($OTCM) OTC Markets Group: If you really want your portfolio to own the "whole market"...

In the land of cocktail bars, the dive bar with the only other liquor license is king; No market cap? No global trading volumes? No problem.

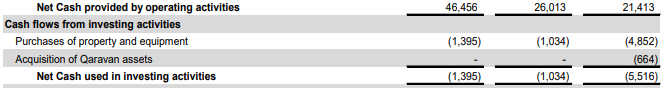

********** UPDATE 20230531: Regarding the EDGAR Online and Blue Sky Data bolt-on acquisitions, I don't really have an opinion on them. Per the (sponsored) Sidoti report, they added a good clip of revenue growth in the market data segment, so there's obviously demand for the products; I like Blue Sky a bit better as I see it as more mission-critical, since more this is more related to compliance requirements for cusomters1. Both of these acquisitions were done via all cash2 and are bolt-ons to OTCM’s market data segment, rather than being any kind of transformational acquisitions, so at the very least they don’t set off any red flags to me (per Mauboussin)3.

IMO, the FINRA approval for OTCM’s FINRA-regulated OTC Link ATS to facilitate trade of digital securities for broker-dealers in somewhat more interesting to me as it has a lot more upside optionality and OTCM basically got it for free by simply executing on their businesses as they have already been doing —a free call option on the expanding adoption and innovation of digital securities (as well as the SEC’s idea of what counts as one).4

An ATS is a regulated trading platform similar to an exchange – there are dozens today, but most operate in the private securities market. OTC Markets provides a trading platform for public securities, including many smaller banks and international firms, as well as Grayscale’s various funds that hold digital assets like Bitcoin (Grayscale Bitcoin Trust) or Ethereum (Grayscale Ethereum Trust). [OTC Markets Deputy General Counsel, Cass] Sanford said that if digital assets are, in fact, securities, they would be considered over-the-counter equity securities. She pointed to Rule 15c2-11 for non-reporting firms, which could be a path for appropriate disclosure. Currently, she believes that a lot of these instruments, when you look at the long tail, they already look like OTC securities.

What’s also interesting about this is that it shows that financial regulators do indeed see a place for digital assets in the US market, rather than being simply interested in creating roadblocks in this space.

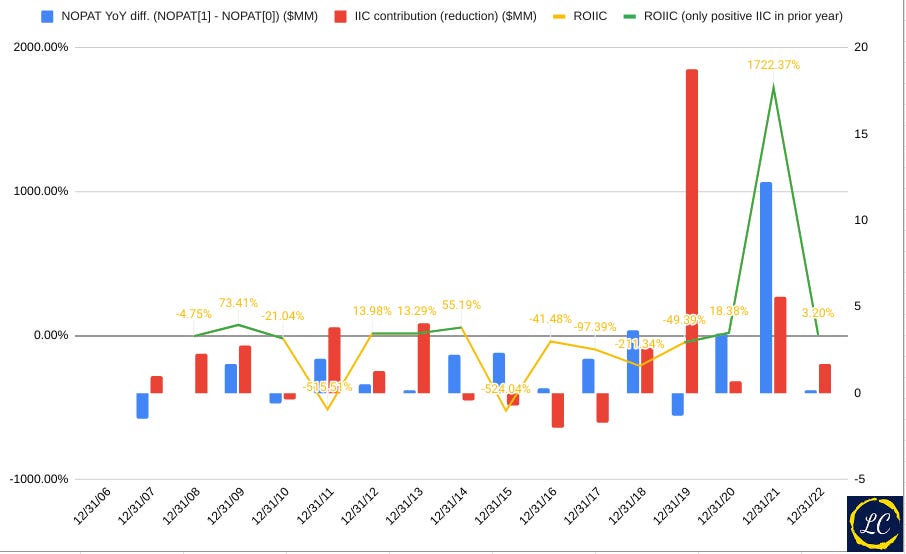

OTCM doesn’t really need to reinvest too much in it’s core business to make money and you could maybe make an argument that it does not use it’s capital super efficiently.

Here I have charted OTCM’s ROIIC where…

ROIIC = (NOPAT[t=1] - NOPAT[t=0]) / (IC[t=0] - IC[t=-1])

NOPAT = Operating income x (1 - effective tax rate)

IC = Equity + Debt + Current and Longterm Deferred Tax Liabilities; I also include the recent Vesay capital lease expenses of OTCM’s HQ property they are sub-leasing from Virtu Financial

We see that often we have a negative ROIIC not because NOPAT declines YoY, but simply because incremental capital is, on net, taken out of the business rather than added to it. In any case, I also highlight the times where IIC is positive to give some view on how NOPAT behaves in cases where management does add capital to the business.

(Note that in the chart, if your looking at NOPAT for a period, the IIC that presumably helped generate that NOPAT is in the period prior, not the IIC that is visually in the same period as the NOPAT bar of interest).

BTW, that big spike in NOPAT in 2021 seems mostly due to large transaction volumes in that year coming out of the 2020 lows, rather than any kind of great leveraging of IIC in the previous year (though perhaps the OTC ECN capex spending in the year prior could be attributed to the helping facilitate those high 2021 volumes —the Virtual Investor Conferences acquisition probably much less so)…

**********

If you were granted the last on-prem liquor license in a town full of fancy, dress-code-enforced cocktail bars, what kind of shop are you going to open? I’d 1) as a (halfhearted) Bitcoin Bro, take the advice of Peter Thiel to note that “competition is for losers”5 and 2) note that even poor college kids and regular people need a place to drink too while they work on their startup, try to get lucky, or just hang around all day and talk about the great things they’re going to do eventually, “The Ice Man Cometh” style (all too common in the land of OTC stocks).

.

Snapshot:6

.

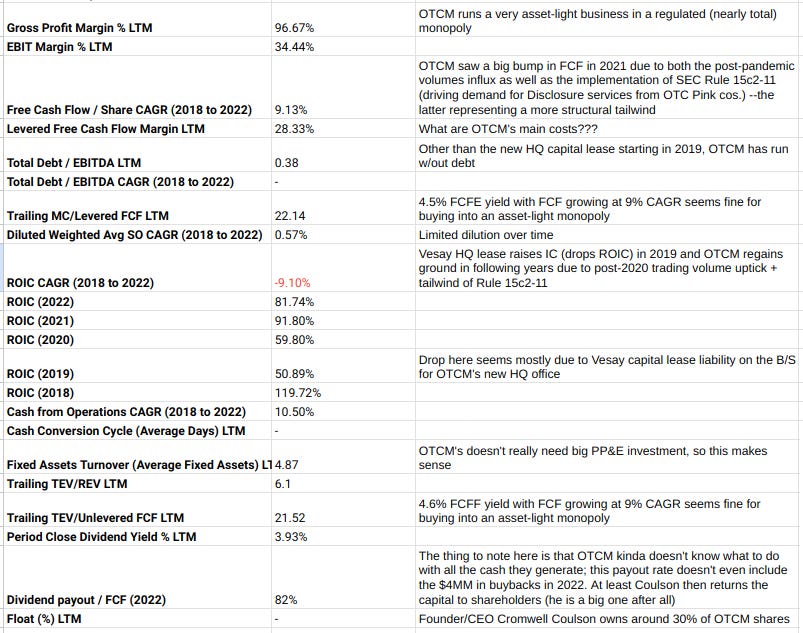

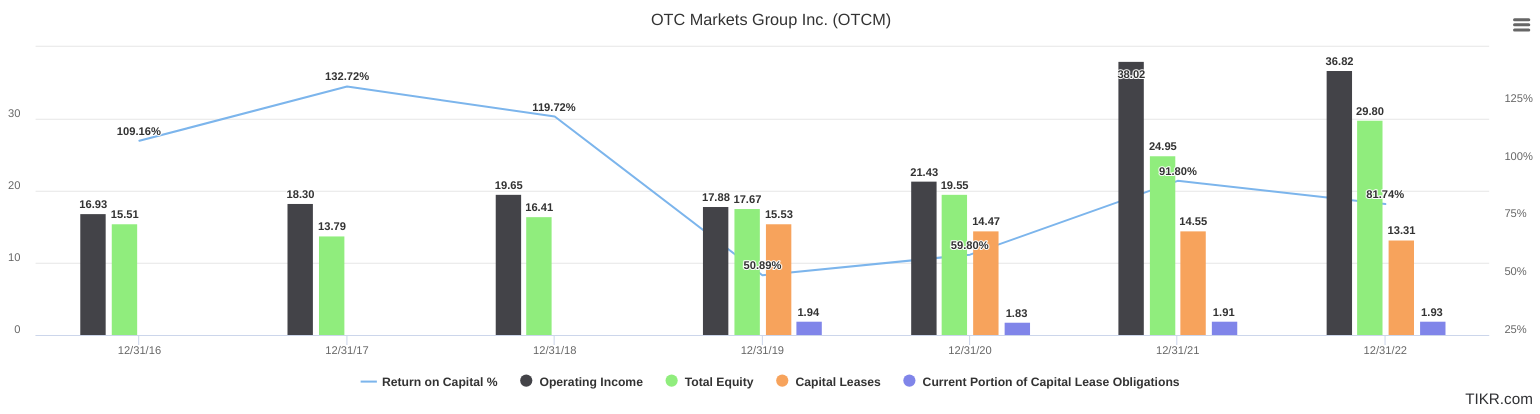

OTCM is a high-moat, asset-light, low-opex, owner-operated, low-leverage, recurring-revenue-based business with a history of returning capital to shareholders (with dividends ranging from ~$5-7MM annually and repurchases of ~$1-3MM in common stock every year since 2015) and a consistently high ROIC, while growing FCF at ~20% CAGR over both the last 10 and 5yr periods7 trading at a 5% FCF yield — not cheap, but not too crazy a number for the quality of the business. (I recall getting very interested in OTCM when it popped up while I was screening for businesses with similar financial characteristics to hard-asset royalty companies, without the requirement that the business actually be relate to physical commodities).

*One thing that’s nice to see here is that the buyback spending is not being done in some fixed way, but rather demonstrate some thought as to when the business should be buying its own stock. To give some idea of this, if you look at the P/FCFE chart for OTCM, you can see these buybacks are being done when OTCM’s P/FCFE drops to local historical lows — certainly for 2016 and 2017, less so for 2020, but still significant to note that they did indeed buy the dip while the market was panicking. I don’t actually have the valuation data for 2007 and 2008, but the general strength and direction of the market sentiment current that OTCM management was swimming against at that time with those buybacks —and in a big way, as can be seen in the graph— is not hard to surmise. I also like that a large part of the dividend distributions were from special dividend payments.8

Spiritual “(re)founder” and current CEO Cromwell Coulson led a group of investors to purchase the National Quotation Bureau in 19979 (the original publishers of the literal Pink Sheet stock quotes as seen in The Wolf of Wall Street) and over the course of the past 20 years built the OTC Markets Group as it exists today.

The average size of the companies that list on the OTC markets are usually vastly smaller, more volatile, and less liquid than any stock that would be allowed to list on a national security exchange (NSE10) like the NYSE and yet many OTC companies listing on this alternative system that are perfectly legitimate businesses. Today, OTC Markets Group acts as a modern disclosure and trading facilitator for companies that don’t meet the stricter requirements of the NSEs or don’t want to deal with the added costs/work to monitor/manage compliance with NSE listing requirements — I’ve actually owned a few for a good while (eg. $FRMO11, $TBTC, $GBTC, and $BVRNY (not counting OTC Market Group’s stock itself)).12

You can see an example of the NYSE’s general listing requirements here (and take note that many of those requirements are not based on business fundamentals, but rather more to do with size and trading liquidity) or NASDAQ vs those of OTCM’s ATS listing tiers here and here; there is an entire swath of businesses listing here that would like to access capital markets and yet do not meet the (in many cases, non-fundamentals-based) requirements for, or want to pay the fees associated with, being a part of the global passive investing and indexation complex. As can be seen here, the annual base fees associated with listing on the OTC Markets system are nearly an order of magnitude cheaper than on the NYSE:

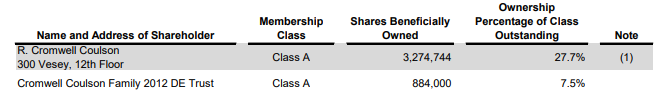

Coulson owns 35% of the company shares as of December 202113 — with the remaining officers collectively owning ~7% of outstanding shares14 — and has paid himself a cash salary of ~$8MM for the last 10yrs15 (making his participation in the dividends ~2-3x his salary). (Of course with insider ownership this high, there’s always the risk of management becoming entrenched16; Coulson has thus far stewarded the company well, but this entrenchment risk is something to consider). Cromwell is currently the Co-chair of the STANY Market Structure Committee17 and a former Chair (2017-2018) of the FINRA Market Regulation Committee that advises FINRA on rulemaking and trading issues18.

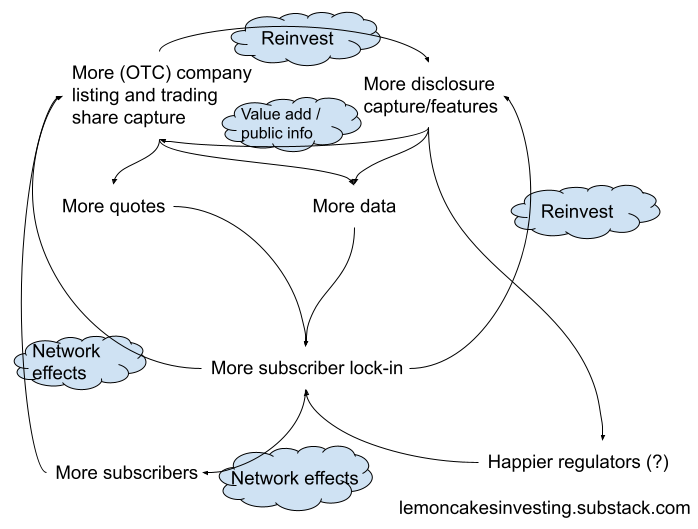

Continually-tightening SEC regulations have attempted19 to tamp down the amount of scamming that occurs on the OTC markets since Jordan Belfort’s time and this tighter regulation has helped create a regulatory moat protecting OTCM from would-be entrants in the space — their only other direct competition coming from NYSE’s Global OTC which boasts a stagnant 11% market share20 of OTC listings. After considering internally routed OTC trades by broker-dealers (BDs)21 OTCM’s website claims 80% of OTC market share — IMO this shows the power of the network effects of OTCM’s listing tiers for attracting and retaining company listings.

Companies listed on the OTC markets have access the public funding, a host of disclosure tools, liquidity for their shares, as well as the less-tangible benefit of increased business performance from the increased (though of course, not guaranteed) pressure of having to “act” like a public company22.

‘The more people know about a company, the better that company will perform. This is an iron-clad rule. You will always be more successful in business by sharing information with the people you work with than by keeping them in the dark. […] Let your people know whatever you know about the company, the division, the department, the particular task at hand. Information should not be a power tool - it should be a means of education.’ — Jack Stack, The Great Game of Business

********** UPDATE 20230622: Regarding Apple, Warren Buffett commented in the latest Berkshire meeting that “the same people pay $35,000 for having a second car, and [when] they have to give up a second car or give up their iPhone, they’d give up their second car.” This is an interesting way to look at sticking power, switching costs, and comparative value. How much would you have to be paid in order to sign a contract to never access OTC Markets Group markets ever again?

One way to think of this, in the immediate-term, is that the price is whatever your total existing capital allocation in OTC stocks is in addition to whatever longterm captial gains you expect to make from that allocation; for me that’s quite a bit. However high this collectively is across investors, relative to the total capital by their broker-dealers’ custodied capital, gives some sense of valuable OTC access is for BDs.

For companies listing in OTC markets, their switching cost would be something like the difference between the OTC listing fees and the major exchange listing fees as well as the capital they’d have to invest to reach the various other liquidity and revenue requirements for listing, offset by the intangible benefits of greater US capital markets access and perceived legitimacy. Again, I’d guess this hurdle to signing the hypothetical contract is quite significant.

**********

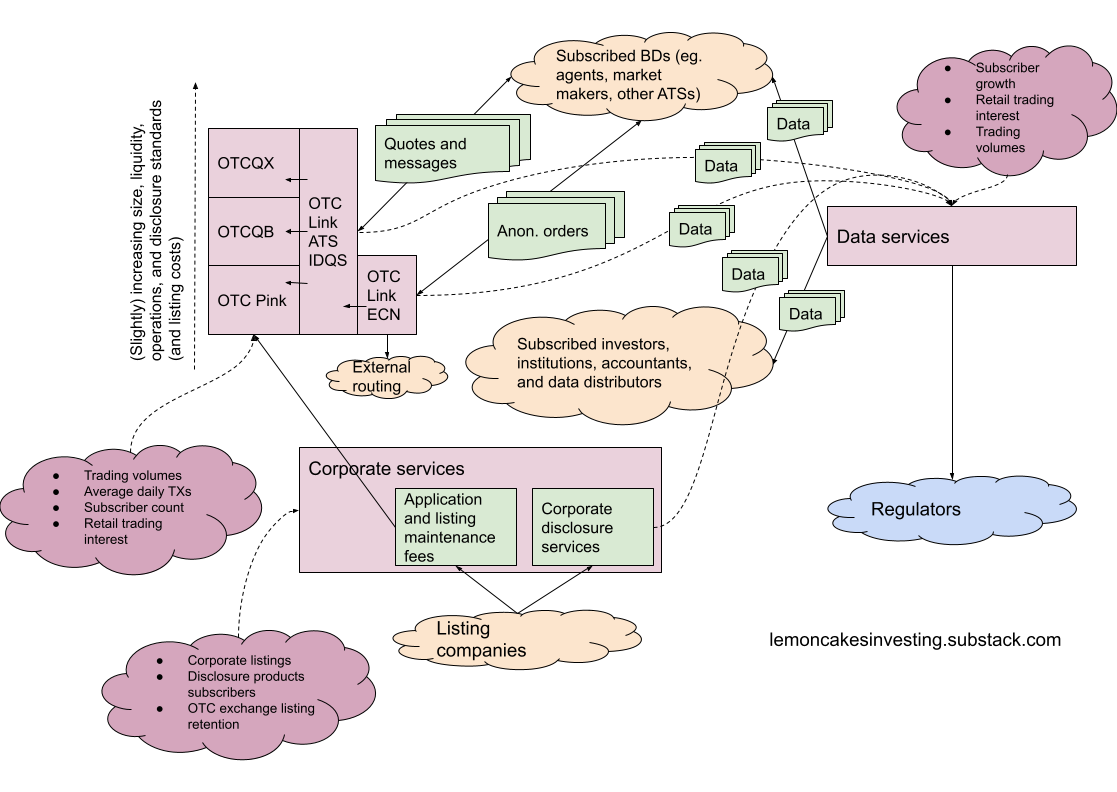

OTCM has three business segments:

Corporate services (for listing businesses)

Corporate listings — Companies pay application and annual subscription fees for listing on OTCQX, OTCQB, or OTC Pink depending on if they meet the listing requirements (largely relating to timeliness and amount of disclosure) for the respective listing tiers (OTCQX, OTCQB, and OTC Pink listing tiers make up 33%, 5%, and 67% of OTCM’s ATS dollar volumes, respectively).

Note that before the amendment of SEC Rule 15c-211 in 2020, OTCM did not have any direct way to make money from stocks listed on the Pink tier of the company’s market23. The amendments to SEC Rule 15c-211 “requires that current information about an issuer be publicly available in order for a security to become quoted initially, and remain quoted on an ongoing basis.”24 This means that, otherwise dark, Pink-listed companies that wanted to remain listed at that tier (and not get kicked into, what OTCM is establishing as, the “Expert Market”) would need to start providing current information in a public way either via their own websites or via OTCM’s OTC Disclosure & News Service.

You can read some interesting commentary on the new regulation from Alaska Permanent Fund’s CIO, Marcus Frampton, on his old Micro Cap Letter blog: https://web.archive.org/web/20220410161240/https://static1.squarespace.com/static/5eff6e898853fb43f159bd0f/t/5f91e6c6044fde04ce2ac022/1603397319407/Edition+8+vFINAL.pdf

Corporate disclosure services et al — Includes disclosure & news services, capital raising solutions, virtual shareholder conferences, etc that are all based on application and annual or monthly subscription/licensing fees (except for virtual conferences that are based on usage). Some of these services are included for companies listing on the OTCQX and OTCQB markets.

OTC Link LLC (for broker-dealers)

Data services licensing (for investors)

Real-time order book data — L1 and L2 order book data for OTC Link ATS/ECN.

Company pricing and reference data — Security, pricing, and data files collected28 from OTC-listed companies.

Compliance data — Data relating to company compliance analysis/auditing and risk.

Data services licensing fees are based on monthly subscription fees, though I believe these data streams are also sold through major data distributors like Bloomberg, Reuters, FactSet, etc that get percentage rebates for this re-distribution29.

The combination of these services positions OTCM as a diversified beneficiary of everything outside of the global passive/indexation investing complex. It serves as a marketplace for companies seeking capital and liquidity, provides trading opportunities for broker-dealers in a wider subset of securities, and offers data services that enhance transparency and facilitate informed decision-making by investors.

By expanding the investment landscape beyond traditional exchanges, OTC Markets Group contributes to total diversification into opportunities and activities outside the mainstream markets. (Note that OTCM hosts all of Grayscale’s various cryptocurrency trusts like the Grayscale Bitcoin Trust and Grayscale Ethereum Trust). As far as I know, while OTCM maintains several OTC-related indexes30, there are no ETFs that track these indexes31, so from a diversification POV, simply owning the marketplace on which these stocks live and pay into is the next best thing —and I’d argue even a bit better in this case.

********** UPDATE 20230806:

“By ignoring Pink Sheet stocks, most investors are saying that about three-fifths of American management of public firms aren’t worth while” —- Lawrence Goldstein, General Partner of Santa Monica Partners LP, director at FRMO

As of March 2023, there were 2,385 listed companies on the NYSE and 3,611 on the Nasdaq. The number of listed companies in the United States dropped from about 5,500 in 2000 to about 4,000 in 2020. (https://www.statista.com/statistics/1277216/nyse-nasdaq-comparison-number-listed-companies/).

As of OTCM’s 2Q2023 report, there were a total of 3,331 companies listed across the various OTC Market tiers, about 55% more additional stocks to those listed on the major exchanges and that are being overlooked by investors only focusing on those exchanges. Put another way, around 33% of publicly listed companies in America are listed OTC.

**********

Together, these businesses generate a flywheel that continually strengthens OTCM’s position in the OTC market by allowing OTCM to attract/retain more company listings and thus OTC trading volumes, which locks in ATS subscribers (which also attracts others into the ATS), which attracts/retains more company listings, and which allows OTCM to reinvest in further disclosure services to provide more value to listed companies as well as more information to investors (which helps boost trading volumes) and regulators32.

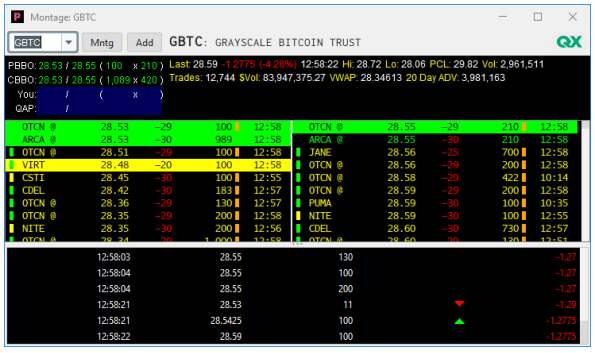

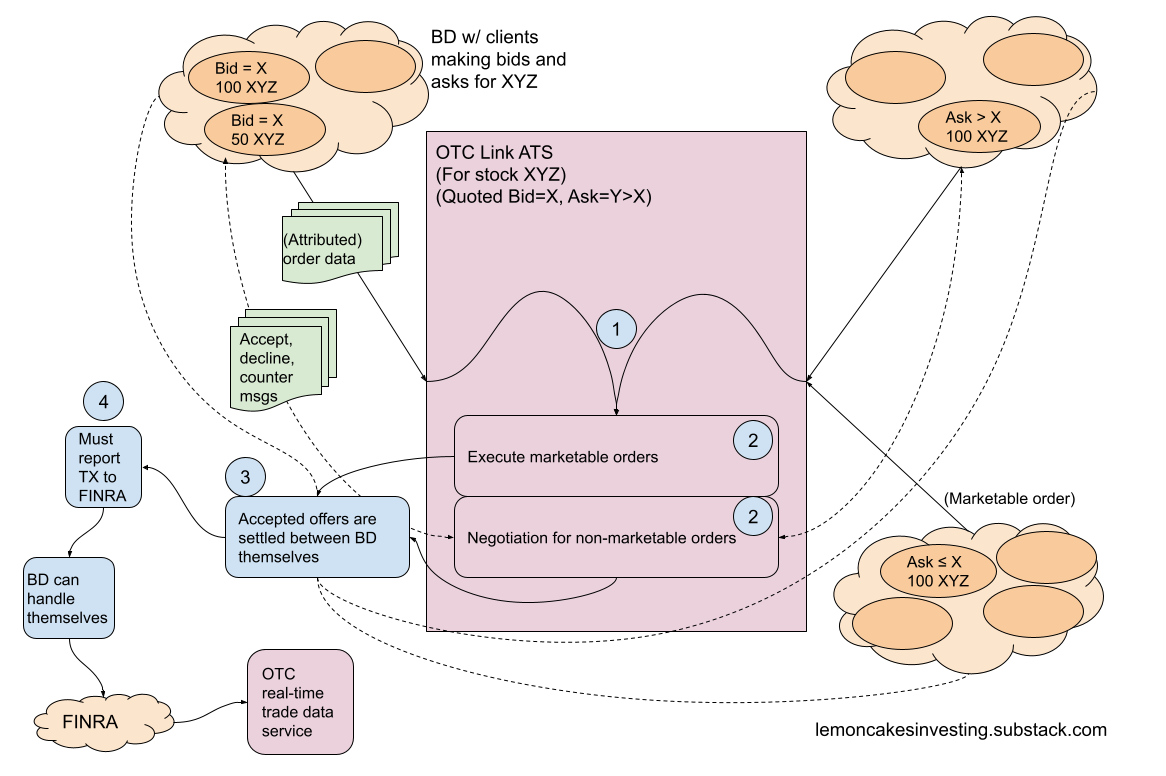

Unlike with stocks on the NYSE or NASDAQ, there is no central exchange for OTC stocks. Link ATS is a qualified inter-dealer quotation system (IDQS33) that aggregates the orders of subscribed broker-dealers members of the ATS to display their bid/ask quotes that make up the ATS’s market as well as connecting those broker-dealers and allowing them to communicate with each other to negotiate trades with each other (so the ATS facilitates trades, but the actual execution of trades are done between broker-dealers themselves). This communication is done over OTCM’s OTC Dealer graphical application or can be done through the OTC FIX interface that BDs can use to integrate their own trading systems.

Here’s an example of the order book for GBTC — which trades over Link ATS on the OTCQX market — from the POV of the OTC Dealer app34. You can see an example of logged MPIDs in the left-most column of the bid/ask screens displayed as well as the price, QAP fee/rebate35, order size, and update time (with the orders that make up the top-of-book highlighted in green).

Here’s a simplified example (to my understanding36) of how a transaction is facilitated through Link ATS:

Suppose the highest bid for a stock XYZ among the subscribing member broker-dealers of the ATS was some limit orders for $X/share (say for 150 shares) and the lowest bid was some limit orders for $Y/share (for some number of shares) which makes up the top-of-book and national best bid/offer (NBBO) quote for the OTC market for XYZ stock. Then say that new sell orders come in for 100 shares at some price > X (but < Y) and for 100 shares at a price equal to X (eg. a market order by a BD client that just wants the liquidity to get out of XYZ right this moment). “Marketable” orders can immediately be executed, while non-marketable orders will need to be negotiated between ATS members (BDs can accept, decline, or counter (on share amounts or price) with OTC FIX messages through the ATS) — eg. the BD with the remaining 50XYZ@$X to sell could send a counter message to the BD wanting to fill 100XYZ@>$X to see if they can fill 50 of their desired shares for $X/sh. In any case, once offers are accepted, the actual reporting, clearing, and settling of the orders are done between the BDs themselves. All transactions executed over an ATS must be reported to FINRA37 which distributes this data to the markets — which OTCM’s data services subscribers can then access; OTCM relies on the SEC to enforce securities laws and FINRA to regulate member BDs38.

When using Link ECN39, the process is a bit simpler. Rather than BDs negotiating with each other to execute orders, the ECN is integrated with Link ATS (as well as being able to route orders externally) to automatically match and execute orders from the ECN’s order book and can do so without orders being “attributed” — thus not revealing the BD’s market participant ID (MPID40) to the rest of the market as would normally be visible if the order was placed directly through the ATS — as well as allowing reserve/iceberg41 limit orders to be submitted (which all helps in reducing price impact). BDs also do not need to report trades to FINRA via ORF themselves when executing through the ECN and this instead handled automatically by the ECN42.

The ECN operates under a maker-taker pricing model43 so charges fractional-cent per-share fees to liquidity-takers that submit market orders or get immediate fills/matches on their limit orders and gives rebates to liquidity-makers that publish limit orders that are not immediately filled. The main takeaway is that —unlike Link ATS where fees are dependent on published quote data and order negotiation message volumes— Link ECN directly makes money based on per-share transaction volumes44.

.

A nice short overview of some interesting attributes of OTCM can be seen in the Twitter threads here:

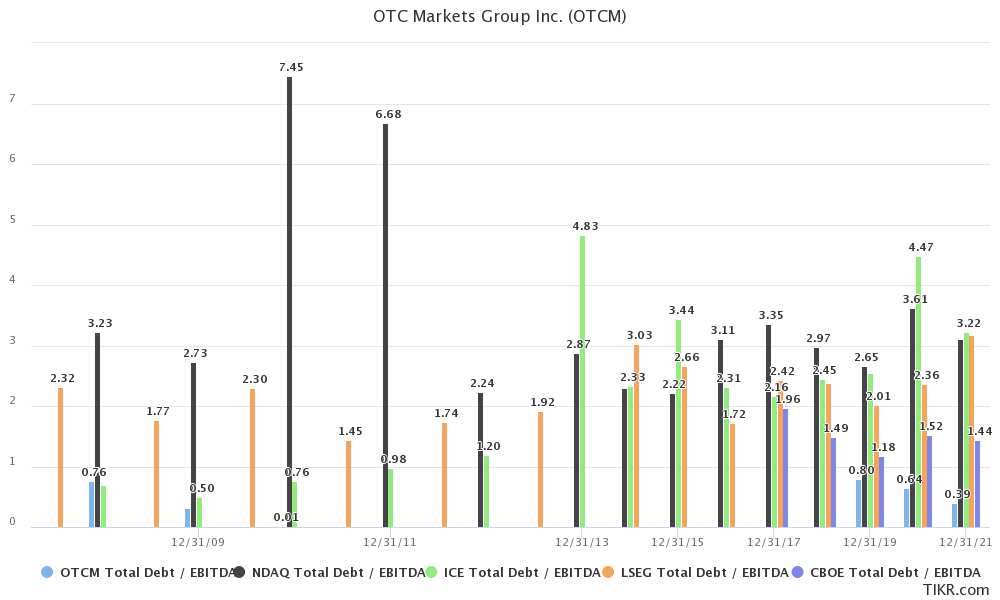

Compared to the other major exchanges, OTCM has consistently higher ROCE, lower debt levels, and trades as a much lower TEV/FCFF (~17x TEV/FCFF, at levels around where it was during the lowest point of the March 2020 crash).

.

From an inflation-hedge POV, the general idea behind securities exchanges as inflation beneficiaries can be summed in this snippet by Murray Stahl in the 2021 FRMO annual letter:

Theoretically, in an inflationary environment, the velocity of money rises and this generally increases the trading volume of securities as well as that of commodities. In an exchange, the existing technology infrastructure can usually process the increased volumes with minimal additional expenditure and, therefore, profits should rise during such periods by a magnitude well in advance of the rate of inflation. Beyond these considerations, after almost four decades of disinflation, the capital markets lack any meaningful supply of inflation beneficiary securities. In fact, most national capital markets are dominated by bonds. In the U.S., bonds offer negligible coupons. Yet, the need for bond income still exists, but it simply cannot be achieved by the existing bond instrumentalities, given the existing central bank monetary policies. Therefore, the range and scope of securities being traded on exchanges seems always to be increasing.

Note that aside from OTC Link ATS/ECN45 which only makes up ~20% of revenues, OTCM’s businesses are not volume-based (though I'd expect OTCM's monopoly position in the OTC marketplace to give them pricing power in these other areas). Across the Data Services and Corporate Services segments, OTCM charges fixed annual subscription fees for the various components (you can see the fee schedules on their website here and here, respectively).

.

Continuing with inflation theme, OTCM’s business is asset-light with opex mainly coming from employee compensation and IT expenses coming in a far second and with generally fixed capex spending.

.

OTCM would also be a beneficiary in the event of a deflationary global USD-shortage. The Dollar Milkshake theory makes note of this USD shortage/dominance as well — ie. there are paths to success (or at least failure-avoidance) in both deflation and inflation scenarios for OTCM.

If everyone around the world needs to drink (the dollar milkshake), OTCM is the most accessible bar in town (many non-US companies simply can’t afford to dress up to get into the fancier places and listing on OTCQX would certainly be the nominally46 cheaper option) with OTCM’s various listing tiers already serving as a home for ~1/2 trillion dollars of trading volume for international companies’ across ~9000 ADR and F-share tickers. Company listing fees made up ~1/3rd of OTCM’s revenues for 2021. Note this could still happen in an inflationary environment, so long as the RoW continues to inflate even more than the USD:

Of course, in the event of such a deflationary shock, who knows how much this would actually buoy OTCM’s fundamentals and share price given the turmoil that would likely be happening regarding the solvency of existing OTC-listed companies as well as when considering OTCM’s own relatively illiquid trading volumes.

.

Drivers: Retail investor sentiment (towards trading — and having access to data for — international, venture, and microcap companies), corporate sentiment towards going public47 (on OTC markets), corporate interest in accessing US markets, general solvency of existing OTC-listed companies (as well as their retention / non-uplisting to the major exchanges), overall trading volumes through Link ATS/ECN, and increasing regulatory standards48 / regulatory complexification in the OTC markets (to further solidify OTCM's monopoly position and add new semi-compulsory products to their data and disclosure services segments); and of course it should be kept in mind that these drivers and the drivers behind these drivers can all interact with each other in positive and negative ways.

.

Unlike many other names, OTCM has not been too greatly affected by the duration risk-off that’s gone on in the markets YTD, so far — which is kinda unfortunate (depending on how you look at it). So, I figured I may as well just start DCA’ing into a position now as I look more into it rather than trying to time the market on this. Rather than a 52-week-low name — of which there were many during the May/June dip — I see OTCM as just a classic compounder-looking business trading at a not-too-crazy P/FCFE that I’ve been hemming and hawing on for a while.

I’d DCA slowly into this one over the next few months. The stock is not cheap, but not overly expensive either for what you’re getting (currently trading around the 5yr TEV/FCFF lows of 18x (ie. a 5.5% FCFF yield)).

.

I’d say it’s basically fairly-valued from a very simple backwards DCF POV —I think this simple model is actually pretty OK given how low and fixed OTCM’s capex has historically been relative to their (growing) CFFO and the recurring/subscription nature and monopoly position of their business; so you pay current fair value and get for free the upside optionality of unexpected increases in trading volumes and more securities (eg. new types of businesses going public on the OTCQB or Pink tiers or F-shares and ADRs) on OTC.

(This leaves a 24% upside to the fair value target published by the current Sidoti research report. Though, keep in mind that this is a report sponsored by OTCM; Sidoti recieves $40000/yr from OTCM for their coverage of the stock49; something to consider when looking at their price targets. In this context, I’d say that their $68/sh is more likely around the upper limit of fair value, vs the lower limit).

One of the main drivers of OTCM’s business is retail investor sentiment, so the time to really average in with strength would be periods when sentiment is really bad (ie. not today) — my initial flag-post position was accumulated during the bottom of the May/June downturn a few months ago when we went into a technical bear market50. Again, I’m mainly writing this to put it on the radar while averaging in a few macro-agnostic percentage points of a portfolio into the name over the course of the next 1-2 quarters (or however long I think it’s going to take for Michael Burry’s earnings-compression doomsday prediction to come to pass or be considered hyperbolic in hindsight).

Some random resources:

https://www.imf.org/external/pubs/ft/fandd/basics/markets.htm

https://www.investopedia.com/terms/o/otc.asp

https://www.otcmarkets.com/learn/market-101

https://www.sec.gov/divisions/marketreg/mrecn.shtml

https://www.findlaw.com/smallbusiness/business-finances/markets-and-listing-requirements.html

https://listingcenter.nasdaq.com/assets/initialguide.pdf

https://invest.net/nasdaq-listing-requirements

https://www.nyse.com/publicdocs/nyse/listing/NYSE_Initial_Listing_Standards_Summary.pdf

https://www.securitieslawyer101.com/2018/sponsoring-market-maker-211-15c-211/

https://www.otcmarkets.com/otcapi/company/financial-report/361123/content

On November 9, 2022, we completed the acquisition of EDGAR Online, a supplier of SEC disclosure data and financial analytics, from Donnelley Financial, LLC for approximately $3.5 million in cash, subject to certain adjustments.

On May 2, 2022, OTC Markets Group closed the acquisition of Blue Sky Data Corp, a provider of compliance data regarding state Blue Sky securities rules and regulations for 40,000 equity and debt securities, for approximately $12.0 million in cash, subject to certain adjustments.

https://www.morganstanley.com/im/publication/insights/articles/article_capitalallocation.pdf

Cash deals do better, on average, than deals funded with equity or a combination of cash and equity. The basic idea is that management of the buyer will finance a deal with cash if it thinks the stock of its company is undervalued and will use stock if it thinks it is overvalued. Cash deals also provide a higher payoff for the shareholders of the acquirer if the deal’s economics are attractive.

Deals between companies with similar operations generate healthier results than those that seek to transform the business.37 With operational deals, the core businesses of the target and the acquirer are related. These are commonly called “bolt-on” deals. Danaher Corporation, a diversified conglomerate, is an example of a company that has executed this strategy effectively over the years.3

I’m actually adding this in much later after initially making this post, so some values are updated to include the year-end 2022 results, but this are the basic numbers I was initially looking at when I first started looking at OTCM.

For the 5yr period I use 2013-2018 just to avoid the unusual periods of 2019 (which saw FCF drop because of OTCM’s acquisition of Qaravan) as well as the subsequent crash and over-recovery of 2020-2021 from the sampling of data points.

********** UPDATE 20240427: I think this snippet from Rational Walk nicely summarizes the benefits of special dividends over regularly scheduled ones: “A regular dividend becomes a sacrosanct part of a company’s obligations that cannot be cut without being interpreted as a negative signal regarding the company’s overall health.2 Regular dividends prevent management from shifting toward share repurchases at opportune times. In contrast, special dividends allow management to retain much more flexibility. Repurchases can occur when shares are cheap and dividends can be paid when shares are expensive.” Also see https://www.simplysafedividends.com/world-of-dividends/posts/234-special-dividend-definition-rules-and-impact-on-stock-price **********

FRMO actually has a small interest (~3% of TBV) in another NSE, MIAX, through an interest in Miami International Holdings which is due to go public later this year (https://www.reuters.com/world/us/miax-parent-miami-international-holdings-confidentially-files-us-ipo-2022-05-06/). The position on FRMO’s balance sheet is carried at cost, so we’ll see how much of a difference to their total holdings’ value this has when the market makes it’s judgement on the exchange once it IPOs.

********** UPDATE 20230702: I recently saw something in the email promotion of the July 2023 issue of the Mutual Fund Observer that I think also applies nicely to OTC stocks:

[M]ost big funds got big because they brought a systemic advantage to the table. Despite MFO’s focus on small, new, and boutique, we don’t disagree with Lynn [Bolin]’s broad thesis. Most small funds are bad ideas, as are most big funds. The difference is that there are a lot more small funds to sort through.

**********

From the 2021 annual report:

OTCM’s market cap as of December 1 2021 was ~$676MM, meaning the value of his stake is ~30x the value of his annual cash salary (+ average bonus) of ~$8MM.

https://www.otcmarkets.com/otcapi/company/financial-report/274312/content

https://www.otcmarkets.com/otcapi/company/financial-report/323114/content

https://www.otcmarkets.com/otcapi/company/financial-report/213065/content

https://www.otcmarkets.com/otcapi/company/financial-report/47000/content

Another interesting thing to note is that the dispersion between Coulson’s cash salary and the rest of the officers is not that high.

https://journals.sagepub.com/doi/pdf/10.1177/0148558X16670048

https://www.sciencedirect.com/science/article/abs/pii/S0929119920302509

If you read the criticisms of people who invest in Sweden, there is a prevalence of companies with high insider ownership there (ie. large family businesses) and many of them are used as personal piggy banks by the family to the detriment of foreign investors.

There are definitely still a bunch of scammy companies (really, they be better described just a stock tickers) mooning and cratering on the OTC markets, but there are now also a lot more legitimate companies listing there as well thanks to OTCM’s technological build-out and enhanced disclosure requirements (and enabling services) for their various exchange tiers.

Notice that there are no direct fees related to companies listing on the Pink tier:

ATS meaning “alternative trading system”, see https://www.investor.gov/introduction-investing/investing-basics/glossary/alternative-trading-systems-atss

“The Financial Information eXchange (FIX) protocol is an open electronic communications protocol designed to standardise and streamline electronic communications in the financial services industry supporting multiple formats and types of communications between financial entities”, see https://www.onixs.biz/fix-protocol.html

ECN meaning “electronic communications network“, see https://www.sec.gov/divisions/marketreg/mrecn.shtml

Captive data? Who owns the company data posted to OTCM’s data services? the company or OTCM? IDK exactly how the data ownership works, but am going on the assumption that it really doesn’t matter too much since OTCM is the one who aggregates the data and owns the interface for subscribers to actually access it from.

From the 2021 annual report:

“We generate a majority of our Market Data Licensing revenues from sales through market data redistributors, and certain of our Market Data Licensing agreements include redistribution fees and rebates.”

********** UPDATE 20230602: Well, there’s the Fidelity OTC Portfolio with the summary description of :

Normally investing at least 80% of assets in securities principally traded on NASDAQ or an over-the-counter market, which has more small and medium-sized companies than other markets. Investing more than 25% of total assets in the technology sector. Investing in either "growth" stocks or "value" stocks or both. Normally investing primarily in common stocks.

Yet, when we look at the actual holding of the fund…

… we see that this is not truly an OTC index fund in any real way —it’s actually not very different from the NASDAQ 100. **********

https://www.yahoo.com/entertainment/otc-markets-ceo-explains-otc-161225536.html

OTC Markets Group is not an SRO, meaning it relies on the SEC to enforce securities laws and FINRA to regulate member broker-dealers. […] “We provide our real-time compliance data to the SEC and other regulators so they can oversee market activity and monitor compliance with securities laws and regulations,” Coulson said.

See https://www.finra.org/filing-reporting/over-the-counter-reporting-facility-orf/eligible-idqs

“Qualified IDQS”s are allowed to make determinations on OTC stocks to determine if they comply with SEC Rule 15c2-11 (AKA “Rule 211”) and can thus have pricing quotes submitted by trading broker-dealers. Note that as of the time of my writing this, these are the FINRA-recognized IDQSs:

Global OTC

OTC Link LLC

OTC Link NQB IDQS

OTC Link LLC and NQB are both owned by OTCM — again showing their essentially monopoly position in the OTC market.

One interesting observation is that the GUI for the OTC Dealer app looks horrible.

I’m not a finance person, so this may just be the norm, but in my experience as a software person, whenever you see a horrible-looking app it’s either because it’s free, going out of business, or they know they don’t need to try too hard because they’ve captured the market.

“FINRA rule 6450 allows broker-dealers to charge [per share] access fees that are not displayed in the quotation price. See http://www.sec.gov/rules/sro/finra/2010/34-62359.pdf OTC Link implements this with Quote Access Payments, or QAP. QAP allows OTC Link quote subscribers to specify access fees or rebates on a scale of integer values from -30 through +30, where negative values represent net fee from quote taker and positive values represents rebates.” —- https://www.otcmarkets.com/files/OTC%20Link%20Trade%20FIX%20Specification.pdf (“2.2.8 Quote Access Payments (QAP)“)

This lets broker-dealers charge a fee to takers of the order to directly compensate them for the making of liquidity in the order book.

Q100.3: What transactions in equity securities must be reported to FINRA?

A100.3: All OTC transactions in equity securities to which a FINRA member is a party must be reported to FINRA, unless expressly excepted from the trade reporting rules (as discussed more fully below). Reportable OTC transactions include trades in NMS stocks effected otherwise than on an exchange, which must be reported to the ADF or a TRF, as well as OTC trades in OTC Equity Securities and transactions in Restricted Equity Securities effected pursuant to Securities Act Rule 144A, which must be reported to the ORF [OTC Reporting Facility].

https://www.finra.org/filing-reporting/otc-transparency:

The trading information is derived directly from OTC trades that ATSs/member firms report to FINRA’s equity trade reporting facilities.

You can find more info about ECNs and order books here:

https://www.investopedia.com/terms/e/ecn.asp

https://www.investopedia.com/terms/l/level2.asp

https://www.investopedia.com/articles/active-trading/042414/what-makertaker-fees-mean-you.asp

From OTCM’s FAQ: “Broker-dealer orders that aren’t matched on OTC Link ECN are routed or displayed as quotes on OTC Link ATS using the MPID OTCX.“

You can see a list of OTCM’s registered MPIDs here: https://www.otcmarkets.com/otc-link/broker-dealer-directory.

I believe that anonymous orders or displayed in the order book with an MPID of OTCN.

The ECN itself registers as a BD with the SEC and reports the trades themselves.

You can see their rebate/fee schedule for liquidity makers/takers on the ECN, here: https://www.otcmarkets.com/files/OTC%20Link%20ECN%20Schedule%20A.pdf

Note that OTC Link ATS charges are based on the volume of quotes and trading messages over the ATS, which are more linked to the number orders on the ATS and investor interest for OTC stocks.

I just say “nominally“ because there are certainly institutional-access and visibility benefits of listing on the traditional major exchanges that companies could be considered bearing the opportunity cost of forgoing by listing on the OTC exchanges.

My understanding is that you don’t really “IPO” on OTC exchanges, see https://lawcast.com/2018/05/08/going-public-without-an-ipo/ and https://www.securitieslawyer101.com/2015/otc-pink-going-public-lawyer/

An example of this can be seen in the discussion of SEC Rule 211 on OTCM’s own blog site here. This rule change in 2021 incentivized more OTC companies to take advantage of OTCM’s corporate disclosure services to become Pink Current for the first time, else be relegated to the illiquid “expert markets“, and resulted in a significant growth in disclosure and new services subscribers in late 2021.

https://bradshawlawgroup.com/15c2-11-reforms-a-new-era-for-otc-securities/

You can read a bit more about some of the interesting the OTC-listed businesses going Pink Current on their disclosures thanks to Rule 211 here:

https://www.otcmarkets.com/otcapi/company/research/345233/content

“Compensation. Sidoti & Company, LLC receives a flat fee of $40,000, renewable annually from the company discussed in Company Sponsored Research reports for the creation and dissemination of an Initiation Report and three Update Reports. The purpose of the fee is to subsidize the high costs of research and monitoring.”

ie. a S&P 500 drawdown of >= 20%, see https://www.finemarkbank.com/the-anatomy-of-a-bear-market/

what about the long term trend of decrease in public market firm? I can see after a certain time, revenue gets stagnant. firms move from NYSE to OTC but the global trend of going to private instead of public is a huge tipping point I can see. OTC relies on data from these trading firms, once the main engine turns off, the rest of the car will stop as well.