Commentary

For the year 2023, my primary portfolio beat the S&P 600 by about 100bps, under-performed vs the Russel 2000 by about 300bps, and beat the IWC iShares Microcap ETF by 500bps.

My most relevant benchmark given the portfolio composition would be the Russell 2000 or, more appropriately, the iShares Micro-Cap ETF and I’d note that —unlike the indexes— 20% of my portfolio is presently kept in cash, money markets, or ultra-short bond funds, so I’m pretty OK with the year’s results.

(“Uncategorized” in this heatmap is mostly just the RENN Fund (RCG) and GBTC, with the addition of various small holdings of actual call options contracts)

I say that the microcap index is the more aligned benchmark for the portfolio because, while Schwab buckets anything under $2bn as “Small Cap” in the asset breakdown above, the average position-size weighted marketcap of the stocks I’m invested in is less than $500MM ($473MM as of this writing), the iShares Micro-Cap IWC ETF having a upper marketcap limit of $550MM1. (Position-size weighted debt/equity of 0.46x).

Considering that the equities portion of the portfolio was net positive for the year, if the various cash and ultra-short fixed income investments were instead also invested in the portfolio’s equities in a uniformly distributed manner, then the performance would have certainly been higher2. My favorite investing thinker, Murray Stahl, had this to say on his company’s own large cash balance in 2015:

“We position FRMO to be ready, but there’s a cost associated with it, and it’s called opportunity cost. If the money were invested, we would, in principle, have a higher return on equity. Currently, we’ve got not quite, but more or less, half our shareholders’ equity invested in cash or cash-like instrumentalities, and we managed to have an 8% return on equity. We could have had a much higher return on equity had we invested the whole balance. But, hopefully, there will be opportunities and we look forward to finding them. Maybe we’ll find them tomorrow but, at the moment, we’re still searching […] The only problem I see with the conventional asset management business is that capital leaves when the market goes down, which is when you have the opportunities, and the capital comes back after the market goes up, after you’ve manifested success. We wanted to have something that was in the field of permanent capital, so that we wouldn’t have to rely upon the flows.” ~~~ Murray Stahl 2015, https://www.frmocorp.com/_content/letters/2015_FRMO_Transcript.pdf

In a similar way, when the market goes down, if you don’t have cash on hand, you are relying on selling existing investments (at a low) or using dividend income (that may be reduced or paused in such a scenario) in order to capture new opportunities in a down market (which is where the most opportunities come from)3. Having cash on hand is an alternative to that and has thankfully gotten significantly easier to hold now that interest rates have come up from their decade-long near-zero levels. If this causes some years of under-performance, that’s OK.

********** UPDATE 20240324: I recently went through my old brokerage statements and used my Dec 31, 2022 statement to reconstruct the holdings of the portfolio I had at the beginning of the year 2023. Backtesting that un-touched portfolio by simply leaving the share counts unchanged and calculating the values of the holdings at the end of the year vs the start in Google Sheets, I see that I’d actually have had a return of -19% on my portfolio for 2023 vs my realized 15%. On one hand this is a bit scary as it shows what could have happened had I not been paying attention on actively managing the portfolio. On the other hand, it’s a bit encouraging as it could be taken to show that 1) I’m a better investor than I was the year before and/or 2) I know when to hold’em and when to fold’em (I like to think it’s a mix of both) and 3) my intervention in the portfolio is generally value additive. **********

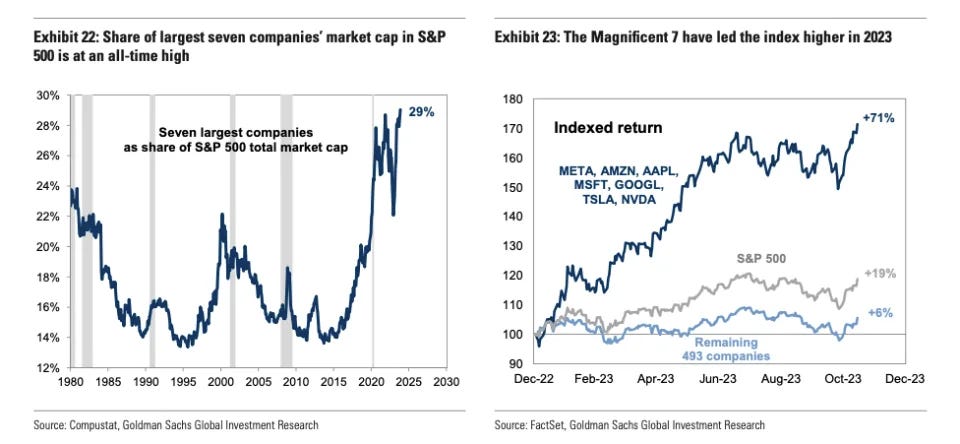

Note the great under-performance relative to the S&P 500 and NASDAQ which were mostly driven this year by the indexes’ small “Magnificent 7” subset of constituents Amazon.com (AMZN), Apple (AAPL), Google parent Alphabet (GOOGL), Meta Platforms (META), Microsoft (MSFT), Nvidia (NVDA) and Tesla (TSLA)4.

Yet, the S&P 500 and NASDAQ have only just about made back their 2022 losses. Looking at the change in EPS from 2022 to 2023 + dividend yield, we get a total economic return of 1.6% from the S&P 500 for 2023 (see https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/spearn.htm). Taking a slightly longer view and looking back at my previous year’s out-performance of the indexes compared to this year’s under-performance, I am reminded of this snippet from Nick Sleep in his 2007 annual Nomad Investment Partnership letter to shareholders:

A trick to help the rational mind is to put our periods of good performance together with our poor performance. We encourage you to mentally shuffle the surplus from the good years and allocate it to the deficit of the bad years. Especially any future bad years, please! Better still, take away the adjectives used to describe the years. That way one can accept life as it is. After all, regardless of the order in which annual results fall, the destination will be just the same.

My investment income for 2023 has also increased by 19.14% over the year 2022. In addition to many of the underlying businesses on the equity side continuing to perform well and grow distributable FCF, this income growth is in large part due to the large short-bonds and money market positions that, while being a drag on overall portfolio performance, have benefited from the Fed’s dramatic rate hikes.

Overall, I find these results to be acceptable and continue to stick to my investing strategy, which appears to be working fine when inspecting the overall positive balance of the natural growth or decline of individual positions.

My general strategy is described in greater detail here:

Portfolio review

Not much has changed since the last update (linked below) and most of what was said then I think is still applicable now. I don’t believe that the overall situation in the markets, nor in my portfolio or investment strategy, have changed drastically in just the last six months…

My strategy is still to invest in a manner intended to be well diversified against whatever economic paradigm the future brings about (with some scattered de minimis percentage points invested into high-risk-high-reward, high operating leverage, long-term “call option” businesses, turnarounds, or degenerate speculations) and allow winners to run and drive greater portions of the portfolio’s total returns in the long-term, while continually adding new diversified seedling positions using dividends and capital gains (in cases where fundamentals have very obviously broken down or the company is wholly acquired for cash) along the way. Time will tell if this emergent strategy (and these stock selections) work out well in the long run; I think it is currently working fine and am presently unbothered.

(Oaktree’s Howard Marks recommends a combination of #2, #3, and #6).

I continue to think that the stars of the market indexes (the FAANGs and now Tesla and Nvidia) have already percolated to the top of the indexes’ concentrations at this point and attracted commensurate attention and fund flows —and that they continue to do so in an unhealthy/imprudent feedback loop.

“Even under the absurd assumption that we could make an accurate forecast of a company’s earnings into infinity —we are lucky if we can make an accurate forecast of next quarter’s earnings— what is a share of a stock in that company worth? An infinite amount? There have been moments when real, live, hands-on professional investors have entertained dreams as wild as that —moments when the laws of probability are forgotten. In the late 1960s and early 1970s, major institutional portfolio managers became so enamored with the idea of growth in general, and with the so-called ‘Nifty-Fifty’ growth stocks in particular, that they were willing to pay any price at all for the privilege of owning shares in companies like Xerox, Coca-Cola, IBM, and Polaroid. These investment managers defined the risk in the Nifty-Fifty, not as the risk of overpaying, but as the risk of not owning them: the growth prospects seemed so certain that the future level of earnings and dividends would, in God’s good time, always justify whatever price they paid.” ~~~ “Against the Gods”, Peter L. Bernstein; https://www.google.com/books/edition/Against_the_Gods/G5TKA6B0pyEC?hl=en&gbpv=0

Recall that the father of value investing, Ben Graham, himself was caught in the stock market crash of the Great Depression as well as able to agree with his fellow investors, after the fact, that the warning signs were there all along…

“We both agreed that the stock market had advanced to inordinate heights, that the speculators had gone crazy, that respected investment bankers were indulging in inexcusable highjinks, and that the whole thing would have to end one day in a major crash. I recall Baruch's commenting on the ridiculous anomaly that combined an 8 percent rate for time-loans on stocks with dividend yields of only 2 percent. To which I replied, "That's true, and by the law of compensation we should expect someday to see the reverse — 2 percent time- money combined with an 8 percent dividend on good stocks." My prophecy was not far wrong as a picture of 1932 — and it was borne out precisely, under a different set of market circumstances, some twenty years later. What seems really strange now is that I could make a prediction of that kind in all seriousness, yet not have the sense to realize the dangers to which I continued to subject the Account's capital.” ~~~ Benjamin Graham, https://archive.org/details/memoirsofdeanofw00grah/page/251/mode/2up?view=theater

For my part, I’m fine —for now— extracting returns from outside of the indexation system and that has so far managed to beat the index in turbulent times and, in more normal times, return well above the 6%/yr performance fee watermark that Warren Buffett initially set for his old hedge fund5. Meanwhile, the sizable cash / money market balance stands ready to nibble into any opportunities that might arise (as was done for ITEX and MKTX) while earning risk-free interest yields previously unobtainable over the last decade.

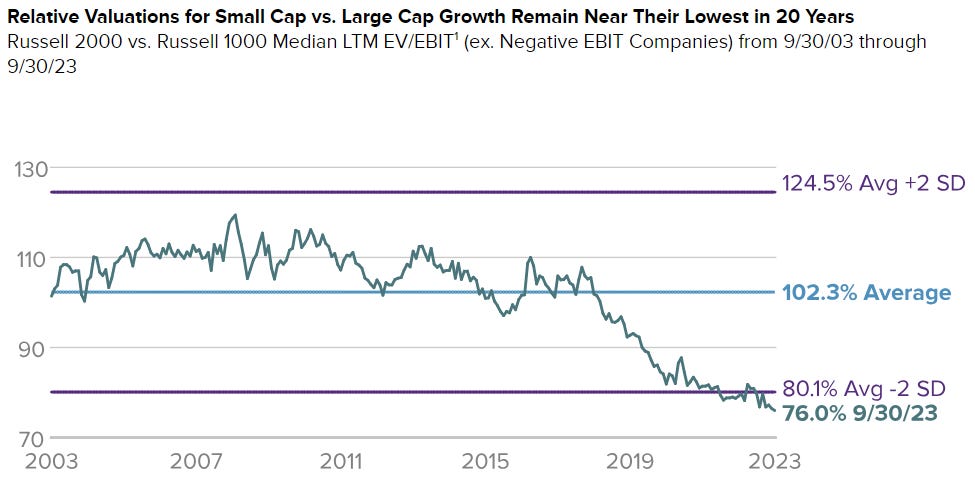

Regarding my overall mix of asset classes, I think that micro/small-caps remain the place to be6. Not only are their businesses and reporting generally much easier to understand, but the category also has a lot more baked in pessimism that has created opportunities.

(https://www.royceinvest.com/insights/small-cap-interview)

(https://www.royceinvest.com/insights/small-cap-interview; Weighted Harmonic Average Price-to Earnings Ratio (Excluding Non-Earners) for the Russell 2000 from 9/30/98-9/30/23)

“In almost every activity of normal life people try to go where the outlook is best. You look for a job in an industry with a good future, or build a factory where the prospects are best. But my contention is if you’re selecting publicly traded investment, you have to do the opposite.” ~~~ Sir John Templeton, https://acquirersmultiple.com/2020/10/john-templeton-the-principle-of-maximum-pessimism/; https://archive.org/details/sirjohntempleton0000herr/page/138/mode/2up

In any case, a bailout by Mr.Market in the form of a re-rating of micro/smallcap valuation multiples is not something I’m really counting on nor care too much about vs growth and the prospects for the fundamentals in the underlying businesses I own (eg. strengthening sales, FCF/sh, ROIC, BVPS, and reduction of WACC).

One final thing I’d like to note: It’s not as if I think the only way to win is to invest in the “Majestic 7” that have been dragging up index returns. There are actually many individual companies beating the indexes, I own a good amount of such companies (as well as a good amount of (for the time being) losers), just not in any incredible size at the moment, but if they continue growing as I expect them to (and I don’t average down too much in too many incorrect situations) then they will become greater and greater drivers of the portfolio’s returns in due time and will have earned such leading positions. In this way one could end up with their own unique top-heavy basket of investment out-performers, without the added systemic risk that comes from stock prices that are in large part supported by the massive non-fundamentals-based fund flows of the passive-investing, indexation complex.

(How it feels underperforming from outside the indexes; video source: here)

Largest positions

Cash (% of portfolio: 20%; % gain/loss: 0%)

This cash position has certainly been a drag on returns, but for now I’m fine with collecting the income generated by the highest interest rates in a decade and using it for reinvestment into the portfolio’s various equity holdings.

(https://fred.stlouisfed.org/graph/?g=1duvu)

Blackstone Minerals, BSM (% of portfolio: 6.99%; % gain/loss: 26.29%)

Starting around the 1980s, the world has seen…

Growing world population (who I assume would mostly7 prefer to increase their prosperity and GDPs) ⇒ growing energy demand

Liberalization and collapse of the USSR starting in 1987 == a onetime event that brought a lot of commodity supply online to global markets by allowing Western companies / commodity traders (who had access to global physical and capital markets) to come in and take managerial control of commodity production and distribution which was formerly the role of the now-dissolved centralized soviet state.

An uptrend which appears to now be stagnating (https://www.researchgate.net/figure/Russian-conventional-oil-production-based-on-a-compilation-of-historical-sources-for_fig2_262188782).

Chinese economic opening in 1978 == a one-time event that brought a lot of low-wage labor supply online to global markets (which is reaching capacity in both physical and political terms) —that also spawned copy-cats like India, Vietnam, etc.

Not only is this capacity of cheap labor reaching a physical limit, but China is also inching towards isolationism and stimulating domestic consumption, which will affect its degree of exports to the rest of the world —pursuing controlled decoupling over past goals of overtaking the USA as the world’s largest economy.

A 25pps decline in corporate tax rates from the ~45% of the 1980s, which can’t be duplicated again with corp tax rates now sitting at around 21% —unless the Overton Window is open for near-0% corporate tax rate (which seems unlikely).

A 90% decline in interest rates (read as: decline in companies’ WACC re. investment decisions) from an EFFR of ~15%, to near-zero, and now back to ~5%. Again this trend can’t be replicated unless the Fed is willing to take the US back to ZIRP.

(The relatively more recent) policy of ESG capital allocation across the Western financial system ⇒ reduced available capital for critical (“legacy“) commodity investment or at least raising the cost of capital for such investment/financing, while green energy/policies have failed to provide a sustainable transition. This has increased both operating expenses and WACC for commodity-based companies. This further raises the hurdle rate for what projects contribute to “economic value added” (= ROIC - WACC).

The RU-UA war and sanctions starting in 2022 ⇒ taking both RU and UA commodity supplies offline —at least to a partial extent when it comes to UA. This conflict has added time (and thus costs) to the global supply chains.

We now have conflict in the middle-east stemming from the Israel-Palestine conflict starting in late 2023, causing major supply chain disruptions in the Red Sea —one of the world’s busiest shipping lanes.

These last two items appear to be tied to the larger trend of deglobalization and political breakdown of international trade. I’ve compiled some info on this idea in an older post here:

So whether we have a recession or not, the cost of opex/capex commodities are going to keep going up because of the underlying, long-term factors stated above that have reached either physical or political limits.

I find this mid-year 2022 interview with mining billionaire Robert Friedland8 to still be relevant and interesting:

Despite the recent selloff in oil equities from their 2022 highs, my cost basis remains quite well below current prices. I won’t go too much into these various names as much has already been written about the merits of holding a basket of these asset-light, cash flowing, perpetual commodity call options.

There is appears to be a significant shift in global sentiment and narratives regarding energy and climate change policies, with skepticism growing about their effectiveness, particularly influenced by changing government actions. The reversal of European governments to coal, wood, and fossil fuels, accompanied by substantial subsidies, has already increased gasoline consumption. The failure of certain climate change policies is resulting in an “unexpected” increase in demand for coal, oil, and especially natural gas. It seems very likely that governments and companies, no longer able to hide the inadequacy of green policies, will turn to natural gas as a more viable option, leading to a surge in demand beyond current forecasts. Investments in oil and gas may become more attractive as the narrative shifts away from strict adherence to ESG principles.

********* UPDATE 20240325: I found this article to be interesting and relevant to the idea of a shift in global sentiment and narratives regarding energy and climate change policies: https://capitalistexploits.at/the-green-u-turn/ **********

I look at it like this, BSM’s dividend —excluding 2020— has been consistent and yielded around 6-8%. Barring any really wild actions by management (like selling Permian acreage in a panic despite having very little debt, as BSM management did in the 2020 oil crash) or another shale bust of operators, all they need to do is continue to sit there and collect royalty checks on their land; you get constant cash flow while holding a long-duration perpetual call option on future oil prices —that would also be paid out as a distribution. This goes similarly for VNOM, TPL, and WPM (in the realm of gold streaming, which is slightly different, but the same idea applies).

(My total investment in O&G royalties is closer to ~16% when accounting for VNOM, TPL, and FRMO’s stake in TPL (via HK Hard Assets LLC and HK LLC))

For some additional interesting reading on royalties and O&G, see:

https://www.valueinvestorsclub.com/idea/BLACK_STONE_MINERALS_LP/5078936356

https://www.valueinvestorsclub.com/idea/BLACK_STONE_MINERALS_LP/7040535210

FRMO, FRMO Corp (% of portfolio: 5.15%; % gain/loss: -32.04%)

I continue to like FRMO for exposure to inflation beneficiaries and cryptocurrencies managed by intelligent and incentive-aligned owner operators (I’ll remind readers that Stahl and Bregman draw no salary from FRMO and own the same equity class that all other investors own).

FRMO is down 22.56% for 2022. This appears to be mostly due to FRMO’s large TPL stake (down 25.21% for 2022) and the court decision favoring the TPL board of directors in the recent lawsuit that the BoD brought against Horizon Kinetics and Softvest (who themselves are fellow board members) for the sake of enabling themselves to dilute shareholders and rule over a larger empire of assets —which HK and Softvest resisted voting in favor of.9

The controversy centers around the TPL BoD’s proposal to expand the number of authorized shares outstanding, which would dilute the holdings of existing shareholders. HK and Softvest resisted voting in step with the rest of the board on this matter. The board then filed a lawsuit against HK and Softvest, alleging that they broke the terms of their Stockholder Agreement by refusing to vote in favor of the proposal. HK and Softvest, on the other hand, assert that they are not required to vote in favor of the proposal and that the item should be considered “non-routine,” which would mean brokers can’t vote non-votes10. You can read a lot more about this in the blog here: https://tpltblog.com/

(Mr.Market seems to dislike this share issuance idea, but, to be honest, TPL’s stock trades at an extremely high multiple vs comps and I wouldn’t be totally opposed to converting that into currency for investments if done by an allocator by whom the cost-of-capital for such share-based deal financing was thoughtfully considered against the possible risk/reward (eg. iff Stahl were elected CEO)).

FRMO also owns 4.95% of Horizon Kinetics LLC which is set to go public some time next year via reverse merger with Scott’s Liquid Gold (SLGD).11

Based on the merger agreement document, here’s how I understand the deal is going to work:

HK LLC is being acquired by Scott's Liquid Gold in an all-stock transaction.

HK LLC will be merged into a wholly owned subsidiary of Scott’s Liquid Gold called HKNY One, LLC. After the merger, HK LLC will be become a wholly owned subsidiary of Scott's Liquid Gold.

At this point SLGD will be controlled by Horizon Kinetics as “the Company is obligated to expand its Board to seven members, with all but one of its existing directors resigning, and the remaining seats filled by candidates selected by Horizon Kinetics.”

The merger consideration that HK LLC members will receive is stock in Scott's Liquid Gold. The number of Scott's Liquid Gold shares will be determined based on a formula that values HK LLC using its net tangible assets plus a valuation of its operating business12. (Note that the HK ownership interest is set to be priced at $1.25/sh and that SLGD shares currently trade at a ~30% discount to that price).

(“Under the Merger Agreement, the value of the Horizon Kinetics operating business is (i) stipulated to be $200 million if and only if Horizon Kinetics’ regulatory assets under management (“AUM”) are between $6 billion and $8 billion, and (ii) otherwise is calculated by multiplying AUM by a factor of 0.03.”)13

As a 4.95% owner of HK LLC, FRMO’s ownership should be converted into shares of Scott's Liquid Gold at the determined exchange ratio. FRMO becomes a shareholder of Scott’s Liquid Gold rather than an owner of HK LLC; the name will probably be changed to something more related to Horizon Kinetics.

The transaction is structured as a tax-free reorganization, so there should be no taxable gains for HK LLC members unless they sell the Scott's Liquid Gold shares received.

Also useful to keep in mind that a lot of HK's AUM is TPL14. Will be interesting to see the conversation around that once HK is public and the issue becomes an investment-merit one. In any case, I wouldn’t sell FRMO to buy HK —even given the existing discount— as the planned destinations for the two businesses are quite different. Management has remarked many times that FRMO is planned to become an operating business (mostly likely relating to crypto via Winland Holdings)15 vs the current holding company model it has today whereas HK is primarily an asset management company.

Here’s a rough valuation scratch-work of FRMO’s value as of Dec 31 2022, taking into account the median Total Company Value of HK LLC in the merger agreement:

I’ve written more about FRMO here:

The RENN Fund, RCG (% of portfolio: 4.77%; % gain/loss: -1.99%)

The main macroeconomic view of the RENN Fund is “a shift from declining interest rates and minimal reported inflation to static or slightly rising rates and inflation well above trend.” (I think it's also rather impressive to note that this statement was made in mid-2020, before the drastic rate hikes of 2022).

If you don’t agree with that macro view —or don’t want that probability hedged by Murray Stahl— then you wouldn’t want to invest in the fund. However, I can’t help but think of the Steve Jobs quote (which also reminds me a lot of Andrew Carnegie’s) that “[i]t doesn’t make sense to hire smart people and then tell them what to do; we hire smart people so they can tell us what to do.” This is my intention in having Stahl manage my capital in this heavily discounted, (reasonably) diversified, incentive-aligned, income-generating fund.

With my existing allocation in FRMO, this puts the total amount of portfolio capital in the hands of Murray Stahl and the HK complex at around 10%. I’m very fine with this other than the major key-man risk it creates around someone who is a few years beyond that required to be classified as a senior citizen by Medicare standards —though I take some comfort in the fact that Carl Icahn, Howard Marks, and the Berkshire chairmen are at least a decade older than Stahl and still doing their thing.

The shares are quite illiquid, but I’ve had pretty good luck in getting my orders filled at around 20-24% discounts to the fund’s NAV.

Now, regarding the reverse merger of HK LLC, one could argue that it would be better to sell held RCG shares and buy SLGD shares for the even greater discount in the business that actually manages the fund itself. Theoretically, this business should do better than than the fund-holders since the business is valued in a pro rata fashion to their AUM with the added benefit of receiving management fees. If you own shares of Kinetics open-ended mutual funds, then this might make sense. However, for the RENN Fund in particular, I think that it probably makes sense to continue to hold shares as 1) RENN holders are not presently charged any management fee by HK and 2) the fund gives much more direct exposure to HK’s private equity ideas. These PE investments are only already relatively small and illiquid portions of the RENN Fund itself and the impact of their performance would even more diluted if one were trying to gain exposure to them through owning overall HK LLC business —which does not hold these PE investments in any of their other funds, so far as I am aware.

I’ve written more about RCG here:

APi Group, APG (% of portfolio: 4.08%; % gain/loss: 96.09%)

Ultimately, I think of APG like a diversified portfolio / PE “fund” of statutorily-mandated fire and life safety businesses with some very reputable insider owners —though I certainly look askance at some of their compensation— but (future M&A that Becker and the Jarden gang may find in the future) I think the stock is likely trading around fair value at this time, so I see no reason to add to the existing position for now (especially given the lack of a dividend cash-back despite management’s lauding of APG’s asset-light nature).

I’ve written more about APG here:

Grayscale Bitcoin Trust, GBTC (% of portfolio: 7.14%; % gain/loss: 158.67%)

********** UPDATE 20240111: Well, looks like the Bitcoin spot ETFs have been approved. See https://www.sec.gov/news/statement/gensler-statement-spot-bitcoin-011023; https://www.sec.gov/Archives/edgar/data/1588489/000095017024004265/0000950170-24-004265-index.html

It appears that Bitwise and VanEck plan to donate a portion of their profits from their spot ETF offerings to the continued Bitcoin Core development (https://cryptopotato.com/bitwise-to-donate-10-of-bitcoin-etf-profits-to-btc-open-source-development/).

**********

I group both GBTC and WELX (% of portfolio 1.5%; % gain/loss: 67.30%) together because they are both purely bets on BTC.

In the previous commentary I mentioned how the conversion of GBTC into an ETF was becoming increasingly likely as other larger institutions appeared to be positioning themselves to launch their own spot ETFs. Since that time, BTC prices have gone from $30K to around $45K as the probability of approval for multiple spot BTC ETFs by 2024 has grown; the resignation of GBTC’s longtime CEO Barry Silbert and elimination of in-kind redemption is peculiar16, but I’m not sure what to make of it at this time17.

On the subject of WELX, I see it as a well-run, shareholder-aligned, self-accumulating, no-fee, BTC pseudo-ETF and that these distinct characteristics will only gain more attention as BTC spot ETFs are granted approval and move into the larger sphere of mainstream investability. Around 40% of Winland is owned by Horizon Kinetics —who continues buying shares every quarter— and it’s CEO is an HK employee. HK’s founder, Murray Stahl, had this to say about WELX in a recent conference call:

“[W]inland continues to mine and to build its cryptocurrency balances. One thing I should say about Winland is that it can be thought of almost like a quasi-bitcoin ETF. When you buy a bitcoin ETF, if there were a bitcoin ETF, you should be aware of the fee impact. Unlike a mutual fund or an ordinary ETF, bitcoin pays no dividends that can be used to pay the operator’s fees. Therefore, if there were a bitcoin ETF, the operator, each and every quarter or probably every month, would have to sell some bitcoin to pay the fees. […] For Winland, as you can see, and a reason we read these statements, [unlike with a traditional BTC ETF] the number of coins increases every quarter, because we mine it. So, which would you rather have? Would you rather have a cryptocurrency ETF in which the coin balance diminishes or would you rather have an investment where the coins increase? I believe the day will come when there are bitcoin ETFs, and there are investors who are going to understand the distinction between the two classes.” ~~~ https://www.frmocorp.com/_content/letters/2023_Q2_FRMO_Transcript.pdf

Most of my GBTC cost basis is from when BTC was trading at or below the $18-$25K range and the GBTC discount to NAV was closer to 40-50%, thus the 150% return as the discount has closed in addition to the recovery in BTC price this year. Nearly all of my existing WELX stock was bought when WELX was trading around $2-$2.15/sh.

I’ve written a bit more on GBTC and WELX (with some updated valuation estimates) in certain sections of the post here:

Charles Schwab, SCHW (in terms of underlying interest via LEAPs) (% of portfolio: 5%; % gains/loss: 23.6%)

********** UPDATE 20240628: Looking at the 2024 Federal Reserve Stress Test Results (https://www.federalreserve.gov/publications/2024-stress-test-scenarios.htm; https://www.federalreserve.gov/publications/files/2024-dfast-results-20240626.pdf), we can see some interesting things about Charles Schwab. Looking at the Table 5. Projected minimum common equity tier 1 capital ratios for stressed ratios with supervisory stress testing capital action assumptions, SCHW has the highest capital ratios among all 31 large banks in the stress test. In Figure 5, SCHW is the only bank (other than Bank of NY-Mellon) projected to have CET1 ratio increases vs it’s starting 2023:Q4 number even in a severe adverse scenario, while in Figure 6 and Table 8, SCHW is projected as being one of the few banks to see their pre-tax net income rates increase, maintaining positive pre-tax income in the severely adverse scenario. Table 10 shows SCHW as having the lowest projected loan portfolio loss rate among the banks in the stress test as well. While their pre-provision net revenue to average assets ratio in the stress test scenario is lower then the median (1.5% vs median of 1.9%), it is still positive and the report itself notes that the ratio of PPNR to average assets varies across banks largely due to differences in business focus (note that Schwab focuses mainly on wealth management and bank sweeps on it’s brokerage accounts rather more traditional retail banking). **********

I don’t really have a lot to say about this position beyond the fact that I wanted to take the opportunity during the early-2023 banking crisis18 to buy something. My broker is Schwab, so it was an obvious invest-in-what-you-use candidate.

When I initially bought the equity, the stock was around the $50-$55/sh range and remained there for most of the year. I later de-risked my cost basis by selling the equity for a >1% loss and buying long-dated call options for a similar underlying interest in terms of number of shares and strike price, but for a fraction of the capital-at-risk.

I wrote more about Schwab in my semi-annual portfolio review here: https://lemoncakesinvesting.substack.com/i/123907428/schw-charles-schwab-corp

One might also be interested in this writeup from Holland Advisors in late 2020 which goes much deeper into the interesting dynamics of the business: https://hollandadvisors.co.uk/wp-content/uploads/2022/07/Schwab-Gorilla-in-the-midst-1220.pdf

Some cost-basis-weighted top gainers

GBTC, Grayscale Bitcoin Trust / WELX, Winland Holdings (+158.67% / +67.30%):

(See previous section)

APG, APi Group (+96.09%):

(See previous section)

TGH, Textainer Group Holdings (+59.76%):

I initially found Textainer Group while I was looking around for anything in the shipping industry that paid a dividend and smelled anything like the asset-light mineral royalty businesses that I was investing in in 2022. TGH is a container lessor focused on long-term contracts to provide dry and refrigerated shipping containers to liner companies. The company stands to benefit from strong container demand and ongoing logistics congestion. Textainer signed extremely long-term leases (10-14 years) in 2021 at very high rates, thus securing cashflows and cashflow visibility for the next decade. This shift to ultra-long leases has improved the quality of TGH’s cash flows (now more stable and recurring). The company also reinstated it’s regular dividend in 2021. These contracts would roll over legacy contracts in 2022-2023, boosting earnings.

Through most of 2022, which is when I was buying the stock, Textainer traded in the low to mid $30s at around a 5x P/E as if the market were pricing in a cyclical peak despite the company having secured long-dated cash flows. Then, in 2023, infrastructure fund Stonepeak agreed to buy the shipping container lessor for $2.1bn with Textainer shareholders set to receive $50/sh in cash (https://seekingalpha.com/news/4022645-stonepeak-nears-purchase-of-shipping-container-firm-textainer-for-50-a-share-wsj). I was happy to hold the stock for the dividend as the company continued to hedge my portfolio against continued supply chain issues, but the buyout provides a nice IRR and interest rates make cash no longer a pain to hold on to.

Some cost-basis-weighted top losers

FRMO, FRMO Corp (-32.04%):

(See previous section)

PMD, Psychemedics Corp (-45.06%):

Psychemedics is the leading hair drug testing company with decades of strong profitability. The stock traded at a steep discount due to the COVID19 pandemic’s effect on hiring in 2020-2021 as well as an unprofitable exploration of the Brazil market that was a drag on margins since 2016. Psychemedics had expanded into Brazil in 2016 which initially boosted revenue but hurt margins as the less developed regulatory environment in the country was not conducive to supporting any kind of regulation-based barriers to entry; PMD could not leverage their certifications or legal expertise in the hair drug testing domain. In 2019 the company began pulling back from Brazil operations (https://investors.psychemedics.com/sec-filings-and-press-releases/news-releases/news-details/2019/Psychemedics-Corporation-Announces-New-Brazilian-Distribution-Agreement/default.aspx).

In the long-run, Psychemedics is poised to benefit as hair testing gains broader regulatory acceptance and displaces urine testing.

(https://truckingalliance.org/new-study-finds-gaping-hole-in-dot-drug-testing-results/)

The company has also begun shifting away from marijuana (which is becoming increasingly accepted by workplaces) and towards fentanyl testing (https://www.psychemedics.com/blog/2023/10/psychemedics-introduces-advanced-5-panel-drug-screen/).

Between March and April 2022, micro-cap superinvestor Peter Kamin bought 624737 shares (~10% of total outstanding shares) worth a total of ~$4.2MM at prices ranging from $6.50-$6.88/sh and was later elected to the board of directors (https://www.sec.gov/Archives/edgar/data/806517/000117184323004595/0001171843-23-004595-index.html; https://www.citybiz.co/article/276997/psychemedics-nominates-peter-kamin-and-darius-nevin-to-serve-as-members-of-its-board/).

In December of that year PMD stock fell slightly as the Federal Motor Carrier Safety Administration (FMCSA) denied a request to allow for standalone hair testing, saying it lacked authority to permit hair testing as an alternative until the US Department of Health and Human Services (HHS) established federal hair testing standards (https://ehsdailyadvisor.blr.com/2022/12/fmcsa-denies-request-for-drug-use-hair-testing/). This, coupled with Kamin’s insider buying at the higher basis, persuaded me into what was effectively a follow-the-leader investment at a cost basis around the $5/sh range.

On Aug 11, 2023Q2, the company reported a 15% drop in revenues and eliminated their regular dividend (https://investors.psychemedics.com/sec-filings-and-press-releases/news-releases/news-details/2023/Psychemedics-Corporation-Reports-Second-Quarter-2023-Financial-Results/default.aspx). That same month, PMD approved a transition plan for the Company’s new President and CEO position (https://investors.psychemedics.com/sec-filings-and-press-releases/news-releases/news-details/2023/Psychemedics-Corporation-Announces-CEO-Succession-Plan/default.aspx). These events (especially the dividend cut) appear to have been the cause of the stock then falling from around $5/sh down to $3/sh in the ensuing months.

Nothing about the present situation seems to warrant selling the stock and I continue to monitor Kamin and the CEO’s actions at the company. A transition to a special-dividend-based cash distribution mechanism and a delisting to the OTC markets for lower listing costs (which I think would be a better time to average down than in the present dip that PMD stock is seeing) would not be out a surprise given Kamin’s involvement.

What one would really want to see here is US Health and Human Services allowing hair testing as a standalone test for the trucking industry. As it stands, federal regulators do not currently allow carriers to submit hair test results to the Federal Motor Carrier Safety Administration’s Drug and Alcohol Clearinghouse without a corresponding positive urine or saliva test (https://www.freightwaves.com/news/trucking-group-study-supports-greater-use-of-hair-tests-for-truckers). Such an approval would be a big tailwind for the company.

VIRT, Virtu Financial (-24.58%):

Virtu Financial is the only publicly-traded US market-making firm; I bought shares in early 2022 at around the $25-$27/sh range. It was trading at an attractive valuation of ~8x P/E at the time with a 5% dividend yield and a track record of being a net buyer of their own stock. With the surge in commission-free retail trading starting around 2019, I expected VIRT to benefit from cultural/generational shift towards permanently higher trading volumes —as opposed what some may have thought to be a temporary phenomenon caused by the massive stimulus in 2020— as well as act as a nice volatility hedge/beneficiary that paid you to hold onto it in the less volatile times as well.

In the time since, the VIX has trended downwards (falling ~50% from a high of around 30 in March 2022 to around 12 as of my writing this) and with it, VIRT’s market-making revenues. I think that increasing uncertainty around macro events/conflict around the world and central banks dealing with interest rates will generate increased volatility going forward, so I’m fine with continuing to hold the stock for now and collecting the dividends.

Given that the cash investments have been there since 2022 while some of the equities were only bought during 2023, it’s hard do an exact calculation of how much the total performance would have been improved.

See https://realinvestmentadvice.com/analysts-are-always-bullish-for-a-simple-reason/.

Over time, stocks go up more often than they go down. In fact, stocks go up about 80% of the time. However, it is the 20% of the time they go down that is the problem. As shown below, over the entire market history, on a buy-and-hold basis, stocks only make new highs about 15% of the time. The rest of the time, they are making up for previous losses.

So, one can slowly accumulate good businesses in the —relatively— calm periods and save dry powder fire large barrages when there’s blood in the streets. From “The Great Depression: A Diary” by Benjamin Roth…

(https://archive.org/details/greatdepressiond0000roth/page/232/mode/2up)

To anyone who’s read Bruce Bueno de Mesquita’s “The Dictator’s Handbook”, you know that there can often be instances where “governments” are perfectly fine with a low GDP per captia and, in fact, happier with a more miserable and demoralized citizenry —so long as they can continue to perform necessary labor. Such engineered/intentional scarcity make it easier to consolidate and retain power, more selectively dole out resources to in-groups, while lowering the risk of rebellion/activism and the risk of emergence of competing elites from any middle-class groups who may be far enough from power to not benefit enough from it and far enough from poverty to spend excess time and energy tackling the issue.

As a relevant aside, there’s an interesting older Founders episode, by David Senra, covering Robert Friedland (a lot of it not very flattering (which makes it even better and more interesting, IMO)): https://www.joincolossus.com/episodes/73597954/senra-robert-friedland-the-big-score?tab=shownotes

More perspective on HK LLC’s value can be gleaned from the FRMO 2023 annual letter released on September 6, 2023:

In the interim, active management does not obtain a very high valuation, even using GAAP accounting on the FRMO financial statements. The balance sheet value of Horizon Kinetics in the FRMO financial statements is $14,607,525. The FRMO interest in Horizon Kinetics is 4.95%. The valuation of Horizon Kinetics in its entirety can be obtained by dividing $14,607,525 by 0.0495, or $295,101,515.

However, as of March 31, 2023, hard assets comprised almost exclusively of cash and marketable securities account for $134,986,973 of the Horizon Kinetics balance sheet. If this sum is subtracted from the prior Horizon Kinetics value of $295,101,515, one arrives at a figure of $160,114,542. This is, in principle, the value of the asset management portion of Horizon Kinetics. It would be equal to about 2.28% of assets under management. This is surely not a high figure and certainly less than the historical norm for active asset managers. Of course, every active asset manager, including Horizon Kinetics, must contend with the business challenges of the growing share of passive management and the fee compression that inevitably accompanies that growing share.

If one were to use the $160 million valuation in relation to Horizon Kinetics revenue for the 12 months ended March 31, 20233 , and compare this to the $64.814 million of Horizon Kinetics revenue for the 12 months ended March 31, 2023, then Horizon Kinetics is trading at 2.46x trailing revenue. The price to revenue ratio of the S&P 500 at the time of this writing is 2.48x. Thus, Horizon Kinetics has virtually the same price to revenue ratio as the S&P 500. However, arguably, it has far more operating leverage in the success mode.

This method for valuing asset management companies is apparently some kind of rule of thumb:

“The general rule of thumb in the world of investment management is to say an asset management company is worth 3% of assets under management.” ~~~ https://www.frmocorp.com/_content/letters/2021_Q3_FRMO_Transcript.pdf

https://www.morovisconti.com/wp/wp-content/uploads/2021/01/Asset-Management-companies-Valuation.pdf

https://www.morningstar.com/funds/fund-shop-bets-ranch-one-stock

Perhaps it could make a bit of sense to sell TPL stock and buy SLGD stock as a kind of discounted TPL derivative. I’d have to think about this idea a bit more…

SLGD will merge with Horizon Kinetics, giving it exposure to HK’s asset management business and a significant, though indirect, exposure to TPL through HK’s funds (about 30% of AUM is TPL stock). Asset managers often trade at valuations linked to their assets under management (generally valued at 3% of AUM). So in theory, SLGD could be viewed as a way to get exposure to TPL at a discount. (If you had 5% of a portfolio in TPL, you’d need to move a whole (.05/.30=)16% of the portfolio into HK LLC for an equivalent exposure). However, asset management comes with it’s own specific risks —ones that are quite different fundamentals of TPL. These include volatile markets and other trends or events that could cause capital outflows and could hurt HK’s AUM and profitability.

IDK.

From the 2023 FRMO annual meeting:

“Now, we’re up to about 35% [ownership] of Winland. If for whatever reason we ever got to 50%, under the rules, we could consolidate it. Little by little, step by step, we’re developing an operating company. […] It’s better, for a whole series of reasons, to be an operating company. We’ll still have investments. But for the future, and for all sorts of other reasons, it’s much better if we have a company that has operating earnings. One reason I'll touch on, for the people who follow us, is that it'll be a source of cash flow. Otherwise, then it's just a fund that sells Investment A to buy Investment B, and if investors are going to follow our approach to their long-term investments, we want to hold them basically for decades—maybe, hopefully, centuries. So, the investments might not throw off enough cash to fund new investments, so we're going to have to have an operating business. And I think that would be better for the valuation as well.”