Portfolio review 20240704, semi-annual

Returns

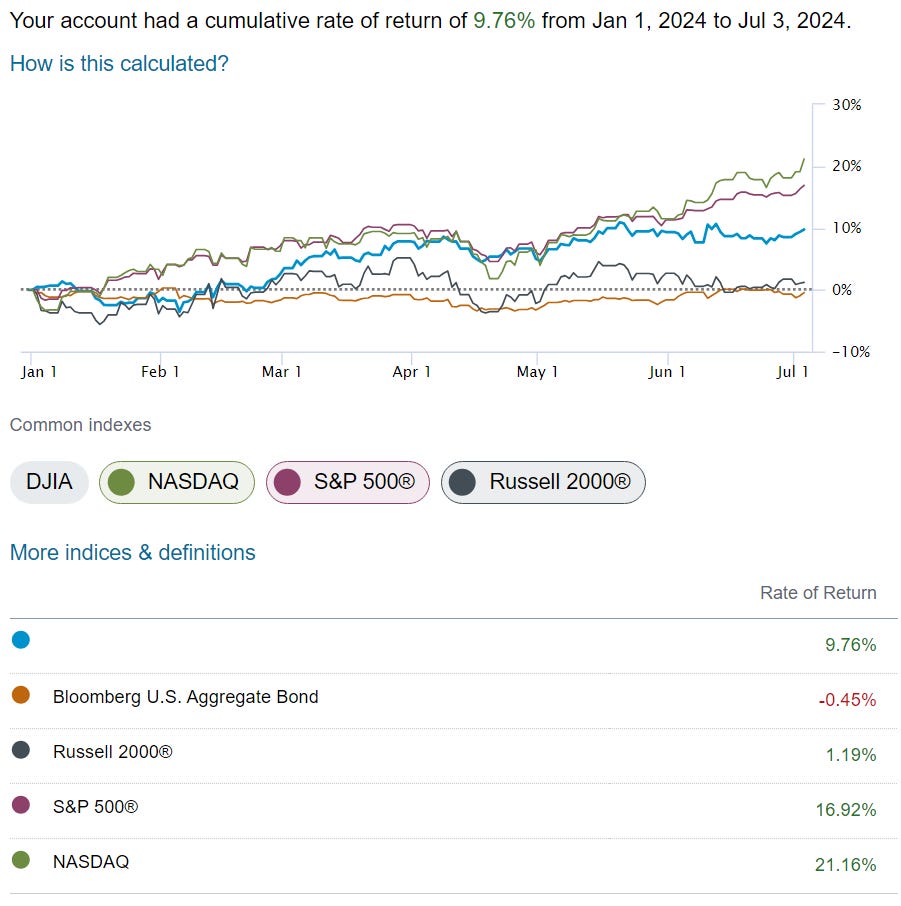

The S&P Global index construction methodology buckets $1bn-$6.7bn as “smallcap” and $6.7bn-$18bn as “midcap” (see https://www.spglobal.com/spdji/en/documents/methodologies/methodology-sp-us-indices.pdf). With the recent small additions of some newer positions, along with my medium-sized positions in FNV and MKTX, my portfolio holdings’ weighted average marketcap just crosses the smallcap threshold to a $6.9bn weighted average. Thus, I will compare my performance vs the smallcap indexes as well as against the S&P 400 midcap index (and, of course, vs the broad market index):

So far we look to be doing well vs the similarly-marketcap’ed indexes, while behind the broad market by 5pps. (Note that my portfolio is currently 17% cash and money market funds, so the performance would have been slightly higher at around 11.75% YTD if that money was invested evenly over the existing equity investments for the period. 1 Regardless, the actual outcome here is still fine to me.)

Commentary

So far for this year, weak price action breadth across the market and a lack of volatility (which has also led to cheap options contracts) has led me to tentatively start cutting small loser positions (such as in-the-red, goldilocks-macro-aligned positions that have not been successfully executing on their business or the thesis that I originally bought them for), while also adding to certain event-based investments via call options.

That is, the floorboards of the current market levels are looking just a bit creaky, so I figure now is a good time to cut some dead weight, while also adding cheap (and low overall cost-basis) exposure to investments whose underlying theses are less likely to loose steam in the event of a slight market correction. In a way, trying to shift more from market/systemic risk exposure, not to cash or other forms of ‘safety’, but more towards specific/idiosyncratic risk. I think the article here describes this POV pretty well: https://realinvestmentadvice.com/bad-breadth-keeps-getting-worse/. (I wonder how the earnings ‘breadth’ looks (eg. what percent of S&P 500 constituents have had positive EPS growth in their most recent quarter compared to the same time last year)).

(https://www.barchart.com/stocks/quotes/$MMFI/technical-chart?plot=BAR&volume=0&data=DO&density=YTD&pricesOn=1&asPctChange=0&logscale=0&startDate=2024-01-01&indicators=MACD(12,26,9)&sym=$MMFI&grid=1&height=500&studyheight=100; https://www.barchart.com/stocks/quotes/$MMTH/technical-chart?plot=BAR&volume=0&data=DO&density=M&pricesOn=1&asPctChange=0&logscale=0&sym=$MMTH&grid=1&height=500&studyheight=100)

.

Much has been said about the Mag7’s outsized effect on overall stock market returns as of late. I’ve written about it myself in the past here and here. It continues to be written about elsewhere, though I’ve not much more to add at this point as not much has changed with this trend so far as I can tell. I will simply add some more recent writings that touch on the topic here for any interested readers: https://capitalistexploits.at/a-giant-sucking-sound/; https://columnalerts.cmail19.com/t/d-e-eiuulx-jutdtltktj-r/; https://archive.ph/ff87V; https://horizonkinetics.com/app/uploads/Horizon-Kinetics-Q1-2024-Commentary.pdf (see “Today’s Technology Sector Risk”).

.

Despite the out-performance of the SPX and Mag7 vs my more modest basket of holdings, I can’t convince myself to start accumulating a position in these more popular stocks (especially at their present valuations). One of the main reasons I’m still quite comfortable with the portfolio despite the current under-performance vs the broad market index is that it aligns much better with the way I think about diversification, while still allowing for growth in the long-run to come from ideas that I think are a bit more under-followed by the market; I am reminded of the line from Kanye West’s “Ghost Town”: “Years ahead, but way behind”; I like to think my portfolio is ‘years ahead, but way behind (for now).’ (Don’t look up the line that directly precedes that one).

“Here is how it works. When $1 is invested in the S&P 500 index, $0.35 flows directly into the top 10 stocks. The remaining $0.65 is divided between the remaining 490 stocks. Investors who benchmark [to] their index risk failing unless 35% of the portfolio is invested in those 10 stocks. With the market capitalization weighting of the largest companies nearing a record, taking on a 35% stake in those companies increases the portfolio’s risk profile significantly more than many investors think. […] The reality is that even if you buy an index, you will still underperform it over time. Over the last 30 years, the S&P 500 Index has risen by 1987% versus the ETF’s gain of 1916%. The difference is due to the ETF’s operating fees, which the index does not have.” ~~~ https://realinvestmentadvice.com/benchmarking-your-portfolio-may-have-more-risk-than-you-think/

.

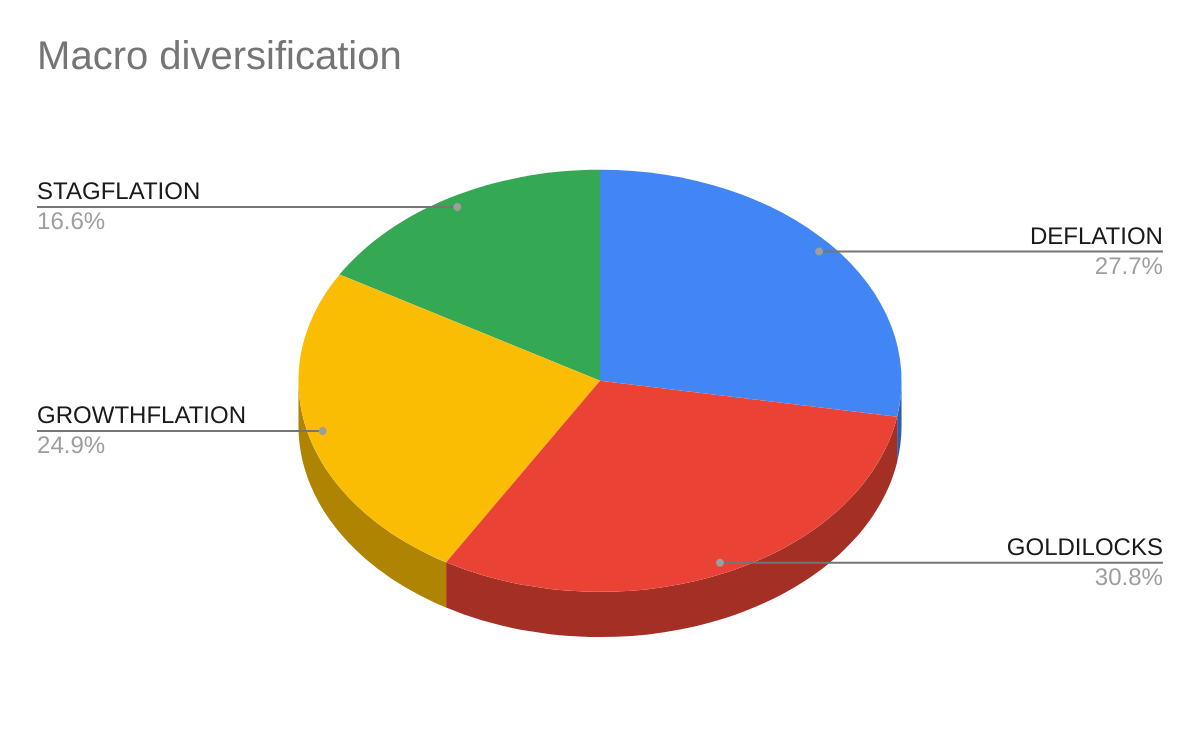

Here is roughly how I view my portfolio’s current macro and value/demand-driver diversification:

(https://intelligencequarterly.com/ahead-of-the-herd/the-thinking-mans-quad-system/; I then apply this idea in a manner similar to Ray Dalio’s concept of the “All-Weather” portfolio (see https://ofdollarsanddata.com/ray-dalio-all-weather-portfolio/))

“Instead of using correlation as a measure of dependence between positions, [Ray] Dalio focuses on the underlying drivers that are expected to affect those positions. Drivers are the cause; correlations are the consequence. In order to ensure a diversified portfolio, it is necessary to select assets that have different drivers. By determining the future drivers that are likely to impact each market, a forward-looking approach, Dalio can more accurately assess which positions are likely to move in the same direction or inversely—for example, anticipate when gold and bonds are likely to move in the same direction and when they are likely to move in opposite directions. In contrast, making decisions based on correlation, which is backward looking, can lead to faulty decisions in forming portfolios. Dalio constructs portfolios so that the different positions have different drivers rather than simply being uncorrelated.” ~~~ Jack Schwager, “Hedge Fund Market Wizards”

(For more info on how I’m calculating these charts, see the footnote here). 2

If I apply similar reasoning to the top 50 stocks in the S&P 500 (as of July 4 2024), I think a reasonably-arrived-at distribution ends up looking much less well-rounded than my own portfolio (noting that the large Bitcoin exposure in my own portfolio is based on a much smaller cost basis than what the total value has grown to today)…

Top 5 holdings

Aside from the 17% of the portfolio that is still sitting in cash and money market funds, the top five equity positions (including their current approximate portfolio weightings and YTD returns) are…

BSM (Black Stone Minerals) and other O&G royalties: (15% of portfolio; +4% YTD average weighted)

Not much has changed here since my previous annual portfolio review.

I noted that there appears to be a significant shift in global sentiment and narratives regarding energy and climate change policies with skepticism growing about their effectiveness, particularly influenced by changing government actions. The reversal of governments to coal (https://www.reuters.com/markets/commodities/energy-crisis-fuels-coal-comeback-germany-2022-12-16/), wood (https://www.dw.com/en/eu-weighs-up-future-of-wood-burning-as-renewable-energy-source/a-64985113), and fossil fuels, accompanied by subsidies (https://www.reuters.com/business/environment/global-fossil-fuel-subsidies-rise-despite-calls-phase-out-2023-11-23/), has already increased gasoline consumption. The failure of certain climate change policies is resulting in an “unexpected” increase in demand for coal, oil, and especially natural gas. It seems likely that governments and businesses, no longer able to hide the inadequacy of green policies, will turn to fossil fuels like natural gas as a more viable option, leading to a surge in demand beyond current forecasts. Investments in oil and gas may become more attractive as the narrative shifts away from strict adherence to ESG ideals.

In a recent interview with Daniel Yergin, author of the famous book on the history of the oil industry, “The Prize”, he predicts that…

“The demand for natural gas will continue to grow until the 2040s, partly to replace coal in electricity generation. Oil and gas have different trajectories. But there is another thing to mention: It is only recently that Western governments have woken up to the fact that there is a problem with the supply chains of metals for green technologies. Now the alarm bell has gone off.” ~~~ https://www.nzz.ch/english/energy-guru-daniel-yergin-im-sick-of-the-discussion-about-energy-transition-ld.1821620

Also earlier in that same interview the question is asked “What is the difference between the current energy transition and previous ones?” to which the response is…

“Well, there is one fundamental difference. All of them were energy additions. Oil overtook coal as the world’s number one energy source in the 1960s. But coal hasn’t disappeared. Last year, the world used more coal than ever before, three times as much as in the 1960s. Now we are trying to go from one system to another in a really short time without paying a lot of attention to the amount of resources and minerals that would be required. […] The aim is to shift supply chains away from China. However, this will be difficult because it is not only about mining, but also about China's dominance in the processing of metals and minerals. What’s more, the process from discovery to production in mining can take up to 20 years. I think that there has been an underestimation of the supply chain challenges that are apparent in the energy transition. […] I think the world is becoming more fragile because of the breakdown of globalization. It’s almost time to be nostalgic, because that era of globalization is now over. And all trends and signs indicate that it’s going to get more challenging.”

Aside from the deglobalization / supply chain issues (which will create other long-term inflationary knock-on effects), what I think is left (just barely) unsaid here is that the current push from fossil fuels to green/renewable energy technologies is the first energy transition that is 1] artificially imposed (vs being pursued by organic market forces seeking a better energy efficiency product), is 2] going from a more efficient energy source to less efficient ones, and 3] attempting to remove, by force, the use of the incumbent (and more efficient) energy source, rather than allowing natural competitive forces to result in the phasing out of the older source (which one would expect to happen if the newer source were actually superior).

“If one studies the history of energy, its production and consumption, new technologies with superior energy efficiency always displace old technologies with inferior energy efficiency. As the pundits argued, if wind and solar were ideal forms of energy with superior energy efficiencies, we would be forced to leave behind our oil and gas investments and embrace renewables, as renewables would ultimately displace all hydrocarbon-related energy production. […] Despite being heralded as the future, wind and solar have terrible EROIs [energy return on investment, which measures how much input energy is required to generate a unit of usable power output]. Compared with coal or natural gas, sunlight and wind are not energy-dense. Compare the energy from a gas stove with a stiff breeze or a sunny afternoon; they are different orders of magnitude. Since renewable energy density is so low, their size must be enormous to generate the same output. […] Large size means copious raw materials, which consume enormous energy. As a result, the energy required to generate output is very high, and the EROI is low. […] We concluded that between 50 and 70% of the fall in wind and solar energy’s LCOE [levelized cost of electricity for a generator over its lifetime] was attributable directly to lower capital and energy costs. […] A decade of abundant energy and loose liquidity helped mask renewables’ poor efficiency. That is now over.” ~~~ https://www.gorozen.com/commentaries/3q2023

(https://ourworldindata.org/land-use-per-energy-source; https://energy.glex.no/feature-stories/area-and-material-consumption)

From “The Bitcoin Miner’s Almanac”…

“Strong stable and predictable nuclear energy has an incredibly high capacity factor [how much energy a generator actually produces relative to it’s actual nameplate capacity], ranging in the 80s and 90s. This means a nuclear energy facility with a nameplate capacity of 1 GW of enegry, or 1000 MW, is consistently producing power in the 800 to 900 MW range over a given period. Compare that to a wind farm with the same 1 GW installed capacity. You can expect to consistently operate at a capacity factor between 20% to 40%, producing 200 to 400 MW of energy over a given period. These capacity factors suggest that to produce the same amount of energy from a wind farm as a nuclear plant in a given year, you would have to triple or quadruple the size of your wind farm. […] And I haven’t even mentioned the immense utilization of hydrocarbons to manufacture, deliver, and install those electrical generators —and the geopolitical risks tied to lithium and cobalt production.” ~~~ Robert Warren

In any case, just because something is a good business, that doesn’t mean it’s a good buy right now. I’ll just note that these positions were initially bought during the brief dip in the markets in September of 2021 and I’ve not added much to them since. Rather, they have grown naturally to their existing weightings in part due to elevated energy price levels since that time (as well as due to certain changes in corporate structure and index inclusions).

GBTC + WELX + IBIT: (13% of portfolio; +45% YTD weighted average)

Not much has changed here from the end of 2023 in regards to how I think about the investment.

For anyone curious about my current thoughts on the crypto miner, WELX, given their long-standing holdings of Mt.Gox crypto bankruptcy claims that are apparently now set to be paid out, see the brief substack note/thread I posted here (TLDR: I think the price has gotten ahead of value for the time being, even if their at-cost claims are about to get marked-(up)-to-market):

For my general thoughts on Bitcoin, one can read the older post here:

FNV, Franco Nevada Corp.: (6% of portfolio; 24% YTD)

********** UPDATE 20240719:

I did not include this when I originally made this post because my portfolio is only weighted 3% in FNV stock, but if I were to factor in the underlying economic interest via call options which I initially bought alongside my equity position, then the total exposure rises to 6%; I figure accounting for total economic exposure is a more transparent method when listing off “top portfolio positions”.

Since the time I originally wrote on this situation in the beginning of 2024, FNV stock has gone up 24% from $105/sh to $131/sh, right about where I had initially valued the business. However, this rise was primarily due to the rise in gold prices (20%) and the FNV/gold sh/oz ratio of how many shares an oz of gold could get you is still the same as when I wrote this post, at 18x.

Rate cuts, expected later this year, could further boost gold prices and FNV’s stock in kind (https://seekingalpha.com/news/4124828-gold-settles-at-all-time-highs-citi-sees-potential-for-continued-gains-to-3000).

Adjusting my original Cobre-reopening-contingent price target to account for this year’s rise in gold prices would put it at a target of $156/sh (=135x1.20) —assuming gold prices remain the same.

Panama’s new President, Jose Raul Mulino, was elected in May and was sworn into office on July 1. Unlike other candidates, Mulino has been seen as less adversarial to the Cobre project and his election has been interpreted as a positive sign towards the possible reopening of the mine (https://www.reuters.com/markets/commodities/first-quantum-seek-dialogue-with-new-administration-panama-over-cobre-panama-2024-05-06/; https://archive.ph/JZBMY). Both the Panama government and First Quantum have strong economic incentives to come to the negotiating table here and I think some kind of settlement will be negotiated within, say, 12 months or before the end of 2025.

My original thesis on FNV can be found here:

**********

FRMO, FRMO Corp.: (5% of portfolio; +16% YTD)

In a similar vein to WELX, I think that FRMO is rather fairly valued at this point —if not slightly overvalued. I continue to hold on to this stock, but have sold off small bits of portfolio basis points from the position to average into other holdings like the RENN Fund and others when I think the market discounts to fair value in those other names are more attractive (and where value-realization ‘durations’ and general demand driver exposure are similar).

Here is my basic model for valuing FRMO:

You can use either the market price for SLGD to determine what FRMO’s 4.955% stake in HK LLC (which is reverse merging into SLGD) is worth or use can use the method that I outlined in my previous post on the reverse merger here:

The HK revenue stream value, I determined based on working backwards from a simple DCF model using the known historical fees that FRMO has gotten from this stream and the apparent fact that HK revenues have grown very little over time (see my SLGD post for more details on how I come to this conclusion); I then just round that figure up to $20MM from around $19MM.

(Ignore the margin of safety and stock price stuff in the graphic here as that’s just an artifact of my inputting the nominal book value of the stream).

RCG, The RENN Fund: (4.5% of portfolio; +3.6% YTD)

Really nothing much new to report here since my 2023 review. I think of this as a VC fund curated by Murray Stahl and I expect the performance to either do nothing until I finally capitulate and sell it off or for HK to figure out something to close the discount and get their NAV above the $25MM threshold to start earning fees on the fund and/or for one or more of their private investments to take off and become one of those ‘20 year over-night success stories.’ Management it well-aligned with shareholders and you’re getting exposure to several of Stahl’s private equity ideas that you would not be getting exposure to elsewhere across the HK complex.

You can see my initial investment thesis (with some minor updates) here:

APG, APi Group: (4% of portfolio; +12% YTD)

See https://lemoncakesinvesting.substack.com/i/139945007/api-group-apg-of-portfolio-gainloss.

.

One final note: I sold off my OTCM position to fund some smaller positions that I think have better upside prospects for now. Basically, I think it’s a good business, but I think current prices are already very fair, so the odds and upsides here just seem to recommend using that capital to fund other investments. I think this article sufficiently covers how I also generally thought about selling this position for the time being: https://seekingalpha.com/article/4698794-otc-markets-group-stock-wrong-price-for-fine-business-hold-for-now.

Some notable new nano positions

I have a habit of collecting up small positions in stocks that I think are interesting even when I think they are already either fairly valued or have upside catalysts that are pretty unlikely. In this case, in a similar manner to my interest in gold royalty FNV, we have some “contingency-investments” coming in as various small additions…

CRMZ, CreditRiskMonitor.com (1% of portfolio; -9% YTD)

I have only a small position at the moment and the price has been coming down recently. My current assumption is that it is due to market anticipation of lower rates incoming and expectations for lower inflation and economic volatility going forward (see https://archive.is/RBj4h). Even if I agreed with Mr.Market on these expectations, I’d note that such a time —one where the future economic environment appears to be, and the price action is reflecting, an environment presenting structural headwinds to CRMZ’s business dynamics— would be a good one for accumulating shares of this owner-operated, no-debt, anti-market-correlated business to hold for the longterm.

I can’t seem to find very many anti-correlated businesses that I like, so I’m always interested in owning bits of those kinds of things when I do find them. I’m currently twiddling my thumbs for a lower price right now, since dollar cost averaging in tiny amounts can be a pain for OTC-traded stocks given the transaction fees that come with it.

ITEX (1% of portfolio; +25% YTD)

This is a rather well covered microcap, so IDK that there’s much I’d add to that information; I had been writing something as a draft, but haven’t gotten around to finishing it. In any case, you can get a good read on the company at various points in time up to more recent years in the writeups here: https://www.valueinvestorsclub.com/search/ITEX

Along a similar theme to CRMZ, ITEX is an asset-light, shareholder-aligned/incentivized company that benefits from times of economic stress, acting as a network for member users to liquidate/move excess inventory or capacity without having to resort to heavy discounts, but rather allowing a barter of value for value between member businesses. For example a restaurant experiencing a drop in table reservations during a recession could exchange the value of those reservations for a local member company’s printing services of equivalent (ITEX-dollar) value that the restaurant can use for advertising themselves. Unlike post-2020 CRMZ, ITEX has also long paid a dividend which could come in handy in times of economic stress for dollar-cost-averaging into opportunities that would undoubtably be available in such a scenario. One thing to note, though, is that unlike CRMZ, the business is a bit of a melting iceberg (with revenues declining at around a 7% CAGR since their peak in 2010). Such an asset can still be valuable, but it means one should be doubly careful about the price paid for any shares —especially considering how illiquid the stock is.

My position here is small at the moment as the stock is very illiquid and volumes started picking up the day after I started DCA’ing into the stock, but I’d be open to put a few more portfolio percentage points into the name at the right prices.

.

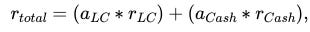

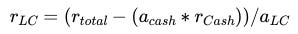

Let’s look at the portfolio as having just two stocks that we could have put out money towards: Lemon Cakes ETF (LC) and Cash.

Our total return for the year so far could be calculated like this:

where…

(I had to copy images of the LaTex as Substack’s built-in interpreter seems unable to render it when it’s in the footnotes section, IDK why; and if anyone knows how to get \newline to work in Substack’s LaTex, do let me know.)

We can get the return of the Lemon Cakes ETF as…

Our cash allocation to Cash is 17% and whether we say the cash return was 0% or 2.3% (accounting for the 4.6% interest rate), so the return on the Lemon Cakes ETF still comes out to around 11.75%.

I have a Google Spreadsheets sheet that contains columns for Ticker, % of portfolio, demand drivers, and macro quads.

The “demand drivers” column contains semicolon-delimited lists of short descriptions of the general value and demand drivers that I think best describe what drives the business for that ticker that are still general enough to apply to more than just that specific company. The “macro quads” column contains semicolon-delimited lists of the primary (and tertiary, if applicable) macroeconomic quads that I think would act as meaningful tailwinds for a given ticker. The macroeconomic quads I use to determine the labels to apply for each ticker is shown below:

(From an old article by Nicholas Glinsman of Malmgren-Glinsman Partners (see https://intelligencequarterly.com/ahead-of-the-herd/the-thinking-mans-quad-system/); I then apply this idea in a manner similar to Ray Dalio’s concept of the “All-Weather” portfolio (see https://ofdollarsanddata.com/ray-dalio-all-weather-portfolio/))

Now to determine the various exposures to different demand drivers of the total portfolio, I do this. In a separate sheet, I use a set of formulas to first list all of the portfolio weights for each ticker and the list of demand drivers for that ticker. Then I have formulas to break up each individual ticker’s list of demand drivers and uniformly distribute the ticker’s total portfolio weights, so a row of stock weighting and value/demand drivers cells for, say, Wheaton Precious Metals, that looks like…

3% | Gold prices; Gold GOE prod. volumes; geopol tensionsWill end up as multiple rows that look like…

1% | GOLD PRICES

1% | GOLD GOE PROD.

1% | GEOPOL TENSIONSI then use all of these final pairs of distributed portfolio weightings and associated drivers to create a pivot table that aggregates everything across all of the companies by the value/demand driver labels and displays the sum portfolio weighting associated with that label.

When doing this exercise for the set of the 50 highest-weighted S&P 500 stocks, I am getting the list of top 50 positions with company name, ticker, and index weighting data, having an LLM (Anthropic’s Claude 3.5 Sonnet) generate the macro quads and generalized demand drivers lists for me, and spot-checking the outputs to check that they make actual sense —so there is the possibility of some bias there on my part, but I think the outputs were reasonable and anyone can do a similar exercise to this on their own and adjust things however they think is most accurate.

(As a spot-check, I gave the LLM my own list of portfolio holdings and had it come up with the individual and aggregate macro exposures on its own and it came up with a roughly similar distribution to the one I came up with. So at the very least, it does not appear that I am too biased in my estimation of my portfolio’s macro diversification vs the S&P 500 on a relative basis.)