($SLGD/$SLGDD) Scott's Liquid Gold / Horizon Kinetics LLC: Not every reverse merger that glitters is gold

Analyzing the spread between SLGD's current discount to the reverse merger's planned "IPO" price

TLDR: Asset management company Horizon Kinetics LLC (HK) is going public via reverse merger into OTC microcap company Scott’s Liquid Gold (SLGD). It may be tempting to look at the reverse merger’s targeted/engineered $1.25/sh post-merger “IPO” price, paired with one’s admiration for HK founder Murray Stahl’s investment thought and demonstrated shareholder friendliness, and see the current trading price of the reverse merger parent stock (~$0.86/sh at the time of my writing this) as an easy and quite significant arbitrage. However, IMO, the market is not making unreasonable assumptions in how it’s currently pricing SLGD.

Lump this post in the basket of other ‘interesting stock, but I wouldn’t buy right now’ posts I’ve written. I’m basically only writing this to possibly help any other fellow investors in the HK complex of funds or sister companies to avoid a possible stinker here —or to get feedback from y’all on why I’m wrong about this and should actually be buying at these levels (as the spread is nominally quite large). This post also could be thought of as containing a general framework to think about the stock as prices fluctuate —and possibly provide a more attractive opportunity— ahead of the (expected) end of April 2024 merger completion date.

Keep in mind that I wouldn’t say that the current price of $0.86 is necessarily my own price target (IDK that I fully have one at the moment). More so I’m just looking at what the market is saying and going “Does that make sense? Is that justified? What would one have to believe to price the stock like that?” and playing around with some numbers to try to see what kind of reasonable assumptions lead to that current price. I'm doing that and, after playing with the numbers and POVs a bit, going “Hmm, maybe Mr.Market(-for-SLGD-stock) 1 has a point here.” There are not-unreasonable POVs from which I think the current market-implied price for HKAM makes sense as I will try to show.

(Source: here)

*I should note that I own a significant position in FRMO which owns a 4.95% stake in HK LLC, so even though I’m saying that I wouldn’t buy SLGD (soon to be HK) or that it’s not very undervalued at the moment, I’d still benefit to some degree if SLGD popped after the merger.

**When I show spreadsheets here, blue text means that it is a figure that I’m deriving myself / is based on formulas in the sheet, while black text is usually hard-coded values (eg. based on data directly copied from another source). Cells are are colored pink denote values that should be noted as key assumptions that are being used in the sheet.

*** When we look at financial statements from FRMO that include results of HK LLC, note that there is going to be some oddness because as mentioned in the FRMO 2023 annual letter: “Horizon Kinetics is on a calendar fiscal year and FRMO is on a May fiscal year, so that the March 31, 2023 financial statements for Horizon Kinetics were the latest available at the time that the FRMO financial statements were prepared.”

Contents

Background info

The relevant entities:

Scott’s Liquid Gold (SLGD): SLGD is a public microcap that trades on the OTC Markets. I don’t really know much about the company. I’m currently going on the assumption that the market price they had before their announcement of the reverse merger with HK was basically fair value. In any case, given their relative pre-merger size vs HK, I don’t think that too much of an analysis of the business is needed to understand the value of the overall deal we’re going to cover.

Regardless, here is a quick history of the company: Incorporated in 1954, SLGD initially focused on its namesake Scott's Liquid Gold household cleaning products and, over time, expanded into household and personal care products. Starting around 2022, the company started making significant divestments of various product lines leaving them with only the Kids N Pets and Messy Pet product lines by the start of 2023. In December 2023, SLGD announced that it had agreed to a (reverse) merger with HK LLC with Horizon Kinetics being the surviving entity. 2

Horizon Kinetics (HK): HK is an asset management company founded in 1994 by Murray Stahl, Steven Bregman, Peter Doyle, Tom Ewing, and John Meditz.

In more recent news, you may know Stalh and HK for their involvement in converting the 100-bagger stock Texas Pacific Land Corp, TPL, (of which they’ve been long-time investors in and now own around 20% of) 3 from a trust to a C-corp and later getting sued by the rest of the company’s BoD (whom are much less invested and aligned with shareholders, I might add) for opposing the dilution of existing shareholders for the purpose of providing ‘deal currency’ for unprecedented M&A adventures by the rest of company management 4.

For more information see their SEC Form ADV 5 and other disclusures here: https://files.adviserinfo.sec.gov/IAPD/Content/Common/crd_iapd_Brochure.aspx?BRCHR_VRSN_ID=902164; https://adviserinfo.sec.gov/firm/summary/106096; (here is some info on their subsidiary KBD Securities (which I assume stands for ‘Kinetics Broker Dealer’) that also mentioned in the merger agreement) https://brokercheck.finra.org/firm/summary/104110

FRMO Corp. (FRMO): FRMO is a public (asset holding) company founded by Stahl around 2001 in which he and co-founder Steve Bregman each own 16% of the common shares and take no other form of compensation. While not directly part of the transaction, they have a 4.95% equity stake and 4.199% revenue participation interest (read as: “royalty”) in HK. I’ve owned the stock for a good while and they are relevant to this discussion because, through their equity stake (which prompted them to start including summarized financials of HK in their annual reports starting in 2020) and revenue interest (from which we can derive a rough sense of what HK’s total revenues might be), we can derive some historical financial data for HK in this situation where we would otherwise have no public source from which to make educated estimates of HK’s fundamentals.

For more information about FRMO, I’ve written more on the company it in the past here

and here

(note that the latter article was the first post I ever wrote so the writing is a lot looser and rambles even more than in my more recent stuff; this was written at a time when I had to make zero considerations for the idea that anyone might actually read anything here; I’d encourage readers to view the About section of this substack).

The merger

For the full details on the deal, see the SLGD 8K filing here: https://www.sec.gov/Archives/edgar/data/88000/000095017023072802/0000950170-23-072802-index.htm

Like I mentioned, in late December 2023, SLGD announced that it had agreed to a (reverse) merger with HK LLC with HK being the surviving entity.

(Congratulations to those who apparently sniffed value in the air when the big divestments started rolling around June 2023, https://www.google.com/finance/quote/SLGD:OTCMKTS?sa=X&ved=2ahUKEwiA0KK03qeFAxU7M0QIHaZfAegQ3ecFegQIKRAf)

The SLGD board of directors will be expanded from 4 to 7 members, with HK selecting 6 of those directors (as 3 of the original 4 will be made to resign and HK will select the 3 who replace them in addition to choosing the new 3 to make up the final 7 (“Section 1.06 Directors and Officers” of the 8K)). After the merger “[t]he Company currently expects its legacy shareholder ownership to be between 2% and 4% of the pro forma combined company. However, the exact percentage may be different and will reflect the number of Merger Shares calculated in accordance with the Merger Agreement based on Horizon Kinetics’ financial position at closing.” Meanwhile, HK members will be receiving the substantial majority of the combined company’s shares (between 96% and 98%) in exchange for their ownership interests in Horizon Kinetics. The 8K does not say who will be Chairman or CEO, but in all likelihood it’s going to be Stahl and/or Bregman.

According to Stahl, the deal is expected to close around April 30, 2024.

“I’m expecting, but don’t hold me to it, this deal to close sometime around the end of April. Let’s say, with fortune, April 30th.” ~~~ Murray Stahl, FRMO FY2024Q2 conference call (https://www.frmocorp.com/_content/letters/2024_Q2_FRMO_Transcript.pdf)

(Pictured above: HK moving from the private market into the emptied out husk of SLGD; source: https://todropscience.tumblr.com/post/109995319497/just-a-hermit-crab-pagurus-prideaux-slowly)

Why they did it

As a bit of foreshadowing to my ambivalent/dour opinion on the spread —and apparent “opportunity” therein— between the current stock price and the post-merger “IPO” target price, note that this merger is not being done with any explicit eye to value creation or HK being able to capture some kind of profitable opportunity by having the company be public, but rather to provide some exit liquidity for some of their long-time owners.

“Why did we decide to do it? There are two kinds of shareholders at Horizon Kinetics. There are ones who are active in the business—you’re talking to one right now. I’m not going anywhere, I’m not selling any shares. As far as I know, I’m in good health, and I like what I’m doing. I’m going to keep doing it. So, everything is fine. I’m not looking for any liquidity. I don’t need any liquidity, thank goodness. But there are people who own shares that are not active in the business. They were just investors in the beginning, and they got to a certain age, and they may have some need of liquidity, so it’s not fair to keep them locked up. So, there are two options. Option number one is, we could have bought their shares, in which case, we would have a negotiated price. We’re the insiders, and we’re giving them a price, which from their point of view may or may not be fair. You can see that might be problematic. It might even be a conflict of interest if we were to quote a price. The other possibility is, the market will determine a price. If they want to sell, they can sell. If they don’t want to sell, they don’t have to sell. Maybe they even want to buy more. We’re going to see what happens.” ~~~ HK founder Murray Stahl, https://www.frmocorp.com/_content/letters/2024_Q2_FRMO_Transcript.pdf

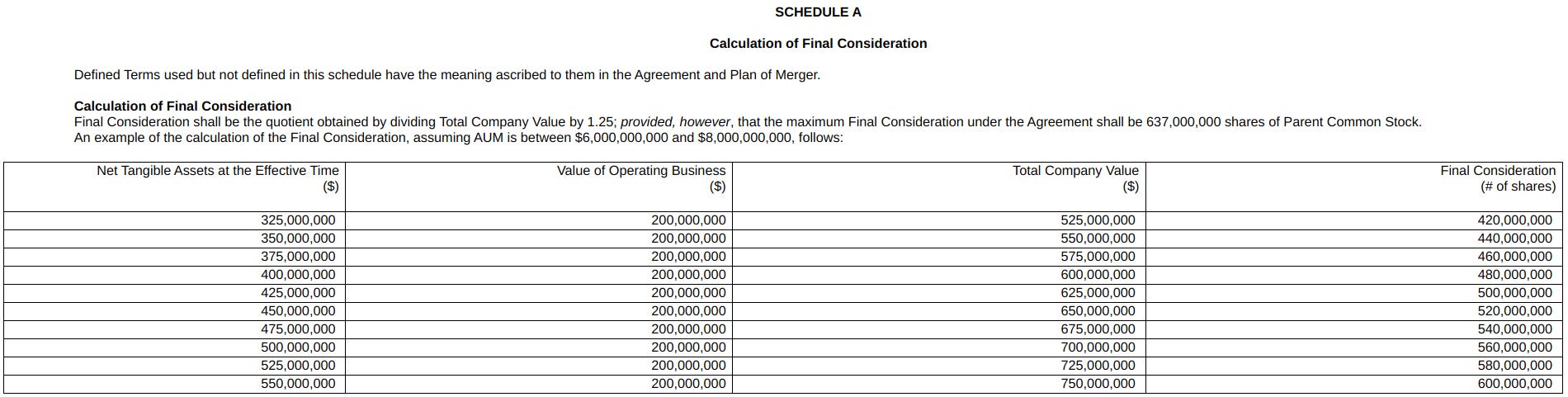

Calculation of Final Consideration

A key point in estimating the per share value of SLGD/HK post-merger is being able to guess as to what the post-merger shares outstanding (S/O) are going to be. We can do this because the calculation for the number of new shares that will be issued in the merger is provided in the merger agreement 6.

(https://www.sec.gov/Archives/edgar/data/88000/000095017023072802/slgd-ex2_1.htm)

The number of shares to be created in the merger are such that, based on the calculation of the HK’s total “value”, the value per share for the newly created shares will (theoretically) be $1.25. (Of course, the market appears to think that the value of HK should be calculated differently to how the merger agreement is planning to do it and is the main subject of this post, which I will get to in a bit).

(Theoretical stock price = Value/Share ==> Final Consideration # of shares = Value / Target price).

Theoretical “IPO” value of SLGD/HK

The value of HK for the Final Consideration of the merger is based on two components: HK’s NAV (net assets owned by HK on their balance sheet) and the value of HK’s “operating business”, which is the asset management business. (Starting from this point, when I’m referring to HK’s operating asset management business, I’ll be using HKAM for short).

HKAM

The value of HKAM, per the merger doc, will be calculated thusly: “Under the Merger Agreement, the value of the Horizon Kinetics operating business is (i) stipulated to be $200 million if and only if Horizon Kinetics’ regulatory assets under management (“AUM”) are between $6 billion and $8 billion, and (ii) otherwise is calculated by multiplying AUM by a factor of 0.03.” We can get a good idea of what HK’s current AUM might be right now using their recent SEC Form ADV Firm Brochure, published March 28, 2024 (https://files.adviserinfo.sec.gov/IAPD/Content/Common/crd_iapd_Brochure.aspx?BRCHR_VRSN_ID=902164), which states: “As of December 31. 2023, client assets managed by HKAM totaled approximately $6,503 million [ie. $6.5 billion]; discretionary assets totaled $6,297 million and non-discretionary assets totaled $207 million.”

This 3%-of-AUM heuristic is something I’ve seen before when it comes to valuing asset management businesses and has been mentioned by Stahl in previous FRMO conference calls 7, so it shouldn’t be a surprise to see HK determining HKAM’s value in this way.

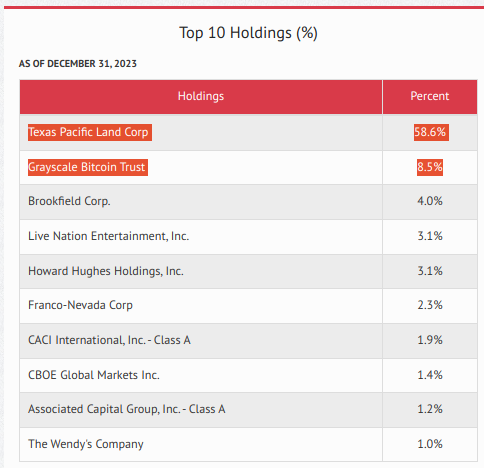

That was in December of 2023, we’re about 1/4 into 2024 now and maybe there’s been some change. One thing to note is that we can kinda guess with high confidence the overall makeup of HK’s AUM using their public 13F/D disclosures 8. From this, we can see that the main drivers of HK’s AUM is going to be the performance of TPL and GBTC (and to a lesser extent, WPM, CACI, ICE, and FNV), both of which are up year-to-date and thus we can be confident the AUM is still above $6bn (though probably less than $8bn) resulting in a value attribution of around $200MM ($6.5bn*0.03=$195MM) to HKAM by the method of the merger doc (well actually, anything between $6bn and $8bn AUM results in HKAM getting pinned to exactly $200MM by the agreement rules, but in this case the difference in tiny).

(https://fintel.io/i/horizon-kinetics-asset-management; HKAM’s public investments were composed of 44% TPL and 11% GBTC as of December 31, 2023; YTD, TPL is up by around 10% and GBTC by 60% for a total YTD percentage point contribution of (0.44*0.10)+(0.11*0.60)=11pps (which is actually nearly identical to the YTD return of HKAM’s headline Kinetics Paradigm Fund 9, which can give one a sense of how much these two investments drive returns for HK overall); we would have needed around 2x that return YTD in order to get $6.5bn up past $8bn)

HK NAV

********** UPDATE 20240807: Scott’s Liquid Gold is now officially Horizon Kinetics Holding Corporation (HKHC) ($SLGDD) with the merger and 1-for-20 reverse split officially completed on Aug 1 2024. The associated 8K filing (https://www.sec.gov/Archives/edgar/data/88000/000095017024092922/0000950170-24-092922-index.htm) also includes a breakdown of consolidated financials for HK LLC.

As of March 31, 2024, total equity was $252,598,000 (they report their estimated NAV at the end of the filing as a slightly lesser $249,606,000, which I assume has something to do with excluding intangibles and goodwill, though I’m not sure). The total consolidated equity of the combined business as of March 31, 2024 (which includes Kinetics Common and Kinetics Holdings) was $296,078,000 (see “UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION”). You can find the breakdown of the investments in the footnotes of the filing. (Be sure to check the associated date for the breakdown values as there are duplicate footnotes because the filing includes numbers for annual 2022 and 2023 results as well as first-three-months of 2024 results, so make sure you’re looking at the right time period).

The largest contributor to HK’s assets is their “investments in proprietary funds”

While they never describe what these various funds do within the document itself, you can find a bit more information on them in an old post on FRMO I made a while back —as they have many of these LP investments in common. See the section link here (try not to scroll in your browser for a few seconds once you get transferred by the link, so the web browser can jump to the right section within the post).

For some info on the Horizon Kinetics Equity Opportunities Fund (which FRMO does not own a stake in), you can see the attached docs on this old 2018 letter from Santa Monica Partners’ Lawrence Goldstein: https://irp.cdn-website.com/cfd0d660/files/uploaded/ltp-2018-q1.pdf

As for the value of the new company after the 1-for-20, while the dollar price has changed, I maintain that the price seems to imply a level of expected future growth for HKAM that seems unfounded given their historical performance as I described in later sections of this existing post.

**********

********** UPDATE 20240504: So the merger proxy was recently published (https://www.sec.gov/Archives/edgar/data/88000/000095017024052083/0000950170-24-052083-index.htm, see “UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION”) and we’re able to see the total NAV of HK, factoring in the contribution of HK’s merged “Member Corporations” less the equity of SLGD, at around $243,669,000 —a good bit below my initial estimate of ~$300MM, even before I considered the possible additional contribution of the member corporations. **********

********** UPDATE 20240406:

Actually, there’s an easier and more current way to get HK’s approximate NAV.

FRMO owns a 4.95% stake in HK LLC. FRMO records their ownership stake on their balance sheet as the proportionate book value of HK LLC.

“But right now, I think the pro-rata ownership is something like either 4.93% or 4.95%. If you take that FRMO balance sheet figure of, let's call it, $14.5 million to make it easy, and you divide it by .0495, just to approximate, that's $292 million. That would be the Horizon Kinetics balance book value, if you wanted to make that calculation. HK doesn’t have $292 million in cash and hard assets, since there's some goodwill there, but it’s got a lot. I'm not disclosing the number we have right now, but as I said, there's not a lot of goodwill there, especially not for an investment management company.” ~~~ Murray Stahl (note this these particular numbers are from Jan 2023)

As of FRMO’s most recent quarterly report, which contains numbers as of Nov 30, 2023, that calculation gives an HK LLC book value of ($15,079,831/0.0495=)$304,643,050.51; not too far off from the low end of the merger doc Final Consideration example table, only requiring a ((325000000/304643050.51)−1=)~7% increase from that level get to the very lowest example number (which is about the same as the return on HK’s headline Kinetics Paradigm Fund since that time to today), so $325MM seems like a reasonable base NAV estimate for HK LLC.

Also note that this does not take into account the NAV that could be included by the consolidation of HK LLC’s “member corporations” in the merger’s pre-closing restructuring (something pointed out to me by the author of https://fundamentalfinanceplaybook.com/):

“The Company shall enter into a merger agreement or agreements with one or more of its members that are corporations for U.S. federal and applicable state and local Income Tax purposes, including one or more of Horizon Common, Kinetics Common and Kinetics Holdings (collectively, the “Member Corporations”), pursuant to which the Member Corporations participating in such merger transaction shall be merged with and into the Company, with the Company being the surviving corporation of such mergers and the shareholders of such Member Corporations receiving membership interests in the Company in exchange for their shares of stock in such Member Corporations.” ~~~ https://www.sec.gov/Archives/edgar/data/88000/000095017023072802/slgd-ex2_1.htm

I played around with this idea a bit and just added to the base HK LLC NAV estimate the share counts (adjusted for the recent 1-to-3 split) of TPL “Amount of Securities Beneficially Owned” from Horizon Common Inc, Kinetics Advisers LLC, and Kinetics Asset Management LLC based on Form 4 filings by HKAM and HK LLC, plus all of Winland Holdings CEO Matt Houk’s (an HK employee) 14% ownership stake in the company, as well as *assuming* a similar stake in CMSC as FRMO (I recall as a 1% stake). This only gives an 8% increase in NAV from $325MM to around $350MM, but there is a lot of unknowns once one starts looking into this (eg. how much of HK Hard Assets I and II are collectively owned by these sister companies that are not counted in the direct beneficial ownership amounts, etc), so there’s quite a bit up in the air on this; I’m just trying to form a base of what’s *known* here.

**********

How can we come up with a reasonable value for HK’s NAV? Well, as I mentioned, the other public Stahl vehicle FRMO Corp has a material equity stake in HK LLC and has been providing summarized financials for the company in their annual reports since 2020 10. I’ve summarized those reported numbers here:

Note that these numbers are reported for the period ending March 31 of that year from the previous year. A lot has happened since March 2023, so how can we guess HK’s current NAV? Well, the Final Consideration Calculation in the merger doc provides a range of possible NAV amounts as an example for what the Final Consideration share count might be. Let’s look at the low end of the range:

I don’t think they provided this particular range in their example just by random chance, especially given that the HKAM value (according to the valuation method of the merger docs) used in this example table is based on realistic estimates of HK’s AUM, and subsequent “value”, that we do have recent data for. How much would HK’s NAV of $192MM in March 2023 need to rise by April of 2024, this year, in order to get up to at least that low end of the range? That would be an increase of ($325MM/$192MM - 1 =) 70% from March 2023, no small feat. However, Stahl and HK have been one of the earliest institutional investors in the Bitcoin space, starting mining operations and buying their first shares of GBTC in around 2015, and that gives these NAV estimates (that are greatly above the March 2023 NAV) an air of plausibility given how Bitcoin has done since that time to today.

At the time of my writing this (April 3, 2024), TPL is up by 3% from March 31, 2023 and GBTC is up 258%. Iff we assume that HK’s private balance sheet was basically the same as it’s public investments at the time (I’m guessing that a lot of their assets are investments in their own HKAM’s own products as well as some private/yet-to-be public assets Stahl has discussed in the past), we could use the HKAM public ownership filings or FRMO’s own reported % of TPL on their books to guess at what ballpark amounts of GBTC HK would need to have been holding in order to get near +70% in April 2024 from March 2023 on just the strength of these two investments.

(FRMO FY2023 annual report, https://www.frmocorp.com/_content/10k/FRMO_Annual_Report_2023.pdf; For those unfamiliar with FRMO, “Investment A” is TPL and “Investment B” is GBTC; if you don’t believe me see “Questioner 8” here: https://www.frmocorp.com/_content/letters/2021_Q3_FRMO_Transcript.pdf)

I set up the problem like this:

(0.03*X)+(2.58*Y)= 0.70, X = 0.466, solve for Y ==> Y = 27%.

That’s quite a bit of GBTC, but not an amount that FRMO has not held, itself, at past points in its history, so it’s not impossible to think that HK would have made that kind of allocation for themselves during the crypto winter or in any case been comfortable holding that level of BTC exposure at the time.

(https://www.frmocorp.com/_content/10q/FRMO_Corp_Q3_2021.pdf)

I think that assuming a BTC/GBTC allocation materially beyond that is a lot less believable (and certainly has no precedent that I’ve seen).

Assuming that the Final Consideration Calculation table’s NAV range was not completely chosen at random, my takeaway here is that HK’s current NAV is likely on the very lowest end of the provided range. So, let’s pin it at that lowest $325MM value as a reasonable, yet conservative, estimate.

(Of course this is ultimately speculation and we will see HK’s true balance sheet and asset makeup once the merger is completed, but I think this estimate is not based on anything too crazy).

.

Combining our educated guess as to HK’s NAV with HKAM’s theoretical value according to the merger agreement’s method of valuation, we get a combined value of $525MM.

Using this estimate for what the HK NAV and HKAM valuation will be determined to be at the time of the Final Consideration, we can then use the Final Consideration calculation to determine the number of shares that will be created; we divide the total estimated HK company value by 1.25. “Final Consideration shall be the quotient obtained by dividing Total Company Value by 1.25; provided, however, that the maximum Final Consideration under the Agreement shall be 637,000,000 shares of Parent Common Stock.”

$525MM/1.25 = 420,000,000 shares

Combine this with the existing 13,006,162 S/O of SLGD (per their most recent 10K, https://www.sec.gov/Archives/edgar/data/88000/000095017024036394/0000950170-24-036394-index.htm) and we can get a total expected number of shares, post-merger, as well as a total company value when adding the expected/theoretical HK total value to the value of SLGD’s existing line of business (I do this by simply taking the SLGD marketcap pre-merger-announcement and assuming that that is fair value for the stock). Take that combined SLGD+HK company value and divide it by the post-merger expected S/O and we can see what the final share price should be; $1.22/sh.

However, what we see in reality is that the collective mind of the market (or the market for these particular microcap OTC SLGD shares, to be more exact) is valuing SLGD existing shares at a much lower price than that ($0.86/sh). The question then is: Is this huge discount to the targeted “IPO” price actually a reasonable evaluation of HK’s “value” or is this price being overly pessimistic and thus creating an opportunity to capture a hefty spread when the deal concludes?

Price implied expectations (PIE) for HK’s value, post-merger

“It is not enough to think about difficult problems one way. You need to think about them forwards and backward. Inversion often forces you to uncover hidden beliefs about the problem you are trying to solve. “Indeed,” says Munger, “many problems can’t be solved forward.” ~~~ “Inversion and The Power of Avoiding Stupidity”, https://fs.blog/inversion/

Now, I’ve mentioned a bit about how great I think Stahl is as an investment thinker, how I’ve been a longtime investor in other companies he runs, and have just shown what a significant spread that SLGD shares are trading at relative to the targeted reverse merger “IPO” price. So why am I mostly indifferent on the stock (aside from the fact that I already have significant exposure to Stahl’s investing ideas through material positions in other Stahl/HK vehicles)? Why do I think that the current price and spread may actually be justified?

We can see the price implied expectation (PIE) value that the market is assigning to HK LLC by taking the current existing share price multiplied by the expected post-merger S/O and netting out the value of SLGD’s existing business (again, assuming that the marketcap pre-merger-announcement was fairly valuing that business). We can also the subtract the estimated value of HK’s NAV to get just the market’s price-implied-expectation value of HKAM ($42.2MM or contributing $0.10/sh to SLGD). In the table below, I’ve also provided some ratios of HKAM’s implied value vs “known” financials such as HK’s most recently reported AUM, revenues, and earnings (the latter two as summarized in FRMO’s annual reports, which here report HK’s numbers as they existed in March 31, 2023).

The question then is: Is this valuation of HKAM justified? What are some reasonable lenses through which one would have to be looking at HKAM in order to assign this value that is at such disagreement with the way that the merger agreement would like to think of its value?

% of AUM

Note that HKAM’s fees on their investment products range from just 0.85% AUM for their ETFs to 1.25% on their mutual funds (see “Fees and Compensation”, https://files.adviserinfo.sec.gov/IAPD/Content/Common/crd_iapd_Brochure.aspx?BRCHR_VRSN_ID=902164). At an assumed average realized fee of 1% of AUM across their products, valuing HKAM at 3% of AUM is the same as valuing it at 3x revenue.

From the table, we see that the price implied value of HKAM vs our known AUM figure is 0.65% of AUM, not 3% as is planned to be used in the merger Final Consideration calculation for HKAM’s value. Is 0.65% an unreasonably low rate at which to capitalize the business against their AUM?

I don’t really know. I’ll say this: There are several problems with simply taking a 3%-of-AUM heuristic and applying it to every asset manager we come across. You can read more about this issue here: https://mercercapital.com/riavaluationinsights/practice-management/valuation-of-asset-management-firms/; https://mercercapital.com/riavaluationinsights/practice-management/asset-manager-valuation-and-rules-of-thumb/; https://www.linkedin.com/pulse/evolution-rule-based-valuation-metrics-why-still-dont-brooks

We can play around with different %s-of-AUM valuations here:

(Note that, while even just at 1%-of-AUM we can still get great returns iff HK’s NAV is valued above 1.2x, I’d just note that people I’ve talked to who contacted HK about what that NAV is —while not being given a specific value— have been told that the majority of those assets are “liquid” assets, which I take to mean “public”, which I’d guess mostly mirror their portfolio investments and are mostly TPL (via another private HK LP, HK Hard Assets and Hard Assets II which I won’t get into) as well as GBTC and BTC owned on HK’s own account, in addition to smaller holdings like MIH/MIAX, HM Tech, CMSC, and Diamond Standard. In fact, I’d bet a lot of HK’s NAV are investments in their own produtcs. In any case, given that these assets would be —on the whole— nothing specific to HK and able to be bought on the market by anyone, I think the conservative approach of sticking with a 1x multiple on NAV is not overly harsh. Others may disagree, but we really have zero information on this element, so not much to really speak on here, IMO.)

Ultimately, the value of a business is much more closely tied to its earnings, the growth prospects thereof, and discount rate(s) against which ones weighs those earnings, rather than any multiple on revenues that bakes in such assumptions (in addition to assumptions on profit margins) in a way that is not made explicit, yet nonetheless exists under the surface.

Given all of the information available on HKAM’s underlying financials from SLGD’s public filings on the merger (that being no information at all), at this point I’d think there wasn’t much else to go on for valuing the business and —in the absence of any other information— would just go with the 3% rule of thumb that HK seems to think was a fine valuation method to use in the merger agreement.

However, remember that FRMO has annual reports going back to 2009, a revenue interest in HK as well as an equity stake that —as we’ve seen in prior sections— has given them reason to report summarized financial results for HK alongside their own annual results, since 2020. We can use these clues to derive some earnings and longterm growth information about HK that we wouldn’t otherwise have any insight into.

Perpetual growth model

OK, yes, HK is kinda “trapped” in TPL (https://www.morningstar.com/funds/fund-shop-bets-ranch-one-stock); it’s an capex-light 100-bagger and there are worse stocks one could be concentrated and stuck in. Yes, Stahl is the main brain of the whole operation, is legally a senior citizen now, and presents a notable key-man risk; I’d assuage those worried about this by directing them to the article here (https://www.mutualfundobserver.com/2023/08/the-unfortunate-manager-the-ill-timed-bus-and-you/). Yes, HK is “IPO’ing” on the much less liquid OTC Markets 11. In any case, the valuation multiples that the market price is implying just seem way too cheap at first glance, but I guess the response then is, “Compared to what, exactly?”...

.

“The cost of a thing is the amount of what I will call life which is required to be exchanged for it, immediately or in the long run.” ~~~ Henry David Thoreau, “Walden”

“The concept of opportunity cost is overlooked. In the real world, your opportunity costs are what you want to base your decisions on. […] In life, if opportunity A is better than B, and you have only one opportunity, you do A. There’s no one-size-fits-all.” ~~~ Charlie Munger, https://25iq.com/2015/11/21/why-and-how-do-munger-and-buffett-discount-the-future-cash-flows-at-the-30-year-u-s-treasury-rate/; https://www.valueinvestingworld.com/2014/05/charlie-munger-on-opportunity-costs.html

Investors in the HKAM business are effectively buying a stake in HKAM’s stock portfolio + asset management business that derives its fees from that portfolio. IMO, the stock portfolio’s expected returns represent a reasonable opportunity cost or benchmark return that the asset management business can be compared against. Using this as the discount rate to value HKAM as a business grounds it to tangible, observable returns which I think better reflects economic reality and opportunity cost for their particular business vs an abstract cost of capital estimate that we might have to use if the business were not as simple as HKAM’s is.

Here is the breakdown of HKAM’s investment portfolio as disclosed in their public 13F/D filings:

Around 42% of that energy exposure is solely from HKAM’s investment in TPL and all of that crypto exposure is from the GBTC Bitcoin ETF. I believe that, overall, the returns of TPL (and to a somewhat lesser extent, GBTC) are what ultimately drive HK’s AUM (and thus management revenues and earnings). IMO (and maybe I’m missing something) this is a bit obvious, but we can kinda check this by looking at how correlated this kind of investment portfolio’s total returns are to just TPL’s returns using the Kinetics Paradigm Fund (ticker: WWNPX) as a proxy.

(https://kineticsfunds.com/funds/paradigm-fund/)

Here is WWNPX vs a custom portfolio of 45% TPL, 5% GBTC, and 50% of plain SPY, without re-balancing, compared over the past 3 years:

(https://www.portfoliovisualizer.com/backtest-portfolio?s=y&sl=3SKyD2LTfXslN3akezztoW)

We see that one could get similar —in fact, better— results from just a fund of HK’s top two individual investments vs their headline mutual fund and that those results have really been mostly driven by TPL over the backtest period (results are similar for a 5yr period).

When I look at HKAM’s investments that ultimately drive their AUM (and thus revenues and earnings), I see the opportunity cost as being a self-bought “mini-ETF” of just TPL and GBTC in a similar relative weighting to HKAM’s overall investment portfolio. That is, just taking the capital that one would have used to invest in stock of HKAM and just going direct by using that money to buy the underlying top two, highly concentrated positions of the asset manager that drive their returns. (Doing this would certainly give you much more liquidity than investing in SLGD shares in the OTC market). What would the return be of such a self-made “ETF”?

(Note that I keep using 5% here as the GBTC initial weighting only because that was the weighting that HKAM had for in the Paradigm Fund in 2021, https://www.nasdaq.com/articles/$7-billion-investment-firm-horizon-kinetics-grows-bitcoin-exposure-2021-07-28. I think it’s a good median point between the 1% they started with and the 15% they have now.)

Something to note is that, in addition to being very large (especially for TPL), these allocations have not changed much since around 2019Q1 for TPL (when HK won their proxy battle to have the Texas Pacific Land Trust converted into a C-corp) and 2021 for GBTC 12. Furthermore, HKAM does not —by and large— take a very active approach to investing, but rather they are highly concentrated and tend to prefer to hold things for a very long time as can be evidenced by WWNPX’s tiny turnover ratio (less than 1%, https://kineticsfunds.com/funds/paradigm-fund/), their Kinetics Fund’s stated investment philosophy (https://kineticsfunds.com/our-approach/investment-philosophy/), and the number of times the phrase “long-term”, “long-view”, etc come up in the 2024 interview with Murray Stahl here (https://horizonkinetics.com/app/uploads/VII_Worth-The-Time_Stahl_Feb-2024.pdf). The name of their firm itself, Horizon Kinetics, was based on the idea of putting their energies (kinetics) into long time horizon endeavors 13. Also, if you read any of the writings, interviews, etc from Stahl or HK, you’d get the strong sense that they don’t intend to sell their TPL or Bitcoin 14 positions any time soon.

My point is that, at the highest level 15, it’s not that hard replicate and maintain the underlying investment fortunes of HKAM on one’s own. They’re not trading a “diversified” portfolio in and out of dozens of long and short special situations every quarter or using technical analysis and high-powered computers to trade in and out of thousands of stock every day/week. All you’d need to to is track 2 things every quarter to manually keep your “mini ETF” on track with HKAM’s main drivers: Their portfolio % of TPL and of GBTC (and you can do so using this: https://whalewisdom.com/filer/horizon-asset-management-inc-ny). Also recall that my backtest of TPL/GBTC/SPY did not do any re-balancing and beat WWNPX in that 3yr time period (and similarly if you change the period to a 5yr one). So, this POV is practical as well.

All this to say, when I think about the opportunity cost of buying HKAM, the business, I don’t think one would be unreasonable for comparing it to simply buying a self-constructed 90%/10%-TPL/GBTC “mini-ETF”. Of course, when we look at the long-term returns of such an “ETF”, we’ve seen that would imply an opportunity cost or discount rate of around 27%. Could this really be something that the market is applying to HKAM’s valuation?

.

For reference, I’ll replicate again the HK financials summarized from the FRMO annual reports and include some additional information:

Let’s look at the perpetual growth model for the terminal value of a business (https://corporatefinanceinstitute.com/resources/financial-modeling/dcf-terminal-value-formula/):

TV = (FCFn * (1+g)) / (WACC - g) ==> g = ((TV/FCFn)*Rd - 1)/(1 + (TV/FCFn))

… and let’s let TV/FCFn be translated to P/E assuming that HKAM, being an asset management business, is extremely capex/asset-light and is free of debt (given that their largest investment is a royalty company and by how FRMO is run, I don’t think these are unreasonable assumptions).

Since we have HKAM’s most recent actual earnings from the summarized financials in the FRMO annual report and we know the market’s price implied expectation for HKAM’s value, then we can get the price-implied-expectation for the P/E multiple and HKAM perpetual growth rate that the market is baking into SLGD share prices.

Recall our working opportunity cost we are using for the discount rate against HKAM’s business is 27%, which from our table here would imply a perpetual growth rate of something like 0%. Is a 0% growth rate for HKAM’s earnings realistic?

.

Like I’ve mentioned, FRMO has had a revenue royalty/participation interest in HK since at least 2010 (the oldest annual report on their website where I can find it mentioned), this participation rate has always been a fixed 4.199% (at least since 2013), and their footnotes have (almost) always included a description of how much of their total revenues were from that HK revenue interest. Since we know the revenue participation rate is fixed, have a 10yr+ record of FRMO’s own revenues, as well as breakdowns of the portion of those revenues that come from the participation interest, we can work backwards to derive HKAM’s revenues going back those same 10+ years. Eg. if FRMO’s annual report shows total fee income is X and disclaims that Y% of fees were from the HK revenue interest, then we can derive HKAM’s total revenues (at the time of FRMO’s end of fiscal year) as (X*(Y/100))/0.04199. Here is a snippet of that data:

(The base revenue data up to 2019 is just copied from the blog post on FRMO here (https://fundamentalfinanceplaybook.com/2020/02/22/embedded-optionality-frmo-case-study/). For the early years where no breakdown was provided, I just use the low end of the range of known portions of stream-based fees. Below I’ve removed the annual report footnote comments to compress the table so I can screenshot the whole thing.)

(Notice that these derived revenue figures roughly line up with the available official summarized revenue figures in the FRMO annual reports, except for 2021. This is due to the fact that HK’s fiscal year is not the same as FRMO’s and GAAP adjustments are made to the official reported numbers summarized in the FRMO reports 16. Given that the numbers here are smoother while still generally matching up with the official FRMO HK summary financials, I’m inclined to take these as being closer to the cash accounting version of HK’s revenues.)

Notice that in these whole 10+ years, HKAM’s apparent revenue growth has been a whopping 0.01%. Given this no-growth status, we can also use the year-weighted average of HKAM’s revenue of $58,422,320.65 to make some estimates about normalized earnings.

One way to estimate HKAM’s normalized earnings from that long-term revenue figure is by taking the average of the officially reported expenses and subtracting that from the normalized revenue estimate ($16,072,169.25). The other way is to take the average net margin ($10,658,172.46); I actually like this way better as it more closely lines up with the actual numbers (aside from 2021 which, as I mentioned, I think is misleading due to GAAP estimates) and the average net margin figure produced is pretty close to the average non-bank financial services’s 15.44% net margin, according to Prof. Damodaran’s NYU dataset for Jan 2024 (https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/margin.html).

.

TV = (FCFn * (1+g)) / (WACC - g) ==> g = ((TV/FCFn)*Rd - 1)/(1 + (TV/FCFn))

So, iff one accepts the idea that the opportunity cost of investing in HKAM is a mini-ETF of 90%/10%-TPL/GBTC (which has a long-term return record of ~27%), then according to the perpetual growth model (using the most recent HK earnings number and the market’s price implied value of HKAM) this would imply an earnings growth of 0% and we’ve just seen that there seems to actually be a case for why one might think that should be expected.

Thus, IMO, the market is not crazy to price SLGD at such a big spread below the merger’s Final Consideration target “IPO” price and the current discount is not quite the slam dunk that fellow Stahl-stans may think it (or I might wish it) to be.

Epilogue

OK, suppose all of that is just wrong.

Let’s play around with the perpetual growth model to see what kinds of earnings multiples would be implied by some alternative growth rates.

TV = (FCFn * (1+g)) / (Rd - g) ==> TV/FCFn = (1 + g)/(Rd - g)

…again, we can let TV/FCFn = P/E for the asset management biz.

(Here I use the normalized long-term earnings estimate based on average known net margins (which is only slightly lower than the actual March 2023 numbers))

What kind of discount and growth rates, Rd, and g look right to you? You can use this table to estimate the upside based on your preferred multiple (and assuming the very low end of HK’s example NAV as presented in the Final Consideration calculation example in the merger doc (which, again, I think is a reasonable and not overly-conservative guess)).

(Here I’ve circumscribed the approximate multiples that line up with a 27% opportunity cost discount rate and 0% long-term earnings growth)

.

We can also look at HKAM as a zero-growth annuity. This seems like a justified POV given the apparent generally range-bound revenues at HKAM over the past 20yrs. From the FY2024Q2 FRMO earnings call:

“Horizon Kinetics has a pretty big dividend payout ratio. FRMO doesn’t pay a dividend, but Horizon Kinetics pays, I think, a pretty robust dividend. We receive that dividend, so whatever’s left over after the dividend gets put back in retained earnings”.

Of course, this assumes a static NAV for HK (eg. as opposed to earnings getting reinvested by Stahl and Bregman into their own balance sheet, as someone very observant has pointed out to me 17). Also, it’s possible that HK sees renewed growth as they shift from mutual funds to “actively managed” ETFs.

TBH, I wouldn’t be surprised if SLGD ultimately just ends up trading based just on the dividend yield. I mean, that could be the play here: Invest in SLGD (or whatever HK is going to change the ticker name to) to get directional exposure to HKAM’s underlying investment portfolio (and likely very similar NAV composition and probably invested in their own funds) in addition to receiving a dividend from the fees that HKAM collects from managing that portfolio for clients. From this POV, anyone who is a retail investor in any of HK’s funds that basically just trade like “TPL/GBTC mini-ETFs” may as well just swap that position for SLGD shares at this current price point (which I think I’ve made the case as representing a fair value).

“[A]bout ten years ago I had this theory —one of the few theories that actually proved to work out— though there was no way to implement it in investing. […] And I thought, well, the private equity companies, they have to put some money in the deal. But then they're getting the incentive fee, on top of everything else. So, let's say they put money in Deal A. If Deal A is successful, then by definition they have to do better than the clients, because they will make the same return the clients make on the deal, but they will also then get the performance fees, which the clients will pay. So, I thought to myself, if I want to be in private equity, I'm much better off buying the publicly traded private equity companies than I am buying into private equity directly or through a private equity fund.” ~~~ Murray Stahl

(Of course there are differences between PE and HK’s asset management business such as the fact that they are investing mainly in public equities, largely do not charge performance/incentive fees on top of their regular management fees, and generally aren’t going to be imposing multi-year lockup periods on clients 18, but the core principle of benefiting from both the investment performance and fee income by owning shares in the management company itself still applies).

.

Hopefully this analysis has been useful for anyone looking at the situation. Writing this all out took a lot longer than I thought it would; this is all just from a single spreadsheet that’s pretty compact and expanding it out into a linear narrative as required by this format was a lot more work than I thought it would be. If anyone catches anything odd or misguided, I’d be happy to be shown where I’m making any major errors in reasoning here.

.

“I try to avoid conceptualizing the market in anthropomorphic terms. Markets don’t think. Just like mobs don’t think. Why did the mob decide to attack that building? Well, the mob didn’t actually think that. The market simply provides a price that comes about through a collection of human beings.” ~~~ Colm O’Shea in Jack Schwager’s “Hedge Fund Market Wizards”

Eg…

“The general rule of thumb in the world of investment management is to say an asset management company is worth 3% of assets under management”, https://www.frmocorp.com/_content/letters/2021_Q3_FRMO_Transcript.pdf

“By the way, we also have some crypto investments at HK, one of which is HM Tech, because HK owns a 50-plus percent in HM Tech. I would argue that's probably worth more than the carrying value. In any event, if we take the assets under management with, let's say, roughly $7.2 billion, and if you valued it at 3% of AUM, you could do the calculation.”, https://www.frmocorp.com/_content/letters/2023_Q3_FRMO_Transcript.pdf

https://fintel.io/i/horizon-kinetics-asset-management; IDK why the AUM figure for December 2023 here is no much smaller than HK’s disclosed AUM in the ADV brochure. I assume it has to do with them filing other ownership disclosures under other subsidiaries

https://www.frmocorp.com/10ks.html, see “NOTE 5 - Investments”

On the topic of liquidity, while the Prop. 4 issues at TPL may be seen as an overall hindrance to the company’s value, I’d bet the 1-to-3 stock split and subsequent reduced per share price might have actually helped HK in some small way by making TPL shares more liquid.

https://whalewisdom.com/filer/horizon-asset-management-inc-ny; TPL is classified as “Real Estate” and GBTC lumped in as “Finance” in the histogram here

This was was in an interview with HK co-founder Peter Doyle that I can’t find the source to at the moment.

Notice I say “Bitcoin”, not “GBTC” here. They may actually want to find a way to sell GBTC to swap that captial into one of the lower-fee ETFs that now exist, such as BlackRock’s IBIT, specifically.

The individual thematic funds with less overall exposure to TPL et al are another story.

HK/FRMO co-founder Steve Bregman discusses this issue here (see “Questioner 4”, https://www.frmocorp.com/_content/letters/2022_FRMO_Transcript.pdf)

I’m only concealing their online identity here because, while basically a harmless statement, this was based on a private conversation I’ve not asked their permission to mention them by name, but did want to note that that was not my own original thought.

Thanks for this very useful analysis

why don't you use the revenues given for HK in the 14A, why use FRMO?