Portfolio Review 20221222, Annual

End of year returns

Basically, this year, if you had just kept your money in a savings account (well… maybe more in sub-1yr bonds), you would have had a good chance at beating my portfolio —and the rest of the stock market for that matter; you could say that my portfolio generated an approximately 20% alpha. (Adding un-reinvested dividend income from this year, my rate of return would be closer to 5% vs the 1.25% displayed, though this would still be a negative real return after factoring in inflation):

********** UPDATE 20240324: I recently went through my old brokerage statements and used my Dec 31, 2021 statement to reconstruct the holdings of the portfolio I had at the beginning of the year 2022. Backtesting that un-touched portfolio by simply leaving the share counts unchanged and calculating the values of the holdings at the end of the year vs the start in Google Sheets, I see that I’d actually have had a return of -11.8% on my portfolio for 2022 (which actually still would have been better than the indexes) vs my realized 1.25%. On one hand this is a bit scary as it shows what could have happened had I not been paying attention on actively managing the portfolio. On the other hand, it’s a bit encouraging as it could be taken to show that 1) I’m a better investor than I was the year before and/or 2) I know when to hold’em and when to fold’em (I like to think it’s a mix of both) and 3) my intervention in the portfolio is generally value additive. **********

Note that this sector breakdown above does not include the ~25% of the portfolio that is invested in ultrashort bonds (and note that the DXY dollar index is up 8% YTD, which could be counted as totaling a (0.75×0.0125+0.25×0.08)=3% portfolio return); I also kinda disagree with how Schwab is categorizing things into some of these sectors, but there you go.

My investment income for 2022 has also increased by 121.48% over the year 2021 (which was itself 144.88% greater than my investment income from 2020, mostly due to the economic recovery coming out of the COVID19 pandemic). In addition to many of the underlying businesses on the equity side continuing to perform well and grow distributable FCF, this income growth is in large part due to the large short-bonds and money market positions that, while being a drag on overall portfolio performance, have benefited from the Fed’s dramatic rate hikes.

Not the worst way to end a year that’s also closing with headlines like…

We can see below how one should have actually invested in hindsight if you wanted to do well.

We’ll see next year, though, how dedicated the Fed is to hiking rates until inflation is beaten (if that will even make a difference given all the other issues in energy); or if they’ll simply declare some kind victory on paper.1

Top 10 holdings

Overall, not a whole lot has changed since the previous review in the middle of 2022:

In general order of concentration, my top holdings (along with some explanation for why I’m holding them) are…

BSM: BLACK STONE MINERALS LP, et al

This position is actually not just BSM, but a basket that also includes oil royalty companies MNRL, VNOM, and TPL. One thing I will say about BSM in particular is that —while they have been derided for their selling off of Permian Basin interests2 (and excess hedging into 2023) during the 2020 lockdown shock that later resulted in muted FCFs during the following oil recovery and rise in late 2020 up to today— the sale of the Permian assets does show that CEO Carter is not simply interested in ruling over as big an empire or basket of assets as possible and is actually willing to make divestitures (though perhaps a valid complaint still remains regarding his nerves —I suppose this could be chalked up to the extra conservatism of running a family business and not wanting to be the one who crashed the ship).

FRMO: FRMO CORP

FRMO has been banging the drum on inflation and energy shortages since before 2020, but also did a good job of calling the inflation and energy issues that came out of the 2020 lockdowns very early on and have been one of my favorite companies to follow along. My interest in the company is one of the main reasons my larger exposures are what they are (a bunch of inflation adjacent businesses). I also use the FRMO position as a way to get managed exposure to Bitcoin given management’s great interest in the cryptocurrency space (whose recent decline continues to be a major drag on the stock as of late; I think of them as an inflation fund with no fees and intelligent, aligned management —that is also slowly and conservatively working to become an integrated crypto/Bitcoin company.

HQI: HIREQUEST INC

The business model is interesting and I have some things to say about this company, but have not really had the time to write about in a way that is more articulate than what’s in my google docs notes. Basically, it’s an interesting, low opex / maint. capex business model —paralleling Horizon Kinetics’ “asset light, hard assets” inflation beneficiaries model (the “hard assets” here being human temp labor)— with lots of room to grow out of it’s microcap status. The post here is a good general overview of the business and CEO:

The position is smaller than I’d normally do at the moment, but I’ve been accumulating on dips below $15-14/sh.

VUSB: VANGUARD ULTRA SHORT-TERM BOND ETF, et al

OTCM: OTC MARKETS GROUP

IAA: IAA INC

VIRT: VIRTU FINANCIAL INCORPORATED

My basic interest in VIRT is as a low-opex/capex, dividend paying, perpetual call option on market volatility —with an added option on the creation of new, or digitization of existing, assets. This vol-hedge idea has not been working out so far, but intend to hold and continue DRIP’ing the dividends it trickles out.

WPM: WHEATON PRECIOUS METALS, F SHARES

I remain mostly convinced by Zoltan Pozsar’s “Bretton Woods 3” theory and this position is part of an expression of that. Other than WPM, I also have positions in FTCO. Not much to say here, just another asset-light inflation allocation (and, being linked to gold prices, a bit of a volatility buffer) —though much smaller than the other commodity sector bets given gold’s more spotty history as an inflation hedge. Note that unlike BSM, which is a mineral rights owner that typically owns the mineral rights in perpetuity, WPM is a royalty stream business, which means that they don’t necessarily own the land that the operators they are getting royalty streams from are mining on; their growth capex is spent not on acquiring acreage that operators would want to mine on, but is spent on directly financing mining operations in exchange for a royalty on future commodity streams from the operation (so, more like a annuity than some kind of perpetuity)3. Honestly, paper gold ETFs may be better at acting as a vol hedge (vs an inflation hedge) than the other ways I’ve been trying to do it.

TGH: TEXTAINER GROUP HOLDINGS, F SHARES

I remain mostly convinced by Zoltan Pozsar’s “Bretton Woods 3” theory and this position is part of an expression of that.

THRY: Thryv Holdings, Inc.

This is a fairly popular stock and I’m not sure what more about it I can add to the already significant body of writings that exist covering it. I would direct readers here for more info: https://ragnarisapirate.blogspot.com/search?q=thryv

For my part, I like this in the sense that it is, in itself, a kind of diversified portfolio, with a mix of short- and long-duration assets (the yellow pages businesses and SaaS side, respectively). It reminds me of the kind of short-duration, FCF-generating biz with a discounted, dormant, long-duration asset that Murray Stahl often talks about in regards to operating leverage and “dormant assets” as perpetual call options.

GBTC: GRAYSCALE BITCOIN TRUST, et al

“Et al” includes cryptocurrency or tokens owned outside of the Bitcoin Trust that I started accumulating after BTC prices sunk below $18K last month (in general order of concentration) — in total this basket is very small, making up around 1% of the portfolio:

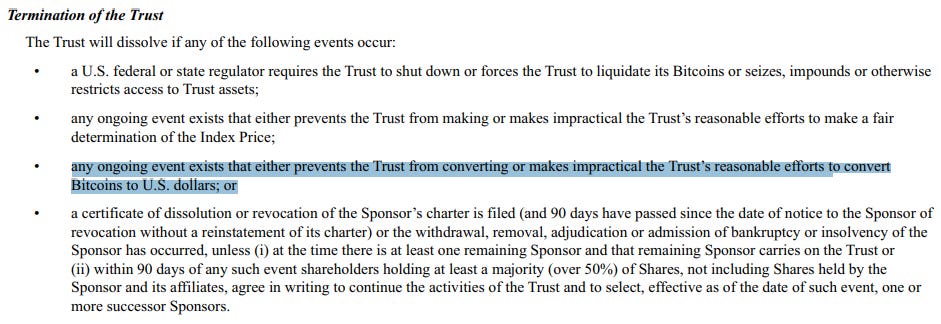

GBTC is currently trading at its largest discount to NAV ever...

... and, while I find their recent actions to be annoying regarding refusing to publish a proof-of-reserves as well as maintaining their 2% sponsor fee6, I do think they have all the BTC they claim to have7...

… and I don’t think DCG, Genesis, or Grayscale are going to go bankrupt8 or get liquidated9.

I thought this were informative threads:

More on GBTC adn the current issues relating to DCG can be found here.

An interesting article on an imminent end to QT can be found here: https://fedguy.com/trapped-liquidity/

Interestingly, even if that 50% of claimed BTC were actually all they had, given the size of the current discount, you’d be getting redeemed at about the price of the shares anyway —not that that wouldn’t suck and also destroy the reputation of Coinbase who attested to their reserves (https://cointelegraph.com/news/grayscale-cites-security-concerns-for-withholding-on-chain-proof-of-reserves).

Some things to note are that $1B of DCG’s $2B debt —which led crypto headlines in the wake of the FTX failure cascade— is not due until 2032. Also, Barry Silbert claimed that DCG would end the year with $800MM in revenues —GBTC at current price generates (($10.61MM AUM × (1−0.10)) × 0.02 ~=) $200MM of that revenue from the 2% sponsor fee (after subtracting the amount collected from DCG themselves via their net 10% ownership of GBTC shares)— which should go towards covering their immediate $575MM liabilities.

https://beincrypto.com/dcg-clarifies-financial-position-reveals-2b-loan/

DCG currently has a liability to Genesis Global Capital of ~$575 million, which is due in May 2023. […] You may also recall there is a $1.1B promissory note that is due in June 2032. As we shared in our previous shareholder letter in August 2022, DCG stepped in and assumed certain liabilities from Genesis related to the Three Arrows Capital default. As stated in August, because these are now DCG liabilities, DCG is participating in the Three Arrows Capital liquidation proceedings on the Creditors’ Committee and is pursuing all available remedies to recover assets for the benefit of creditors. Aside from the Genesis Global Capital intercompany loans due in May 2023 and the long-term promissory note, DCG’s only debt is a $350M credit facility from a small group of lenders led by Eldridge. — Barry Silbert (in a November 2022 letter to DCG private equity shareholders)

(Couldn’t find much more info on the Eldridge facility terms other than here)

There is this, which is a bit concerning…

… which I’m pretty sure means that if Genesis does go down, the trust will be forced to liquidate.