned on and off at will. This mode of thinking was imported from the business sector and has spread through US government culture. In the civilian sector, customers can increase or decrease their orders. The producer may be hurt by a drop in orders but rarely is that drop catastrophic because usually there are multiple consumers and losses can be spread among consumers. Unfortunately, this does not work for military purchases. —- The Return of Industrial Warfare

“Captial” = par protection (see MC&BW3) = supply and supply chain protection (in the real economy)

“Liquidity” = ability to convert your stuff into other stuff (with little/no market impact) = availability of inventory (in the real economy)

The government(s) is going to have to provide both of those things in order to “bail out” Globalization Inc (or at least the common-law Anglosphere) and, like in 2008, is going to have to do it with a “bazooka” of overwhelming force to calm “markets” and "stop the “short sellers” — keeping in mind that 2008’s TARP bailout came with greater regulations for the banks.

This bailout is going to have to be funded somehow and it’s either going to be done via debt monetization (ie. QE) or placing USTs to the rest of the world. The former will require rates < inflation (ie. financial repression)11 and the latter will require it be ≥ inflation12. In any case, the government is going to have to / is already in the process of investing in re-arming and re-stocking themselves and working with the commercial side to re-shore manufacturing and re-wire the energy grid (as well as having to reconsider how they manage their own inventory / supply chains).

The Great Re-Everything’ing

If competition between autocracies and democracies has really entered a military phase, then the arsenal of democracy must first radically improve its approach to the production of materiel in wartime. —- The Return of Industrial Warfare

This Great Re-Everything bailout / restructuring is going to be involve a lot of commodities and capital (read as: higher commodity and credit demand) as well as being totally insensitive to whatever the interest rate environment is at the time — this is essentially economic warfare spending (and war is always inflationary) — and not exactly investable to the East / TRICKs nations (which would be like Michael Burry lending money to the banks in 2008).

Comments

Aside from my comments in the various footnotes, I’d add that, while I think USD remains the better money, I do think that Bitcoin is / will be the better gold — so long as the civilized world remains generally in tact (ie. deglobalization does not lead to a “hot” WW3). I only mention this because in Pozsar’s BW3, he commented that the ultimate outcome would likely be a positive for BTC, but I’m not really convinced that the dollar is going to lose it’s status to the RMB. BTW, China has problems of it’s own and maybe Chimerica ultimately won’t need a divorce after all. Furthermore, despite constant warnings re. China’s rising military in the MSM by Pentagon and military officials (which are more likely simply trying to scare the public and policymakers into writing them bigger checks) I think that China’s doesn’t have the military/logistics nor the inclination to displace the US’s role as the police of the world and global supply chains…

The Chinese were building on a massive scale, but the dollar being the currency of trade, and whenever dollar loans are created – in Eurodollars – you get dollar reserves at the Fed. People think that the money belongs to China and they can do what they like with it – but it’s not quite like that. The Chinese do have the capacity to lend money. They’re going into Africa and hoovering up assets, in the same way that the US did before them. But they’re also pissing a lot of people off, in the same way that the US did before them. But what the Chinese don’t have that the US did, is the military muscle to go in and enforce the debts. So that’s the realpolitik. If you didn’t pay your debts to Britain in the empire days, they would take your country away from you. US, the same. But China doesn’t have that ability, and I don’t believe they ever will have. Big difference. China built the wall to keep people out. Their posture has never been adventurism. They’re too smart for that. They’d rather other people’s 19-year-olds die defending the trade routes. Their 19-year-olds will never do that. —- https://www.lowimpact.org/posts/chris-cook-oil-markets-from-nixon-to-trump

Another critic of Pozsar’s is Ektrit (Kris) Manushi13, who’s been commenting on the apparent breakdown of global supply chains and the the increasing “short position” on Pax Americana by an Anti American Circle — and claiming that the West is already / has been in a cold WW3 with the general members of Pozsar’s TRICKs faction — since 2014:

And while he converges with Pozsar on the idea that global supply chains are going to need to be reconfigured and re-armed…

…he also believes (and is not totally alone in this) that the way forward is via Powell’s Vockler-like rate hikes themselves as a means to spur production (ie. that central banks — as opposed to Pozsar’s thoughts on the “price level” of money — can indeed control production). Cheap money is not necessarily easy money.

UPDATE 20221207: Kris Ektrit’s thread on Pozsar…

I wrote about this when talking about the idea of a cash as an allocation is a previous post here:

In my next post, I plan to write about the intersections I see with Pozsar’s Great Re-Everything’ing and the industrial future envisioned by the Malmgren Strategic Institute (which unlike Pozsar’s BW3 and corollary knock-on effects, is actually deflationary) and how I plan to / am investing with those ideas in mind.

If you’re going to read the articles yourself — which you should because 1) they’re interesting and written in a mostly accessible way and 2) the notes I’m making here are really for reference purposes and not mean to verbally distill anything from the articles further — there are some terms used by Pozsar that are unnecessarily confusing or niche, so I’ll translate here as best as I understand it:

“Price of balance sheet”

When you see things referring to the price of balance sheet or providing balance sheet, this is basically the cost or amount of capital for businesses holding commods on their balance sheet — ie. to physically own, transport, and store them (vs simply owning/trading the futures)

When he talks about swaps (or other derivatives or collateral) showing “signs of stress”…

…it usually means that there are more sellers than buyers (or vice versa)

“Cash is bid”

Cash is catching a lot of bids — lots of people are bidding for cash (ie. lots of people are wanting to take on debt)

“o/n cash” and “term cash”

“o/n” literally refers to “overnight” (eg. overnight interest rates), but I think in this context he could be meaning rates for cash borrowed for any time under 1yr

“term” cash being anything borrowed for longer than that (but again, in this case likely intending to describe cash borrowed for multiple years).

“Premia”

Basically interest rates — eg. if o/n premia were going up and term premia were going down, then the yield curve would generally be going up and to the left (ie. inverting).

Very tangent but, even though I use the phrase ‘concept map’ here, this is not really a proper “mind map” in the pedagogical sense as a way to necessarily “learn” something. The strategy I’m using here is good as a reference and reflection tool — like I mention, to be able to see relationships all in one image w/out having to read passages over again and remember what relates to what — but if you really want to learn something using “mind maps” (which I recommend), you’d do something more like this:

This bank rate impact is based on Pozsar claiming that commod traders are the ones that drive the marginal bid for long-term cash — and thus term interest rates — in the money markets (IDK if this is totally true or what evidence there is for this).

Something I though was interesting/funny is that — via this World Gold Council 2022 survey of central banks — while CB majority expectations for total global CB gold reserves are that it will increase, the actual expectations of the majority of surveyed CBs it to keep their own reserve levels unchanged.

Note, I actually doubt Pozsar’s headlining, Bretton Woods 3 prediction of a gold/commodity-backed RMB, secondary world reserve currency for the supposed TRICKs faction or the idea of totally supplanting the EuroUSD with a EuroRMB system ever coming true.

IDK why anyone would trust the CCP for their reserve currency and monetary system vs the more consensus-based, inclusive, and stable Anglosphere rule of common law nor are people — I think — considering the dominating logistical military power and will of the US to enforce its own interests, so I think the USD remains the best house in a bad neighborhood .

********** UPDATE 20230707:

https://www.foreignaffairs.com/united-states/high-price-dollar-dominance

**********

See https://capx.co/the-anglosphere-holds-the-key-to-the-future-of-international-relations/

Oil expert, Dr.Anas Alhajji on the unlikelyhood of any overthrow of the petrodollar:

So OPEC met OPEC experts met and they brought in experts from all around the world and they use the IMF and the World Bank, etc. They studied various options to price the oil that was in 1974-1975. They are public studies and some secret studies. And after they looked at other currencies, which was of course the Sterling was one choice. The Yen was one choice as you remember the Yen was kind of a good currency when they looked at the basket of currencies. They looked at pricing it in gold. They looked at the IMF SDR. After looking at all the choices, they decided to stick to the dollar despite the losses and by the way, OPEC report every month shows a chart in the first section of the report on the losses from using the dollar. So you can look at the losses from inflation and the dollar on the chart.

[…] First, the problem of pricing all in one currency is the same whatever currency you use. So whether you use the yen, or the dollar, or the Sterling or the euro, etc, you move from the dollar to other currency, you still have the same problems. So moving to another currency is not going to solve your problem.

[…] The other choice they had was to price oil in basket of currencies. But a basket does not work. And the reason why because OPEC members historically are scattered around the world. […] Therefore, a basket of currency will benefit some and hurt the others. So they cannot, there is no way for OPEC members to agree on the content of the basket, because whatever content they have, some member is going to be hurt by it. And then even if they do so and they agree on it, they have to change it every month and the management of it is going to be extremely costly.

[…] Saudi Arabia, Bahrain, Qatar, Kuwait, and the UAE. Five countries, all of them, their currencies are pegged to the dollar at a certain exchange rate, at a fixed exchange rate. Which means that when the dollar goes up, their currencies goes up. Their currencies go up and they benefit from that. Why shoot themselves in the foot by getting rid of the dollar, lowering it, and lowering their currencies, because their inflation will go up. So they need to depeg first and that will take like structural changes in the economy to do that. I don't think they are willing to do that before 2030.

And we can go even further and see Jeff Snider’s take on the unlikelihood of the overthrow of the Eurodollar — and China’s past attempts:

From the Horizon Kinetics 2Q2021 Commentary:

The Federal debt is now 127% of GDP (as of March) The prior all-time high was 119%, but that was in 1946, after the end of World War II. A difference between then and now is that Federal spending decreased dramatically after the war. As well, the war spending had funded an extraordinary expansion in the productive capacity of the nation’s factories and in new technology, so that the post-war civilian economy expanded at a torrid rate.

Our current era’s massive debt accumulation did not fund new productive capacity in the nation’s factories and research facilities; it did not purchase robust economic growth. And there appears to be no expectation of a dramatic decline in spending.

[…] One can speak of the economy outgrowing the debt, but during the very favorable past 10 and 20 years, GDP expanded at only a 3.7% rate. No one seriously suggests that it will be more robust in the next 10 years than in the last 10.

An example provided by Pozsar is the EU having to buy gas using the Russian RUB, but as pointed out by Dr.Anas Alhajji in the interview here, this is not exactly how the situation is playing out:

[T]hey came up with a system, they said, Okay, you buy gas from Gazprom, and you pay to a bank that is related to Gazprom. So what about this, that your contract calls for paying in dollar or euro, go to this bank and pay in dollar or euro, so you can fulfill the legal obligations of the contract. And you cannot go to the Russian Central Bank, because it's on the list of sanctions. So you don't have to mess with it, just give us the money and we will exchange it to ruble. And then in our country, we will open a ruble account in your name. And then we take the money and we pay Gazprom so it was just again, and that's how they continued. So now Russia can play the same game and continue with it. So okay, to fulfill the obligation of the EU. Let's continue with the same game. You just pay me and I will do the exchange. And we go with that game. —- Anas Alhajji (on EU RUB payments for RU gas)

This “stuff” per unit of currency POV is also brought up by Murray Stahl in the 1Q2Q2022 Interim Horizon Kinetics Commentary to illustrate HK’s energy and monetary inflation thesis:

Money functions similarly, except that it is increasing by well in excess of 10% a year. If you believe in the law of supply and demand, then if the world currencies—dollars, euros, yen, pounds or whatever currency you want to use—are collectively increasing at a double-digit rate, while the supply of oil, the number of barrels being produced, is not going to grow at anything like that rate, what do you think is going to happen?

If the supply of oil were to grow even as high as 2% a year, while the supply of currency to pay for it is growing at 12% a year, then the price of oil measured in currency is going to go up. The discussions around inflation and currency debasement would be easier to understand if people said, or could see, that it’s really like a currency exchange rate, except oil versus currency instead of one currency vs. another. The fiat currencies are going to fall in relation to a barrel of oil: much more currency supply circulating every year for each available barrel of oil; more dollars or Euros or yen, but not much more oil.

Not to mention that new global maritime regulations are about to enforce a literal slow-down of ships (ie. any given amount of shipping capacity will be used for longer periods of time, artificially) in the name of ESG:

The easiest way to get the energy efficiency index down is to reduce engine power, as vessels’ fuel consumption and emissions, respectively, increase as speed increases. The propulsion power, thus CO2 emissions, is approximately proportional to the cube of the speed. This means that reducing speed by 20% can drop the emitted CO2 by 50%. Slow steaming, therefore, is a more carbon-efficient way to transport goods. The engine power limitation systems can be bypassed, but only if required for the safe operation of the ship, for example, in harsh weather conditions.

Though it may also be the case that higher rates can spur an economic recovery themselves:

This idea of longterm currency debasement vs inflation is the position that $FRMO’s Murray Stahl and many other inflationistas are expecting from the Fed — many also are expecting a Fed pivot rather than Chair Powell ever even making good on his Volcker promise:

I found this to be an interesting argument against Stahl, Gromen, et al’s case for rates to remain below inflation:

Upon writing this, I found that Murray Stahl did actually address this idea in the HK interim 1Q2Q2022 Commentary:

The U.S. federal government, as an example, needs about $6.5 trillion to buy what it needs. It raises about $4 trillion a year in revenue. So, it’s going to have to get to a net two trillion dollars or so from borrowing. Add in all the state and local governments, then you have, in round numbers, another $3.5 trillion of government spending.

Roughly speaking, then, the three types of governments, federal, state and local, spend in the neighborhood of $10 trillion. The economy, the GDP, is $24 trillion. There's just no way, no matter how you configure tax laws, that they can collectively extract $10 trillion from a $24 trillion economy. The difference has to be debt funded. That's number one.

Number two, even if the governments could somehow extract that degree of tax revenue, it would cause a depression, not just a recession, in which case you wouldn't have a GDP of $24 trillion. It would contract to something less than that. And that initiates a vicious cycle, because the government’s social contractual obligations rise during a recession, because people lose work. The tax base falls and local communities can’t afford police or a fire department or hospitals or schools or ambulances, whatever services they happen to fund. Which, in turn, means the government must look for even more money. It’s not a pretty picture, and that’s a constant in all societies, not just the United States.

What ends up happening? Governments are tempted to do what governments have been doing for many centuries, millennia even. A), borrow money, and then B), create money.

Not to mention the increased interest payments that the Fed itself would have to pay in interest expense to depositing banks.

Note that he also believes in a bit of a wackier, flying-spaghetti-monster-type hypothesis (in the sense that it kinda defies the idea of having any evidence with any diagnosticity or hypothesis-rejection by the nature of the supposed mechanism being carried out in secret) re. global commodity supply capacity that makes me take his ideas with a grain of salt. I go over this a bit in a previous post here: https://lemoncakesinvesting.substack.com/i/56739528/the-world-for-sale-and-subsequent-storage-and-rehypothecation

The logic is interesting, but it’s not something I can really commit too much capital to it given that I don’t personally know what / the sources he knows, so can really only have it my head as “possible” (vs “probable” or “likely”).